Housing Statistics in Canada

Intergenerational housing outcomes in Canada: Parents’ housing wealth, adult children’s property values and parent–child co-ownership

Skip to text

Text begins

Overview

This article examines the association between parents’ housing wealth and the values of houses owned by their adult children. It also documents parent and child property co-ownership arrangements. The article follows a previous article that examined the role parents’ property ownership played in the likelihood of homeownership for children born in the 1990s. These articles use residential property and ownership information for the 2021 reference year for all provinces and territories, except Quebec and Saskatchewan.

Key findings

- In 2021, around one in six residential properties owned by people born in the 1990s (17.3%) were co-owned with their parents.

- Higher rates of co-ownership between parents and children were found in more expensive urban markets, such as Toronto, Guelph, Abbotsford–Mission, Vancouver and Victoria.

- Parents’ housing wealth is most strongly associated with children’s property values in Toronto, Kelowna, Vancouver and Victoria.

Rising house prices have generated increasing concerns about housing affordability in Canada in recent years. Although average house prices in Canada have dropped since a peak in the spring of 2022, prices remain significantly higher than five years ago (Canadian Real Estate Association [CREA], 2024). Combined with rising interest rates, this has contributed to a decline in housing affordability (Hogue, 2023), especially for young adults hoping to enter the housing market. In pursuit of homeownership, young Canadians have increasingly turned to their parents for financial help. A recent report from the Canadian Imperial Bank of Commerce found that nearly 30% of first-time homebuyers in 2021 received a monetary gift from their parents, up from 20% in 2015 (Tal, 2021). However, not all young Canadians have access to financial support from their parents, contributing to inequalities in access to homeownership.

This article is the second in a series on intergenerational housing outcomes. It examines the role of parents’ housing wealth in the housing market outcomes of young homeowners. The first article of this series examined the relationship between parents’ property ownership and the likelihood of their children born in the 1990s to own residential property in 2021 (Mirdamadi and Khalid, 2023). It showed that adult children (aged 22 to 31 in 2021) of homeowners were twice as likely to own a home as those whose parents were non-homeowners and that their homeownership rate increased with the number of properties owned by their parents.

The analysis in this article has two parts. The first part examines parent and child co-ownership (or joint ownership) arrangements to provide a better understanding of phenomena such as multigenerational households, co-investment, early inheritance and mortgage “co-signing” across the country. The second part estimates the association between parents’ housing wealth—measured as the gross value of all residential properties they own—and the value of properties owned by their adult children.

This research is part of a broader literature that investigates the transmission of economic advantages from parents to children. Parents can transfer such advantages to their children in several ways, including through direct financial support, childhood socialization, access to certain social networks and investments in education (Ermisch et al., 2012; Putnam, 2015). The first article of this series suggests that these mechanisms can play a role in explaining why the children of homeowners are more likely to own a home than the children of non-homeowners. Existing literature also suggests that the level of parents’ housing wealth has an influence on the value of the properties purchased by their adult children (Henretta, 1984; Engelhardt and Mayer, 1998; Guiso and Jappelli, 2002; Ma and Kang, 2015; Barrett et al., 2015; Pfeffer and Killewald, 2018). This article represents the first attempt to estimate that role in Canada, drawing primarily on administrative data (for more information on methods and data, see Note to readers).

Rates of parent and child co-ownership are highest in Ontario and British Columbia

Residential properties might be co-owned by parents and their children for several reasons. The property may be a family asset or a joint investment property, or parents and children may be living together and have purchased it together. Another possibility is that a property was bought together to obtain better mortgage conditions by virtue of the parents’ accumulated wealth or credit rating, without the intention of cohabiting. These arrangements are often referred to as “mortgage co-signing,” which involves being on the property title and on the mortgage loan (Galea and Alini, 2023). Parent–child co-ownership is investigated below to better understand the prevalence of these different forms of parental involvement in property acquisition.

Parent–child co-ownership is highest in the most expensive housing markets

In the jurisdictions studied, the share of residential properties owned by people born in the 1990s that were co-owned with their parents in 2021 ranged from 5.8% in the Northwest Territories (which includes the census agglomeration [CA] of Yellowknife only in these data) to 20.3% in British Columbia, as shown in Chart 1. Ontario followed British Columbia, with a rate of parent–child co-ownership of 19.8%.

People born in the 1990s can also own a residential property with people who are not their parents, such as a spouse or a friend (referred to as “other adult child co-ownership types” in the chart).Note The data show that this form of ownership was the most prevalent in all provinces and territories covered by the study. Finally, 31.3% (Nunavut) to 41.6% (Prince Edward Island) of properties owned by people born in the 1990s were cases of “sole ownership,” where the only owner on the title was the adult child.

Chart 2 shows the relationship between rates of parent–child co-ownership and the median dwelling value from the 2021 Census for each census metropolitan area (CMA).Note The results show a strong positive correlation between parent–child co-ownership and housing prices, indicating that greater affordability challenges may play a role in the phenomenon. Higher housing prices will also correspond to greater parental housing wealth, which may allow parents to support their children’s homeownership aspirations through forms of co-ownership.

Data table for Chart 1

| Parent–child co-ownership | Other adult child co-ownership | Adult child sole ownership | |

|---|---|---|---|

| share of properties owned (percent) | |||

| Nvt. | 12.5 | 56.3 | 31.3 |

| N.W.T. | 5.8 | 59.6 | 34.6 |

| Y.T. | 11.3 | 55.7 | 33.0 |

| B.C. | 20.3 | 42.6 | 37.1 |

| Alta. | 14.2 | 50.0 | 35.8 |

| Man. | 11.2 | 51.8 | 37.0 |

| Ont. | 19.8 | 46.9 | 33.3 |

| N.B. | 8.1 | 51.5 | 40.4 |

| N.S. | 10.0 | 49.8 | 40.3 |

| P.E.I. | 10.3 | 48.2 | 41.6 |

| N.L. | 7.8 | 52.7 | 39.5 |

|

Note: In Newfoundland and Labrador, the provincial data are incomplete and do not cover 142 census subdivisions (municipalities). In the Northwest Territories, data are available only for the census agglomeration of Yellowknife. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Data table for Chart 2

| Median dwelling value (dollars) | Parent–child co-ownership rate (percent) | |

|---|---|---|

| Abbotsford–Mission | 850,000 | 26.7 |

| Barrie | 700,000 | 19.9 |

| Belleville | 424,000 | 12.8 |

| Brantford | 600,000 | 15.7 |

| Calgary | 460,000 | 18.4 |

| Edmonton | 400,000 | 13.9 |

| Greater Sudbury | 348,000 | 10.4 |

| Guelph | 750,000 | 27.1 |

| Halifax | 348,000 | 9.1 |

| Hamilton | 755,000 | 19.3 |

| Kelowna | 750,000 | 21.2 |

| Kingston | 492,000 | 17.7 |

| Kitchener–Cambridge–Waterloo | 700,000 | 19.5 |

| Lethbridge | 320,000 | 13.9 |

| London | 548,000 | 16.2 |

| Moncton | 200,000 | 6.9 |

| Oshawa | 755,000 | 21.6 |

| Ottawa–Gatineau (Ontario part) | 548,000 | 16.9 |

| Peterborough | 552,000 | 22.2 |

| Saint John | 200,000 | 6.6 |

| St. Catharines–Niagara | 552,000 | 19.5 |

| St. John's | 312,000 | 8.3 |

| Thunder Bay | 300,000 | 11.8 |

| Toronto | 980,000 | 27.2 |

| Vancouver | 1,050,000 | 23.4 |

| Victoria | 850,000 | 23.7 |

| Windsor | 420,000 | 11.5 |

| Winnipeg | 348,000 | 14.0 |

|

Note: Restricted to census metropolitan areas with over 500 observations of properties owned by adult children born in the 1990s. Median owner-estimated dwelling values are from the 2021 Census. The correlation coefficient is 0.91. The dotted line represents the line of best fit. Source: Statistics Canada, Canadian Housing Statistics Program and 2021 Census of Population. |

||

Around three in ten properties co-owned by parents and their children are likely to be mortgage co-signing arrangements

Most properties co-owned by children and their parents (84.1%) were owned by an adult child with a single property (Table 1). In a majority of these cases, representing half of all co-owned properties (49.7%), the property was owned by an adult child who was a single-property owner and at least one parent who was a multiple-property owner. In most of these situations, the adult child was living in the single property they own, and the parents were living in one of their other properties. These cases are likely situations of “mortgage co-signing” and represent around three tenths of all co-owned properties.Note

For 34.4% of parent–child co-owned properties, the parents and their adult children co-owned a sole property. These may represent, for example, a multigenerational housing arrangement or a situation where a parent added a child to the title for inheritance purposes. This arrangement was more prevalent in the Toronto (42.6% of all cases) and Vancouver (46.1% of all cases) CMAs than in the other CMAs studied.

In the remaining 15.9% of parent–child co-owned properties, where the adult child owned multiple properties (see Table 1), most parents also owned multiple properties. This is consistent with earlier findings where most children who owned multiple properties have parents who also owned multiple properties (Mirdamadi and Khalid, 2023). In these cases, parents may be helping their children build investment property portfolios, including through co-signing arrangements. This raises the broader question of how many adult children who owned multiple properties received support from their parents. This cannot be answered directly with the available data. However, among people born in the 1990s who were multiple-property owners (5.9% of all homeowning adult children born in the 1990s), 29.7% co-owned at least one of their properties with a parent.

| Parent owns one property | Parent owns two properties | Parent owns three or more properties | Total | |

|---|---|---|---|---|

| Child owns one property | 34.4 | 33.7 | 16.0 | 84.1 |

| Child owns two or more properties | 2.2 | 6.0 | 7.7 | 15.9 |

| Total | 36.6 | 39.7 | 23.7 | 100.0 |

|

Note: The analysis in this table is at the property level and is limited to properties where at least one adult child co-owns the property with at least one of their parents. When multiple parents own one of these properties, the parent with the greatest number of properties was used to indicate the level of parental property ownership. Similarly, when multiple children co-own a property with parents, the child with the greatest number of properties was used to indicate the level of children’s property ownership. Results are similar when the parent or adult child with the fewest properties is used instead. Source: Statistics Canada, Canadian Housing Statistics Program. |

||||

Immigrant parents are more likely to co-own properties with their adult children

Parents who are immigrants tended to co-own properties more frequently with their adult children than Canadian-born parents. Looking at all provinces and territories combined, almost half of co-owning parents were immigrants. This finding is consistent with the fact that co-ownership occurs most in higher-priced CMAs, as shown in Chart 2, and these CMAs tend to have higher proportions of immigrants in the population. In the Toronto CMA, for example, 80.9% of co-owning parents were immigrants. This is higher than the share of immigrants among all homeowning parents in the Toronto sample (64.4%) and among the population more generally (41.8%). In Vancouver, 76.9% of parents who co-owned properties were immigrants, compared with 59.9% of all homeowning parents linked to adult children born in the 1990s and 46.6% of the CMA population.Note

The positive association between parents’ housing wealth and the property value of their adult children is strongest in Toronto and Vancouver

Parents’ housing wealth may influence the value of properties owned by their adult children (Engelhardt and Mayer, 1998; Guiso and Jappelli, 2002; Ma and Kang, 2015; Barrett et al., 2015; Pfeffer and Killewald, 2018). To date, there have been no attempts to estimate the magnitude of this relationship in Canada. The analysis below provides the first estimates of the association between parents’ housing wealth—measured as the total assessed value of the properties they own—and the value of each property owned by their adult children.

The analysis is conducted at the property level. That is, if a child owns two properties, each property is included and valued separately, rather than considered together. This is done to account for the fact that different properties may have different combinations of owners, and this will affect the calculation of owner income. Parents’ housing wealth, meanwhile, is measured as the gross value of all residential properties they own, regardless of their location. This includes all parents linked to their adult children. For example, if two children who were born in the 1990s are listed on a property title, each linked to two parents, then the parental housing wealth will be the sum of the assessed value of all the distinct properties owned by those four parents. This measure of housing wealth is thus the sum of gross asset values and does not consider liabilities, such as outstanding mortgages or any other debts associated with property ownership.Note

To connect children’s property values to parental housing wealth, properties owned by adult children born in the 1990s are first separated into three groups (terciles) based on the distribution of parental housing wealth in each CMA: lowest (first), middle (second) and highest (third). Children whose parents are not residential property owners in the provinces studied are excluded from this analysis, as are the properties co-owned between parents and children.Note

To estimate the relationship between parents’ housing wealth and the value of their adult children’s properties, it is important to account for the incomes of the adult children, as children of wealthier parents tend to have higher incomes (Mirdamadi and Khalid, 2023). This is because of factors such as childhood socialization, access to certain social networks and investments in education (Ermisch et al., 2012; Corak, 2013; Putnam, 2015). Taking adult children’s income into account helps control for these indirect mechanisms and therefore better isolates the potential importance of parents’ property wealth.

To control for adult children’s income, the analysis below presents the median property value of adult children at varying levels of their total income. Specifically, three total owner income ranges are examined: below $60,000, from $60,000 to $120,000 and over $120,000.Note If parents’ housing wealth matters—through such things as inheritances and gifts—there should be significant differences in the median property values between the terciles of parental housing wealth, even within a given income range.

The median value of children’s properties, at these different income levels, is reported at the CMA level, based on the location of these properties. In addition, terciles of parental housing wealth are also calculated for each CMA. This CMA-level approach is designed to capture variations in housing values across CMAs and the role of parental wealth within each market. This also alleviates the issue that property assessments are conducted in different years across CMAs, making it difficult to compare property values across CMAs.

Limited potential role of parents’ housing wealth found in rural areas in most provinces

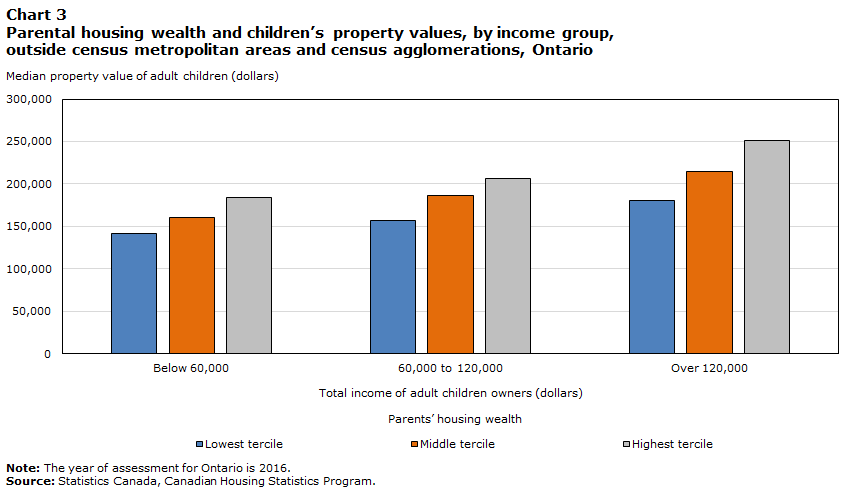

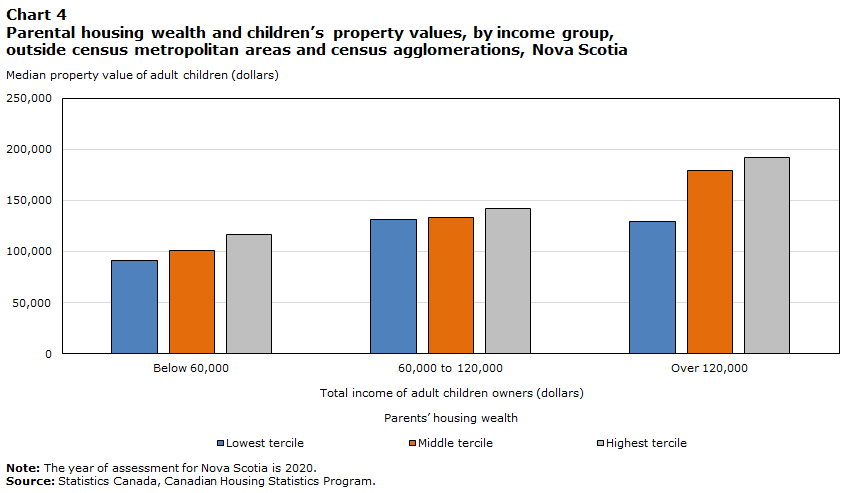

The first estimate of the potential influence of parental housing wealth is for properties in areas outside CMAs and CAs, referred to here as rural areas. Charts 3 and 4 present the results from two provinces, Ontario and Nova Scotia, as examples of this analysis.

In both provinces, higher adult children’s incomes are associated with higher median property values. This is consistent with the idea that higher revenues provide greater purchasing power to buyers and a greater opportunity to build savings.Note In addition, for any level of total owner income, the difference in median property values between the terciles of parental housing wealth indicates the potential role of this factor.

Chart 3 shows that in rural Ontario, for instance, the median property value of adult children increases with the level of their parents’ housing wealth. For adult children with total incomes from $60,000 to $120,000, for example, the median property value for a child in the lowest tercile of parental housing wealth is $157,000, whereas it is $206,000 for a child in the highest tercile. This represents a $49,000 (31.2%) difference.Note In rural Nova Scotia, the difference in median property values between the lowest ($131,000) and the highest ($142,000) terciles is smaller in this same income range, at 8.4%.

Data table for Chart 3

| Ontario, outside CMAs and CAs Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 142,000 | 161,000 | 184,000 |

| 60,000 to 120,000 | 157,000 | 186,000 | 206,000 |

| Over 120,000 | 181,000 | 215,000 | 251,000 |

|

Note: The year of assessment for Ontario is 2016. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Data table for Chart 4

| Nova Scotia, outside CMAs and CAs Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 91,500 | 101,000 | 117,000 |

| 60,000 to 120,000 | 131,000 | 133,000 | 142,000 |

| Over 120,000 | 129,000 | 179,000 | 192,000 |

|

Note: The year of assessment for Nova Scotia is 2020. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Higher potential role of parental housing wealth found in larger cities

In most CMAs, adult children’s property values were positively related to their incomes and to the housing wealth of their parents, similar to the results found in rural areas. Charts 5 and 6 illustrate this finding for two CMAs, Ottawa–Gatineau (Ontario part) and Calgary. Results for other selected CMAs are provided in the appendix.

Adult children with parents in the highest tercile of housing wealth have higher median property values in each range of owner income in Ottawa–Gatineau (Ontario part). For example, for those with a total income from $60,000 to $120,000 in that CMA, the difference between the median property value of children in the lowest ($253,000) and the highest ($297,000) terciles was $44,000 (17.4%). In Calgary, a similar relationship is seen. For those in the same income range, the median property value of children in the lowest tercile was $273,000, whereas it was $321,000 for those in the highest tercile, a difference of $48,000 (17.6%). In both CMAs, the median values of parental housing wealth were similar in each tercile, and this may help explain the similar results.

Data table for Chart 5

| Ottawa–Gatineau (Ontario Part) Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 224,000 | 270,000 | 294,000 |

| 60,000 to 120,000 | 253,000 | 270,000 | 297,000 |

| Over 120,000 | 313,000 | 322,000 | 342,000 |

|

Note: The year of assessment for Ontario is 2016. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Data table for Chart 6

| Calgary Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 231,000 | 260,000 | 292,000 |

| 60,000 to 120,000 | 273,000 | 299,000 | 321,000 |

| Over 120,000 | 348,000 | 380,000 | 412,000 |

|

Note: The year of assessment for Alberta is 2020. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

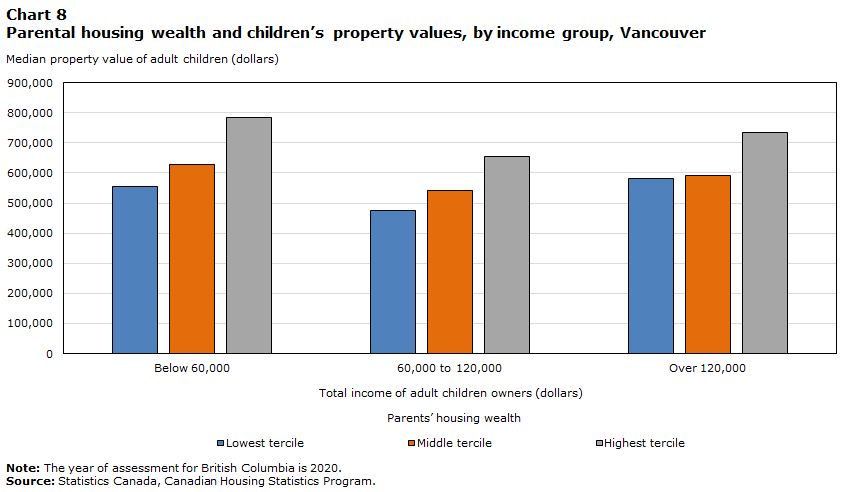

Largest potential role of parents’ housing wealth in Toronto and urban British Columbia

The analysis of Toronto and the British Columbia CMAs produced distinctive results. In these areas, children’s property values varied the most based on parents’ housing wealth. This may be a result of the higher housing prices in these CMAs and the extent to which adult children may rely more on their parents to enter the expensive housing markets (see Mirdamadi and Khalid, 2023).

In Toronto, for example, adult children with a total income from $60,000 to $120,000 owned properties with a median value of $334,000 in the lowest tercile, compared with $451,000 in the highest tercile, a difference of $117,000 (35.0%).Note In Vancouver, this difference was $178,000 (37.4%). While these larger differences between terciles are notable, they are consistent with the higher levels of parental housing wealth that adult children can draw on in these markets. For instance, in 2021, the median household parental housing wealth for adult children in the highest (third) tercile was nearly $4,000,000 in Vancouver.

Data table for Chart 7

| Toronto Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 398,000 | 451,000 | 524,000 |

| 60,000 to 120,000 | 334,000 | 371,000 | 451,000 |

| Over 120,000 | 390,000 | 443,000 | 542,000 |

|

Note: The year of assessment for Ontario is 2016. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Data table for Chart 8

| Vancouver Total income of adult children owners (dollars) |

Parents’ housing wealth | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| median property value of adult children (dollars) | |||

| Below 60,000 | 554,000 | 629,000 | 783,000 |

| 60,000 to 120,000 | 476,000 | 541,000 | 654,000 |

| Over 120,000 | 582,000 | 592,000 | 733,000 |

|

Note: The year of assessment for British Columbia is 2020. Source: Statistics Canada, Canadian Housing Statistics Program. |

|||

Toronto and Vancouver also stand out from other Canadian CMAs because the median property values of each tercile did not steadily increase with the income of their owners. Instead, property values of children in the lowest income range were comparable with those of the highest income range, and higher than the intermediate range ($60,000 to $120,000), consistent with a U-shaped relationship between values and income.

Further analysis of these two CMAs was undertaken to understand these unique results.Note It was found that most of this pattern can be explained by a larger proportion of cases where children had low incomes while owning highly valued properties. For example, in Vancouver, 14.6% of the properties analyzed in this section had a ratio of assessed value to total owner income over 30.Note Of these properties, the vast majority (94.6%) were associated with owner incomes in the lowest income range (lower than $60,000). In Toronto, 7.2% of the properties analyzed had a ratio over 30, of which 99.1% were in the lowest income range. The significant number of these high-ratio cases resulted in median property values for the lowest income range that were higher than for the other income ranges in these two CMAs.

Adult children with an assessed value-to-owner-income ratio exceeding 30 were more likely to be first-generation immigrants (born abroad).Note In Toronto, about half (52.1%) of the high-ratio properties had at least one adult child who was a first-generation immigrant listed on the title, compared with 35.2% of all properties analyzed. In Vancouver, 65.4% of the high-ratio properties were owned by at least one first-generation immigrant adult child, compared with 37.3% of all properties owned by adult children.

This result may be due to distinctive patterns among immigrant groups in the use of wealth and income to purchase housing. For example, previous research by Statistics Canada suggested that immigrant populations—which are a larger proportion of the populations of these two CMAs than of other CMAs—were more likely to devote greater proportions of wealth or spending to homeownership relative to other investments (Morissette, 2019). In addition, the measurement strategy used here does not reflect other forms of liquid assets, such as cash savings and disposable assets, that can be drawn upon to support the purchase of residential real estate. This means that the results shown above may be explained in part by higher levels of disposable assets for immigrant families, including savings held abroad (Ley, 2010; Gougeon and Moussouni, 2021; Gordon, 2022).

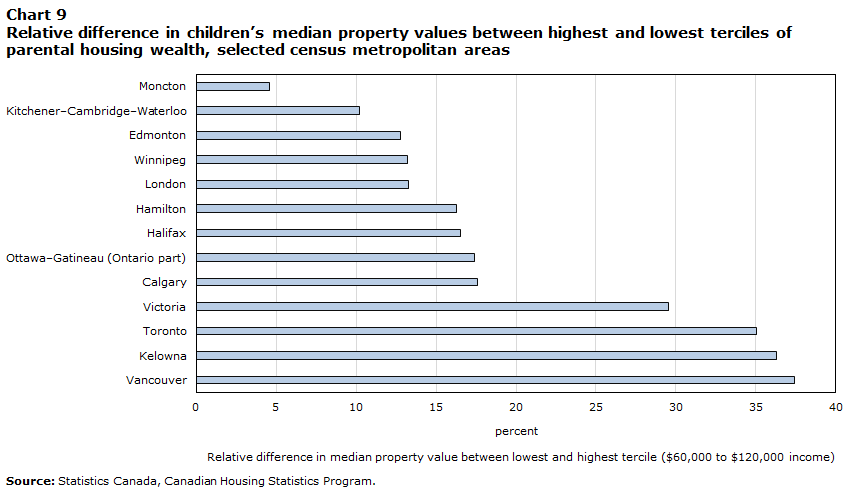

Summarizing the potential role of parents’ housing wealth across census metropolitan areas

To summarize the relative influence that parents’ housing wealth may play in different CMAs, Chart 9 shows the relative difference between children’s median property values in the lowest and highest terciles in the intermediary owner income range ($60,000 to $120,000).Note The largest relative difference in children’s property values occurred in the CMAs of Vancouver, Kelowna and Toronto, while lower differences were found in smaller CMAs in central and Eastern Canada. This result reinforces the findings of the first article of this series that parents’ housing wealth may play a larger role in these high-priced markets than in other parts of the country (Mirdamadi and Khalid, 2023). In less expensive areas, where parents’ financial support may be less important for the purchase of a house, such as in rural areas and smaller urban areas, the differences in children’s property values associated with parental housing wealth are smaller.

Data table for Chart 9

| Relative difference in property value between lowest and highest tercile ($60,000 to $120,000 income) | |

|---|---|

| percent | |

| Moncton | 4.6 |

| Kitchener–Cambridge–Waterloo | 10.2 |

| Edmonton | 12.8 |

| Winnipeg | 13.2 |

| London | 13.3 |

| Hamilton | 16.3 |

| Halifax | 16.5 |

| Ottawa–Gatineau (Ontario part) | 17.4 |

| Calgary | 17.6 |

| Victoria | 29.6 |

| Toronto | 35.0 |

| Kelowna | 36.3 |

| Vancouver | 37.4 |

| Source: Statistics Canada, Canadian Housing Statistics Program. | |

Note to readers

The data in this study are compiled from the Canadian Housing Statistics Program (CHSP) for the 2021 reference year. The geography covered in the study includes all provinces and territories, except Saskatchewan and Quebec. Homeownership estimates for the 2021 reference year are linked to tax data from the T1 Family File (T1FF) up to the 2020 tax year. Data in the T1FF include all individuals who filed a T1 Income Tax Return, combined with other administrative files from the Canada Revenue Agency.

Definitions

Homeownership or property ownership refers to the possession of residential properties, excluding vacant land.

Housing wealth in this study is the sum of the assessed values of residential properties owned by an individual. It is a measure of gross asset value and does not take into account liabilities, such as outstanding mortgages or any other debts associated with property ownership.

Adult children in this study are residents of Canada who were born in the 1990s. Their parents are those who have declared them as dependants, as reflected in the T1FF.

Linking parents and children in the housing market

The housing market outcomes of parents and children are linked by first creating “tax families” with longitudinal tax data from the T1FF. People born in the 1990s are linked to individuals who have declared them as dependants in tax filings at some point from 1996 to 2021. In this article, the former are designated “children” and the latter are designated “parents,” although being a parent in this context does not require a biological relation.Note Once children born in the 1990s are linked to parents through tax files, they are then connected to residential property ownership data from the CHSP. The adult children studied in this article are the subset that own property (15.5%) among the broader population of adult children born in the 1990s who have been linked with a parent in the T1FF. For further details about the methodology used in the study and data coverage, see the Note to readers in the first article in this series (Mirdamadi and Khalid, 2023).

Appendix: Parents’ housing wealth and children’s property values, census metropolitan area-level results

The table below presents the results of the analysis conducted for each census metropolitan area in the provinces studied. The values reported for each tercile of parental wealth and income range are the median property values of properties owned by people born in the 1990s. In this analysis, properties were only included when (1) all owners on the title were born in the 1990s, (2) all owners were linked to a parent in the tax data, (3) at least one parent owned a residential property in the provinces studied, and (4) the owners did not have a negative or missing value for gross income in tax data for 2020.

| CMA | Parental housing wealth group | ||

|---|---|---|---|

| Lowest tercile | Middle tercile | Highest tercile | |

| St. John’sTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 1 |

|||

| Below $60,000 | 235,000 | 243,000 | 246,000 |

| $60,000-$120,000 | 279,000 | 276,000 | 278,000 |

| Over $120,000 | 323,000 | 307,000 | 332,000 |

| HalifaxTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 175,000 | 198,000 | 262,000 |

| $60,000-$120,000 | 212,000 | 219,000 | 247,000 |

| Over $120,000 | 270,000 | 292,000 | 291,000 |

| MonctonTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 3 |

|||

| Below $60,000 | 131,000 | 132,000 | 144,000 |

| $60,000-$120,000 | 152,000 | 153,000 | 159,000 |

| Over $120,000 | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | 180,000 | 204,000 |

| Saint JohnTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 3 |

|||

| Below $60,000 | 120,000 | 138,000 | 130,000 |

| $60,000-$120,000 | 156,000 | 157,000 | 177,000 |

| Over $120,000 | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | 212,000 | 215,000 |

| Ottawa–Gatineau (Ontario Part)Table A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 224,000 | 270,000 | 294,000 |

| $60,000-$120,000 | 253,000 | 270,000 | 297,000 |

| Over $120,000 | 313,000 | 322,000 | 342,000 |

| KingstonTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 207,000 | 222,000 | 257,000 |

| $60,000-$120,000 | 234,000 | 231,000 | 251,000 |

| Over $120,000 | 249,000 | 270,000 | 281,000 |

| BellevilleTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 155,000 | 153,000 | 150,000 |

| $60,000-$120,000 | 175,000 | 181,000 | 190,000 |

| Over $120,000 | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | 204,000 | 204,000 |

| PeterboroughTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 211,000 | 207,000 | 252,000 |

| $60,000-$120,000 | 230,000 | 240,000 | 241,000 |

| Over $120,000 | 251,000 | 242,000 | 261,000 |

| OshawaTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 281,000 | 333,000 | 359,000 |

| $60,000-$120,000 | 280,000 | 285,000 | 313,000 |

| Over $120,000 | 319,000 | 331,000 | 353,000 |

| TorontoTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 398,000 | 451,000 | 524,000 |

| $60,000-$120,000 | 334,000 | 371,000 | 451,000 |

| Over $120,000 | 390,000 | 443,000 | 542,000 |

| HamiltonTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 267,000 | 283,000 | 321,000 |

| $60,000-$120,000 | 264,000 | 294,000 | 307,000 |

| Over $120,000 | 310,000 | 341,000 | 382,000 |

| St. Catharines–NiagaraTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 160,000 | 184,000 | 187,000 |

| $60,000-$120,000 | 173,000 | 187,000 | 200,000 |

| Over $120,000 | 214,000 | 229,000 | 235,000 |

| Kitchener–Cambridge–WaterlooTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 238,000 | 261,000 | 299,000 |

| $60,000-$120,000 | 255,000 | 261,000 | 281,000 |

| Over $120,000 | 295,000 | 296,000 | 307,000 |

| BrantfordTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 193,000 | 195,000 | 258,000 |

| $60,000-$120,000 | 204,000 | 217,000 | 223,000 |

| Over $120,000 | 222,000 | 259,000 | 281,000 |

| GuelphTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 255,000 | 301,000 | 308,000 |

| $60,000-$120,000 | 275,000 | 305,000 | 318,000 |

| Over $120,000 | 323,000 | 335,000 | 353,000 |

| LondonTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 161,000 | 180,000 | 200,000 |

| $60,000-$120,000 | 181,000 | 199,000 | 205,000 |

| Over $120,000 | 200,000 | 230,000 | 246,000 |

| WindsorTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 111,000 | 116,000 | 122,000 |

| $60,000-$120,000 | 129,000 | 149,000 | 156,000 |

| Over $120,000 | 155,000 | 187,000 | 188,000 |

| BarrieTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 273,000 | 304,000 | 321,000 |

| $60,000-$120,000 | 277,000 | 293,000 | 301,000 |

| Over $120,000 | 317,000 | 318,000 | 342,000 |

| Greater SudburyTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 188,000 | 192,000 | 190,000 |

| $60,000-$120,000 | 204,000 | 208,000 | 213,000 |

| Over $120,000 | 216,000 | 232,000 | 245,000 |

| Thunder BayTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 4 |

|||

| Below $60,000 | 151,000 | 153,000 | 166,000 |

| $60,000-$120,000 | 173,000 | 194,000 | 193,000 |

| Over $120,000 | 217,000 | 216,000 | 231,000 |

| WinnipegTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 5 |

|||

| Below $60,000 | 197,000 | 214,000 | 241,000 |

| $60,000-$120,000 | 242,000 | 255,000 | 274,000 |

| Over $120,000 | 290,000 | 300,000 | 331,000 |

| LethbridgeTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 213,000 | 214,000 | 233,000 |

| $60,000-$120,000 | 259,000 | 261,000 | 275,000 |

| Over $120,000 | 318,000 | 302,000 | 328,000 |

| CalgaryTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 231,000 | 260,000 | 292,000 |

| $60,000-$120,000 | 273,000 | 299,000 | 321,000 |

| Over $120,000 | 348,000 | 380,000 | 412,000 |

| EdmontonTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 216,000 | 247,000 | 284,000 |

| $60,000-$120,000 | 282,000 | 302,000 | 318,000 |

| Over $120,000 | 338,000 | 356,000 | 380,000 |

| KelownaTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 322,000 | 355,000 | 422,000 |

| $60,000-$120,000 | 353,000 | 402,000 | 481,000 |

| Over $120,000 | 522,000 | 525,000 | 582,000 |

| Abbotsford–MissionTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 291,000 | 442,000 | 444,000 |

| $60,000-$120,000 | 332,000 | 383,000 | 490,000 |

| Over $120,000 | 585,000 | 572,000 | 649,000 |

| VancouverTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 554,000 | 629,000 | 783,000 |

| $60,000-$120,000 | 476,000 | 541,000 | 654,000 |

| Over $120,000 | 582,000 | 592,000 | 733,000 |

| VictoriaTable A Median property value of adult child homeowners according to tercile of parental housing wealth and total income level Note 2 |

|||

| Below $60,000 | 381,000 | 436,000 | 495,000 |

| $60,000-$120,000 | 389,000 | 429,000 | 504,000 |

| Over $120,000 | 479,000 | 582,000 | 607,000 |

x suppressed to meet the confidentiality requirements of the Statistics Act

|

|||

References

Barrett, G., Cigdem, M., Whelan, S., Wood, G. (2015). The relationship between intergenerational transfers, housing and economic outcomes, Australian Housing and Urban Research Institute.

Canada Mortgage and Housing Corporation (2018). Canadian homebuyers insights: 2018 Mortgage Consumer Survey Results.

Canadian Real Estate Association (2024). MLS Home Price Index.

Corak, M. (2013). Income Inequality, Equality of Opportunity, and Intergenerational Mobility. Journal of Economic Perspectives, 27(3). 79-102.

Engelhardt, G.V., Mayer, C.J. (1998). Intergenerational Transfers, Borrowing Constraints, and Saving Behavior: Evidence from the Housing Market. Journal of Urban Economics, 44(1). 135-157.

Ermisch, J., Jantti, M., Smeeding, T. (Eds.) (2012). From parents to children: The intergenerational transmission of advantage. New York: Russell Sage Foundation.

Galea, I., Alini, E. (2023). The ‘Bank of Mom and Dad’ is no longer just for down payments. Globe and Mail.

Gellatly, G., Richards, E. (2019). Indebtedness and wealth among Canadian households. Economic Insights: Statistics Canada.

Gordon, J. (2022). Solving puzzles in the Canadian housing market: Foreign ownership and de-coupling in Toronto and Vancouver. Housing Studies, 37(7). 1250-1273.

Gougeon, A., Moussouni, O. (2021). Residential real estate sales in 2018: Who is purchasing real estate? Canadian Housing Statistics Program: Statistics Canada.

Guiso, L., Jappelli, T. (2002). Private Transfers, Borrowing Constraints and the Timing of Homeownership. Journal of Money, Credit and Banking, 34(2). 315-339.

Henretta, J. (1984). Parental status and child’s homeownership status. American Sociological Review, 49(1). 131-140.

Hogue, R. (2023). Brighter days ahead as home ownership costs go through the roof, RBC.

Ley, D. (2010). Millionaire Migrants: Trans-Pacific Life Lines. Malden, MA: Wiley-Blackwell.

Ma, K.-R., and Kang, E.-T. (2015). Intergenerational effects of parental wealth on children’s housing wealth. Environment and Planning A: Economy and Space, 47(8). 1756-1775.

Mirdamadi, M., Khalid, A. (2023). Parents and children in the Canadian housing market: Does parental property ownership increase the likelihood of homeownership for children? Canadian Housing Statistics Program: Statistics Canada.

Morissette, R. (2019). The wealth of immigrant families in Canada. Analytical Studies Branch Research Paper Series: Statistics Canada.

Pfeffer, F.T., Killewald, A. (2018). Generations of advantage: Multigenerational correlations in family wealth. Social Forces, 96(4). 1411-1442.

Putnam, R. (2015). Our kids: The American dream in crisis. New York: Simon & Schuster Paperbacks.

Statistics Canada (2024). Table 36-10-0661-01 Distributions of household economic accounts, wealth, Canada, regions and provinces, quarterly (x 1,000,000). January 22, 2024.

Tal, B. (2021). Gifting for a down payment — perspective. CIBC. October 25, 2021.

- Date modified: