Analysis in Brief

The state of business financing and debt in Canada, fourth quarter of 2022

Skip to text

Text begins

There can be several reasons businesses decide to take on debt. For flourishing businesses, debt can be a useful tool for growth and investment purposes. For struggling businesses, it could be to endure difficult business conditions. For instance, due to the COVID-19 pandemic, many businesses took on debts in the form of assistance from government programs.

Recent changes in economic conditions may have impacted business decisions related to debt. Monetary authorities have reacted to inflationary pressures by introducing tighter money policies and interest rate hikes, which could affect debt servicing costs. In Canada, the overnight rate reached its highest level since 2008 at 3.75% on October 26, 2022, after remaining unchanged at its historically low rate of 0.25% from March 2020 to March 2022.Note 1 In this rapidly changing context, keeping track of business debt levels, challenges associated with debt, and business plans for new debt is important.

From the beginning of October to early November 2022, Statistics Canada conducted the Canadian Survey on Business Conditions to better understand the current environment that businesses in Canada are operating in and their expectations moving forward. Based on the results of the survey, over one-fifth of businesses had a greater current debt level and nearly two-fifths had a similar debt level compared to the onset of the COVID-19 pandemic, and some businesses foresee challenges repaying government support programs. At the same time, nearly three-quarters of businesses did not apply for a loan in the last 12 months, and most businesses do not plan to apply for a new loan over the next three months. This article provides insights on the topic of debt and its impacts on businesses in Canada.

Businesses in accommodation and food services and smaller businesses more likely to report a greater current debt level compared with the start of the pandemic

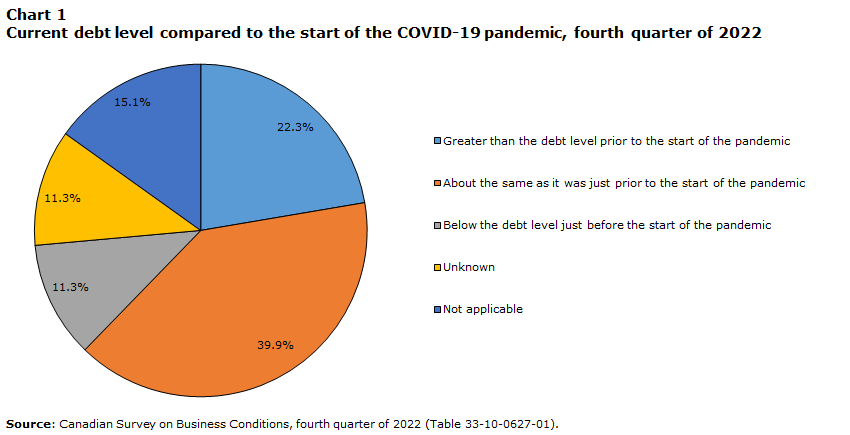

Over one-fifth (22.3%) of businesses stated that their debt level was greater than it was prior to the start of the pandemic, and nearly two-fifths (39.9%) said their debt level was about the same now as it was prior to the start of the pandemic. Meanwhile, 11.3% reported that their current debt level was below their level prior to the start of the pandemic and 11.3% were unsure.

Data table for Chart 1

| Greater than the debt level prior to the start of the pandemic | About the same as it was just prior to the start of the pandemic | Below the debt level just before the start of the pandemic | Unknown | Not applicable | |

|---|---|---|---|---|---|

| percent | |||||

| Current debt level compared to the start of the COVID-19 pandemic | 22.3 | 39.9 | 11.3 | 11.3 | 15.1 |

| Source: Canadian Survey on Business Conditions, fourth quarter of 2022 (Table 33-10-0627-01). | |||||

More businesses in accommodation and food services reported a greater current debt level than businesses in other sectors, at over one-third (36.6%), followed by businesses in arts, entertainment and recreation (29.7%) and administrative and support, waste management and remediation services (29.5%).

Additionally, smaller businesses generally were more likely to report a greater current debt level. One-quarter (25.7%) of businesses with 5 to 19 employees, and over one-fifth of businesses with 1 to 4 employees (20.8%) and 20 to 99 employees (21.8%) reported that their current debt level was greater than it was prior to the start of the pandemic, in contrast with 12.2% of businesses with 100 or more employees who reported the same.

Challenges repaying government support programs and future outlook

Government support programs were put in place because of the COVID-19 pandemic as public health mandates restricted access to and implemented closures of non-essential businesses. This included repayable support programs such as the Canada Emergency Business Account (CEBA) or the Indigenous Business Initiative.Note 2 Some businesses indicated that it may be challenging to repay these loans over the next 12 months.

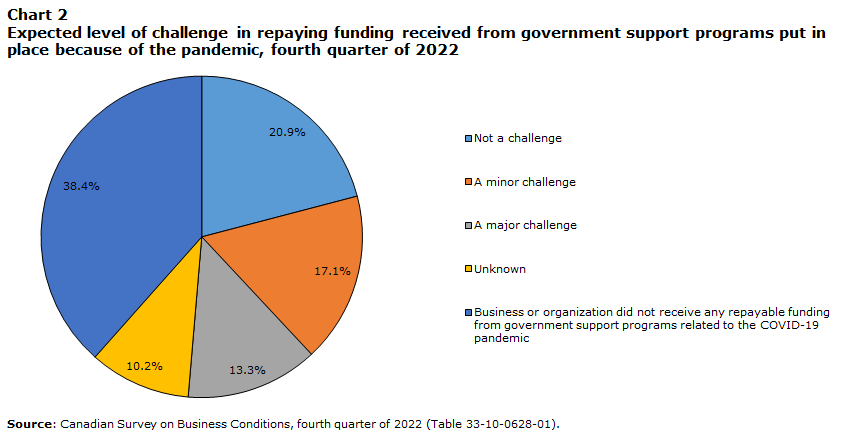

Three-fifths (61.5%) of businesses reported that they received repayable funding from government support programs related to the COVID-19 pandemic. Of these, one-fifth (20.9%) reported that it would not be a challenge to repay the funding received from government support programs over the next 12 months.Note 3 On the other hand, 3 in 10 (30.4%) businesses said it would be a challenge, with 17.1% stating it would be a minor challenge and 13.3% reporting that it would be a major challenge. One in ten (10.2%) businesses were undecided.

Data table for Chart 2

| Not a challenge | A minor challenge | A major challenge | Unknown | Business or organization did not receive any repayable funding from government support programs related to the COVID-19 pandemic | |

|---|---|---|---|---|---|

| percent | |||||

| Expected level of challenge in repaying funding received from government support programs put in place because of the pandemic | 20.9 | 17.1 | 13.3 | 10.2 | 38.4 |

| Source: Canadian Survey on Business Conditions, fourth quarter of 2022 (Table 33-10-0628-01). | |||||

In addition, nearly two-fifths (39.4%) of businesses expected the rising interest rates and debt costs to be an obstacle over the next three months. Nevertheless, 7 in 10 (70.3%) businesses had an optimistic future outlook, while 18.5% had a pessimistic outlook.

Businesses in accommodation and food services (54.4%) were significantly more likely to report that it would be a challenge to repay funding received from government support programs over the next 12 months, followed by businesses in agriculture, forestry, fishing and hunting (42.0%) and administrative and support, waste management and remediation services (38.0%). This is in line with the level of optimism businesses had for their future outlook, with businesses in accommodation and food services being the most likely (26.8%) sector to report a pessimistic future outlook over the next 12 months.

Additionally, smaller businesses were more likely to report an expected challenge in repaying government support. Over one-third (36.1%) of businesses with 5 to 19 employees, 3 in 10 (29.7%) businesses with 1 to 4 employees, and over one-fifth (22.2%) of businesses with 20 to 99 employees reported that it would be a challenge to repay any government support received. In comparison, 5.7% of businesses with 100 or more employees expected the same challenges.

Similarly, smaller businesses were more likely to report a pessimistic future outlook, with 20.2% of businesses with 1 to 4 employees, 17.6% of businesses with 5 to 19 employees, and 14.6% of businesses with 20 to 99 employees stating these views. In contrast, 8.1% of businesses with 100 or more employees had a pessimistic future outlook over the next 12 months.

Most businesses did not apply for credit or loans over the last 12 months

Over the last 12 months,Note 4 nearly three-quarters (74.1%) of businesses did not apply for a new line of credit, a new term loan, a new non-residential mortgage, or refinancing of an existing non-residential mortgage. Meanwhile, 15.0% of businesses did apply.

Of businesses that did not apply for loans in the last 12 months, the most common reason was that they did not require a loan (73.8%). Other reasons included interest rates or cost of borrowing being too high (13.4%) and concerns about the economy or inflation (10.6%).

Among businesses that applied, the majority (78.1%) had their largest request approved, while 7.3% did not receive an approval. About 1 in 10 (11.0%) businesses are still waiting for the outcome of their request.

Business liquidity and plans for new debt

Over three-quarters (77.3%) of businesses reported that they had the cash or liquid assets required to operate for the next three months, while 10.7% did not and 11.9% were undecided. Among those who said that they did not have the cash or liquid assets required to operate, 43.9% said they would be able to acquire these assets if needed.

The vast majority of businesses do not plan to apply for a new loan over the next three months.Note 5 Specifically, nearly three-quarters (74.7%) of businesses reported that they did not plan to apply for a new line of credit, a new term loan, a new non-residential mortgage, or the refinancing of an existing non-residential mortgage over the next three months, while 7.0% stated that they did have plans to apply and 18.3% were unsure of their plans.

Among businesses that did not plan to apply for a new loan over the next three months, one-quarter (25.7%) said that they did not have the ability to take on more debt. The top reasons businesses could not take on more debt included interest rates being unfavourable (39.7%), a lack of confidence or uncertainty in future sales (34.0%), and cash flow (33.6%).

Methodology

From October 3 to November 7, 2022, representatives from businesses across Canada were invited to take part in an online questionnaire about business conditions and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 35,914 and results are based on responses from a total of 17,363 businesses or organizations.

References

Statistics Canada. 2022. Canadian Survey on Business Conditions, fourth quarter of 2022.

- Date modified: