StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on Small Businesses in Canada, May 2020

StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on Small Businesses in Canada, May 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

by Stephanie Tam, Shivani Sood, and Chris Johnston

Text begins

As a result of the widespread measures taken to contain the spread of COVID-19, the Canadian economy has dramatically declined over the past few months and has significantly impacted the ability of businesses in Canada to operate. The latest gross domestic product by industry release for April 2020 reported that real gross domestic product (GDP) dropped 11.6% in April, following a 7.5% decline in March. All 20 industrial sectors of the Canadian economy were down, producing the largest monthly decline since the series started in 1961. The economy was 18.2% below its February level, the month before the COVID-19 measures began.Note

As Canada’s economy moved towards a recovery, Statistics Canada ran the Canadian Survey on Business Conditions to better understand the ongoing effects on businesses as the economy begins to reopen. Based on the results of the survey, while the majority of businesses in Canada were impacted, small businesses with 1 to 99 employees were slightly more affected by the recent economic downturn even as businesses began reopening.

Revenues: Small businesses were more likely than businesses with 100 or more employees to see revenues down by 40% or more from April 2019

The majority of businesses of all sizes reported revenues down from April 2020 when compared with April 2019. Approximately two-fifths of businesses with 5 to 19 employees (41.4%) and 20 to 99 employees (39.1%) reported that their revenues were down 40% or more. However, less than three-tenths (27.7%) of businesses with 500 or more employees said the same. In fact, nearly one-quarter (23.7%) of businesses with 500 or more employees said there was no change in their revenues, compared to less than one-fifth of businesses with 20 to 99 employees (16.5%) and 5 to 19 employees (16.1%) that said the same.

| Percentage of businesses that reported no change in revenue | Percentage of businesses that reported a 1% to less than 20% decline in revenue | Percentage of businesses that reported a 20% to less than 40% decline in revenue | Percentage of businesses that reported a 40% or more decline in revenue | |

|---|---|---|---|---|

| All employment sizes | 19.6 | 10.6 | 17.5 | 42.1 |

| 1 to 4 employees | 22.5 | 9.7 | 15.3 | 43.4 |

| 5 to 19 employees | 16.1 | 11.9 | 18.8 | 41.4 |

| 20 to 99 employees | 16.5 | 11.1 | 23.4 | 39.1 |

| 100 to 249 employees | 12.6 | 16.8 | 20.3 | 31.3 |

| 250 to 499 employees | 21.2 | 14.5 | 19.9 | 32.3 |

| 500 or more employees | 23.7 | 13.2 | 20.7 | 27.7 |

|

Note: Respondents were asked: Compared to April 2019, how did the revenues of this business change in April 2020? Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0253-01). |

||||

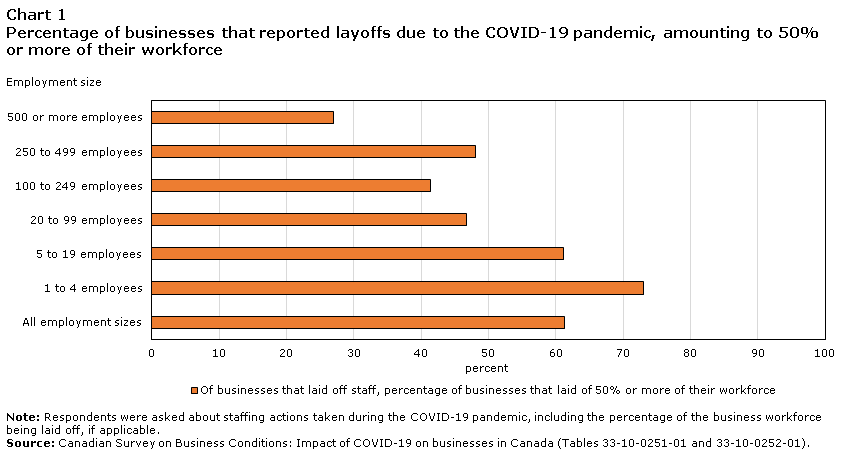

Layoffs: Small businesses with 5 to 99 employees were more likely to report laying off at least one staff due to the pandemic

Over two-fifths (41.7%) of businesses with 5 to 19 employees reported laying off staff. Nearly half (47.4%) of businesses with 20 to 99 employees reported the same. Conversely, less than one-fifth (15.9%) of businesses with 1 to 4 employees, and less than one-quarter (23.0%) of businesses with 500 or more employees reported laying off staff.

Of the businesses that laid off at least 1 employee, nearly three-quarters (73.0%) of businesses with 1 to 4 employees, over three-fifths (61.2%) of businesses with 5 to 19 employees, and nearly half (46.8%) of businesses with 20 to 99 employees reported laying off 50% or more of their staff. In contrast, over a quarter (27.0%) of businesses with 500 or more employees reported the same.

Data table for Chart 1

| Of businesses that laid off staff, percentage of businesses that laid of 50% or more of their workforce | |

|---|---|

| All employment sizes | 61.3 |

| 1 to 4 employees | 73.0 |

| 5 to 19 employees | 61.2 |

| 20 to 99 employees | 46.8 |

| 100 to 249 employees | 41.4 |

| 250 to 499 employees | 48.1 |

| 500 or more employees | 27.0 |

|

Note: Respondents were asked about staffing actions taken during the COVID-19 pandemic, including the percentage of the business workforce being laid off, if applicable. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Tables 33-10-0251-01 and 33-10-0252-01). |

|

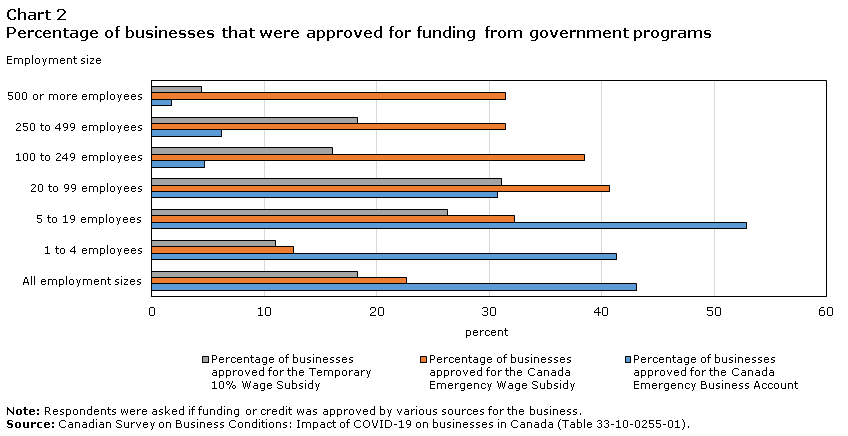

Funding or credit: Small businesses were more likely to be approved for funding from government programs put in place to support businesses during the pandemic

Due to COVID-19, various government programs focusing on funding or credit were made available to support businesses. The Canada Emergency Business account (CEBA) provides eligible small businesses and non-profits with a loan up to $40,000, designed to help cover operating costs. The Canada Emergency Wage Subsidy (CEWS) is a subsidy of 75% of employee wages for eligible businesses, to re-hire previously laid off staff due to COVID-19 and prevent further job losses. The Temporary 10% Wage Subsidy is a three-month measure that will allow eligible employers to reduce the amount of payroll deductions required to be remitted to the Canada Revenue Agency (CRA).Note

Over half (52.9%) of businesses with 5 to 19 employees, over two-fifths (41.3%) of businesses with 1 to 4 employees and nearly one-third (30.7%) of businesses with 20 to 99 employees were approved for the CEBA.

Small businesses with 5 to 99 employees were more likely to be approved for the CEWS than larger businesses. Two-fifths (40.7%) of businesses with 20 to 99 employees were approved for the CEWS, compared to under one-third (31.4%) of businesses with 500 or more employees. The CEWS allowed some businesses to hire back a share of their workforce. Nearly two-fifths (39.4%) of businesses with 1 to 4 employees and close to one-third (32.7%) of businesses with 5 to 19 employees reported they were able to hire back 80% or more of their workforce. Over two-fifths (42.7%) of businesses with 500 or more employees were able to do the same with the CEWS.

Under one-third (31.1%) of businesses with 20 to 99 employees were approved for the Temporary 10% Wage Subsidy, while under one-fifth of businesses with 250 to 499 employees (18.3%) and 100 to 249 employees (16.1%) were approved for the subsidy.

Data table for Chart 2

| Number of employees | Percentage of businesses approved for funding | ||

|---|---|---|---|

| Percentage of businesses approved for the Canada Emergency Business Account | Percentage of businesses approved for the Canada Emergency Wage Subsidy | Percentage of businesses approved for the Temporary 10% Wage Subsidy | |

| All employment sizes | 43.1 | 22.6 | 18.3 |

| 1 to 4 employees | 41.3 | 12.6 | 11.0 |

| 5 to 19 employees | 52.9 | 32.2 | 26.3 |

| 20 to 99 employees | 30.7 | 40.7 | 31.1 |

| 100 to 249 employees | 4.7 | 38.5 | 16.1 |

| 250 to 499 employees | 6.2 | 31.4 | 18.3 |

| 500 or more employees | 1.7 | 31.4 | 4.4 |

|

Note: Respondents were asked if funding or credit was approved by various sources for the business. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0255-01). |

|||

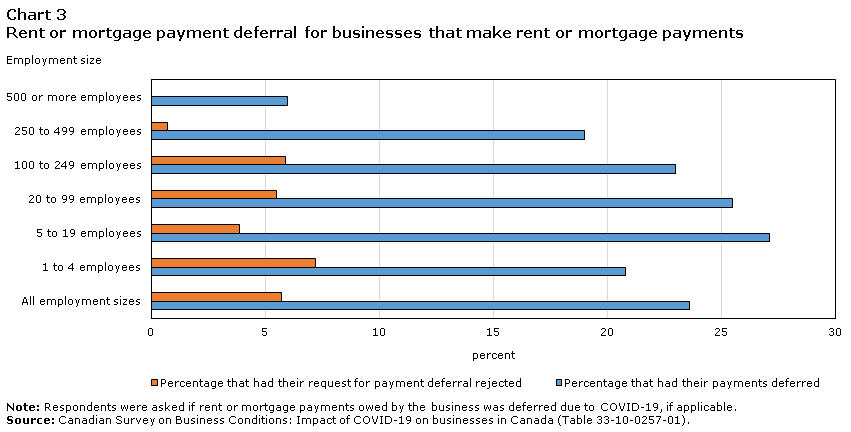

Rent deferral: Small and medium sized businesses were more likely to have their request for rent or mortgage payment deferral rejected

Of businesses that make rent or mortgage payments, small businesses with 1 to 4 employees (7.2%), 20 to 99 employees (5.5%), 5 to 19 employees (3.9%), and medium businesses with 100 to 249 employees (5.9%) were more likely than larger businesses with 500 or more employees to have their request for payment deferral during the COVID-19 pandemic rejected. Meanwhile for the same group of businesses, over one-quarter of businesses with 5 to 19 employees (27.1%) and 20 to 99 employees (25.5%) reported having their payments deferred. 6.0% of businesses with 500 or more employees had their payments deferred.

Data table for Chart 3

| Number of employees | Businesses that made rent or mortgage payments | |

|---|---|---|

| Percentage of businesses that had their payments deferred | Percentage of businesses that had their request for payment deferral rejected | |

| All employment sizes | 23.6 | 5.7 |

| 1 to 4 employees | 20.8 | 7.2 |

| 5 to 19 employees | 27.1 | 3.9 |

| 20 to 99 employees | 25.5 | 5.5 |

| 100 to 249 employees | 23.0 | 5.9 |

| 250 to 499 employees | 19.0 | 0.7 |

| 500 or more employees | 6.0 | 0.0 |

|

Note: Respondents were asked if rent or mortgage payments owed by the business was deferred due to COVID-19, if applicable. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0257-01). |

||

Protective measures: Majority of businesses plan to implement protective measures to protect employees and customers during the pandemic

Over 75% of businesses of all sizes reported that they would be likely or very likely to provide facemasks, gloves, and other personal protective equipment to employees once transitioned back to on-site work as restrictions are eased. Over 90% of businesses of all sizes reported that they would insist that employees displaying any signs of illness stay home once transitioned back to on-site work. Nearly 90% of businesses are likely or very likely to increase sanitization of the workplace.

Data table for Chart 4

| Number of employees | Businesses that may implement protective measures once transitioned back to on-site work | ||

|---|---|---|---|

| Percentage that are likely or very likely to provide facemasks, gloves, and other personal protective equipment | Percentage that are likely or very likely to insist that employees displaying any signs of illness to stay home | Percentage that are likely or very likely to increase sanitization of the workplace | |

| All employment sizes | 79.0 | 91.2 | 87.0 |

| 1 to 4 employees | 75.9 | 90.9 | 83.8 |

| 5 to 19 employees | 80.6 | 90.9 | 88.4 |

| 20 to 99 employees | 84.1 | 92.5 | 93.4 |

| 100 to 249 employees | 87.2 | 94.4 | 94.9 |

| 250 to 499 employees | 79.2 | 90.6 | 91.4 |

| 500 or more employees | 92.8 | 95.5 | 95.8 |

|

Note: Respondents were asked to rank the likelihood the business would implement various protective measures once transitioned back to on-site work, if applicable. Source: Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada (Table 33-10-0264-01). |

|||

Methodology

From May 29th to July 3rd, representatives from businesses across Canada visited Statistics Canada's website and took part in the online questionnaire about how COVID-19 is affecting their business. This iteration of the Canadian Survey on Business Conditions used a stratified random sample of business establishments with employees classified by geography, industry sector, and size. Estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest.

References

Statistics Canada - Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada, May 2020.

- Date modified: