Patterns in online banking in Canada, 2022

Release date: April 30, 2024

Description: Patterns in online banking in Canada, 2022

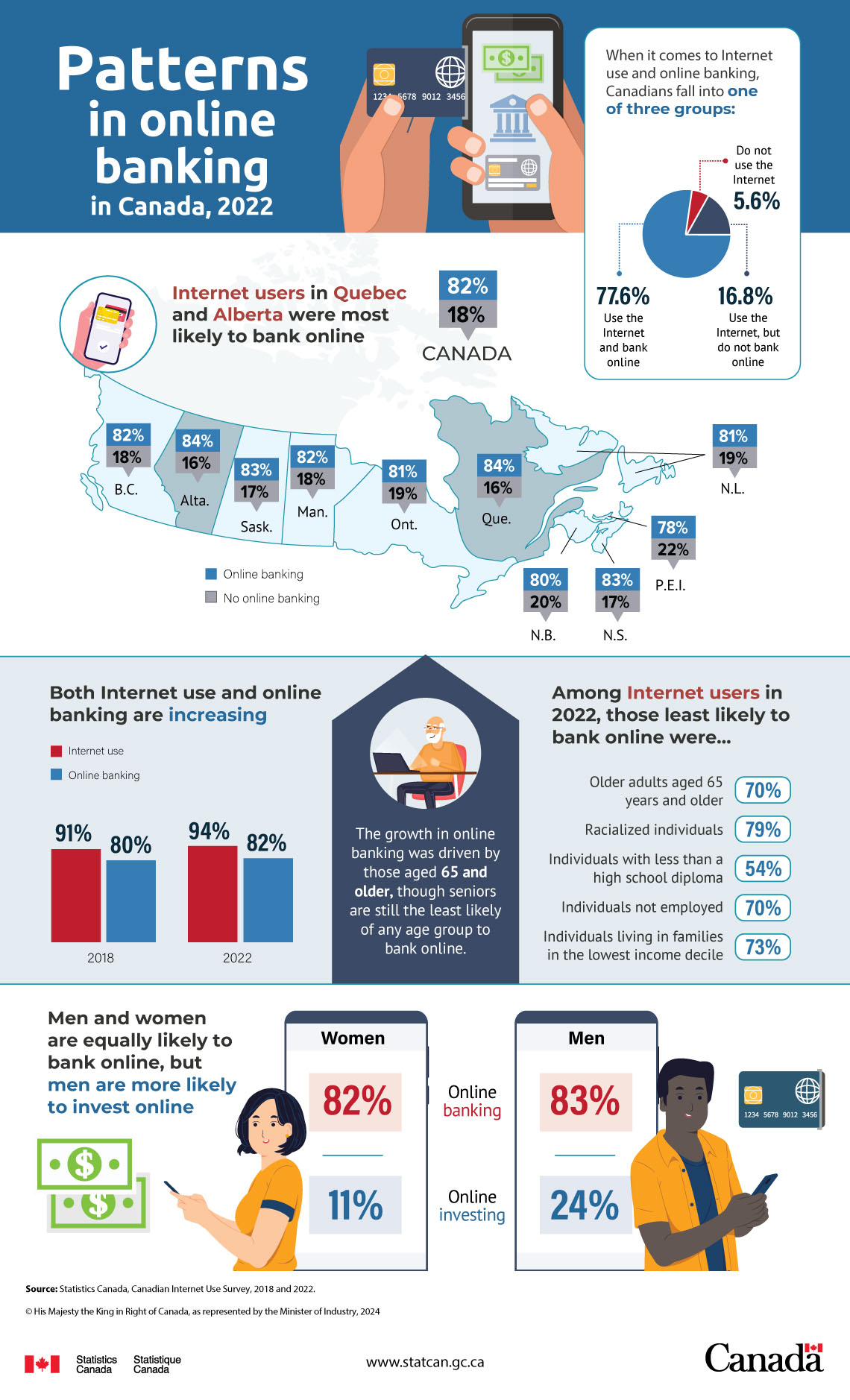

When it comes to Internet use and online banking, Canadians fall into one of three groups:

Do not use the Internet – 5.6%

Use the Internet, but do not bank online – 16.8%

Use the Internet and bank online – 77.6%

Internet users in Quebec and Alberta were most likely to bank online

| No online banking | Online banking | |

|---|---|---|

| Canada | 18% | 82% |

| Newfoundland and Labrador | 19% | 81% |

| Prince Edward Island | 22% | 78% |

| Nova Scotia | 17% | 83% |

| New Brunswick | 20% | 80% |

| Quebec | 16% | 84% |

| Ontario | 19% | 81% |

| Manitoba | 18% | 82% |

| Saskatchewan | 17% | 83% |

| Alberta | 16% | 84% |

| British Columbia | 18% | 82% |

Both Internet use and online banking are increasing

| 2018 | 2022 | |

|---|---|---|

| Internet use | 91% | 94% |

| Online banking | 80% | 82% |

Among Internet users in 2022, those least likely to bank online were…

- Older adults aged 65 years and older – 70%

- Racialized individuals – 79%

- Individuals with less than a high school diploma – 54%

- Individuals not employed – 70%

- Individuals living in families in the lowest income decile– 73%

The growth in online banking was driven by those aged 65 and older, though seniors are still the least likely of any age group to bank online.

Men and women are equally likely to bank online, but men are more likely to invest online

| Online banking | Online investing | |

|---|---|---|

| Women | 82% | 11% |

| Men | 83% | 24% |

Source: Statistics Canada, Canadian Internet Use Survey, 2018 and 2022.

- Date modified: