StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on businesses majority-ownedNote by visible minorities, third quarter of 2020

StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on businesses majority-ownedNote by visible minorities, third quarter of 2020

by Stephanie Tam, Shivani Sood and Chris Johnston

Text begins

This article provides disaggregated data to better understand the impact of COVID-19 on specific groups. Visit the Gender, Diversity and Inclusion Statistics Hub for more analysis, including disaggregated data on labour, public safety, health and more.

The COVID-19 pandemic continues to impact the Canadian economy and the ability of businesses to operate. Real gross domestic product (GDP) grew 1.2% in AugustNote , the fourth consecutive monthly increase which continued to offset the steepest drops on record in Canadian economic activity observed in March (7.5%) and April (11.6%).Note However, overall economic activity was still about 5% below February’s pre-pandemic level.Note

Different communities in Canada have been impacted in various ways by the COVID-19 pandemic. In the recent Speech from the Throne, the Government of Canada recognized the challenges faced by visible minority communities, and identified the need to address economic inequalities for these communities. Initiatives such as the Black Entrepreneurship Program are designed to address these disparities.Note

Revenue changes

Businesses majority-owned by visible minorities were more likely to see lower revenues compared to August 2019. Almost one-quarter (24.7%) of businesses majority-owned by visible minorities reported a decrease in revenue of 40% or more, while over one-fifth (21.1%) of all businesses in Canada said the same. Furthermore, under one-fifth (19.8%) of businesses majority-owned by visible minorities reported no change in revenues, compared to just over one-quarter (25.5%) of all businesses in Canada. Businesses majority-owned by visible minorities were less likely to report an increase (13.7%) in revenue.

| Percentage of businesses that reported an increase in revenue | Percentage of businesses that reported no change in revenue | Percentage of businesses that reported a 1% to less than 20% decline in revenue | Percentage of businesses that reported a 20% to less than 40% decline in revenue | Percentage of businesses that reported a 40% or more decline in revenue | Not applicable | |

|---|---|---|---|---|---|---|

| All businesses | 17.2 | 25.5 | 14.6 | 20.8 | 21.1 | 0.8 |

| Businesses majority-owned by visible minorities | 13.7 | 19.8 | 16.1 | 25.0 | 24.7 | 0.9 |

|

Note: Majority-owner owns 51% or more of the business. Respondents were asked: Compared to August 2019, how did the revenues of this business change in August 2020? Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0281-01). |

||||||

Debt and liquidity

Businesses majority-owned by visible minorities were less likely to have the ability to take on more debt, and also less likely to have the sufficient liquid assets to operate. Over a quarter of businesses majority-owned by visible minorities (27.3%) reported that they had the ability to take on more debt, compared to 36.6% of all businesses. Additionally, almost two-thirds (64.8%) of businesses majority-owned by visible minorities reported that they had the cash or liquid assets required to operate, while over three-quarters (76.9%) of all businesses reported the same.

Data table for Chart 1

| Ownership type | Percentage of businesses able to take on more debt | Percentage of businesses that had the cash or liquid assets required to operate |

|---|---|---|

| percent | ||

| All businesses | 36.6 | 76.9 |

| Businesses majority-owned by visible minorities | 27.3 | 64.8 |

|

Note: Majority-owner owns 51% or more of the business. Respondents were asked if the business or organization had the ability to take on more debt, and if they had the cash or liquid assets required to operate. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Tables 33-10-0286-01 and 33-10-0287-01). |

||

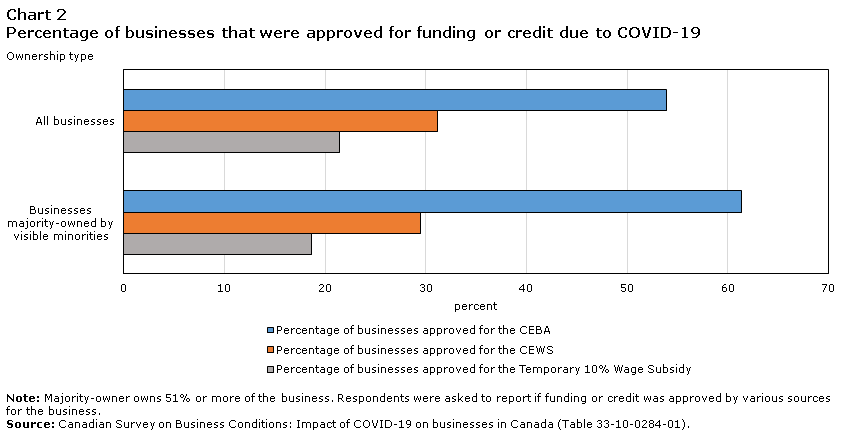

Funding or credit

Due to COVID-19, various programs focusing on funding or credit were made available to support businesses during this time. The Canada Emergency Business account (CEBA) provides eligible small businesses and non-profits with a loan up to $40,000, designed to help cover operating costs. The Canada Emergency Wage Subsidy (CEWS) is a subsidy of 75% of employee wages for eligible businesses, to re-hire previously laid off staff due to the pandemic and prevent further job losses. The Temporary 10% Wage Subsidy is a three-month measure that will allow eligible employers to reduce the amount of payroll deductions required to be remitted to the Canada Revenue Agency (CRA). Businesses majority-owned by visible minorities were more likely to apply for and be approved for certain types of funding or credit due to COVID-19.Note

Under two-thirds (61.4%) of businesses majority-owned by visible minorities were approved for CEBA, while just over half (53.9%) of all businesses in Canada were approved for CEBA.

Businesses majority-owned by visible minorities were just as likely to be approved for CEWS and the Temporary 10% Wage Subsidy. Under one-third of businesses majority-owned by visible minorities (29.5%) and all businesses in Canada (31.2%) were approved for CEWS, and about one-fifth of businesses majority-owned by visible minorities (18.6%) and businesses owned by all ownership types (21.4%) were approved for the Temporary 10% Wage Subsidy.

Data table for Chart 2

| Ownership type | Percentage of businesses approved for the CEBA | Percentage of businesses approved for the CEWS | Percentage of businesses approved for the Temporary 10% Wage Subsidy |

|---|---|---|---|

| percent | |||

| All businesses | 53.9 | 31.2 | 21.4 |

| Businesses majority-owned by visible minorities | 61.4 | 29.5 | 18.6 |

|

Note: Majority-owner owns 51% or more of the business. Respondents were asked to report if funding or credit was approved by various sources for the business. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0284-01). |

|||

Personal protective equipment or supplies

In general, businesses majority-owned by visible minorities were more likely to report that they expected difficulty in procuring personal protective equipment or supplies in the future. For example, almost one-third of businesses majority-owned by visible minorities (32.1%) reported that they expected difficulty in procuring hand sanitizer, while one-quarter (25.2%) of all businesses reported the same. Similarly, close to one-third of businesses majority-owned by visible minorities (31.3%) reported expecting difficulty in procuring masks, while under one-quarter (24.1%) of all businesses reported these expectations. Lastly, nearly one-third of businesses majority-owned by visible minorities (30.1%) reported expectations of difficulty in procuring gloves, compared with just over one-fifth of all businesses (21.5%).

Data table for Chart 3

| Ownership type | Hand sanitizer | Masks | Gloves |

|---|---|---|---|

| percent | |||

| All businesses | 25.2 | 24.1 | 21.5 |

| Businesses majority-owned by visible minorities | 32.1 | 31.3 | 30.1 |

|

Note: Majority-owner owns 51% or more of the business. Respondents were asked if the business or organization expected to experience difficulty in procuring various personal protective equipment or supplies. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0289-01). |

|||

Businesses majority-owned by visible minorities also were more likely to report that cost was a reason they expected difficulty in procuring personal protective equipment or supplies. Under half (45.3%) of businesses majority-owned by visible minorities reported that the cost of personal protective equipment or supplies as reasons they might have difficulty. In contrast, over one-quarter (27.0%) of all businesses had the same reasoning.

Methodology

From September 15th to October 23rd, representatives from businesses across Canada were invited to take part in an online questionnaire about how COVID-19 is affecting their business. This iteration of the Canadian Survey on Business Conditions used a stratified random sample of business establishments with employees classified by geography, industry sector, and size. Estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. Respondents were asked to self-identify whether their business was majority-owned by members of a visible minority group. If applicable, respondents were asked to identify the visible minority group. Detailed results by individual visible minority group were limited by the large number of “Prefer not to say” responses.

References

Statistics Canada - Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada, third quarter of 2020

- Date modified: