Aviation

Airport Activity: Air Carrier Traffic at Canadian Airports, 2021

Skip to text

Text begins

Highlights

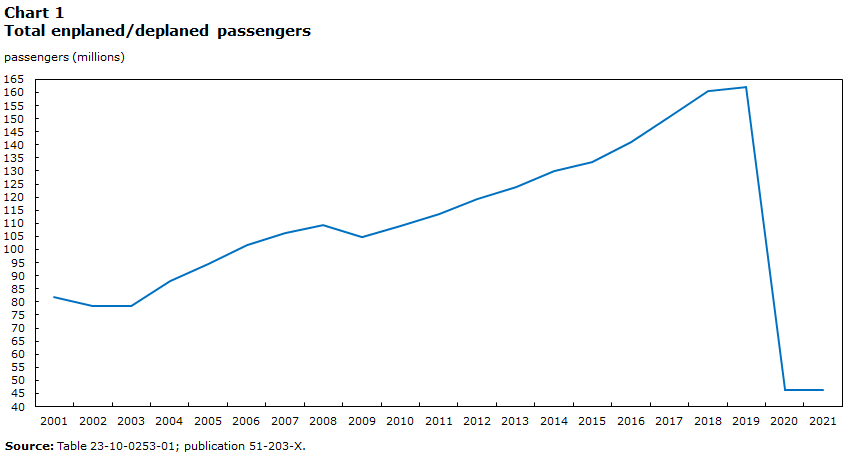

The onset of the pandemic during 2020 brought an abrupt end to ten consecutive annual increases in air passenger volumes. In 2021, COVID-19 continued to dampen Canadian aviation. The total number of passengers enplaned and deplaned at Canadian airports was 46.2 million in 2021, akin to 2020 (-0.4%) but still 71.7% below the 2019 pre-pandemic level.

These totals mask sub-annual differences between the two pandemic-impacted years of 2020 and 2021. As reported earlier based on data from airlines, while the majority (roughly 70%) of passengers in 2020 were flown in the first three months, conversely in 2021, more than four in five passengers were carried in the second half of the year.

In 2021, passenger traffic decreased at three of Canada’s four largest airports. Toronto/Lester B Pearson International, Vancouver International and Montréal/Pierre Elliott Trudeau International each saw decreases in passenger traffic of 4.8%, 2.7% and 3.9% respectively. This largely reflected the lag in international passenger volumes compared to domestic passengers. Calgary International was the exception, with traffic increasing 11.0%.

Restrictions inhibit international recovery

With an uptake in vaccination rates during 2021, some restrictions were relaxed. For example, mandatory testing for fully vaccinated Canadian citizens arriving in Canada ceased in July which helped domestic traffic to start recovering sooner. Indeed, the number of domestic passengers increased 18.3% in 2021 (5.3 million) from the previous year.

However, this uptick in domestic traffic was partly offset by further declines in international travel, as some travel restrictions lingered. Beginning in early 2021, tighter border restrictions were introduced to combat a new variant of the virus. These included a ban on discretionary travel to Canada by non-residents, a negative PCR test prior to boarding, testing upon arrival to Canada and a mandatory 14-day quarantine.

Some recovery in international travel resumed mid-year as higher vaccination rates allowed the federal government to ease border restrictions for non-residents while provinces relaxed remaining interprovincial travel restrictions. Nevertheless, transborder traffic (Canada-United States) and international traffic remained farther below 2020, with the former down 31.7% (2.2 million passengers) and overseas traffic down 31.9% (3.3 million passengers).

| 2020 | 2021 | Change 2020 to 2021 | |

|---|---|---|---|

| number | percent | ||

| Enplaned and Deplaned Passengers | |||

| Domestic Segments | 29,044,556 | 34,369,227 | 18.3 |

| Transborder Segments | 7,057,778 | 4,819,268 | -31.7 |

| Other International Segments | 10,247,201 | 6,975,445 | -31.9 |

| Total | 46,349,535 | 46,163,940 | -0.4 |

| Loaded/Unloaded Cargo (tonnes) | 1,186,629 | 1,279,817 | 7.9 |

| Source: Tables 23-10-0253-01 and 23-10-0254-01 | |||

Canada’s busiest airports

In 2021, the four busiest airports accounted for just under two-thirds (65.5%) of all passenger traffic in Canada including over half (54.7%) of all domestic traffic and much larger shares of transborder (95.5%) and other international traffic (98.5%). For most of the year, commercial flights originating from any international location were directed to land at one of these four Canadian airports.

Passenger traffic at Canada’s busiest airport, Toronto’s Lester B Pearson International, declined 4.8%, going from 13.0 million passengers in 2020 to 12.4 million passengers in 2021. The overall traffic decrease in 2021 is attributed to the international and transborder sectors, which fell 24.2% and 25.3% respectively. Continued intermittent travel restrictions on non-domestic travel throughout 2021 contributed to the decline.

This overall decline at Pearson was somewhat offset by the domestic sector recording an increase of 24.4%. Domestic traffic benefitted from the easing of some government travel restrictions late in 2021.

Vancouver International enplaned and deplaned 7.0 million passengers in 2021, down 2.7% from 2020. This drop was entirely due to international traffic, with overseas traffic falling 39.1% and transborder down 29.2%. As with Toronto Pearson, the decrease at Vancouver was offset by a 22.0% increase in domestic traffic.

In a challenging year for the aviation industry, Calgary International maintained its position as Canada’s third busiest airport. Of the busiest 4 airports in the country, Calgary International was the only airport to post a year-over-year increase in passenger traffic. Overall traffic was up 11.0% in 2021, with 5.9 million passengers enplaning and deplaning at the airport.

This increase was due to a rebound in domestic traffic (up 23.9% in 2021). However, international traffic continued to contract, with the other international sector falling 30.8% and transborder traffic down 27.0%.

Rounding out the top 4, Montréal/Pierre Elliot Trudeau International saw 5.0 million passengers enplaned and deplaned, down from 5.2 million in 2020. With international travel restrictions in place, transborder traffic declined 18.4% and international traffic fell 17.8%. Conversely, domestic traffic increased at a slower rate than at the other top airports (up 19.9% in 2021).

Data table for Chart 1

| Passagers (millions) | |

|---|---|

| 2001 | 81,751,079 |

| 2002 | 78,229,504 |

| 2003 | 78,391,224 |

| 2004 | 87,799,030 |

| 2005 | 94,605,005 |

| 2006 | 101,677,328 |

| 2007 | 106,433,442 |

| 2008 | 109,360,095 |

| 2009 | 104,765,830 |

| 2010 | 109,099,196 |

| 2011 | 113,471,763 |

| 2012 | 119,197,489 |

| 2013 | 123,909,945 |

| 2014 | 129,868,870 |

| 2015 | 133,426,703 |

| 2016 | 140,892,544 |

| 2017 | 150,808,451 |

| 2018 | 160,641,587 |

| 2019 | 162,185,308 |

| 2020 | 46,349,535 |

| 2021 | 46,163,940 |

| Source: Table 23-10-0253-01; publication 51-203-X. | |

Cargo the silver lining

The year 2021 continued a shift in aviation activity from moving passengers to moving cargo. With passenger traffic still scarce, this shift helped to keep aircraft in use. Early in the pandemic, some airlines began to operate cargo-only flights and made aircraft modifications to do so. The increase in cargo-only flights helped to boost cargo traffic in 2021 with the tonnes loaded and unloaded at Canadian airports up 7.9% after a decline of 13.8% in 2020.

The amount of domestic cargo transported by air increased 7.1% from 2020 to 655 000 tonnes in 2021. Transborder cargo grew modestly by 3.7% (254 000 tonnes) while other international cargo grew by 12.3% (371 000 tonnes).

During the second year of the pandemic, cargo operators continued to benefit from transporting essential goods and from online shopping. By the end of 2021, quarterly goods revenue earned by the airline industry had doubled from 2019 pre-pandemic levels.

Looking ahead

While 2021 brought the Canadian aviation industry hope of recovery with an increase in domestic traffic and cargo volumes, all measures of passenger and cargo activity continued to be far below their pre-pandemic 2019 levels.

With vaccine rollouts, re-opening of provincial economies and the subsequent easing of travel restrictions throughout 2021, airport activity crept closer to pre-pandemic levels each month. After a pause in January 2022 due to Omicron, demand for air travel – domestic and international – has steadily increased each month of 2022.

The increase during 2022 culminated with a surge in travel demand into the busy summer travel season. The higher volume of passengers coupled with ongoing industry labour shortages resulted in long delays and cancellations at some airports, and several carriers trimmed flight schedules to improve operations.

Note to Users

Cargo data

It is important to note that the air cargo data presented does not represent the total cargo loaded and unloaded in Canada. Comprehensive cargo data are not collected for the following reasons:

- the regional and local scheduled carriers do not file cargo data on the airport activity survey and,

- the major charter survey does not collect data on domestic courier cargo or domestic entity cargo flights.

Passenger flights which carry cargo on them are classified as passenger flights. The cargo carried on these passenger flights is defined as belly-hold cargo. The belly-hold cargo data are included with the pure cargo data in the cargo table, Table 23-10-0254-01.

Services offered by carriers

Scheduled Services

- ABX Air Inc.

- Aer Lingus

- Aeromexico

- Air Algerie

- Air Canada

- Air Canada Rouge

- Air China

- Air Creebec Inc.

- Air France

- Air India

- Air Inuit Ltd.

- Air New Zealand

- Air North Charter Training Ltd.

- Air St Pierre

- Air Tahiti Nui

- Air Tindi Ltd.

- Air Transat A.T. Inc.

- Air Wisconsin

- Aklak Air

- Alaska Airlines

- All Nippon Airways

- American Airlines

- Amik Aviation Ltd.

- Austrian Airlines

- Avianca

- Avianca Costa Rica

- Bearskin Airlines

- Bradley Air Services Limited

- British Airways

- Calm Air International Ltd.

- Canadian North Inc.

- Cargojet Airways Ltd.

- Cargolux Airlines International

- Caribbean Airlines

- Carson Air Ltd.

- Castle Aviation

- Cathay Pacific Airways

- Central Mountain Air Ltd.

- Champlain Enterprises

- China Airlines

- China Eastern Airlines

- China Southern Airlines

- Condor Flugdienst

- COPA

- Corilair Charters Limited

- Delta Air Lines

- EgyptAir

- El Al Israel Airlines

- Emirates Airlines

- Endeavor Air

- Envoy Air Inc.

- Ethiopian Airlines

- Etihad Airways

- EVA Airways Corporation

- FedEx

- Flair Airlines Ltd.

- Global Airways

- GoJet Airlines LLC

- Gulf Island Seaplanes

- Hainan Airlines

- Harbour Air Ltd.

- Horizon Air Industries Inc.

- Icelandair

- JAL-Japan Airlines International Co. Ltd.

- Jazz Air Inc.

- JDR Pacific Ventures

- KF Aerospace

- KLM Royal Dutch Airlines

- Korean Air

- LOT-Polish Airlines

- Lufthansa German Airlines

- McMurray Aviation

- Mesa Airlines

- Montmagny Air Service Inc.

- Morningstar Air Express Inc.

- Nolinor Aviation

- North Star Air

- Northway Aviation Ltd.

- Northwestern Air Lease

- Northwright Air

- Pacific Coastal Airlines Limited

- Pakistan International

- Pascan Aviation Inc.

- Perimeter Aviation Ltd.

- Philippine Airlines Inc.

- Piedmont Airlines

- Porter Airlines Inc.

- Provincial Airlines

- PSA Airlines

- Qantas Airways

- Qatar Airways

- Republic Airways

- Royal Air Maroc

- Royal Jordanian

- SATA Internacional

- Sharp-Tail Air Ltd.

- Sichuan Airlines Co. Ltd.

- Singapore Airlines

- Sky Jet M G Inc..

- Sky Regional Airlines Inc.

- Sky West Airlines

- Skylink Express Inc.

- Sunwing Airlines Inc.

- Swiss International Air Lines Ltd.

- Swoop

- TAP Air Portugal

- Thunder Airlines Limited

- Tofino Air

- Transwest Air

- Tunisair

- Turkish Airlines

- United Airlines

- United Parcel Service

- Wasaya Airways Limited Partnership

- WestJet

- WestJet Encore

- Wilderness Seaplanes

- Xiamen Airlines

Major Charter Services

- Acass

- ACM Aviation

- Aeroméxico

- Air Canada

- Air Creebec

- Air Foyle

- Air Hamburg

- Air Inuit Ltée / Air Inuit Ltd.

- Air St Pierre

- Air Transat A.T. Inc.

- AirNet II

- American Air Services Inc.

- Ameristar Air Cargo Inc.

- Anderson Air

- Atlas Air Inc.

- Aurora Jet Partners

- Aviation Consultants Inc.

- Bearskin Airlines

- Beijing Capital Airlines

- British Airways

- Buffalo Airways

- Calm Air International Ltd.

- Canadian North Inc.

- Chartright Air Inc.

- Chrono Aviation Inc.

- Chrono Jet Inc.

- Chrysler Aviation

- Clay Lacy Aviation

- Cockrell Resources Inc.

- Condor Flugdienst

- Continental Airlines

- DC Aviation

- Delta Air Lines

- Egyptair

- Elite Jets

- Execaire

- Executive Flight Services

- Fast Air Ltd.

- Flexjet

- Flight Options

- Flightexec

- Global Aviation

- Gulf & Caribbean Cargo Inc.

- Image Air Charter

- Independent Flight Leasing Inc.

- Jazz Air Inc.

- Jet Access Aviation

- Jet Concierge Club

- Jetport Inc.

- Kalitta Air LLC

- Kenn Borek Air Ltd.

- Korean Air

- London Air Services Limited

- Lufthansa German Airlines

- Lynden Air Cargo LLC

- McNeely Charter Service Inc.

- NetJets

- Nolinor Aviation

- Novajet

- Oak Air Ltd.

- Pacific Coastal Airlines

- Pal Aerospace Ltd.

- Partner Jet Inc.

- Pascan Aviation Inc.

- Priester Aviation

- Saturn Aviation

- Sharp-Tail Aviation Ltd.

- Skycharter

- Sunwest Aviation Ltd.

- Sunwing Airlines Inc.

- TUI fly Netherlands

- United Airlines

- USA Jet Airlines Inc.

- VIH Execujet Ltd.

- VistaJet (Malta)

- WestJet

- WestJet Encore

Factors which may have influenced the data

For additional contextual information on events affecting air travel, including summaries of selected Canadian economic events, as well as international and financial market developments by calendar month, check out the Canadian Economic News.

- Date modified: