Analysis in Brief

Retail e-commerce and COVID-19: How online sales evolved as in-person shopping resumed

Skip to text

Text begins

In 2022, all remaining COVID-19 public health restrictions on Canadian retailers were gradually lifted allowing consumers to resume unrestricted in-person shopping. Despite the reopening of the Canadian economy, e-commerce remains an important platform for business operations. From February 2020 to July 2022, retail e-commerce sales increased by 67.9%, and the share of e-commerce sales as a proportion of total retail sales increased markedly from 2019 to 2022 (July year to date).Note The persistence of retail e-commerce sales above pre-pandemic levels suggests that the switch to e-commerce during COVID-19 lockdown periods may have prompted a long-term change in consumer spending habits and retailer operating models.

This follow-up study updates a previous paper that investigated the growing importance of e-commerce sales to the retail trade sector in the early stages of the pandemic.Note The current study precedes the transition to the 2022 North American Industry Classification System (NAICS) in the retail industry,Note which will allow Statistics Canada to look more closely at industry-based retail e-commerce sales on an ongoing basis.

Retail e-commerce sales higher than pre-pandemic levels

After a sharp increase at the onset of the pandemic, retail e-commerce sales have receded as of July 2022 but remain well above pre-pandemic levels. The share of retail e-commerce sales, as a proportion of total retail sales, rose from 3.9% in 2019 to 6.2% in 2022 (July year to date). During the height of the pandemic in 2020 and 2021, the shares of retail e-commerce sales were 6.6% and 6.9%, respectively. The retail e-commerce share of total retail sales peaked in 2021, as retailers were impacted by a second wave of store closures during the first half of that year.

Data table for Chart 1

| E-commerce | In-store | |

|---|---|---|

| index (Jan. 2017 = 100) | ||

| 2017 | ||

| January | 100.0 | 100.0 |

| February | 99.1 | 99.6 |

| March | 100.7 | 99.5 |

| April | 103.2 | 101.8 |

| May | 100.7 | 100.6 |

| June | 102.0 | 101.3 |

| July | 109.0 | 101.8 |

| August | 107.8 | 102.0 |

| September | 107.0 | 101.9 |

| October | 109.4 | 103.0 |

| November | 114.5 | 102.4 |

| December | 111.7 | 104.1 |

| 2018 | ||

| January | 116.2 | 102.7 |

| February | 114.9 | 102.5 |

| March | 114.9 | 102.9 |

| April | 113.8 | 101.6 |

| May | 117.2 | 105.4 |

| June | 118.1 | 105.3 |

| July | 118.9 | 103.1 |

| August | 126.3 | 105.1 |

| September | 122.3 | 105.6 |

| October | 131.4 | 104.5 |

| November | 139.8 | 104.1 |

| December | 119.4 | 105.8 |

| 2019 | ||

| January | 132.2 | 105.9 |

| February | 134.9 | 105.4 |

| March | 135.3 | 106.6 |

| April | 137.3 | 105.4 |

| May | 144.2 | 107.4 |

| June | 148.3 | 106.2 |

| July | 156.7 | 106.8 |

| August | 155.9 | 107.9 |

| September | 157.1 | 106.1 |

| October | 152.5 | 104.9 |

| November | 153.5 | 106.9 |

| December | 166.6 | 107.6 |

| 2020 | ||

| January | 158.8 | 108.2 |

| February | 171.8 | 116.4 |

| March | 204.4 | 95.0 |

| April | 315.4 | 69.8 |

| May | 325.1 | 88.2 |

| June | 277.0 | 109.8 |

| July | 270.1 | 112.3 |

| August | 275.9 | 110.6 |

| September | 269.9 | 115.1 |

| October | 269.0 | 116.7 |

| November | 270.6 | 114.9 |

| December | 291.1 | 110.1 |

| 2021 | ||

| January | 348.6 | 110.4 |

| February | 338.9 | 115.2 |

| March | 335.6 | 121.2 |

| April | 331.0 | 114.1 |

| May | 329.8 | 110.0 |

| June | 301.8 | 116.1 |

| July | 257.9 | 118.3 |

| August | 265.4 | 118.1 |

| September | 273.3 | 117.5 |

| October | 274.9 | 119.9 |

| November | 269.6 | 120.0 |

| December | 259.1 | 118.7 |

| 2022 | ||

| January | 295.7 | 122.4 |

| February | 271.0 | 121.6 |

| March | 264.2 | 123.0 |

| April | 275.0 | 122.7 |

| May | 294.8 | 124.1 |

| June | 287.6 | 124.9 |

| July | 288.3 | 123.7 |

| Source: Statistics Canada, Monthly Retail Trade Survey. | ||

E-commerce remained a popular option for consumers and businesses in some subsectors

At times throughout the pandemic, retailers were mandated to cease in-store sales to help reduce the spread of COVID-19. Many businesses bolstered their online platforms to lessen the negative impacts of these closures on their sales. Early in the pandemic, increases in retail e-commerce sales and declines in in-store sales were observed for most retail subsectors. In 2022, retail e-commerce sales continued to remain elevated in some subsectors, while in others, the resumption of in-store operations has led consumers and businesses to transition closer to pre-pandemic shopping preferences.

Data table for Chart 2

| Furniture and home furnishings stores (e-commerce) | Furniture and home furnishings stores (in-store) | Electronics and appliance stores (e-commerce) | Electronics and appliance stores (in-store) | Clothing and clothing accessories stores (e-commerce) | Clothing and clothing accessories stores (in-store) | Sporting goods, hobby, book and music stores (e-commerce) | Sporting goods, hobby, book and music stores (in-store) | |

|---|---|---|---|---|---|---|---|---|

| index (Q1 2019 = 100) | ||||||||

| 2019 | ||||||||

| Q2 | 110.5 | 101.4 | 106.1 | 102.4 | 104.6 | 96.8 | 106.2 | 99.2 |

| Q3 | 122.9 | 100.3 | 110.8 | 102.0 | 110.8 | 96.7 | 113.2 | 96.9 |

| Q4 | 138.2 | 97.2 | 119.6 | 99.7 | 118.0 | 93.4 | 122.6 | 94.8 |

| 2020 | ||||||||

| Q1 | 206.0 | 84.7 | 154.0 | 92.1 | 154.0 | 72.4 | 183.7 | 83.4 |

| Q2 | 242.8 | 87.2 | 175.6 | 94.8 | 181.2 | 64.8 | 222.5 | 85.0 |

| Q3 | 280.3 | 92.3 | 194.3 | 96.4 | 206.3 | 58.2 | 257.0 | 87.3 |

| Q4 | 302.2 | 105.9 | 186.9 | 106.0 | 216.9 | 73.1 | 245.4 | 97.4 |

| 2021 | ||||||||

| Q1 | 342.0 | 103.4 | 189.0 | 104.1 | 229.6 | 66.9 | 253.2 | 95.7 |

| Q2 | 357.8 | 104.1 | 181.9 | 105.3 | 228.5 | 75.2 | 247.2 | 98.7 |

| Q3 | 323.3 | 105.1 | 170.9 | 103.2 | 210.5 | 80.9 | 234.3 | 101.9 |

| Q4 | 306.0 | 110.9 | 159.4 | 107.7 | 202.0 | 93.8 | 227.4 | 106.5 |

| 2022 | ||||||||

| Q1 | 298.3 | 111.5 | 162.1 | 110.5 | 207.6 | 96.7 | 226.7 | 108.0 |

|

Note: Data in this chart are centered quarterly moving averages. Source: Statistics Canada, Monthly Retail Trade Survey. |

||||||||

For businesses in retail subsectors deemed to be non-essential—such as clothing and clothing accessories stores; furniture and home furnishings stores; electronics and appliance stores; and sporting goods, hobby, book and music stores—retail e-commerce sales increased, while in-store sales fell as a result of store closures at the onset of the pandemic (Chart 2). As public health restrictions were lifted across the country in 2021 and consumers resumed in-store shopping, retail e-commerce sales began to decline across these subsectors, while in-store sales trended upward. Despite the pullback in online shopping, retail e-commerce sales are stabilizing at levels above those observed before the pandemic. These higher levels of retail e-commerce sales may signal a structural change in both consumer preferences and retailer business models.

Data table for Chart 3

| Building material and garden equipment and supplies dealers (e-commerce) | Building material and garden equipment and supplies dealers (in-store) | |

|---|---|---|

| index (Q1 2019 = 100) | ||

| 2019 | ||

| Q2 | 124.6 | 102.1 |

| Q3 | 136.1 | 102.6 |

| Q4 | 147.0 | 102.6 |

| 2020 | ||

| Q1 | 248.3 | 102.9 |

| Q2 | 330.0 | 108.3 |

| Q3 | 430.7 | 115.3 |

| Q4 | 552.1 | 124.6 |

| 2021 | ||

| Q1 | 707.9 | 127.7 |

| Q2 | 694.8 | 125.2 |

| Q3 | 571.9 | 121.9 |

| Q4 | 481.1 | 125.4 |

| 2022 | ||

| Q1 | 518.7 | 130.7 |

|

Note: Data in this chart are centered quarterly moving averages. Source: Statistics Canada, Monthly Retail Trade Survey. |

||

Building material and garden equipment and supplies dealers were deemed essential businesses during the pandemic. Despite the availability of in-store shopping, businesses in this subsector experienced large increases in retail e-commerce sales. Higher sales in this subsector were bolstered by strong demand related to Canadians’ investments in their homes and by price pressures of some commonly purchased products. Retail e-commerce sales for this subsector peaked in the first quarter of 2021, followed by a steep decline observed throughout the remainder of the year (Chart 3). In-store retail sales rose following the initial shock of the pandemic and have continued to trend upward. Both in-store and e-commerce retail sales remained above pre-pandemic levels moving into 2022. Whether e-commerce will persist above pre-pandemic levels remains to be seen as consumer shopping patterns change and external factors continue to impact demand for products in this subsector.

Data table for Chart 4

| Health and personal care stores (e-commerce) | Health and personal care stores (in-store) | |

|---|---|---|

| index (Q1 2019 = 100) | ||

| 2019 | ||

| Q2 | 102.8 | 100.6 |

| Q3 | 105.6 | 100.4 |

| Q4 | 113.1 | 101.1 |

| 2020 | ||

| Q1 | 134.0 | 98.3 |

| Q2 | 147.2 | 99.7 |

| Q3 | 157.3 | 101.0 |

| Q4 | 152.8 | 106.5 |

| 2021 | ||

| Q1 | 150.8 | 107.3 |

| Q2 | 144.3 | 108.2 |

| Q3 | 139.1 | 109.0 |

| Q4 | 135.5 | 110.7 |

| 2022 | ||

| Q1 | 137.3 | 113.7 |

|

Note: Data in this chart are centered quarterly moving averages. Source: Statistics Canada, Monthly Retail Trade Survey. |

||

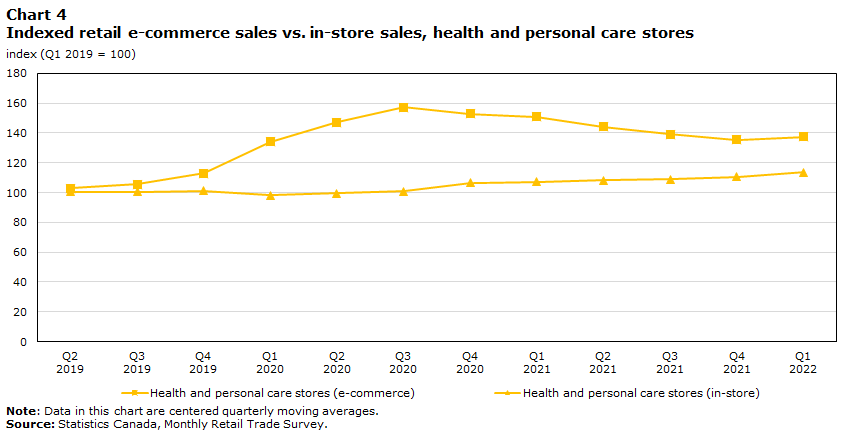

Health and personal care stores saw slower growth in retail e-commerce sales relative to other subsectors. In the first quarter of 2020, in-store retail sales declined while e-commerce sales rose as public health restrictions limited capacity forcing consumers online (Chart 4). After peaking in the third quarter of 2020, retail e-commerce sales began to decline as in-store sales approached pre-pandemic levels. Many products sold in this subsector were deemed essential allowing consumers to continue making purchases in stores rather than online. The gap between in-store and e-commerce retail sales is narrowing as consumers shift back toward in-store shopping at health and personal care stores.

Final thoughts

Canadians became increasingly reliant on retail e-commerce platforms in the face of COVID-19. Retail consumers have shown that, as restrictions were lifted, e-commerce remained an attractive method of shopping as some businesses increased their online presence and continued to invest in online sales and e-commerce capabilities. As the pandemic runs its course, the changes in business offerings and consumer preferences during the past few years may have long-term impacts on the structure of the retail trade sector.

Note to readers

All data in this paper are seasonally adjusted and are expressed in current dollars, unless otherwise noted.

A standard usage of the 2017 North American Industry Classification System (NAICS) groups all Internet-only retailers together under NAICS code 45411, regardless of their associated retail subsector. To determine e-commerce sales by subsector for this study, establishments classified under NAICS 45411 were combined with their brick-and-mortar retail NAICS code. In addition, establishments with no related brick-and-mortar retail NAICS code were assigned a new code based on the products they sell. This results in different figures when comparing data in this paper with data from Statistics Canada’s Monthly Retail Trade Survey releases. The implementation of NAICS 2022 will classify all Internet-only retailers in the same groupings as their non-digital counterparts.

Goods and services sold to Canadian consumers online from legal entities operating in foreign countries are not included in Canadian retail sales figures.

Appendix A

| North American Industry Classification System | Method | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 (January to July) |

|---|---|---|---|---|---|---|---|

| percent | |||||||

| Retail trade (44–45) | In store | 97.1 | 96.7 | 96.1 | 93.4 | 93.1 | 93.8 |

| E-commerce | 2.9 | 3.3 | 3.9 | 6.6 | 6.9 | 6.2 | |

| Motor vehicle and parts dealers (441) | In store | 99.4 | 99.1 | 98.6 | 98.0 | 98.1 | 97.1 |

| E-commerce | 0.6 | 0.9 | 1.4 | 2.0 | 1.9 | 2.9 | |

| Furniture and home furnishings stores (442) | In store | 96.7 | 95.2 | 93.9 | 87.0 | 84.6 | 87.0 |

| E-commerce | 3.3 | 4.8 | 6.1 | 13.0 | 15.4 | 13.0 | |

| Electronics and appliance stores (443) | In store | 81.6 | 79.5 | 74.0 | 62.3 | 64.1 | 68.1 |

| E-commerce | 18.4 | 20.5 | 26.0 | 37.7 | 35.9 | 31.9 | |

| Building material and garden equipment and supplies dealers (444) | In store | 99.0 | 99.0 | 98.7 | 96.8 | 95.0 | 95.9 |

| E-commerce | 1.0 | 1.0 | 1.3 | 3.2 | 5.0 | 4.1 | |

| Food and beverage stores (445) | In store | 99.5 | 99.4 | 99.3 | 98.3 | 97.9 | 98.2 |

| E-commerce | 0.5 | 0.6 | 0.7 | 1.7 | 2.1 | 1.8 | |

| Health and personal care stores (446) | In store | 96.4 | 96.4 | 95.0 | 93.0 | 93.8 | 94.5 |

| E-commerce | 3.6 | 3.6 | 5.0 | 7.0 | 6.2 | 5.5 | |

| Clothing and clothing accessories stores (448) | In store | 91.6 | 90.8 | 89.3 | 76.5 | 76.9 | 81.0 |

| E-commerce | 8.4 | 9.2 | 10.7 | 23.5 | 23.1 | 19.0 | |

| Sporting goods, hobby, book and music stores (451) | In store | 91.3 | 90.4 | 88.9 | 77.9 | 79.1 | 81.3 |

| E-commerce | 8.7 | 9.6 | 11.1 | 22.1 | 20.9 | 18.7 | |

| General merchandise stores (452) | In store | 97.2 | 97.0 | 97.0 | 95.2 | 94.1 | 95.8 |

| E-commerce | 2.8 | 3.0 | 3.0 | 4.8 | 5.9 | 4.2 | |

| Miscellaneous store retailers (453) | In store | 86.9 | 86.7 | 86.9 | 80.3 | 81.8 | 86.4 |

| E-commerce | 13.1 | 13.3 | 13.1 | 19.7 | 18.2 | 13.6 | |

| Source: Statistics Canada, Monthly Retail Trade Survey. | |||||||

- Date modified: