Infographic 1

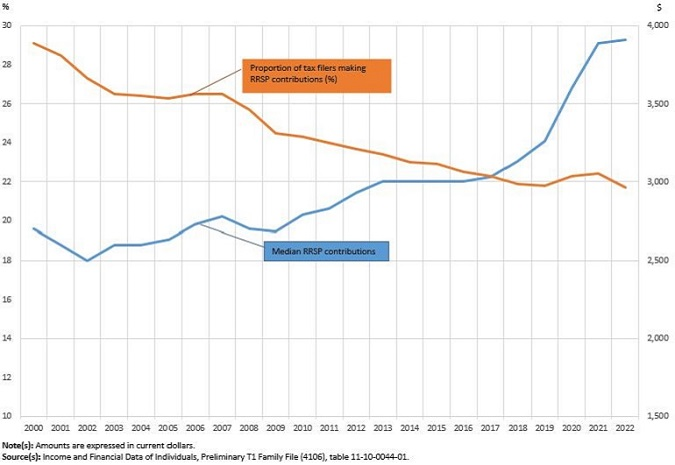

Proportion of contributors among tax filers and median registered retirement savings plan (RRSP) contributions, 2000 to 2022

RRSP) contributions, 2000 to 2022" alt="001&8211;Infographic1, 001" aria-describedby="adb-g001" />

RRSP) contributions, 2000 to 2022" alt="001&8211;Infographic1, 001" aria-describedby="adb-g001" />

Infographic description

The title of the infographic is "Proportion of contributors among tax filers and median registered retirement savings plan (RRSP) contributions, 2000 to 2022"

This is a line chart with one horizontal axis and two vertical axes.

The horizontal axis represents the timeline and goes from 2000 to 2022.

The first line represents the increase or decrease in the percentage of RRSP contributors among tax filers.

The second line represents the increase or decrease in the median RRSP contribution among contributors.

The left vertical axis goes from 10% to 30%, by increments of 2%.

The right vertical axis goes from $1,500 to $4,000, by increments of $500.

In 2000, the proportion of RRSP contributors among tax filers was 29.1%, and the median RRSP contribution was $2,700.

In 2001, the proportion of RRSP contributors among tax filers was 28.5%, and the median RRSP contribution was $2,600.

In 2002, the proportion of RRSP contributors among tax filers was 27.3%, and the median RRSP contribution was $2,500.

In 2003, the proportion of RRSP contributors among tax filers was 26.5%, and the median RRSP contribution was $2,600.

In 2004, the proportion of RRSP contributors among tax filers was 26.4%, and the median RRSP contribution was $2,600.

In 2005, the proportion of RRSP contributors among tax filers was 26.3%, and the median RRSP contribution was $2,630.

In 2006, the proportion of RRSP contributors among tax filers was 26.5%, and the median RRSP contribution was $2,730.

In 2007, the proportion of RRSP contributors among tax filers was 26.5%, and the median RRSP contribution was $2,780.

In 2008, the proportion of RRSP contributors among tax filers was 25.7%, and the median RRSP contribution was $2,700.

In 2009, the proportion of RRSP contributors among tax filers was 24.5%, and the median RRSP contribution was $2,680.

In 2010, the proportion of RRSP contributors among tax filers was 24.3%, and the median RRSP contribution was $2,790.

In 2011, the proportion of RRSP contributors among tax filers was 24.0%, and the median RRSP contribution was $2,830.

In 2012, the proportion of RRSP contributors among tax filers was 23.7%, and the median RRSP contribution was $2,930.

In 2013, the proportion of RRSP contributors among tax filers was 23.4%, and the median RRSP contribution was $3,000.

In 2014, the proportion of RRSP contributors among tax filers was 23.0%, and the median RRSP contribution was $3,000.

In 2015, the proportion of RRSP contributors among tax filers was 22.9%, and the median RRSP contribution was $3,000.

In 2016, the proportion of RRSP contributors among tax filers was 22.5%, and the median RRSP contribution was $3,000.

In 2017, the proportion of RRSP contributors among tax filers was 22.3%, and the median RRSP contribution was $3,030.

In 2018, the proportion of RRSP contributors among tax filers was 21.9%, and the median RRSP contribution was $3,130.

In 2019, the proportion of RRSP contributors among tax filers was 21.8%, and the median RRSP contribution was $3,260.

In 2020, the proportion of RRSP contributors among tax filers was 22.3%, and the median RRSP contribution was $3,600.

In 2021, the proportion of RRSP contributors among tax filers was 22.4%, and the median RRSP contribution was $3,890.

In 2022, the proportion of RRSP contributors among tax filers was 21.7%, and the median RRSP contribution was $3,910.

Note(s): Amounts are expressed in current dollars.

Source(s): Income and Financial Data of Individuals, Preliminary T1 Family File (4106), table 11-10-0044-01.

- Date modified: