Technical Reference Guide for the Preliminary Estimates from the T1 Family File (T1FF)

Skip to text

Text begins

Data Source

The data sets based on the T1 Family File (T1FF) are derived from T1 income tax returns. For the most part, tax returns were filed in the spring of the year following the reference year. For example, for the 2021 tax year, most income tax returns were filed by April 30, 2022.

Demographic characteristics such as age are given as of December 31 of the tax year. Income information is for the calendar year under review.

The data for the products associated with this release are derived from an early version of a file that Statistics Canada receives from Canada Revenue Agency (CRA). The file benefits from timeliness, but loses some accuracy because of it. This earlier tax file, often referred to as the T1 preliminary file, typically contains about 97% of the records on the CRA file received four to five months later.

Data Frequency

Data are updated on an annual basis.

Data Quality - Number of Canadian Tax Filers

The data used are direct counts from T1 preliminary tax file. For the 2021 tax year, 28.1 million Canadians or 72.7% filed tax returns.

| Tax year | Number of Tax filers ('000) | Date of Population Estimate | Population ('000) | Percent Coverage |

|---|---|---|---|---|

| 1991 | 18,786 | 1-Apr-92 | 28,270 | 66.5 |

| 1992 | 19,267 | 1-Apr-93 | 28,601 | 67.4 |

| 1993 | 19,882 | 1-Apr-94 | 28,907 | 68.8 |

| 1994 | 20,184 | 1-Apr-95 | 29,212 | 69.1 |

| 1995 | 20,536 | 1-Apr-96 | 29,514 | 69.6 |

| 1996 | 20,772 | 1-Apr-97 | 29,818 | 69.7 |

| 1997 | 21,113 | 1-Apr-98 | 30,080 | 70.2 |

| 1998 | 21,431 | 1-Apr-99 | 30,315 | 70.7 |

| 1999 | 21,893 | 1-Apr-00 | 30,594 | 71.6 |

| 2000 | 22,249 | 1-Apr-01 | 30,911 | 72.0 |

| 2001 | 22,804 | 1-Apr-02 | 31,252 | 73.0 |

| 2002 | 22,968 | 1-Apr-03 | 31,548 | 72.8 |

| 2003 | 23,268 | 1-Apr-04 | 31,846 | 73.1 |

| 2004 | 23,625 | 1-Apr-05 | 32,143 | 73.5 |

| 2005 | 23,952 | 1-Apr-06 | 32,471 | 73.8 |

| 2006 | 24,258 | 1-Apr-07 | 32,818 | 73.9 |

| 2007 | 24,624 | 1-Apr-08 | 33,191 | 74.2 |

| 2008 | 24,987 | 1-Apr-09 | 33,604 | 74.4 |

| 2009Table A Number of Canadian Tax filers Note 1 |

24,321 | 1-Apr-10 | 34,002 | 71.5 |

| 2010Table A Number of Canadian Tax filers Note 1 |

24,495 | 1-Apr-11 | 34,368 | 71.3 |

| 2011Table A Number of Canadian Tax filers Note 1 |

24,842 | 1-Apr-12 | 34,754 | 71.5 |

| 2012Table A Number of Canadian Tax filers Note 1 |

25,160 | 1-Apr-13 | 35,025 | 71.8 |

| 2013Table A Number of Canadian Tax filers Note 1 |

25,483 | 1-Apr-14 | 35,416 | 71.9 |

| 2014Table A Number of Canadian Tax filers Note 1 |

25,922 | 1-Apr-15 | 35,755 | 72.5 |

| 2015Table A Number of Canadian Tax filers Note 1 |

26,187 | 1-Apr-16 | 36,147 | 72.4 |

| 2016Table A Number of Canadian Tax filers Note 1 |

26,350 | 1-Apr-17 | 36,561 | 72.1 |

| 2017Table A Number of Canadian Tax filers Note 1 |

26,808 | 1-Apr-18 | 36,890 | 72.7 |

| 2018Table A Number of Canadian Tax filers Note 1 |

27,395 | 1-Apr-19 | 37,312 | 73.4 |

| 2019Table A Number of Canadian Tax filers Note 1 |

27,172 | 1-Apr-20 | 37,417 | 72.6 |

| 2020Table A Number of Canadian Tax filers Note 1 |

27,855 | 1-Apr-21 | 38,153 | 73.0 |

| 2021Table A Number of Canadian Tax filers Note 1 |

28,104 | 1-Apr-22 | 38,645 | 72.7 |

|

||||

Confidentiality and Rounding

Over the years since its creation, the T1 Family File (T1FF) has become known as a reliable, annual source for income. To protect the confidentiality of Canadians, all data are subject to the confidentiality procedures of rounding and suppression.

All counts are rounded. Rounding may increase, decrease, or cause no change to counts. Rounding can affect the results obtained from calculations. For example, when calculating percentages from rounded data, results may be distorted as both the numerator and denominator have been rounded. The distortion can be greatest with small numbers.

Starting with the 2007 data, all aggregate amounts are rounded to the nearest $5,000 dollars. Also as of 2007, median incomes in the data tables are rounded to the nearest ten dollars (prior to 2007 they were rounded to the nearest hundred dollars).

Since 1990, data cells represent counts of 15 or greater, and are rounded to a base of 10. For example, a cell count of 15 would be rounded to 20 and a cell count of 24 would be rounded to 20.

Note: Counts represent the number of persons. Reported amounts are aggregate dollar amounts reported.

In the data tables:

- Medians, Percentiles and Average amount are rounded to the nearest ten dollars.

- Percentages are published with no decimal and calculated on rounded data; therefore, the sum of percentages might not equal 100% in the case of small counts.

Suppressed Data

To maintain confidentiality, data cells have been suppressed whenever:

- areas comprise less than 100 tax filers;

- cells represent less than 15 tax filers;

- cells were dominated by a single filer;

- cells for median income were based on a rounded count of less than 20 tax filers.

Suppressed data may occur:

- Within one area:

- when one of the income categories is suppressed, a second category must also be suppressed to avoid disclosure of confidential data by subtraction (called residual disclosure);

- when one of the gender categories is suppressed, the other gender category must also be suppressed to avoid residual disclosure;

- when one age group category is suppressed, another age group must also be suppressed to avoid residual disclosure.

- Between areas:

- when a variable amount in one area is suppressed, that variable amount is also suppressed in another area to prevent disclosure by subtraction.

Data Tables

In the table description sections of this document, the standard table number, the new Statistics Canada table number from its website and the former CANSIM number are all included.

The standard tables available from the Client Services Section of the Centre for Income and Socioeconomic Well-being Statistics are available for a variety of census and postal geography level. The tables available directly from Statistics Canada’s website only include data as of the year 2000 and are only available for Canada, provinces & territories, census metropolitan areas and census agglomerations.

Canadian Tax Filers

This data set provides a demographic and income profile of Canadians who filed a personal tax return in the reference year, according to the T1 preliminary file.

The content of the data set is as follows:

Standard Table CT-01: Summary characteristics of Canadian tax filers (preliminary T1 Family File)

Website Table 11-10-0047-01 (formerly CANSIM 111-0041)

- Number of tax filers

- Percent of tax filers 0-24 years of age

- Percent of tax filers 25-34 years of age

- Percent of tax filers 35-44 years of age

- Percent of tax filers 45-54 years of age

- Percent of tax filers 55-64 years of age

- Percent of tax filers 65+ years of age

- Average age of tax filers

- Median total income of tax filers

- 75th percentile of total income of tax filers

- 85th percentile of total income of tax filers

- 95th percentile of total income of tax filers

- Median employment income of tax filers

- 75th percentile of employment income of tax filers

Standard Table CT-02: Characteristics of Canadian tax filers, income groups (preliminary T1 Family File)

Website Table 11-10-0047-01 (formerly CANSIM 111-0041)

- Number of tax filers

- Percent of tax filers with total income less than $20,000

- Percent of tax filers with total income between $20,000 and $39,999

- Percent of tax filers with total income between $40,000 and $59,999

- Percent of tax filers with total income between $60,000 and $79,999

- Percent of tax filers with total income $80,000+

- Value of total income (in thousands of dollars)

- Percent of total income reported by tax filers with total income less than $20,000

- Percent of total income reported by tax filers with total income between $20,000 and $39,999

- Percent of total income reported by tax filers with total income between $40,000 and $59,999

- Percent of total income reported by tax filers with total income between $60,000 and $79,999

- Percent of total income reported by tax filers with total income $80,000+

Charitable Donations

Start of text boxT1 Line 340 – Allowable charitable donations and government gifts

This data set provides information on tax filers classified as charitable donors. Charitable donors are defined as tax filers reporting donations on T1 line 340 of the tax return.

Canadians contribute in many ways to charitable organizations. The data set on charitable donors provides information on tax filers who claimed a tax credit for charitable donations on their income tax return in the reference year. These data may include donations that might be denied by the Canada Revenue Agency (CRA) after an audit. To find out more about why donations might be denied (i.e. tax shelter gifting arrangements, false receipting) please go to the Canada Revenue Agency website.

Persons making charitable donations, but not reporting them on their personal tax return are not included in this data set. These include donations for which no receipt was provided and donations for which the receipt was lost. No estimate of such donations is included in these data.

Only donations made to approved organizations are allowable as deductions in the tax system. Donations are eligible if made to Canadian registered charities and Canadian amateur athletic associations. They are also eligible if made to: prescribed universities outside Canada; certain tax exempt housing organizations in Canada; Canadian municipalities; the United Nations; and certain charities outside Canada to which the Government of Canada has made a gift.

It is possible to carry donations forward for up to five years after the year in which they were made. In the reference year, it is possible to claim donations made in any of the previous five years, as long as they were not already claimed in a prior year. The donations made in the reference year could be claimed the same year, or could be carried forward to any of the next five years. According to tax laws, tax filers are permitted to claim both their donations and those made by their spouses to get better tax benefits. Consequently, the number of persons who made charitable donations may be higher than the number who claimed tax credits.

A change was introduced in the 2016 tax year for tax filers with a taxable income over $200,000 (amount to be adjusted annually) who made charitable donations of over $200 to a recognized charity (as outlined above). In 2021, tax filers qualify for the following charitable donation tax credit:

- 15% of their donations up to $200;

- 33% of lesser of (1) their donations over $200, and (2) their taxable income over $216,511; and

- 29% of their donation over $200 not qualifying for the 33% tax credit rate.

Tax filers who contributed to a recognized charity with a taxable income of $216,511 or under continue to calculate their credit at 15% of donations up to $200 plus 29% of their donations over $200.

From 2013 to 2017, in addition to the regular tax credits for donations, another tax credit was available in order to encourage donations from tax filers who had not previously made any donation. This credit ended in 2017.

The content of the data set is as follows:

Standard Table CD-01: Summary of charitable donors

Website Table 11-10-0130-01 (formerly CANSIM 111-0001)

- Total Number of tax filers

- Number of charitable donors

- Average age of donors

- Average donation for age group 0-24

- Average donation for age group 25-34

- Average donation for age group 35-44

- Average donation for age group 45-54

- Average donation for age group 55-64

- Average donation for age group 65+

- Total amount of charitable donations (thousands of $)

- Median donation

- Median total income of donors

- 75th percentile of donors' total income

Standard Table CD-02: Tax filers with charitable donations by sex and age

Website Table 11-10-0002-01 (formerly CANSIM 111-0002)

- Total Number of tax filers

- Percent of tax filers who are male

- Percent of tax filers who are female

- Number of charitable donors

- Percent of charitable donors who are male

- Percent of charitable donors who are female

- Percent of donors 0 - 24 years of age

- Percent of donors 25 - 34 years of age

- Percent of donors 35 - 44 years of age

- Percent of donors 45 - 54 years of age

- Percent of donors 55 - 64 years of age

- Percent of donors 65+ years of age

- Total median donation

- Median donation of males

- Median donation of females

- Total amount of charitable donations (thousands of $)

- Total amount of charitable donations for males (thousands of $)

- Total amount of charitable donations for females (thousands of $)

Standard Table CD-03: Tax filers with charitable donations by income

Website Table 11-10-0002-01 (formerly CANSIM 111-0003)

- Total number of tax filers

- Total number of charitable donors

- Percent of charitable donors with total income less than $20,000

- Percent of charitable donors with total income between $20,000 and $39,999

- Percent of charitable donors with total income between $40,000 and $59,999

- Percent of charitable donors with total income between $60,000 and $79,999

- Percent of charitable donors with total income $80,000+

- Total value of charitable donations (in thousands of dollars)

- Percent of donations reported by donors with total income under $20,000

- Percent of donations reported by donors with total income between $20,000 and $39,999

- Percent of donations reported by donors with total income between $40,000 and $59,999

- Percent of donations reported by donors with total income between $60,000 and $79,999

- Percent of donations reported by donors with total income $80,000+

RRSP Contributors

This data set provides information on tax filers who contributed to a Registered Retirement Savings Plan (RRSP) during the tax year under review.

Starting in 2013, tax filers who contributed to a Pooled registered pension plan (PRPP) are also included.

The content of the data set is as follows:

Standard Table R-01: Summary (CANSIM 111-0039)of RRSP contributors

Website Table 11-10-0044-01 (formerly CANSIM 111-0039)

- Total number of tax filers

- Number of RRSP contributors

- Average age of RRSP contributors

- Median employment income of RRSP contributors

- 75th percentile of employment income of RRSP contributors

- Amount of RRSP dollars reported (in thousands of dollars)

- Median RRSP contribution

Standard Table R-02: RRSP contributors by age groups (CANSIM 111-0039)

Website Table 11-10-0044-01 (formerly CANSIM 111-0039)

- Total number of tax filers

- Total number of RRSP contributors

- Percent of contributors 0 to 24 years of age

- Percent of contributors 25 to 34 years of age

- Percent of contributors 35 to 44 years of age

- Percent of contributors 45 to 54 years of age

- Percent of contributors 55 to 64 years of age

- Percent of contributors 65+ years of age

- Total amount of RRSP dollars reported (in thousands of dollars)

- Percent of contributions reported by age group 0 to 24

- Percent of contributions reported by age group 25 to 34

- Percent of contributions reported by age group 35 to 44

- Percent of contributions reported by age group 45 to 54

- Percent of contributions reported by age group 55 to 64

- Percent of contributions reported by age group 65+

Standard Table R-03: RRSP contributors by sex

Website Table 11-10-0044-01 (formerly CANSIM 111-0039)

- Total number of tax filers

- Percent of tax filers who are male

- Percent of tax filers who are female

- Total number of RRSP Contributors

- Percent of contributors who are male

- Percent of contributors who are female

- Median RRSP contribution of all contributors

- Median RRSP contribution of males

- Median RRSP contribution of females

Standard Table R-04: RRSP contributors by income groups (CANSIM 111-0039)

Website Table 11-10-0044-01 (formerly CANSIM 111-0039)

- Total number of tax filers

- Total number of RRSP contributors

- Percent of RRSP contributors with total income less than $20,000

- Percent of RRSP contributors with total income between $20,000 and $39,999

- Percent of RRSP contributors with total income between $40,000 and $59,999

- Percent of RRSP contributors with total income between $60,000 and $79,999

- Percent of RRSP contributors with total income $80,000+

- Total amount of RRSP dollars reported (in thousands of dollars)

- Percent of total RRSP amount reported by contributors with total income less than $20,000

- Percent of total RRSP amount reported by contributors with total income between $20,000 and $39,999

- Percent of total RRSP amount reported by contributors with total income between $40,000 and $59,999

- Percent of total RRSP amount reported by contributors with total income between $60,000 and $79,999

- Percent of total RRSP amount reported by contributors with total income $80,000+

Wages, Salaries and Commissions

This data set provides an overview of annual income from wages, salaries and commissions of Canadians who filed a personal tax return in the reference year, according to the T1 preliminary file. Data tables are available as of 2017.

The content of the data set is as follows:

Standard Table W-01: Wages, salaries and commissions of tax filers aged 15 years and over by sex and age group

Website Table 11-10-0072-0

- Tax filers by sex, 15 years of age and over with wages, salaries and commissions

- Tax filers 15 years of age and over with wages, salaries and commissions, count and percentage

- Tax filers 15-24 years of age, count and percentage

- Tax filers 25-34 years of age, count and percentage

- Tax filers 35-44 years of age, count and percentage

- Tax filers 45-54 years of age, count and percentage

- Tax filers 55-64 years of age, count and percentage

- Tax filers 65-74 years of age, count and percentage

- Tax filers 75+ years of age, count and percentage

- 25th percentile of wages, salaries and commissions of tax filers

- Median wages, salaries and commissions of tax filers

- 75th percentile of wages, salaries and commissions of tax filers

- Median total income of tax filers with wages, salaries and commissions

Standard Table W-02: Wages, salaries and commissions of tax filers aged 15 years and over by main industry sector (North American Industry Classification System) and sex

Website Table 11-10-0073-01

- Number of tax filers 15 years of age and over with wages, salaries and commissions, all industries, total count and percentage of males and females

- 11. Agriculture, forestry, fishing and hunting, total count and percentage of males and females

- 21. Mining, quarrying, and oil and gas extraction, total count and percentage of males and females

- 22. Utilities, total count and percentage of males and females

- 23. Construction, total count and percentage of males and females

- 31-33. Manufacturing, total count and percentage of males and females

- 41. Wholesale trade, total count and percentage of males and females

- 44-45. Retail trade, total count and percentage of males and females

- 48-49. Transportation and warehousing, total count and percentage of males and females

- 51. Information and cultural industries, total count and percentage of males and females

- 52. Finance and insurance, total count and percentage of males and females

- 53. Real estate and rental and leasing, total count and percentage of males and females

- 54. Professional, scientific and technical services, total count and percentage of males and females

- 55- 56. Business, building and other support services, total count and percentage of males and females (since 2019)

- 55. Management of companies and enterprises, total count and percentage of males and females (up until 2018; as of 2019 categories 55 and 56 were combined into one category)

- 56. Administrative and support, waste management and remediation services, total count and percentage of males and females (up until 2018; as of 2019 categories 55 and 56 were combined into one category)

- 61. Educational services, total count and percentage of males and females

- 62. Health care and social assistance, total count and percentage of males and females

- 71. Arts, entertainment and recreation, total count and percentage of males and females

- 72. Accommodation and food services, total count and percentage of males and females

- 81. Other services (except public administration), total count and percentage of males and females

- 91. Public administration, total count and percentage of males and females

- Not available, total count and percentage of males and females

- 25th percentile of wages, salaries and commissions of tax filers

- Median wages, salaries and commissions of tax filers

- 75th percentile of wages, salaries and commissions of tax filers

Statistical Tables - Footnotes and Historical Availability

Charitable Donations

- Table CD-01 (summary) is available starting with the 1990 data, according to the postal geography. Census metropolitan areas (CMAs) are available starting with the 1993 data, census divisions (CDs) with the 1995 data and federal electoral districts (FEDs) with the 1997 data.

- Changes were made to the age groups in table CD-01 in 1991 and in 1997.

- Table CD-02 (age groups) is available starting with the 1995 data, for the postal geography and for CMAs. CDs are available starting with the 1995 data and FEDs with the 1997 data.

- Changes were made to the age groups in table CD-02 in 1997.

- Table CD-03 (Income groups) is available in its current format starting with the 2007 data, for the postal geography, for CMAs, CDs and FEDs. From 1997 to 2006, the income groups were cumulative.

RRSP Contributors

- Table R-01 is available in its current format starting with the 1990 data, according to the postal geography. Census metropolitan areas (CMAs) are available starting with the 1993 data, census divisions (CDs) with the 1994 data and federal electoral districts (FEDs) with the 1997 data.

- Table R-02 (age groups) and table R-03 (sex) are available in their current formats starting with the 1994 data, for postal areas, CMAs, CDs and FEDs (since 1997). Some changes were made to the age groupings over the years.

- Table R-04 (income groups) is available in its current format starting with the 2007 data, for postal areas, CMAs, CDs and FEDs. From 1997 to 2006, the income groups were cumulative.

- Starting in 2013, tax filers who contributed to a Pooled registered pension plan (PRPP) are included.

- Starting in 2013, contributions made by the tax filer to a Pooled Registered Pension Plan (PRPP) are included (employer contributions to PRPP are not included).

Wages, Salaries and Commissions

- Tables W-01 and W-02 were introduced for reference year 2018. At the time of release, they also included data for 2017.

- Tables W-01 and W-02 only include data for tax filers over the age of 15.

- In Tables W-01 and W-02, wages, salaries and commissions include employment pay and commissions as stated on T4 information slips, training allowances, tips, gratuities and royalties. This also includes tax-exempt employment income earned on an Indian reserve.

- In Table W-02, Wages, salaries and commissions received by a tax filer may come from multiple employers, and therefore may be linked to multiple industries. The industry for which these employment income amounts are the highest is used to determine the main industry of the tax filer. The North American Industry Classification System (NAICS) code is used to describe the main industry sector. In some cases the main industry for the tax filer cannot be clearly determined. It is not always possible to clearly link wages, salaries and commissions earned by tax filer to a specific employer. Even when the employer is known, it is not always possible to determine the appropriate industry according to the NAICS.

Glossary of Terms

25th percentile

Income values are ranked from highest to lowest and the value reported as being the 25th percentile indicates that 25% of the tax filers report an income equal or below that amount and 75% are above. Percentiles are calculated for each geographical level.

For example, if the 25th percentile of total income is shown as $20,000 this means that 25% of the population under review has a total income less than or equal to $20,000 and 75% of the population has a total income greater than or equal to $20,000.

75th percentile

Income values are ranked from highest to lowest and the value reported as being the 75th percentile indicates that 25% of the tax filers report an income equal or above that amount and 75% fall below. Percentiles are calculated for each geographical level.

For example, if the 75th percentile of total income is shown as $60,000 this means that 25% of the population under review has a total income greater than or equal to $60,000 and 75% of the population has a total income less than or equal to $60,000.

85th percentile

Income values are ranked from highest to lowest and the value reported as being the 85th percentile indicates that 15% of the tax filers report an income equal or above that amount and 85% fall below. Percentiles are calculated for each geographical level.

For example, if the 85th percentile of total income is shown as $65,000 this means that 15% of the tax filers has a total income greater than or equal to $65,000

95th percentile

Income values are ranked from highest to lowest and the value reported as being the 95th percentile indicates that 5% of the tax filers report an income equal or above that amount and 95% fall below. Percentiles are calculated for each geographical level.

For example, if the 95th percentile of total income is shown as $90,000 this means that 5% of the population under review has a total income greater than or equal to $90,000

Age

Calculated as of December 31 of the reference year ( i.e., tax year minus year of birth).

Charitable donation

Is the allowable portion of total donations, as reported on the income tax return. Canadians contribute in many ways to charitable organizations. These data include only amounts given to charities and approved organizations for which official tax receipts were provided and claimed on tax returns. It is possible to carry donations forward for up to five years after the year in which they were made. Therefore, donations reported for the 2012 taxation year could include donations that were made in any of the five previous years. According to tax laws, tax filers are permitted to claim both their donations and those made by their spouses to receive better tax benefits. Consequently, the number of people who made charitable donations may be higher than the number who claimed tax credits.

Charitable donor

Is defined as a tax filer reporting a charitable donation amount on line 340 of the personal income tax form.

Employment income

The total reported employment income. Employment income includes wages and salaries, commissions from employment, training allowances, tips and gratuities, and self-employment income (net income from business, profession, farming, fishing and commissions) and Tax Exempted Status Indian Employment Income (new in 1999 for wages and salaries, commissions, and in 2010 for self-employment income).

Level of geography

Is a code designating the type of geographic area to which the information in the table applies. See the section on Geography for further information.

Main industry based on the North American Industry Classification System (NAICS)

Wages, salaries and commissions received by a tax filer may come from multiple employers, and therefore may be linked to multiple industries. The industry for which these employment income amounts are the highest is used to determine the main industry of the tax filer. The NAICS code is used to describe the main industry sector. It is not always possible to clearly link wages, salaries and commissions earned by tax filer to a specific employer. Even when the employer is known, it is not always possible to determine the appropriate industry according to the NAICS.

Median

The middle number in a group of numbers. Where a median income, for example, is given as $26,000, it means that exactly half of the incomes reported are greater than or equal to $26,000, and that the other half is less than or equal to the median amount. With the exception of "Total Income", zero values are not included in the calculation of medians for individuals.

North American Industry Classification System (NAICS)

The North American Industry Classification System (NAICS) is an industry classification system developed by the statistical agencies of Canada, Mexico and the United States. Created against the background of the North American Free Trade Agreement, it is designed to provide common definitions of the industrial structure of the three countries and a common statistical framework to facilitate the analysis of the three economies. NAICS is based on supply-side or production-oriented principles, to ensure that industrial data, classified to NAICS, are suitable for the analysis of production-related issues such as industrial performance.

Pooled registered pension plan (PRPP)

Pooled registered pension plan is a retirement savings option for individuals, including self-employed individuals. PRPP contributions made by an employer are not a taxable benefit to the tax filer, but they do reduce the tax filer’s RRSP/ PRPP deduction room.

Registered retirement savings plan (RRSP)

An individual retirement savings plan that is registered by the Canada Revenue Agency. It permits limited contributions, and income earned in the RRSP is exempt from tax until payments are received from the plan.

RRSP contributions

RRSP contributions includes money put into a Registered Retirement Savings Plan (RRSP) or a Pooled Registered Pension Plan (PRPP) during the tax year under review. For PRPPs, only the tax filers portion is included in the contributions. Employer contributions to PRPP are not included.

RRSP contributors

Canadian tax filers who contributed to Registered Retirement Savings Plan (RRSP) or a Pooled Registered Pension Plan (PRPP) during the tax year under review.

Tax filer

Individual who filed a personal income tax return for the reference year.

Total income

Note: this variable was revised over the years, as reflected in the comments below; data users who plan to compare current data to data from previous years should bear in mind these changes. Also, it should be noted that all income amounts are gross, with the exception of net rental income, net limited partnership income and all forms of net self-employment income.

Income reported by tax filers from any of the following sources:

- Employment income

- Wages/Salaries/Commissions

- Other Employment Income as reported on line 104 of the tax form (tips, gratuities, royalties, etc.)

- Net Self-Employment

- Tax Exempted Employment Income for Status Indians (Wages/Salaries/Commissions) (since 1999)

- Tax Exempted Self-Employment Income for Status Indians (since 2010)

- Investments

- Interest and other investment income;

- Dividend income;

- Government Transfers

- Employment Insurance

- Unemployment Insurance/Employment Insurance since 1982;

- Quebec Parental Insurance Plan since 2006;

- Tax Exempted Maternity Benefits Amount for Status Indians (since 2019)

- Pension Income

- Old Age Security since 1982;

- Net Federal Supplements (previously included in other income, shown separately since 1992)

- Guaranteed Income Supplement created in 1967 and Spousal Allowance created in 1975, available since 1992;

- Spousal Allowance (included in Net Federal Supplements since 1992; previously included in non-taxable income.

- Canada and Quebec Pension plans benefits, since 1982;

- Child Benefit;

- Family Allowance program up to 1992;

- Child Tax Credit up to 1992;

- Canada Child Tax Benefit (from 1993 to June 2016)

- Universal Child Care Benefit (from 2006 to June of 2016; includes some retroactive amounts after 2016);

- Canada Child Benefit starting in July 2016

- Federal Tax, Goods and Services Tax, Harmonized Sales Tax

- Federal Sales Tax Credit (from 1988 to 1990);

- Goods and Services Tax (GST) credit from 1990 to 1996;

- Harmonized Sales Tax (HST) credit since 1997

- Workers’ Compensation (included in other income prior to 1992 and shown separately since 1992);

- Social Assistance (included in other income prior to 1992 and shown separately since 1992);

- Provincial Refundable Tax Credits/Family Benefits

- Other Government Transfers

- Working Income Tax Benefit (starting in 2007 depending on the province or territory; included since 2010 in the statistical tables);

- Children’s Fitness tax credit (from 2015 to 2017)

- Eligible Educator School Supply tax credit

- Refundable medical expense supplement (included as of 2018)

- Climate Action Supplement (starting in 2018 for select provinces)

- Other Refundable Tax Credit (starting in 2021)

- Employment Insurance

- Private Pensions

- Registered Retirement Savings Plan/ Pooled Registered Pension Plan Income (since 1994; previously in "other income" ; since 1999, only for tax filers 65+)

- Other Income

- Net limited partnership income

- Alimony

- Net rental income

- Other incomes as reported on line 130 of the tax form (fellowships, bursaries, etc.)

- Registered Disability Savings Plan (RDSP) Income as reported on line 125 of the tax form (introduced in 2008)

- Taxable scholarship, fellowship, bursaries, and artists’ project grants (since 2019)

- Tax Exempted Other Income for Status Indians (since 2019)

For 2021, COVID-19 - Government income support programs and benefits have been included in total income. They are included within the following income sources:

- Pension income;

- Provincial Refundable Tax Credits/Family Benefits; and

- Other government transfers.

More detail information regarding these will be included in the summer/fall releases of the T1FF 2021 final data.

Monies not included in income above are: veterans' disability and dependent pensioners' payments, war veterans' allowances, lottery winnings and capital gains.

Wages, Salaries and Commissions

This source of income includes employment pay and commissions as stated on T4 information slips, training allowances, tips, gratuities and royalties. Starting with the 1999 data, the total of wages, salaries and commissions includes tax-exempt employment income earned on an Indian reserve.

Geography

The data are available for the following geographic areas. See "Statistical Tables - Footnotes and Historical Availability" for further details. The mailing address at the time of filing is the basis for the geographic information in the tables.

Standard areas:

- Canada

- Provinces and Territories

- Census Geography

- Economic Regions

- Census Divisions

- Census Metropolitan Areas

- Census Agglomerations

- Census Tracts

- Federal Electoral Districts (2013 Representation Order)

- Postal Geography:

- City Totals

- Urban Forward Sortation Areas (excludes Rural Routes and Suburban Services, and Other Urban Areas within City)

- Suburban Services*

- Rural Routes (Within City)*

- Rural Postal Code Areas (Within City)

- Other Urban Areas (Non-residential within city)

- Rural Communities (not in City)

- Other Provincial Totals

*These postal geography levels were available in the past but are no longer available for this data.

User-defined areas:

For cost recovery tabulations, users may select specific areas of interest which do not correspond to standard areas. To obtain aggregated data for such areas, users can provide a list of lower level postal or census geography (Postal Codes, forward sortation areas, census tracts, census subdivisions, etc.) grouped according to their defined areas. These areas must satisfy our confidentiality requirements. See the "Special Geography" section for further information.

Geographic Levels – Census Geography

Data are also available for the following levels of the Census geography; the following table shows the coded designators for these geographies, as well as a brief description of each.

Level of Geography (L.O.G.): 12

Area: Canada

Description:

This level of data is an aggregation of the provincial/territorial totals (code 11). The national total is identified by the region code Z99099.

Level of Geography (L.O.G.): 11

Area: Province or Territory Total

Description:

These totals are identified by a provincial/territorial postal letter, then a "990" followed by the province/territory code, as follows:

- Newfoundland and Labrador = A99010

- Nova Scotia = B99012

- Prince Edward Island = C99011

- New Brunswick = E99013

- Quebec = J99024

- Ontario = P99035

- Manitoba = R99046

- Saskatchewan = S99047

- Alberta = T99048

- British Columbia = V99059

- Northwest Territories = X99061

- Nunavut = X99062

- Yukon Territory = Y99060

Level of Geography (L.O.G.): 71

Area: Census Subdivision

Description:

Introduced in 2020 in the T1FF Preliminary Estimates data tables, census subdivision (CSD) is the general term for municipalities (as determined by provincial/territorial legislation) or areas treated as municipal equivalents for statistical purposes (e.g., Indian reserves, Indian settlements and unorganized territories). Municipal status is defined by laws in effect in each province and territory in Canada.

CSDs are classified into 57 types according to official designations adopted by provincial/territorial or federal authorities. The census subdivision type accompanies the CSD name in order to distinguish CSDs from each other, for example, Balmoral - VL (for the village of Balmoral) and Balmoral - P (for the parish / paroisse (municipalité de) of Balmoral). The full list of CSD types is available in Table P of this document.

The 2021 Census contain 5,161 census subdivisions (this includes about 268 CSDs with no population); however only 3,787 areas coded as level of geography 71 (CSD) are available in the 2021 T1FF data tables. For more information on the precision of the geographic coverage in T1FF data tables for CSDs, please refer to the section “Precision of Census Subdivision” of this document.

Census subdivisions are identified in the tables by a seven digits code. This is necessary in order to uniquely identify each CSD in Canada.

- 2 first digits = Province

- 2 next digits = Census Division

- 3 last digits = Census Subdivision

Level of Geography (L.O.G.): 61

Area: Census Tract

Description:

Census tracts (CTs) are small geographic units representing urban or rural neighbourhood-like communities in census metropolitan areas (see definition below) or census agglomerations with an urban core population of 50,000 or more at time of 1996 Census. CTs were initially delineated by a committee of local specialists (such as planners, health and social workers and educators) in conjunction with Statistics Canada.

The 2021 data tables contain 6,089 areas coded as level of geography 61, based on 2021 Census.

Level of Geography (L.O.G.): 51

Area: Economic Region

Description:

An economic region is a grouping of complete census divisions (see definition below) with one exception in Ontario. Economic regions (ERs) are used to analyse regional economic activity. Within the province of Quebec, ERs are designated by law. In all other provinces, they are created by agreement between Statistics Canada and the provinces concerned. Prince Edward Island and the territories each consist of one economic region.

The 2021 data tables contain 76 areas coded as level of geography 51, based on 2021 Census.

Level of Geography (L.O.G.): 42

Area: Census Agglomeration

Description:

The general concept of a census agglomeration (CA) is one of a very large urban area, together with adjacent urban and rural areas that have a high degree of economic and social integration with that urban area. CAs have an urban core population of at least 10,000, based on the previous census.

The 2021 data tables contain 130 area codes as level of geography 42, based on the 2021 Census: 111 CAs, 6 provincial parts for the 3 CAs which cross provincial boundaries and 13 residual geographies called Non CMA-CA, one for each province and territory.

Level of Geography (L.O.G.): 41

Area: Census Metropolitan Area

Description:

The general concept of a census metropolitan area (CMA) is one of a very large urban area, together with adjacent urban and rural areas that have a high degree of economic and social integration with that urban area. CMAs have an urban core population of at least 100,000, based on the previous census.

The 2021 data tables contain 43 areas coded as level of geography 41, based on 2021 Census:

- 001, St. John's, Newfoundland and Labrador

- 205, Halifax, Nova Scotia

- 305, Moncton, New Brunswick

- 310, Saint John, New Brunswick

- 320, Fredericton, New Brunswick

- 408, Saguenay, Quebec

- 421, Québec, Quebec

- 433, Sherbrooke, Quebec

- 442, Trois-Rivières, Quebec

- 447, Drummondville, Quebec

- 462, Montréal, Quebec

- 505, Ottawa-Gatineau (3 items: combined, Quebec part and Ontario part)

- 521, Kingston, Ontario

- 522, Belleville, Ontario

- 529, Peterborough, Ontario

- 532, Oshawa, Ontario

- 535, Toronto, Ontario

- 537, Hamilton, Ontario

- 539, St-Catharines-Niagara, Ontario

- 541, Kitchener-Cambridge-Waterloo, Ontario

- 543, Brantford, Ontario

- 550, Guelph, Ontario

- 555, London, Ontario

- 559, Windsor, Ontario

- 568, Barrie, Ontario

- 580, Greater Sudbury, Ontario

- 595, Thunder Bay, Ontario

- 602, Winnipeg, Manitoba

- 705, Regina, Saskatchewan

- 725, Saskatoon, Saskatchewan

- 810, Lethbridge, Alberta

- 825, Calgary, Alberta

- 830, Red Deer, Alberta

- 835, Edmonton, Alberta

- 915, Kelowna, British Columbia

- 925, Kamloops, British Columbia

- 930, Chilliwack, British Columbia

- 932, Abbotsford-Mission, British Columbia

- 933, Vancouver, British Columbia

- 935, Victoria, British Columbia

- 938, Nanaimo, British Columbia

Level of Geography (L.O.G.): 31

Area: Federal Electoral District

Description:

A federal electoral district (FED) refers to any place or territorial area represented by a Member of Parliament elected to the House of Commons. There are 338 FEDs in Canada according to the 2013 Representation Order. The Representation Order is prepared by the Chief Electoral Officer describing, naming and specifying the population of each electoral district established by the Electoral Boundaries Commission and sent to the Governor in Council.

The 2021 data tables contain 338 areas coded as level of geography 31.

Level of Geography (L.O.G.): 21

Area: Census Division

Description:

A census division (CD) is a group of neighbouring municipalities joined together for the purposes of regional planning and managing common services (such as police or ambulance services). A CD might correspond to a county, a regional municipality or a regional district.

CDs are established under laws in effect in certain provinces and territories of Canada. In other provinces and territories where laws do not provide for such areas (Newfoundland and Labrador, Manitoba, Saskatchewan and Alberta), Statistics Canada defines equivalent areas for statistical reporting purposes in cooperation with these provinces and territories.

The 2021 Census contain 293 areas coded as level of geography 21; however, the 2021 data tables contain 295 areas since the CD of Halton (Ont.) straddles 2 Economic Regions.

Starting in 2007, Census divisions are identified in the tables by a six digits code:

- 2 first digits = Province

- 2 next digits = Economic Region

- 2 last digits = Census Division

Changes in Census Geography – 2021 boundaries as compared to 2016 boundaries

When comparing data between the 2020 and 2021 reference years, users should consider that some of the changes in the data can be due to census boundary changes. The data for the 2020 reference year are produced according to the 2016 Census boundaries, while the data for the 2021 reference year are based on the 2021 Census boundaries.

Changes to Census Metropolitan Areas (CMA)

As of the 2021 Census, Canada has 41 CMAs, as opposed to 35 CMAs in the 2016 Census. Fredericton (NB), Drummondville (QC), Red Deer (AB), Chilliwack (BC), Kamloops (BC), and Nanaimo (BC), which were previously census agglomerations (CAs), became census metropolitan areas (CMAs) according to the 2021 Census.

One CMA from the previous census changed its name: Belleville became Belleville-Quinte West.

As of 2021, Arnprior (ON) and Carleton Place (ON) are no longer CAs as they have been merged into the Ottawa-Gatineau CMA. Similarly, the CA of Leamington has been merged into the Windsor CMA. Table B list the census subdivisions (CSDs) which were added to Ottawa-Gatineau and Windsor CMAs according to the above-mentioned mergers.

| 2021 Census Metropolitan Area | Census Subdivisions added from former 2016 Census Agglomerations |

||

|---|---|---|---|

| Code | Name | Code | Name |

| 505 | Ottawa – Gatineau | 3547002 | Arnprior |

| 3547003 | McNab/Braeside | ||

| 3509028 | Carleton Place | ||

| 3509024 | Beckwith | ||

| 3509030 | Mississippi Mills | ||

| 559 | Windsor | 3537003 | Leamington |

| 3537013 | Kingsville | ||

In addition, CSDs previously considered to be outside CMAs were added in twelve CMAs (Table C). Census subdivision is the general term for municipalities (as determined by provincial/territorial legislation) or areas treated as municipal equivalents for statistical purposes (e.g., Indian reserves, Indian settlements and unorganized territories).

| 2021 Census Metropolitan Area | 2021 Census Subdivisions not previously in 2016 Census Metropolitan Areas |

||

|---|---|---|---|

| Code | Name | Code | Name |

| 001 | St. John's | 1001472 | Holyrood |

| 205 | Halifax | 1208008 | East Hants |

| 1208014 | Indian Brook 14 | ||

| 320 | Fredericton | 1310016 | Prince William |

| 408 | Saguenay | 2494220 | Ferland-et-Boilleau |

| 421 | Québec | 2433090 | Saint-Apollinaire |

| 447 | Drummondville | 2449125 | Saint-Bonaventure |

| 462 | Montréal | 2463035 | Saint-Roch-de-l'Achigan |

| 505 | Ottawa - Gatineau | 2480085 | Mulgrave-et-Derry |

| 559 | Windsor | 3537016 | Essex |

| 580 | Greater Sudbury | 3552004 | St.-Charles |

| 602 | Winnipeg | 4602046 | Niverville |

| 705 | Regina | 4706078 | Craven |

Many CSDs within CMAs have experienced minor boundary changes which may also alter the area they cover within the 2021 Census CMAs.

Changes to Census Agglomerations (CA)

As of the 2021 Census, Canada has 111 CAs, as opposed to 117 CAs in the 2016 Census.

As previously mentioned, six CAs were promoted to CMAs and three were merged with existing CMAs. In addition, five new CAs (Table D) have been added according to the 2021 Census: Amos (QC), Sainte-Agathe-des-Monts (QC), Essa (ON), Ladysmith (BC), and Trail (BC). Amos (QC) regained its CA status in 2021 which it last had in the 2011 Census. The names of all these new CAs were based on the largest municipality (census subdivisions) within the CA.

As of 2021, the CAs of Bay Roberts (NL) and Cold Lake (AB) were retired because the population of their cores dropped below 10,000.

| 2021 Census Agglomeration | 2021 Census Subdivisions not previously in 2016 Census Agglomerations |

||

|---|---|---|---|

| Code | Name | Code | Name |

| 481 | Amos | 2488040 | Saint-Marc-de-Figuery |

| 2488050 | Saint-Mathieu-d'Harricana | ||

| 2488055 | Amos | ||

| 2488060 | Saint-Félix-de-Dalquier | ||

| 2488065 | Saint-Dominique-du-Rosaire | ||

| 2488070 | Berry | ||

| 2488075 | Trécesson | ||

| 2488085 | Sainte-Gertrude-Manneville | ||

| 2488802 | Pikogan | ||

| 467 | Sainte-Agathe-des-Monts | 2478005 | Val-Morin |

| 2478010 | Val-David | ||

| 2478032 | Sainte-Agathe-des-Monts | ||

| 563 | Essa | 3543021 | Essa |

| 936 | Ladysmith | 5919015 | Cowichan Valley G |

| 5919017 | Cowichan Valley H | ||

| 5919021 | Ladysmith | ||

| 5919804 | Chemainus 13 | ||

| 5919809 | Penelakut Island 7 | ||

| 5919811 | Shingle Point 4 | ||

| 5919813 | Lyacksun 3 | ||

| 5919816 | Oyster Bay 12 | ||

| 5919817 | Portier Pass 5 | ||

| 910 | Trail | 5905005 | Fruitvale |

| 5905009 | Montrose | ||

| 5905014 | Trail | ||

| 5905018 | Warfield | ||

| 5905026 | Kootenay Boundary A | ||

Although all CMAs are subdivided into census tracts, based on the 2021 Census only nine CAs currently meet the census tract creation threshold of having a core population above 50,000: Granby (QC), Saint-Hyacinthe (QC), North Bay (ON), Sarnia (ON), Sault Ste. Marie (ON), Grande Prairie (AB), Medicine Hat (AB), Wood Buffalo (AB), and Prince George (BC). As compared previous years, Saint-Hyacinthe (QC) is the only CA which previously was not subdivided into census tracts.

In addition, there are twenty eight census agglomerations (Table E) which exist in both the 2016 Census and 2021 Census where additions and deletions of CSDs, or boundary changes of CSDs which have altered the area covered within a CA. In some cases, these types of changes had no significant impact on the population covered within the CA. The list in Table E only includes the CAs for which changes in CSDs had an impact on the population included in the CA.

| Census Agglomeration | |||

|---|---|---|---|

| Code | Name | Code | Name |

| 015 | Corner Brook | 512 | Brockville |

| 105 | Charlottetown | 571 | Midland |

| 110 | Summerside | 610 | Brandon |

| 330 | Campbellton | 710 | Yorkton |

| 335 | Edmundston | 735 | North Battleford |

| 403 | Matane | 755 | Weyburn |

| 404 | Rimouski | 806 | Brooks |

| 410 | Alma | 840 | Lloydminster |

| 411 | Dolbeau-Mistassini | 940 | Port Alberni |

| 428 | Saint-Georges | 943 | Courtenay |

| 430 | Thetford Mines | 950 | Williams Lake |

| 440 | Victoriaville | 955 | Prince Rupert |

| 444 | Shawinigan | 965 | Terrace |

| 452 | Saint-Hyacinthe | 975 | Dawson Creek |

Problematic Census Tracts

Caution should be used when using T1FF data at the census tract level (neighbourhoods in large urban areas) for the areas listed in Table F. In these CTs, there appears to be a significant quantity of tax filers who supplied an address which is a P.O. Box, an address of a business that offers personal income tax services (addresses of accountants, lawyers, financial advisors or labour related groups), or a provincial government office responsible for providing public guardian and trustee services. For these areas the counts of individuals according to the T1FF 2021 are significantly higher than what can be observed in the 2021 Census.

| CMA/CA code | CMA/CA Name | Census Tract |

|---|---|---|

| 001 | St. John's | 0400.00 |

| 462 | Montréal | 0062.00 |

| 529 | Peterborough | 0102.01 |

| 535 | Toronto | 0035.00 |

| 535 | Toronto | 0299.01 |

| 539 | St. Catharines - Niagara | 0111.00 |

| 543 | Brantford | 0002.05 |

| 559 | Windsor | 0130.01 |

| 559 | Windsor | 1002.00 |

| 559 | Windsor | 1002.00 |

| 602 | Winnipeg | 0013.00 |

| 602 | Winnipeg | 0590.02 |

| 602 | Winnipeg | 0590.02 |

| 705 | Regina | 0013.00 |

| 725 | Saskatoon | 0021.01 |

| 805 | Medicine Hat | 0009.00 |

| 810 | Lethbridge | 0007.00 |

| 810 | Lethbridge | 0102.00 |

| 825 | Calgary | 0043.00 |

| 825 | Calgary | 0044.00 |

| 835 | Edmonton | 0045.00 |

| 850 | Grande Prairie | 0011.00 |

| 915 | Kelowna | 0008.00 |

| 925 | Kamloops | 0200.00 |

| 932 | Abbotsford - Mission | 0102.00 |

| 933 | Vancouver | 0049.03 |

| 933 | Vancouver | 0059.11 |

| 935 | Victoria | 0010.03 |

| 970 | Prince George | 0012.00 |

Changes to Census Divisions (CD)

According to the 2021 Census, three CDs (Table G) have had a name change.

| Code | 2021 CD Name and Type | 2016 CD Name and Type |

|---|---|---|

| 2401 | Communauté maritime des Îles-de-la-Madeleine, TÉ | Îles-de-la-Madeleine, TÉ |

| 6204 | Qikiqtaaluk, REG | Baffin, REG |

| 6205 | Kivalliq, REG | Keewatin, REG |

In Prince Edward Island, boundary changes occurred in two adjacent CDs: CD 1101 Kings and CD 1102 Queens. A series of CSDs found in the 2016 versions of these CDs were amalgamated to create a new 2021 CSD, and that CSD (CSD 1101045 Three Rivers, C) is as of 2021 only located within CD 1101 Kings. The following list of 2016 CSD were amalgamated to form CSD 1101045 Three Rivers, C in 2021.

- CSD 1101023 Georgetown, FD

- CSD 1102007 Valleyfield, Part 2, RM

- CSD 1101010 Valleyfield, Part 1, RM

- CSD 1101013 Montague, Part 1, FD

- CSD 1101018 Montague, C

- CSD 1101007 Lower Montague, RM

- CSD 1101017 Brudenell, RM

- CSD 1101024 Georgetown, C

- CSD 1101021 Cardigan, RM

- CSD 1101015 Lorne Valley, RM

- CSD 1101020 part of Cardigan, FD

Changes to Census Subdivisions (CSD)

Between the 2016 Census and 2021 Census, some CSDs have had a name change or a CSD type change, without having had a reference code change or a land area change. Creation of new CSDs and deletions of others have also occurred. For a complete list of CSD changes, users can consult Table 1 of “Interim List of Changes to Municipal Boundaries, Status, and Names” for the Standard Geographical Classification (SGC) 2021.

Additional Information for Census Subdivisions

Census Subdivision Type

CSDs are classified into 57 types according to official designations adopted by provincial/territorial or federal authorities. Two exceptions are 'subdivision of unorganized' (SNO) in Newfoundland and Labrador, and 'subdivision of county municipality' (SC) in Nova Scotia, which are geographic areas created as equivalents for municipalities by Statistics Canada, in cooperation with those provinces, for the purpose of disseminating statistical data. The full list of CSD types is available in Table H.

The CSD type accompanies the census subdivision name to distinguish CSDs from each other—for example, Balmoral, VL (for the village of Balmoral) and Balmoral, P (for the parish / paroisse (municipalité de) of Balmoral).

| CSD Type | CSD Type |

|---|---|

| C – City / Cité | RDA – Regional district electoral area |

| CC – Chartered community | RGM – Regional municipality |

| CG – Community government | RM – Rural municipality |

| CN – Crown colony / Colonie de la couronne | RV – Resort village |

| CT – Canton (municipalité de) | RMU – Resort Municipality |

| CU – Cantons unis (municipalité de) | S-É – Indian settlement / Établissement indien |

| CV – City / Ville | SA – Special area |

| CY – City | SC – Subdivision of county municipality / Subdivision municipalité de comté |

| DM – District municipality | SÉ – Settlement / Établissement |

| FD – Fire District | SET – Settlement |

| GR – Gouvernement régional | SG – Self-government / Autonomie gouvernementale |

| HAM – Hamlet | SM – Specialized municipality |

| ID – Improvement district | SNO – Subdivision of unorganized / Subdivision non organisée |

| IGD – Indian government district | SV – Summer village |

| IM – Island municipality | T – Town |

| IRI – Indian reserve / Réserve indienne | TAL – Tla'amin Lands |

| LGD – Local government district | TC – Terres réservées aux Cris |

| M – Municipality / Municipalité | TI – Terre inuite |

| MD – Municipal district | TK – Terres réservées aux Naskapis |

| MRM – Regional Municipality / Municipalité Régional | TL – Teslin land |

| MÉ – Municipalité | TP – Township |

| MU – Municipality | TV – Town / Ville |

| NH – Northern hamlet | TWL – Tsawwassen Lands |

| NL – Nisga'a land | V – Ville |

| NO – Unorganized / Non organisé | VC – Village cri |

| NV – Northern village | VK – Village Naskapi |

| P – Parish / Paroisse (municipalité de) | VL – Village |

| PE – Paroisse (municipalité de) | VN – Village nordique |

| RCR – Rural community / Communauté rurale |

Precision of Census Subdivision:

Since Postal Codes are used to derive the CSDs, and since Postal Codes do not respect census boundaries, the precision of the geographic coverage in T1FF data tables for CSDs varies across the country. This is most problematic in areas where Postal Codes cover vast rural areas. For example, if a Postal Code crosses two or more CSD boundaries (this is common in rural areas), all the population associated with that Postal Code will be assigned to the CSD which contains the most addresses associated to the Postal Code.

It is also important to note that although most tax filers provide their residential address on their tax forms, some use an address different than their true residential address on their T1 form. Non-residential addresses are sometime used by tax filers if it is more convenient for them to receive mail regarding their tax returns elsewhere than their home. For example, some tax filers use a P. O. Box address when filing their taxes instead of their true residential address. The reliance on mailing addresses can have an impact on the geographic precision of the T1FF data in some areas.

Geographic Levels – Postal Geography

The various data compiled from the tax file are available for different levels of the postal geography. Coded geographic indicators appearing on the data tables are shown below with a brief description.

Level of Geography (L.O.G.): 12

Postal Area: Canada

Description:

This level of data is an aggregation of the provincial/territorial totals (code 11). The national total is identified by the region code Z99099.

Level of Geography (L.O.G.): 11

Postal Area: Province or Territory Total

Description:

This level of data is an aggregation of the following geographies within a province:

- City Totals = Code 08

- Rural Communities = Code 09

- Other Provincial Totals = Code 10

These totals are identified by a provincial/territorial postal letter, then a "990" followed by the province/territory code, as follows:

- Newfoundland and Labrador = A99010

- Nova Scotia = B99012

- Prince Edward Island = C99011

- New Brunswick = E99013

- Quebec = J99024

- Ontario = P99035

- Manitoba = R99046

- Saskatchewan = S99047

- Alberta = T99048

- British Columbia = V99059

- Northwest Territories = X99061

- Nunavut = X99062

- Yukon Territory = Y99060

Level of Geography (L.O.G.): 10

Postal Area: Other Provincial Total ("P" Pot)

Description:

This level of data is an aggregation of small communities in the province that had less than 100 tax filers, where these communities are combined into a "pot". Before 1992, it was identified by the same codes as the provincial/territorial totals, and only the "Delivery Mode" codes 2 and 3 distinguished between the two. To avoid this problem, starting with the 1992 data, an "8" appears after the provincial/territorial letter instead of a "9". The "9" will be reserved for the provincial/territorial total, as explained in 11 above. These "pot" codes are as follows:

- Newfoundland and Labrador = A89010

- Nova Scotia = B89012

- Prince Edward Island = C89011

- New Brunswick = E89013

- Quebec = J89024

- Ontario = P89035

- Manitoba = R89046

- Saskatchewan = S89047

- Alberta = T89048

- British Columbia = V89059

- Northwest Territories = X89061

- Nunavut = X89062

- Yukon Territory = Y89060

Level of Geography (L.O.G.): 09

Postal Area: Rural Communities (Not in City)

Description:

For data obtained prior to reference year 2011, this level of geography was called “Rural Postal Codes (Not in a City)”.

This level of geography pertains to rural communities that have one and only one rural Postal Code. These rural communities are based on areas serviced by Canada Post. These areas are often similar to the official boundaries of rural communities. Rural Postal Codes can be identified by a "zero" in the second position of the Postal Code.

The 2021 data tables contain 3,834 areas coded as level of geography 09.

Level of Geography (L.O.G.): 08

Postal Area: City Total (Postal city)

Description:

In postal geography, this city concept is often linked to older city boundaries or to neighbourhoods. Most often, this geography does not correspond to official municipal limits.

This level of data is an aggregation of the following geographies for unique place names within a province/territory:

- Urban FSA (Residential) = Code 03

- Rural Route= Code 04

- Suburban Services = Code 05

- Rural Postal Code Areas (within city) = Code 06

- Other Urban Area = Code 07

As of 2011, data for L.O.G. 04 and 05 are suppressed but included in the city totals.

They have the following format: e.g., Edmonton = T95479; Regina = S94876. The pattern is the postal letter of the city plus "9" in the second position (indicating a total), followed by a 4 digit numeric code for the community (often called "CityID").

Data based on the true municipal limits (census subdivisions) is only available through cost recovery data tabulations.

The 2021 data tables contain 1,791 areas coded as level of geography 08.

Level of Geography (L.O.G.): 07

Postal Area: Other Urban Area (Non-residential within city - "E" Pot)

Description:

This aggregation of data (or "pot") covers non-residential addresses within an urban centre and all other data not otherwise displayed. Commercial addresses, post office boxes and general delivery are included, as are residential addresses with too few tax filers to report separately. They can be recognized by codes that are similar to the city totals, with a distinguishing difference: an "8" will follow the city postal letter rather than the "9" of the city total (e.g., Edmonton = T85479; Regina = S84876).

The 2021 data tables contain 430 areas coded as level of geography 07.

Level of Geography (L.O.G.): 06

Postal Area: Rural Postal Code Areas (Within City)

Description:

For data obtained prior to reference year 2011, this level of geography was called “Rural Postal Codes (Within a City)”.

These data pertain to rural Postal Codes that belong to communities with more than one rural Postal Code. These occur in areas that were formerly serviced by rural delivery service and changed by Canada Post to urban delivery service or in communities served by more than one rural Postal Code. Rural Postal Codes can be identified by a "zero" in the second position of the Postal Code.

The 2021 data tables contain 619 areas coded as level of geography 06.

Level of Geography (L.O.G.): 05

Postal Area: Suburban Service

Description:

No longer available.

Sparsely populated fringe areas of urban centres may receive their postal service from an urban post office by delivery designated as "suburban service". Their region code retains all six characters of the Postal Code. Suburban Services are usually near or on the perimeters of urban areas, and mail is delivered by a contractor to group mail boxes, community mail boxes and/or external delivery sites (e.g., kiosks, miniparks).

Level of Geography (L.O.G.): 04

Postal Area: Rural Route

Description:

No longer available.

Reasonably well-settled rural areas may receive their postal service from an urban post office by delivery designated as "rural route". Mail is delivered by a contractor to customers living along or near well-defined roads. Their region code retains all six characters of the Postal Code.

Level of Geography (L.O.G.): 03

Postal Area: Urban FSA (Partial FSA in Residential Area)

Description:

Forward Sortation Areas (FSA) are identified by the first three characters of the Postal Code. This version of urban FSA only includes Postal Codes associated with regular residential mail delivery in an urban areas. They exclude the geography levels 04, 05 and 07) and therefore are often just a subset of the true complete urban FSA.

An Urban FSA of this type can be identified by the FSA followed by three blanks. One FSA can be split in different parts if it is associated with more than one city.

Data based on the true FSA delivery limits (without any FSA splits) according to the complete list of postal codes associated with the FSA, can only be produced through cost recovery data tabulations for both urban and rural areas.

The 2021 data tables contain 2,583 areas coded as level of geography 03.

Adding postal areas without duplication

Data files according to the postal geography will often contain subtotals and totals. Many data users need to add certain geographies in order to come up with a total for their particular area of interest. However, including subtotals during this process results in double-counting some populations, and this leads to an erroneous total. The following is a summary of which postal areas are aggregations in the standard postal geography.

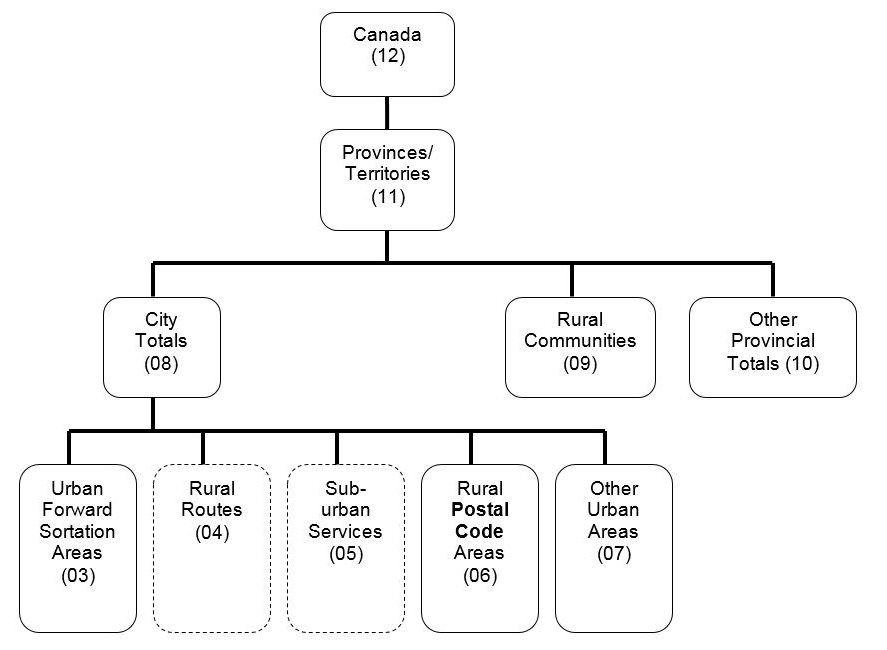

Urban FSAs (LOG 3), Rural Routes (LOG 4), suburban services (LOG 5), Rural Postal Code Areas within a city (LOG 6) and Other Urban Areas (LOG 7) add up to City Totals (LOG 8).

City Totals (LOG 8), Rural Communities not in a city (LOG 9) and Other Provincial Totals (LOG 10) add up to provincial/territorial totals (LOG 11).

Provincial/territorial totals (LOG 11) add up to the Canada total (LOG 12).

Thus, using the Level of geography codes:

3 + 4 + 5 + 6 + 7 = 8

8 + 9 + 10 = 11

City identification number (CityID)

The CityID is created for postal cities. This concept of cities does not correspond to the official boundaries of municipalities.

As of 2007, CityID has been modified.

Previous to 2007:

- CityID was a 4 digits number

- Each postal city had a unique number between 1 and 9999

- Almost every number was allocated to a postal city. Few numbers remained available for future new postal cities.

Starting with 2007 data:

To create more possibilities without changing the CityID length in our systems:

- CityID number is now combined with 1st letter of Postal Code

- Each 1st letter of Postal Code has a possibility of numbers, ranged from 1 to 9999 (Table J)

- Old numbers have been kept for existing postal cities and 1st letters of Postal Code have been added to them (Table I)

- New postal cities have been assigned a new CityID number in new format (Table I)

| Postal Code | Postal City name | 2006 and Prior | 2007 and Follow |

|---|---|---|---|

| K1A xxx | Ottawa | 2434 | K2434 |

| G3C xxx | Stoneham-et-Tewkesbury | n/a | G2 |

| Province | Letter file | Range of number |

|---|---|---|

| Newfoundland & Labrador | A | 1 – 9999 |

| Prince Edward Island | C | 1 – 9999 |

| Nova Scotia | B | 1 – 9999 |

| New Brunswick | E | 1 – 9999 |

| Quebec | G | 1 – 9999 |

| Quebec | H | 1 – 9999 |

| Quebec | J | 1 – 9999 |

| Ontario | K | 1 – 9999 |

| Ontario | L | 1 – 9999 |

| Ontario | M | 1 – 9999 |

| Ontario | N | 1 – 9999 |

| Ontario | P | 1 – 9999 |

| Manitoba | R | 1 – 9999 |

| Saskatchewan | S | 1 – 9999 |

| Alberta | T | 1 – 9999 |

| British Columbia | V | 1 – 9999 |

| Yukon | Y | 1 – 9999 |

| Northwest Territories | X | 1 – 9999 |

| Nunavut | X | 1 – 9999 |

Therefore, it is now essential to identify a postal city by adding the Postal Code 1st letter to the number in order to get the proper postal city in the proper province (Table K):

| Letter | Number | Postal City name | Province |

|---|---|---|---|

| A | 2 | Avondale | NL |

| B | 2 | Bible Hill | NS |

| T | 2 | Rocky View | AB |

| G | 2 | Stoneham-et-Tewkesbury | QC |

Hierarchy of postal geography

Figure 1: Hierarchy of postal geography

Hierarchy of postal geography. The various data compiled from the taxfile are available for different levels of the postal geography. Canada (12) is divided into Provinces and Territories (11), which are subsequently divided into City Totals (08), Rural Communities (09) and Other Provincial Totals (10). City Totals (08) is then broken down into Urban Forward Sortation Areas (03), Rural Routes (04), Sub-urban Services (05), Rural Postal Code Areas (06) and Other Urban Areas (07).

Geographic Levels – Special Geography

Clients may select geographical areas of their own definition; areas that are not part of the standard areas listed here (for example, bank service areas, retail store catchment areas). For this, clients must submit a list of lower level geographies such as Postal Codes or census tracts that make up their user defined areas. We will then aggregate the micro data to correspond to that area of interest. If there is more than one level of geography within the areas submitted by the client, this must be clearly indicated. A list of low level geographies which rollup into user defined areas is commonly referred to as a conversion file and is usually supplied to us in an Excel format.

We invite your comments

We are always working on ways to improve our products. The comments we receive concerning quality and presentation are essential to meet this objective. If you have any suggestions in this regard, we encourage you, the user, to provide us with your comments.

How to obtain more detailed information

Inquiries about these data and related statistics or services should be directed to:

Statistics Canada

150 Tunney's Pasture Driveway

Ottawa, Ontario K1A 0T6

Telephone:

(toll free) 1-800-263-1136

(international) 1-514-283-8300

E-mail: STATCAN.infostats-infostats.STATCAN@canada.ca

List of available data products

The Centre for Income and Socioeconomic Well-being Statistics of Statistics Canada tabulates statistical data derived from administrative records - most notably, the tax files. The resulting demographic and socio-economic data sets available are listed in the table below, along with their identifying product number and the usual release dates.

| Product name | Product number | Release date | T1FF file version |

|---|---|---|---|

| Canadian Tax Filers | 17C0010 | Winter | Preliminary |

| Charitable Donors | 13C0014 | Winter | Preliminary |

| RRSP Contributors | 17C0006 | Winter | Preliminary |

| Wages, Salaries and Commissions | 11230001 | Winter | Preliminary |

| Income of Individuals | 13C0015 | Spring - Summer | Final |

| Income of Families | 13C0016 | Spring - Summer | Final |

| Income of Seniors | 89C0022 | Spring - Summer | Final |

- Date modified: