StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on businesses in retail trade, third quarter of 2021

StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on businesses in retail trade, third quarter of 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Text begins

In March 2020, the government imposed measures aimed at slowing the spread of COVID-19. Many Canadian retailers shut down operations mid-month, curtailed hours and customer flow in the stores that remained open, all of which contributed to changes in the shopping habits of consumers. Many retailers were deemed non-essential, resulting in temporary storefront closures or reduced hours of operation. As a result, in March 2020, retail sales fell 10.0% to $47.1 billion, the largest drop on record, and about 40% of retailers closed their doors to in-store shopping.Note

Amid the ongoing COVID-19 pandemic in Canada, public health measures were repeatedly imposed and eased by provincial governments in several regions across the country, which had significant impacts on the retail sector. For example, in 2020, nearly three-fifths (58.9%) of businesses in retail experienced a decrease in revenue compared with 2019.Note

By the third quarter of 2021, the Canadian economy had experienced over a full year of COVID-19. While challenges remain, retail business sentiment has improved significantly as a result of easing of restrictions in many regions across the country. Retail sales were up 4.2% to $56.2 billion in June, led by higher sales at clothing and clothing accessories stores.Note

From the beginning of July to early August, Statistics Canada conducted the Canadian Survey on Business Conditions to better understand the ongoing effects of the pandemic on businesses and business expectations moving forward. This article provides insights on those expectations, as well as on the challenges and uncertainties faced by businesses in retail trade.Note Based on the results of this survey, businesses in retail trade expect selling prices and profitability to increase in the short term, and have a positive future outlook in the long term.

Retail businesses expect inventory levels and costs of inputs to be obstacles

Around two-fifths of businesses in retail trade expected maintaining inventory levels (42.5%) and the rising cost of inputs (38.8%) to be obstacles over the next three months.Note Additionally, over one-third of retail businesses expected recruiting skilled employees (37.8%) and a shortage of labour force (33.7%) to be obstacles over the coming three months.

Nearly one-third (30.5%) of businesses in retail expected their selling price of goods and services offered to increase over the next three months, higher than the proportion of all businesses (21.7%). Almost two-thirds (64.5%) of businesses in the retail industry expected selling prices to remain the same, and 4.9% expected selling prices to decrease.

Additionally, just over one-fifth (20.9%) of businesses in retail trade expected their profitability to increase over the next three months, compared with 13.7% of all businesses. Over half (52.9%) of businesses in retail expected their profitability to stay about the same, and more than one-quarter (26.2%) expected their profitability to decrease.

| Increase (% of businesses) | Stay about the same (% of businesses) | Decrease (% of businesses) | |

|---|---|---|---|

| Selling price of goods and services | 30.5 | 64.5 | 4.9 |

| Profitability | 20.9 | 52.9 | 26.2 |

| Number of employees | 15.0 | 77.0 | 8.0 |

| Sales of goods and services | 28.5 | 55.3 | 16.2 |

| Demand for products and services offered | 28.9 | 59.7 | 11.4 |

|

Note: Respondents were asked between July 2 and August 6 how various business aspects were expected to change over the next three months. Therefore, the three month period could range from July 2 to November 6, 2021, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2021 (Table 33-10-0363-01). |

|||

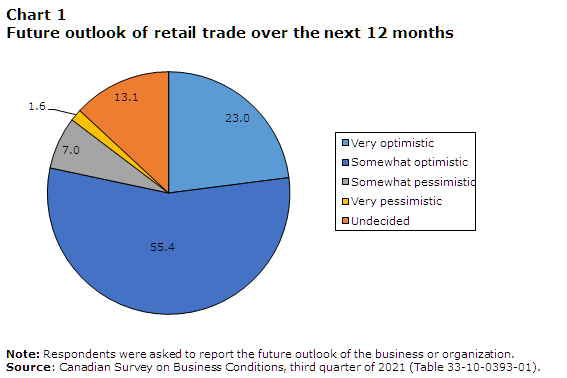

Future outlook of businesses in retail trade are mostly positive in the long term

In recent months, public health restrictions, which limited non-essential retail activities, were eased in many regions across the country.Note As a result, in the long term, the majority of businesses in retail trade were either somewhat (55.4%) or very optimistic (23.0%) about the future outlook of their business over the next 12 months. In comparison, nearly one in ten (8.6%) reported that their future outlook was pessimistic, while 13.1% were undecided.

Data table for Chart 1

| Future outlook | |

|---|---|

| percent | |

| Very optimistic | 23.0 |

| Somewhat optimistic | 55.4 |

| Somewhat pessimistic | 7.0 |

| Very pessimistic | 1.6 |

| Undecided | 13.1 |

|

Note: Respondents were asked to report the future outlook of the business or organization. Source: Canadian Survey on Business Conditions, third quarter of 2021 (Table 33-10-0393-01). |

|

At their current level of revenue and expenditures, over half (53.3%) of businesses in retail trade reported that they could continue to operate for 12 months or more before considering closure or bankruptcy. However, over two-fifths (41.3%) of businesses in retail were unsure, and 5.3% said they could continue to operate for less than 12 months before considering closure or bankruptcy. At the same time, 1.2% of businesses in retail plan to close in the next 12 months.

Nearly half (49.0%) of businesses in retail can continue to operate at their current level of revenue and expenditures for 12 months or more before considering laying off staff. Meanwhile, over one-third (34.7%) of businesses in retail trade reported they did not know how long they could continue to operate before considering laying off staff, while one in six (16.3%) reported that they could continue to operate for less than 12 months before considering these actions.

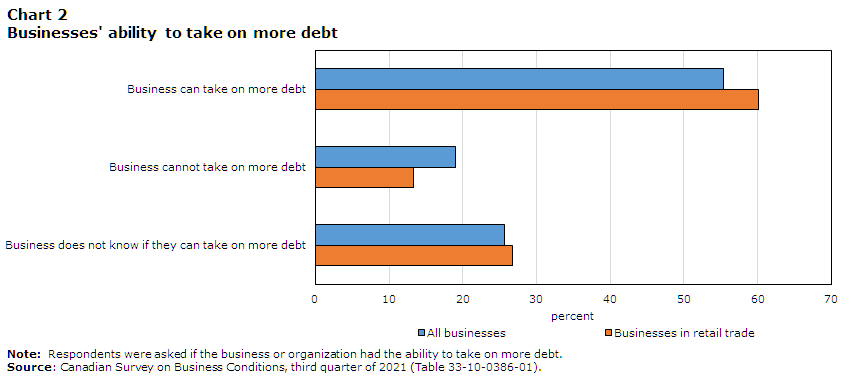

Businesses in retail trade have the ability to take on more debt

Three-fifths (60.1%) of businesses in retail trade reported that they could take on more debt, compared with over half of all businesses (55.3%). Conversely, over one in ten (13.3%) businesses in retail reported that they did not have the ability to take on more debt.

Data table for Chart 2

| All businesses | Businesses in retail trade | |

|---|---|---|

| percent | ||

| Business can take on more debt | 55.3 | 60.1 |

| Business cannot take on more debt | 19.0 | 13.3 |

| Business does not know if they can take on more debt | 25.7 | 26.7 |

|

Note: Respondents were asked if the business or organization had the ability to take on more debt. Source: Canadian Survey on Business Conditions, third quarter of 2021 (Table 33-10-0386-01). |

||

When considering businesses that could not take on more debt, the most commonly reported reasons for businesses in the retail sector were cash flow (42.9%) and the lack of confidence or uncertainty in future sales (38.2%).

The majority (77.1%) of businesses in retail reported that they had the cash or liquid assets required to operate for the next three months, compared with nearly four-fifths (79.3%) of all businesses.

Maintaining sufficient cash flow or managing debt was an obstacle expected over the next three months by nearly one-fifth (18.5%) of businesses in retail, similar to all businesses (18.0%).

In response to the challenges experienced by businesses due to the pandemic, various government programs focusing on funding or credit were made available to support businesses. A similar proportion of businesses in the retail industry (70.4%) were approved for or received some form of funding or credit because of the COVID-19 pandemic, compared with all businesses (71.3%).

However, when considering businesses that did not access any COVID-19 related funding or credit, nearly half (46.8%) of businesses in retail trade stated that it was because funding or credit was not needed, while under two-thirds (63.5%) of all businesses reported this reason.

Methodology

From July 2 to August 6, 2021, representatives from businesses across Canada were invited to take part in an online questionnaire about how COVID-19 is affecting their business and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 36,294 and results are based on responses from a total of 16,925 businesses, 1,533 of which were in retail trade.

References

Statistics Canada. (2021). Canadian Survey on Business Conditions, third quarter of 2021.

- Date modified: