StatCan COVID-19: Data to Insights for a Better CanadaImpact of COVID-19 on businesses majority-owned by visible minorities in Canada, second quarter of 2021

StatCan COVID-19: Data to Insights for a Better CanadaImpact of COVID-19 on businesses majority-owned by visible minorities in Canada, second quarter of 2021

by Kiran Toor and Marina Smailes

This article provides disaggregated data to better understand the impact of COVID-19 on specific groups. Visit the Gender, Diversity and Inclusion Statistics Hub for more analysis, including disaggregated data on labour, public safety, health and more.

The COVID-19 pandemic continues to impact the Canadian economy and the ability of businesses to operate. Although real gross domestic product (GDP) grew 1.1% in March 2021, the 11th consecutive monthly increase which continued to offset the steepest drop on record in Canadian economic activity observed in March and April 2020 ,Note it remains 1% below pre-pandemic levels.

The pandemic has impacted all Canadians and all communities across the country. Visible minoritiesNote in particular are likely to work in industries impacted the hardest by the pandemic, such as accommodation and food services.Note The April Labour Force Survey (LFS) found that the unemployment rate of populations designated as visible minorities was 9.9%, but was 7.6% for all other Canadians who were not Indigenous or a visible minority.

Along with higher levels of unemployment, visible minority groups also continue to experience higher levels of financial difficulties and higher representation in low-wage jobs.Note Results from the Canadian Survey on Business Conditions show that businesses majority-ownedNote by visible minorities expect lower profits, and are more likely to expect to face obstacles obtaining financing. Their financial constraints do not differ greatly from all private sector businesses, and one in eight businesses majority-owned by visible minorities can continue to operate for less than 12 months. Businesses majority-owned by visible minorities made up 13.2% of all private sector businesses.

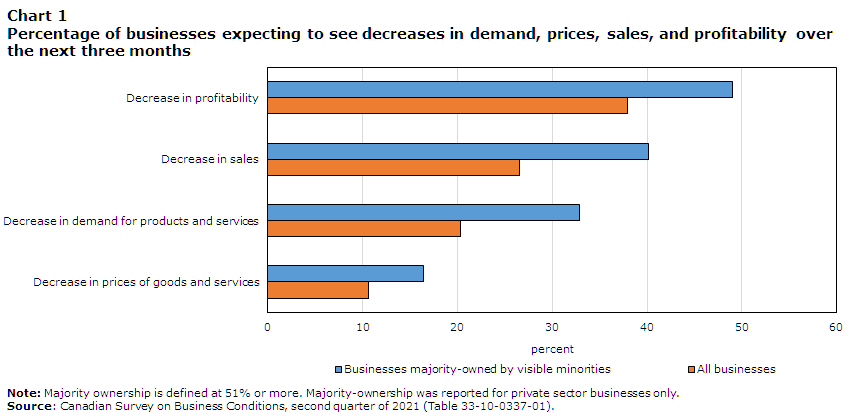

Businesses majority-owned by visible minorities expect decreases in demand, prices, sales, and profitability

One-third (32.9%) of businesses majority-owned by visible minorities expect demand for their products and services to decrease in the next three monthsNote compared to one-fifth (20.3%) of all private sector businesses. Furthermore, one in six (16.4%) businesses majority-owned by visible minorities expect to decrease the prices of goods and services they offer, while one-tenth (10.6%) of all private sector businesses expect to do the same.

Over the next three months, a larger proportion of businesses majority-owned by visible minorities (40.1%) expect their sales to decrease compared to all private sector businesses (26.5%). While half (49.0%) of businesses majority-owned by visible minorities expect their profitability to decrease over the next three months, by contrast just under two-fifths (37.9%) of all private sector businesses expect the same. Business expectations seem to be improving compared to the first quarter of 2021, when nearly three-fifths (58.0%) of businesses majority owned by visible minorities and over two-fifths (43.0%) of all private sector businesses expected their profitability to decrease over the next three months.

Data table for Chart 1

| Decrease in profitability | Decrease in sales | Decrease in demand for products and services | Decrease in prices of goods and services | |

|---|---|---|---|---|

| percent | ||||

| Businesses majority-owned by visible minorities | 49.0 | 40.1 | 32.9 | 16.4 |

| All businesses | 37.9 | 26.5 | 20.3 | 10.6 |

|

Note: Majority ownership is defined at 51% or more. Majority-ownership was reported for private sector businesses only. Source: Canadian Survey on Business Conditions, second quarter of 2021 (Table 33-10-0337-01). |

||||

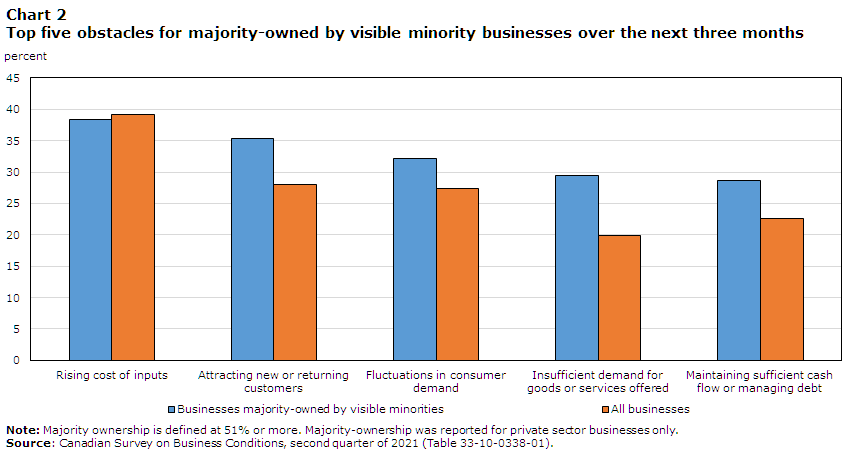

Businesses majority-owned by visible minorities are more likely to expect obstacles maintaining sufficient cash flow or managing debt

Over one-quarter (28.6%) of businesses majority-owned by visible minorities expect maintaining sufficient cash flow or managing debt to be an obstacle over the next three months, while this was expected to be an obstacle for more than one-fifth (22.6%) of all private sector businesses. This is a slight decrease from the first quarter of 2021, when under one-third (31.0%) of businesses majority-owned by visible minorities and one-quarter (25.0%) of all private sector businesses indicated maintaining sufficient cash flow was expected to be an obstacle. One-fifth (19.6%) of businesses majority-owned by visible minorities expect obtaining financing to be an obstacle over the next three months; however, over one-tenth (12.6%) of all private sector businesses expect the same.

The rising cost of inputs was the top obstacle expected over the next three months for businesses majority-owned by visible minorities (38.4%) as well as for private sector businesses (39.1%). Under one-third (29.5%) of businesses majority-owned by visible minorities expect to face obstacles with insufficient demand for goods and services over the next three months, compared to one-fifth (19.9%) of all private sector businesses. In the first quarter of 2021, a larger proportion of businesses majority-owned by visible minorities (39.0%) and all private sector businesses (30.1%) expected insufficient demand for goods and services to be an obstacle.

Over one-third (35.4%) of businesses majority-owned by visible minorities also expect to face obstacles attracting new or returning customers over the next three months, while 28.0% of all private sector businesses expect the same.

Data table for Chart 2

| Rising cost of inputs | Attaching new or returning customers | Fluctuations in consumer demand | Insufficient demand for goods or services offered | Maintaining sufficient cash flow or managing debt | |

|---|---|---|---|---|---|

| percent | |||||

| Businesses majority-owned by visible minorities | 38.4 | 35.4 | 32.1 | 29.5 | 28.6 |

| All businesses | 39.1 | 28.0 | 27.4 | 19.9 | 22.6 |

|

Note: Majority ownership is defined at 51% or more. Majority-ownership was reported for private sector businesses only. Source: Canadian Survey on Business Conditions, second quarter of 2021 (Table 33-10-0338-01). |

|||||

Businesses majority-owned by visible minorities face similar financial constraints as all businesses

Nearly one-fifth (18.0%) of businesses majority-owned by visible minorities indicated that their business could take on more debt, while almost one-quarter (23.6%) of all private sector businesses indicated the same. This is a decrease from the first quarter of 2021, when three in ten (29.0%) businesses majority-owned by visible minorities and over one-third (34.6%) of all private sector businesses indicated the ability to take on more debt.

Similar proportions of businesses majority-owned by visible minorities (43.2%) and all private sector businesses (41.9%) stated they did not need to take on more debt. Of businesses that could not take on more debt, seven in ten (70.6%) businesses majority-owned by visible minorities indicated a lack of confidence or uncertainty in future sales as the reason, while under three-fifths (58.0%) of all private sector businesses indicated the same. Close to two-thirds (64.3%) of businesses majority-owned by visible minorities reported having the cash or liquid assets required to operate over the next three months, compared to three-quarters (74.7%) of all private sector businesses.

Over one-fifth (21.6%) of businesses majority-owned by visible minorities did not access any funding or credit due to COVID-19, compared to over one-quarter (26.4%) of all private sector businesses. Of these businesses, those majority-owned by visible minorities (12.0%) were twice as likely to indicate this was because they were unaware of funding options available, compared to 5.9% of all private sector businesses. Meanwhile, three-fifths (59.9%) of businesses majority-owned by visible minorities and nearly two-thirds (64.8%) of all private sector businesses stated that funding or credit was not needed.

Nearly half (48.9%) of businesses majority-owned by visible minorities indicated that the COVID-19 pandemic has not negatively affected their credit rating, compared to nearly three-fifths (58.0%) of all private sector businesses.

Data table for Chart 3

| Status on cash or liquid assets over the next three months | Ability to take on more debt | ||||

|---|---|---|---|---|---|

| Yes, business has the cash or liquid assets required to operate cash or liquid assets required to operate | No, business does not have the cash or liquid assets requires to operate | Business does not need to take on more debt | Yes, business can take on more debt | No, business cannot take on more debt | |

| percent | |||||

| Businesses majority-owned by visible minorities | 64.3 | 15.5 | 43.2 | 18.0 | 14.3 |

| All businesses | 74.7 | 9.0 | 41.9 | 23.6 | 14.9 |

|

Note: Respondents were asked if the business or organization had the ability to take on more debt. Source: Canadian Survey on Business Conditions, second quarter of 2021 (Tables 33-10-0353-01 and 33-10-0354-01). |

|||||

In terms of funding or credit obtained during the COVID-19 pandemic, close to two-thirds (63.1%) of businesses majority-owned by visible minorities were approved for or received the Canada Emergency Business Account (CEBA),Note compared to over half (55.4%) of all private sector businesses. Businesses majority-owned by visible minorities (36.5%) were just as likely to receive the Canada Emergency Wage Subsidy (CEWS)Note as all private sector businesses (36.8%).

One in eight businesses majority-owned by visible minorities can continue to operate for less than 12 months

One in eight (12.7%) businesses majority-owned by visible minorities indicated that they could operate at their current level of revenue and expenditures for less than 12 months before considering closure or bankruptcy, compared to under one-tenth (9.8 %) of all private sector businesses. This is not significantly different from the first quarter of 2021, when over one-tenth (13.2%) of businesses majority-owned by visible minorities and one-tenth (10.7%) of all private sector businesses indicated being able to operate for less than 12 months before considering a closure.

Over one-fifth (22.4%) of businesses majority-owned by visible minorities indicated they could operate at their current level of revenues and expenditures for less than 12 months before considering laying off staff, compared to one-fifth (20.7%) of all private sector businesses that reported the same. This is not substantially different from the first quarter of 2021, when under one-quarter (23.9%) of businesses majority-owned by visible minorities and over one-fifth (21.6%) of all private sector businesses could operate for less than 12 months before laying off staff.

One-quarter (25.7%) of businesses majority-owned by visible minorities indicated that they intended to spend on employee training over the next 12 months to prepare for when the economy recovers, compared to under one-sixth (15.8%) of all private sector businesses.

Methodology

From April 1 to May 6, representatives from businesses across Canada were invited to take part in an online questionnaire about how COVID-19 is affecting their business and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 34,169 and results are based on responses from a total of 16,937 businesses.

References

Statistics Canada. (2021). Canadian Survey on Business Conditions, first quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, second quarter of 2021.

- Date modified: