StatCan COVID-19: Data to Insights for a Better CanadaWork interruptions and financial vulnerability

StatCan COVID-19: Data to Insights for a Better CanadaWork interruptions and financial vulnerability

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

by Derek Messacar and René Morissette

The COVID-19 pandemic has led to massive work interruptions in Canada and several other countries since mid-March 2020. The resulting economic lockdown has raised concerns about the ability of Canadian families to meet their financial obligations and essential needs.

To address these concerns and minimize job losses, the federal government has recently implemented several programs such as the Canada Emergency Response Benefit (CERB) and the Canada Emergency Wage Subsidy (CEWS).Note

Since household savings rates in Canada have declined steadily over the past few decades, from an average of approximately 5.5% in 2000 to a low of 1.5% in 2018 (OECD 2020), some Canadian families likely have relatively few financial assets to go through the temporary work stoppages that have been implemented since mid-March 2020. These families would likely face significant income vulnerability in the absence of the aforementioned programs. In other words, these families would, in the absence of government transfers, be financially vulnerable during even a short period of joblessness. The goal of this article is to identify the types of families that are financially vulnerable with the aim of informing discussions regarding those most in need of immediate financial assistance.

To that end, the article focuses on families who rely primarily on earnings—wages and salaries and self-employment income—to maintain their living standards.Note Among this group, the study identifies families who would not have enough liquid assets and other private sources of income to make ends meet, i.e. to keep them out of low income during a two-month work stoppage in the absence of government transfers or borrowing.Note This includes working Canadians and their dependents, such as children and spouses.

The study uses the Survey of Financial Security (SFS) of 2016. While this survey was carried out a few years ago, the distribution of wealth in an economy evolves slowly over time. The SFS 2016 provides the most up to date snapshot and is likely a reasonable approximation of the potential financial vulnerability of Canadian families going into the COVID-19 pandemic.Note

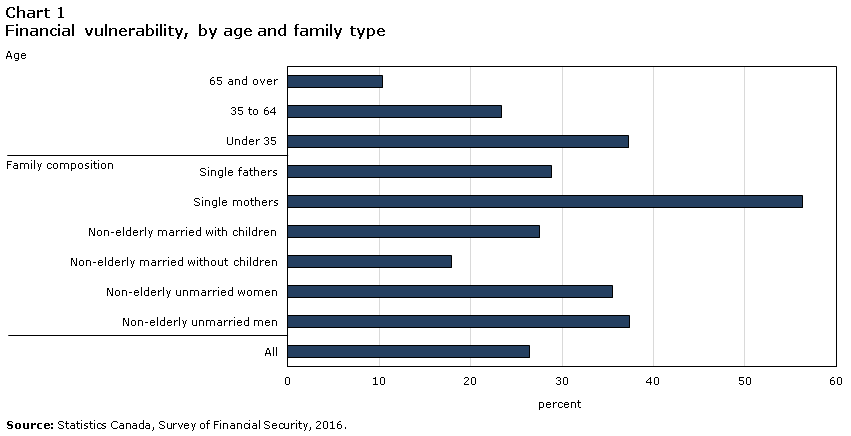

Approximately one in four Canadians (26%) could be financially vulnerable to the economic lockdown based on the approach outlined above (Chart 1).Note By comparison, Statistics Canada’s March 2020 Canadian Perspectives Survey Series showed that nearly three in ten (28.9%) Canadians reported that the COVID-19 situation is having a moderate or major impact on their ability to meet financial obligations or essential needs (Statistics Canada 2020).Note

Data table for Chart 1

| Percent | |

|---|---|

| Age | |

| 65 and over | 10.4 |

| 35 to 64 | 23.4 |

| Under 35 | 37.3 |

| Family composition | |

| Single fathers | 28.9 |

| Single mothers | 56.3 |

| Non-elderly married with children | 27.5 |

| Non-elderly married without children | 17.9 |

| Non-elderly unmarried women | 35.5 |

| Non-elderly unmarried men | 37.4 |

| All | 26.4 |

| Source: Statistics Canada, Survey of Financial Security, 2016. | |

Of all groups considered in this study, single mothers and their children are among the most financially vulnerable during a short period of joblessness: more than half of them (56%) are at-risk of not being able to make ends meet even after selling their liquid assets and using other private sources of income.

Individuals living in families in which the main income earner is under 35 years of age and does not have a high school diploma also face a high risk of financial vulnerability: 67% of them are financially vulnerable to a two-month work stoppage (Table 1). The corresponding percentage for older families in which the main income earner has no high school diploma is 45%.

Data table for Chart 2

| Percent | |

|---|---|

| Indigenous people (off-reserves) | 46.9 |

| Canadian-born (non-Indigenous) | 23.5 |

| Immigrant | 29.4 |

| Recent immigrant | 49.7 |

|

Note: Indigenous people include First Nations people living off-reserve, Métis and Inuit. Source: Statistics Canada, Survey of Financial Security, 2016. |

|

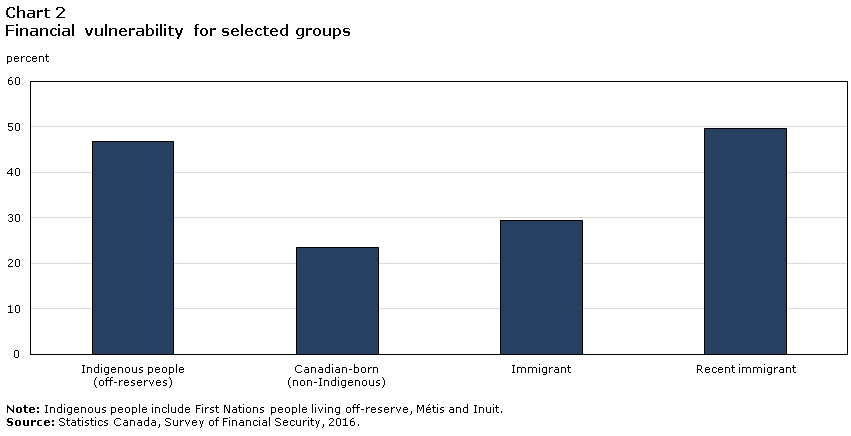

Financial vulnerability is also relatively high in two other groups. Of all individuals living in families headed by an Indigenous person (including First Nations people living off-reserve, Métis and Inuit), 47% are unlikely to have enough liquid assets and other private sources of income to sustain themselves for a period of two months without employment income (Chart 2).Note The same is true for 50% of persons living in a family where the major income earner is a recent immigrant, i.e. immigrated to Canada between 2011 and 2016.

How far off are financially vulnerable Canadians from low income lines? On average, the liquid assets they hold and the other private sources of income they receive cover only one-third of what is needed to raise them out of low income for two months without a family member working, borrowing or receiving government transfers (Table 1).Note Put differently, these individuals would, in the absence of government transfers and borrowing, not have enough resources to make ends meet for even one complete month of joblessness. This is true regardless of the groups of families considered.

In absolute terms, financially vulnerable families would, in the absence of government transfers, lack $3,489 (in 2016 dollars), on average, to keep them out of low income during a two-month work interruption (Table 1). In other words, these families would lack about $1,745 per month, on average, to make ends meet, if they did not receive any government transfers.

Conclusion

In the absence of government transfers, lone-mothers, recent immigrants, Indigenous people living off-reserves and individuals living in families where the main income earner has little education would be highly vulnerable financially during temporary work interruptions. For many of these families, liquid assets and private sources of income other than earnings would not be sufficient to keep them out of low income during a two-month work stoppage.

An important question then is the degree to which the current set of government transfers (e.g. Employment Insurance benefits, child tax benefits, goods and services tax credit payment, CERB) help these financially vulnerable families meet their financial obligations and essential needs. While some of these programs---such as CERB--- may address financial vulnerability for many familiesNote , the degree to which the whole set of government transfers reduces financial vulnerability is currently unknown and should be investigated in future research.

One limitation of the study is that some adults living in families that are financially vulnerable during work stoppages have not actually experienced work interruptions since mid-March 2020. This is the case, for example, of grocery stores employees living in financially vulnerable families. Identifying which families have experienced work interruptions (i.e. have been laid-off or have not worked any hours while being still employed) in the two months following Mid-March 2020 will be possible shortly as new data from the Labour Force Survey becomes available.

| Percentage of persons living in financially vulnerable families | Funds available as a percentage of low income cutoffs over 2 months (financially vulnerable families) | Shortage of funds to meet low income cutoffs over 2 months (financially vulnerable families) | |

|---|---|---|---|

| percent | 2016 dollars | ||

| All family units | 26.4 | 33.0 | 3,489 |

| Non-elderly unattached men | 37.4 | 26.5 | 2,816 |

| Non-elderly unattached women | 35.5 | 28.1 | 2,752 |

| Non-elderly married couple with no children | 17.9 | 36.9 | 2,913 |

| Non-elderly married couple with children | 27.5 | 35.6 | 4,554 |

| Lone mothers | 56.3 | 36.2 | 3,908 |

| Lone fathers | 28.9 | 34.7 | 3,617 |

| Major income earner is: | |||

| Under 35 | 37.3 | 33.4 | 3,224 |

| Aged 35 to 64 | 23.4 | 32.5 | 3,696 |

| Aged 65 and over | 10.4 | 41.0 | 2,778 |

| Indigenous people (off-reserves) | 46.9 | 27.9 | 3,438 |

| Canadian-born (non-Indigenous) | 23.5 | 32.0 | 3,314 |

| Immigrant | 29.4 | 36.8 | 4,003 |

| Recent immigrant | 49.7 | 31.3 | 4,134 |

| Under 35: Less than high school | 67.2 | 24.3 | 3,860 |

| Under 35: High school diploma | 45.8 | 27.3 | 3,421 |

| Under 35: Post-secondary education | 43.6 | 36.4 | 3,197 |

| Under 35: University degree | 22.1 | 40.5 | 2,783 |

| 35 to 64: Less than high school | 45.0 | 23.6 | 3,944 |

| 35 to 64: High school diploma | 30.6 | 30.7 | 3,819 |

| 35 to 64: Post-secondary education | 26.0 | 34.1 | 3,608 |

| 35 to 64: University degree | 13.5 | 37.6 | 3,544 |

|

Notes: Assuming a 2-month interruption in earnings, financially vulnerable family units would have difficulty making ends meet if they used all the funds available to them, i.e. liquidated all their financial assets and added the proceeds to their other private sources of income received over two months. Low income cutoffs are before tax. Family units include both economic families and unattached individuals. Source: Statistics Canada, Survey of Financial Security, 2016. |

|||

Data and Methods

The focus of the study is on families (and unattached individuals) whose employment income represents 50% or more of the total family income before tax. Liquid financial assets are defined as all assets held in chequing and saving accounts, term deposits, treasury bills, tax-free savings accounts, stocks and bonds (in mutual funds or not), and registered retirement savings plans.Note If the combined sum of the total value of these liquid financial assets and other (non-employment) private sources of family income expressed on a two-month basis falls below the low income cut-off (LICO) before tax for 2016 expressed on a two-month basis, then individuals in this family are identified as financially vulnerable.Note For these individuals, asset liquidation cannot keep them out of low income for the duration of a two-month work stoppage.

References

OECD. 2020. Household savings (indicator). Paris: Organisation for Economic Cooperation and Development. doi: 10.1787/cfc6f499-en. Accessed: 20 April 2020.

Statistics Canada. 2020. “Canadian Perspectives Survey Series 1: Impacts of COVID-19 on job security and personal finances, 2020.” The Daily. Statistics Canada Catalogue no. 11-001-X. Ottawa: Statistics Canada.

- Date modified: