Analysis in Brief

When the world changed: How the rental vehicle industry in

British Columbia adjusted to the pandemic

Skip to text

Text begins

The authors would like to thank Andrea Gal for her helpful guidance in this project.

The rental vehicle industry is an integral part of the tourism sector supply chain. The tourism sector was one of the most impacted by government restrictions globally during the pandemic. In 2020, tourism gross domestic product (GDP) in Canada was down 54.9%.Note This contributed to a decline in tourism’s share of GDP, which fell by almost half from 2.0% in 2019 to 1.1% in 2020.Note The pandemic upended many businesses in the tourism sector, including car rental companies, as international and business travel came to a near standstill in Canada. The market for passenger car rental at airports and in other locations was severely hit.

Car rental companies downsized their fleets rather than having vehicles unused in car lots for long periods of time.Note While the demand for travel is recovering, even as Canada is dealing with successive waves of the pandemic, the car rental industry is coping with challenges in building its vehicle supply back up. The motor vehicle industry is facing many supply chain issues, as a global shortage of semiconductors has delayed worldwide vehicle production, causing long delays to resupply fleets at a time of pent-up demand for travel.Note

This study examined provincial motor vehicle registration data files to provide new estimates on rental vehicle fleets in the last decade, with a special focus on turnover and management of inventories during the pandemic. The estimates are presented first for British Columbia and will be presented for other regions of Canada as data become available.

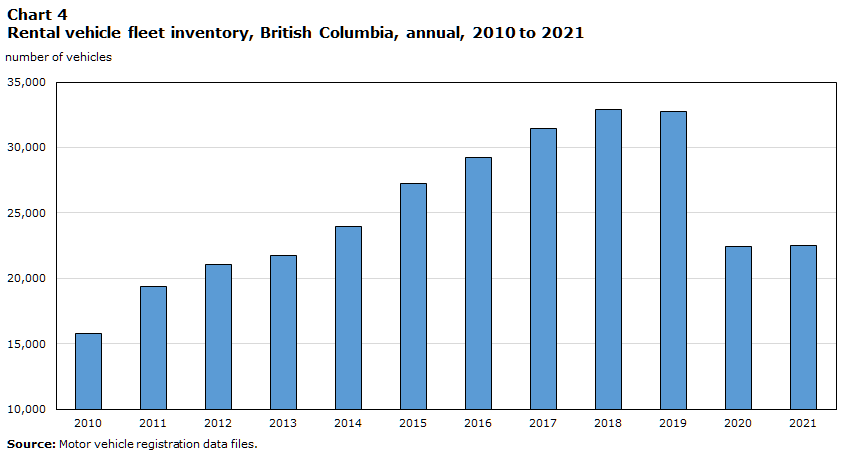

As a share of the economy, British Columbia has the largest tourism sector of all provinces.Note After growing by an annual average of 6.6% between 2015 and 2019, the rental vehicleNote fleet in British Columbia dropped by almost one-third in 2020 and, by the end of the first year of the pandemic, had reached its lowest level in a decade. Even though fleet inventories were being replenished throughout 2021 as domestic and international travelling restrictions loosened and demand picked up, fleet inventories remained well under pre-pandemic levels and grew at a much slower pace than in the past decade.

The rental vehicle industry in the Canadian economy

How important is the Canadian rental vehicle industry? While representing around 2.0% of the tourism sector, the vehicle rental industry is an integral part of the Canadian tourism supply chain.Note At the end of 2019, there were 1,219 passenger car rental businesses (with employees) in Canada.Note The industry in Canada directly employed over 22,000 workers in 2019, with 3,149 of them located in British Columbia.Note Up until the pandemic, the automotive equipment rental and leasing industry in CanadaNote had been expanding, with operating revenue reaching $7.9 billion in 2019, up by over 33.7% since 2015, and a relatively stable profit margin averaging 12.5% over that period.Note While the largest share of the industry is in Ontario, British Columbia represents a little under 14% of the national industry, with operating revenue rising from $774.6 million in 2015 to $1.1 billion in 2019.Note

Impacts of the pandemic on the car rental industry

The pandemic upended many businesses in the tourism sector, including passenger car rental companies, as international and business travel came to a near standstill and stay-at-home orders discouraged domestic travel. Air passenger traffic in 2020 tumbled by close to three-quarters at both the Montréal-Pierre Elliott Trudeau International Airport and Toronto-Lester B. Pearson International Airport, and it dropped by nearly as much in Calgary and at Vancouver International Airport, even though these were the four airports where international travellers were allowed to land.Note This decline severely impacted the market for car rental at airports and other locations. Vehicle rental companies downsized their fleets, rather than having vehicles sit unused in car lots for long periods of time and to control costs as sales plunged significantly.Note A drop in demand, cost reductions, bankruptcy filings, acquisitions and government pandemic assistance impacted industry trends in 2020.Note The number of employees in the automotive equipment rental and leasing industry dropped 27.6% in 2020 and operating revenues fell 17.7%Note (Chart 1), while the profit margin averaged 9.2%.Note The number of businesses (with employees) in the passenger car rental industry contracted slightly to 1,190 by the end of 2020.Note

Data table for Chart 1

| Automotive equipment rental and leasing, number of employees | Automotive equipment rental and leasing, operating revenue | |

|---|---|---|

| payroll employment | millions of dollars | |

| 2012 | 19,222 | 5,635.70 |

| 2013 | 20,001 | 5,416.10 |

| 2014 | 20,708 | 5,664.00 |

| 2015 | 21,823 | 5,910.70 |

| 2016 | 21,602 | 6,248.80 |

| 2017 | 21,950 | 6,850.50 |

| 2018 | 21,493 | 7,374.30 |

| 2019 | 22,111 | 7,900.80 |

| 2020 | 16,010 | 6,498.90 |

| Source: Statistics Canada, Table 14-10-0202-01 and Table 21-10-0012-01. | ||

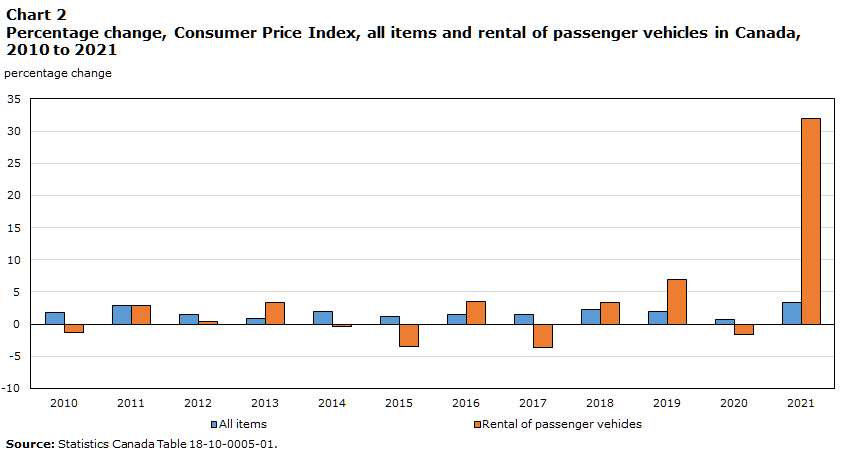

The pandemic led to large swings in consumer prices for many goods and services in Canada, including car rentals, as demand and supply imbalances impacted pricing. At the onset of the pandemic, consumer rental prices of passenger vehicles dropped by more than 6% between February and May 2020 as demand fell precipitously. Then, as travel restrictions loosened, rental prices picked up, rising by 7.8% in the second half of 2020. Availability issues fuelled a 31.9% price increase in 2021Note in Canada, even though tourism activity was nowhere near the pre-pandemic peak (Chart 2). At the end of 2021, overall tourism activity in Canada was still almost 30% below the level reached before the pandemic.Note

Data table for Chart 2

| All items | Rental of passenger vehicles | |

|---|---|---|

| percentage change | ||

| 2010 | 1.8 | -1.4 |

| 2011 | 2.9 | 2.9 |

| 2012 | 1.5 | 0.4 |

| 2013 | 0.9 | 3.4 |

| 2014 | 2.0 | -0.4 |

| 2015 | 1.1 | -3.4 |

| 2016 | 1.4 | 3.5 |

| 2017 | 1.6 | -3.6 |

| 2018 | 2.3 | 3.4 |

| 2019 | 1.9 | 6.9 |

| 2020 | 0.7 | -1.6 |

| 2021 | 3.4 | 31.9 |

| Source: Statistics Canada, Table 18-10-0005-01. | ||

British Columbia’s rental vehicle fleet from 2010 to 2021

The car rental vehicle fleet estimates for British Columbia were derived from vehicle registration data files. For businesses operating in the passenger car rental industry, the vehicle identification numbers of vehicles were tracked over time to see how long the vehicles were registered to a particular business (for further information on methodology, see the note to readers).

The British Columbia rental vehicle fleet shows large seasonal fluctuations, exhibiting similar quarterly patterns from one year to the next (Chart 3). Businesses in the industry typically add to their fleets in the second quarter every year to meet peak demand. In the remaining quarters, rental businesses downsize their inventories, more so in the fourth and first quarters of the year. The decision to shed inventory is often driven by kilometres driven or model type and vehicle age. On average, in the last decade, rental businesses in British Columbia did not keep rental vehicles for more than a year.

Data table for Chart 3

| Rental vehicle fleet inventory | |

|---|---|

| number of vehicles | |

| 2010 | |

| Q1 | 15,229 |

| Q2 | 17,376 |

| Q3 | 16,779 |

| Q4 | 13,649 |

| 2011 | |

| Q1 | 16,020 |

| Q2 | 22,028 |

| Q3 | 21,524 |

| Q4 | 18,063 |

| 2012 | |

| Q1 | 17,468 |

| Q2 | 24,141 |

| Q3 | 23,045 |

| Q4 | 19,449 |

| 2013 | |

| Q1 | 18,460 |

| Q2 | 24,978 |

| Q3 | 23,438 |

| Q4 | 20,080 |

| 2014 | |

| Q1 | 20,055 |

| Q2 | 26,563 |

| Q3 | 26,432 |

| Q4 | 22,730 |

| 2015 | |

| Q1 | 22,943 |

| Q2 | 30,429 |

| Q3 | 29,885 |

| Q4 | 25,861 |

| 2016 | |

| Q1 | 24,507 |

| Q2 | 32,936 |

| Q3 | 31,628 |

| Q4 | 27,846 |

| 2017 | |

| Q1 | 26,764 |

| Q2 | 35,298 |

| Q3 | 33,779 |

| Q4 | 29,985 |

| 2018 | |

| Q1 | 27,605 |

| Q2 | 36,697 |

| Q3 | 36,454 |

| Q4 | 31,009 |

| 2019 | |

| Q1 | 29,000 |

| Q2 | 36,032 |

| Q3 | 35,492 |

| Q4 | 30,592 |

| 2020 | |

| Q1 | 26,104 |

| Q2 | 23,877 |

| Q3 | 20,677 |

| Q4 | 19,061 |

| 2021 | |

| Q1 | 18,636 |

| Q2 | 22,679 |

| Q3 | 24,457 |

| Q4 | 24,411 |

| Source: Motor vehicle registration data files. | |

As the economy and the tourism sector performed well in the last decade, the rental vehicle fleet in British Columbia more than doubled from an estimated average of 15,758 vehicles in 2010 to an average of 32,779 vehicles in 2019 (Chart 4).

Data table for Chart 4

| Rental vehicle fleet inventory | |

|---|---|

| number of vehicles | |

| 2010 | 15,758 |

| 2011 | 19,409 |

| 2012 | 21,026 |

| 2013 | 21,739 |

| 2014 | 23,945 |

| 2015 | 27,280 |

| 2016 | 29,229 |

| 2017 | 31,457 |

| 2018 | 32,941 |

| 2019 | 32,779 |

| 2020 | 22,430 |

| 2021 | 22,546 |

| Source: Motor vehicle registration data files. | |

Vehicle fleet contracted in every quarter of 2020

As tourism and business demand plunged with the pandemic, the rental vehicle industry in British Columbia downsized its fleet from an average of 26,104 passenger vehicles (not seasonally adjusted at annual rates) in the first quarter of 2020 to an average of 19,061 passenger vehicles at the end of 2020. The industry did not add to inventories in the second quarter of 2020 as it would have typically for peak seasonal demand. After growing by an annual average of 8.7% between 2010 and 2019, the rental car fleet in British Columbia dropped by 31.5% in 2020 and, by the fourth quarter of the year, had reached its lowest level in a decade.

Timid recovery of rental fleet in 2021

With the third wave of the pandemic impacting the ability to travel in the first part of 2021, rental vehicle businesses did not resume their typical way of managing their operations. There were challenges with replenishing the depleted inventory to meet the recovering tourism demand when travel restrictions loosened in the summer and fall of 2021. A global semiconductor chip shortage and supply chain issues have limited passenger car manufacturing.Note Rental vehicle inventories picked up in British Columbia from the second quarter of 2021 until the end of the year, but are not near pre-pandemic levels. In the United States, the rental car industry is supplementing its fleet by purchasing low-kilometre pre-owned vehicles.Note As well, the rental vehicle industry may not turn inventory over as quickly as in the past. The dynamics in the industry have changed. While some factors are temporary, others may be structural and will permanently change the industry.

Final thoughts

Similarly to many other sectors of the Canadian economy, the rental vehicle industry is facing imbalances. Rental vehicle fleets in British Columbia were depleted during the first year of the pandemic as demand dried up and have yet to recover to pre-pandemic levels. Reduced supply of new vehicles has been hampering the replenishment of inventories to more normal levels. The disruption to the car market could spur lasting changes for the rental vehicle industry, leading to tighter fleet inventory control and higher prices for consumers.

Note to readers

The car rental vehicle fleet estimates for British Columbia were derived from vehicle registration data files. For businesses operating in the passenger car rental industry, the vehicle identification numbers (VINs) of vehicles were tracked over time to see how long the vehicles were registered to a particular business. To extract the detailed characteristic information the VIN provides for each vehicle manufactured for sale in Canada, a special software was used to decode the VINs.

Specific information about a car was extracted, including make, model and year; where the vehicle was manufactured; and ownership transfers. In general, the ownership transfer information helps establish when a vehicle changes hands, including transfers within the rental car industry.

Reference

- Date modified: