Assets, debts and net worth of Canadian families,Note 1 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Release date: December 22, 2020

Description: Assets, debts and net worth of Canadian families, 2019

Assets, debts and net worth of Canadian families, 2019

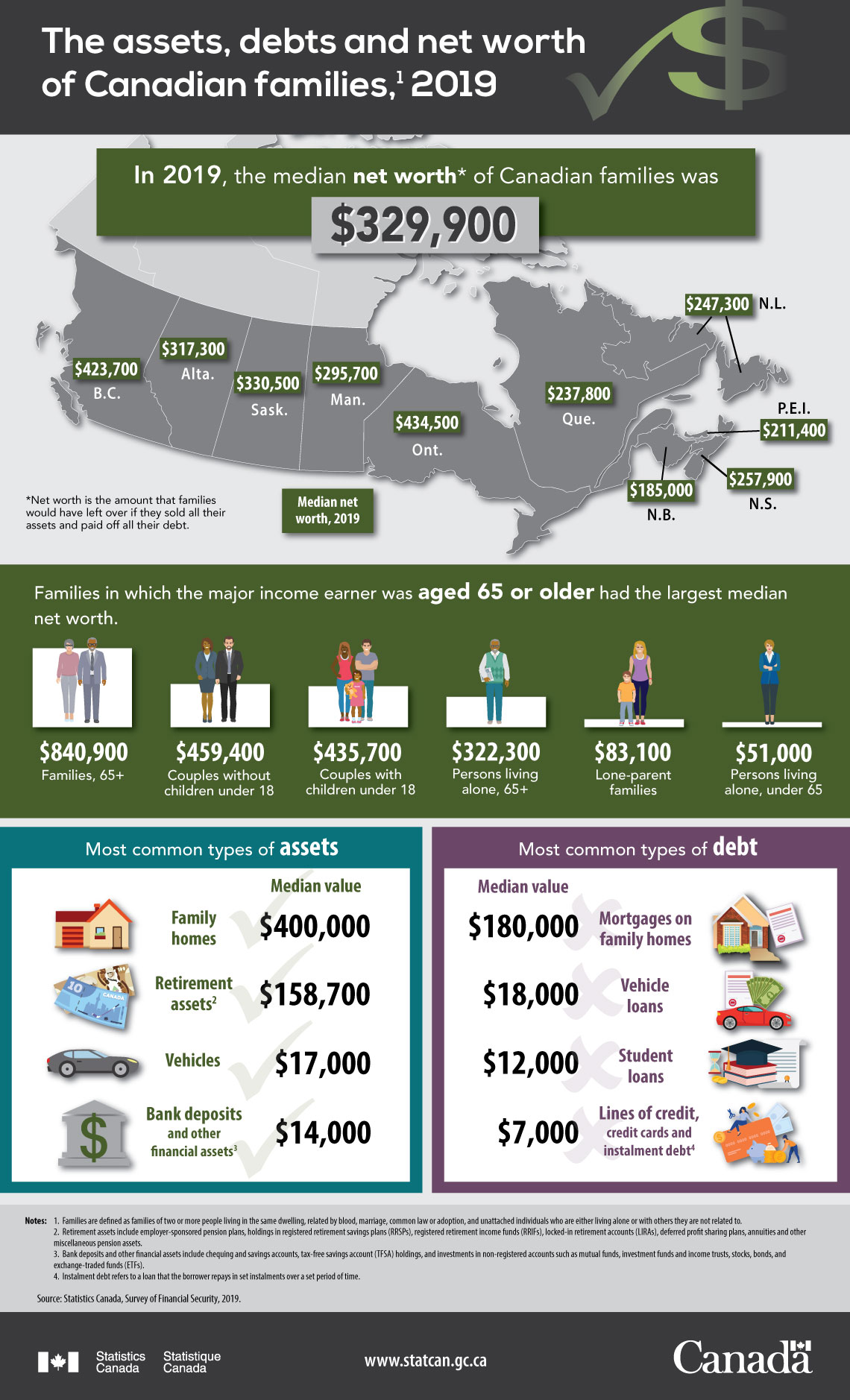

In 2019, the median net worth* of Canadian families was $329,900.

| Provinces | Median net worth, 2019 |

|---|---|

| Newfoundland and Labrador | 247,300 |

| Prince Edward Island | 211,400 |

| Nova Scotia | 257,900 |

| New Brunswick | 185,000 |

| Quebec | 237,800 |

| Ontario | 434,500 |

| Manitoba | 295,700 |

| Saskatchewan | 330,500 |

| Alberta | 317,300 |

| British Columbia | 423,700 |

*Net worth is the amount that families would have left over if they sold all their assets and paid off all their debts.

Families in which the major income earner was aged 65 or older had the largest median net worth.

| Family Types | Median net worth |

|---|---|

| Families, 65+ | $840,900 |

| Couples without children under 18 | $459,400 |

| Couples with children under 18 | $435,700 |

| Persons living alone, 65+ | $322,300 |

| Lone-parent families | $83,100 |

| Persons living alone, under 65 | $51,000 |

| Most common types of assets | Median value |

|---|---|

| Family homes | $400,000 |

| Retirement assetsNote 2 | $158,700 |

| Vehicles | $17,000 |

| Bank deposits and other financial assetsNote 3 | $14,000 |

| Most common types of debts | Median value |

|---|---|

| Mortgages on family homes | $180,000 |

| Vehicle loans | $18,000 |

| Student loans | $12,000 |

| Lines of credit, credit cards and instalment debtNote 4 | $7,000 |

Source: Survey of Financial Security, 2019.

- Date modified: