Rural and Small Town Canada Analysis Bulletin

The outlook of rural businesses, second quarter of 2022

Skip to text

Text begins

In April 2022, while unemployment fell by 0.1 percentage point to a record low of 5.2%, total hours worked per week decreased by 1.9% over the previous month.Note While average hourly wages increased year-over-year in April by 3.3%Note , consumer prices increased by 6.8% year-over-yearNote and the prices of raw materials purchased by manufacturers operating in Canada increased by 38.4% year-over-year in April 2022Note , reducing the purchasing power of consumers and businesses. Real gross domestic product (GDP) continued to grow, increasing by 0.8% in the first quarter of 2022 following an increase of 1.6% in the previous quarter.Note

The extent to which these changing conditions impacted businesses varied, depending on their region and industry, as well as other factors. The Canadian Survey on Business Conditions (CSBC) provides detailed information on businesses’ perceptions of the environment in which they are currently operating as well as their expectations moving forward. This analysis focuses on businesses in rural areasNote using results from the CSBC, second quarter 2022, conducted from April 1 to May 6, 2022.Note

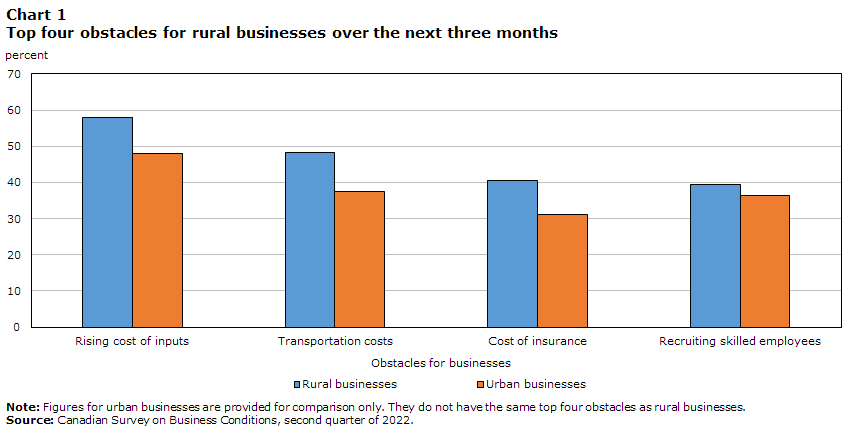

The most frequently expected short-term obstacles among rural businesses were the rising cost of inputs (58.0%), transportation costs (48.2%), and cost of insurance (40.6%). Two-in-five (40.6%) rural businesses planned to increase their prices over the short-term, slightly higher than urban businesses (38.7%).

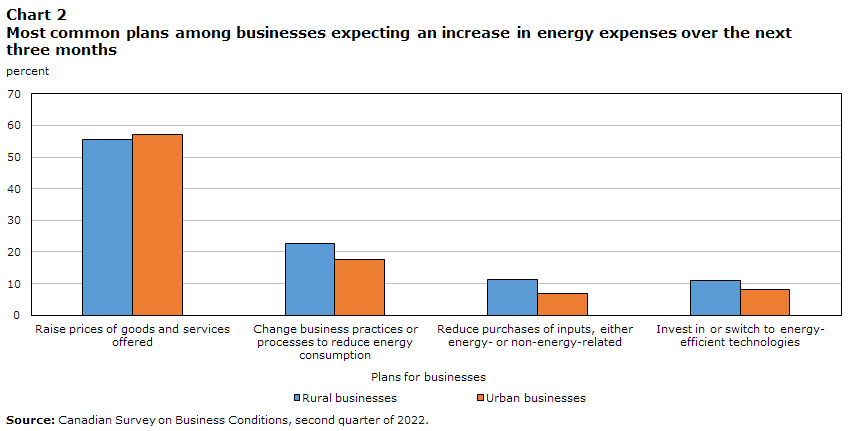

Three-in-five rural businesses (59.4%) expected their energy expenditures to increase within the next three months, much higher than urban businesses (40.8%). The most common response to rising energy expenditures among all businesses was to increase the price of their goods and services, although rural businesses were more likely to plan alternative responses.

Among rural businesses that anticipated supply chain challenges, almost two-thirds (65.4%) reported that they had worsened, and nearly three-fifths (56.9%) anticipating domestic supply chain challenges expected them to continue for six months or more. For rural businesses, the most commonly cited factors in supply chain issues were delays in deliveries (81.2%), increased prices (76.6%), and shortages (73.2%).

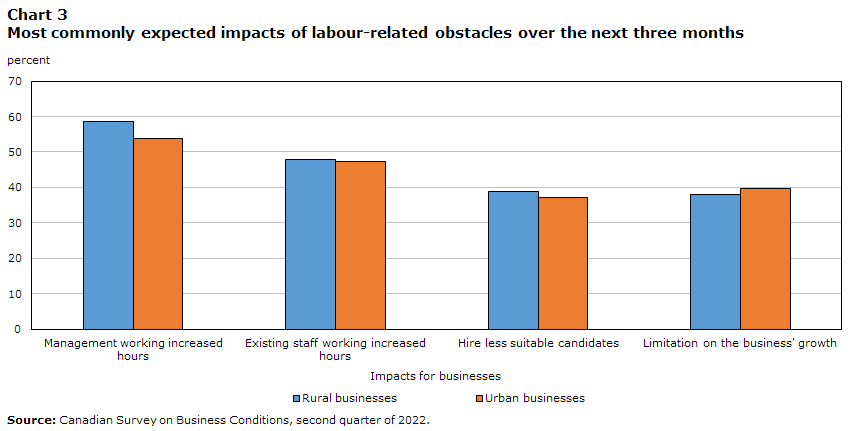

For rural businesses that expected labour-related obstacles, the anticipated impacts included management working increased hours (58.5%), existing staff working more hours (47.9%), hiring criteria being less selective (38.7%), and business growth being compromised (38.0%). A majority (52.3%) of these businesses reported that recruiting and retaining staff was more difficult than a year previously, but an even greater proportion (60.1%) of urban businesses shared this challenge.

The costs of inputs, transportation and insurance the most common concerns among rural businesses

The prices of raw materials purchased by manufacturers operating in Canada increased by 38.4% year-over-year in April 2022.Note Average hourly wages for employees increased 3.3% over the same period.Note

The rising cost of inputsNote was the most commonly expected short-term obstacleNote among rural businesses for the sixth consecutive quarter, increasing from 56.0% of businesses in the first quarter of 2022 to 58.0% in the second quarter of 2022. The rising cost of inputs was also the most frequently cited short-term obstacle for urban businesses in the second quarter of 2022 at 48.0%, relatively unchanged from the first quarter of 2022.

Transportation costs was the second most common short-term obstacle for rural businesses at 48.2%, increasing from 39.4% in the previous quarter. The prices for energy and petroleum products had increased for the fourth consecutive month in April, and were up 69.5% year-over-year.Note

Cost of insurance was the third most commonly cited obstacle at 40.6%, decreasing slightly from 42.2% in the first quarter. Recruiting skilled employees was the fourth most common short-term obstacle for rural businesses, up from 38.0% in the previous quarter to 39.4%.

In response to concerns about these costs, 40.6% of rural businesses reported they expect to raise their prices in the short-term. This is slightly higher than the 38.7% of urban businesses that also expect to do so. In addition, over a quarter (27.7%) of rural businesses expect their profitability to decrease in the next three months, in comparison to 29.8% of urban businesses.

Data table for Chart 1

| Rising cost of inputs | Transportation costs | Cost of insurance | Recruiting skilled employees | |

|---|---|---|---|---|

| percent | ||||

| Rural businesses | 58.0 | 48.2 | 40.6 | 39.4 |

| Urban businesses | 48.0 | 37.4 | 31.2 | 36.4 |

|

Note: Figures for urban businesses are provided for comparison only. They do not have the same top four obstacles as rural businesses. Source: Canadian Survey on Business Conditions, second quarter of 2022. |

||||

Rural businesses more likely to expect energy expenses to increase

About three-in-five rural businesses (59.4%) expected their energy expenditures to increase over the next three months, greater than the two-in-five (40.8%) urban businesses that had this concern.

A majority of businesses planned to respond to these expenditures by raising their own prices, with urban businesses slightly more likely than rural ones (57.2% to 55.7%). In contrast, rural businesses were more likely than urban ones to have plans to reduce energy consumption (22.6% to 17.6%), reduce purchases of general or energy-related inputs (11.2% to 7.0%), and invest in or switch to energy-efficient technologies (11.0% to 8.2%) in response to increased energy expenses.

Data table for Chart 2

| Raise prices of goods and services offered | Change business practices or processes to reduce energy consumption | Reduce purchases of inputs, either energy- or non-energy-related | Invest in or switch to energy-efficient technologies | |

|---|---|---|---|---|

| percent | ||||

| Rural businesses | 55.7 | 22.6 | 11.2 | 11.0 |

| Urban businesses | 57.2 | 17.6 | 7.0 | 8.2 |

| Source: Canadian Survey on Business Conditions, second quarter of 2022. | ||||

Supply chain difficulties continue for rural businesses

Over one-third (34.5%) of rural businesses anticipated challenges acquiring inputs, products or supplies domestically in the short-term, nearly double the proportion (17.5%) that expected similar challenges acquiring inputs, products or supplies internationally.

Close to two-thirds (65.4%) of rural businesses expecting supply chain difficultiesNote in the short-term reported that these challenges had worsened over the preceding three months. Similarly, 68.6% of urban businesses expecting supply chain difficulties reported that these issues had increased in severity over the preceding three months.

The majority of rural businesses experiencing supply chain challenges attributed these intensified difficulties to increased delays in deliveries for inputs, products or supplies (81.2%), increased prices for inputs, products or supplies (76.6%), and shortages resulting in fewer inputs, products or supplies being available (73.2%).

Among rural businesses that expected difficulty acquiring inputs, products or supplies from within Canada in the short-term, almost three-fifths (56.9%) expected the challenges to continue for six months or more. On the other hand, 12.8% expected these difficulties to subside within the next six months, while 30.4% were unsure how long the difficulties would remain.

Of rural businesses that expected difficulty acquiring foreign inputs, products or supplies, over half (51.7%) expected the challenges to continue for six months or more, 11.2% expected the difficulties to be resolved within six months, and 37.1% were unsure when they would subside.

Nearly three-fifths of rural businesses anticipating labour-related challenges expect management to work longer hours

Among rural businesses that anticipated labour-related obstaclesNote in the short-term, the most commonly expected impacts of these challenges were: management working increased hours (58.5%); existing staff working increased hours (47.9%); less suitable candidates being hired (38.7%); and, business growth being limited (38.0%). These anticipated impacts were similar among urban businesses.

Data table for Chart 3

| Management working increased hours | Existing staff working increased hours | Hire less suitable candidates | Limitation on the business' growth | |

|---|---|---|---|---|

| percent | ||||

| Rural businesses | 58.5 | 47.9 | 38.7 | 38.0 |

| Urban businesses | 53.7 | 47.2 | 37.1 | 39.7 |

| Source: Canadian Survey on Business Conditions, second quarter of 2022. | ||||

Over half (52.3%) of rural businesses expecting labour-related obstacles reported that challenges with recruiting and retaining staff had worsened compared to 12 months previously, in comparison to (60.1%) of urban businesses.

A majority (57.0%) of rural businesses expected that inflation would be a bigger issue when discussing wage increases with their employees over the next 12 months. A lower percentage (54.8%) of urban businesses shared this expectation.

Methodology

From April 1 to May 6, 2022, representatives from businesses across Canada were invited to take part in an online questionnaire about business conditions and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 35,775 and results are based on responses from a total of 16,678 businesses or organizations. Businesses were classified as rural or urban based on their geographic location. The 2016 Census Subdivision Boundary File was used to identify all businesses’ census subdivisions (CSD) based on location. Businesses located in CSDs classified as either Census Metropolitan Areas or Census Agglomerations were classified as urban. All businesses in other locations were classified as rural.

References

Statistics Canada. (2022). Canadian Survey on Business Conditions, second quarter of 2022.

Statistics Canada. (2022). Canadian Survey on Business Conditions, first quarter of 2022.

Statistics Canada. (2022). Canadian Survey on Business Conditions, fourth quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, third quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, second quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, first quarter of 2021.

- Date modified: