Infographic 1

Residential construction investment, May 2020

Infographic description

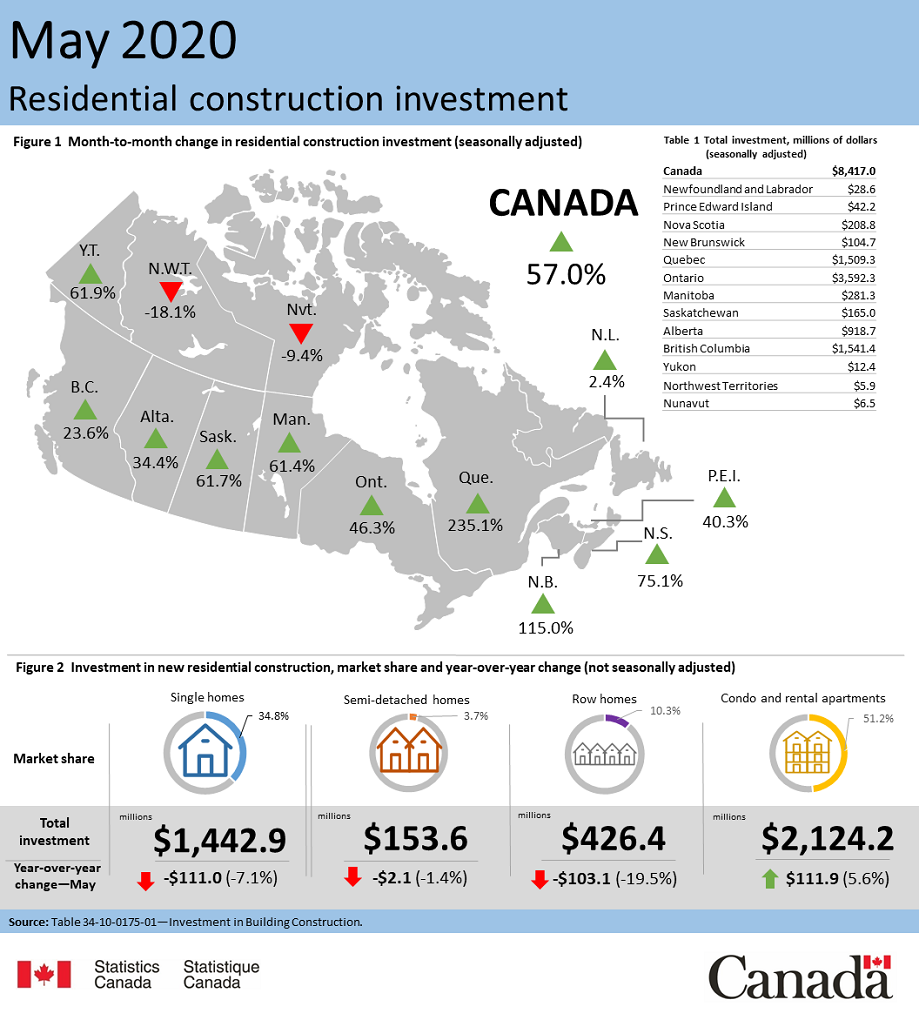

The title of the infographic is "Residential construction investment, May 2020"

The infographic includes multiple components such as a map, tables, pictographs and images.

Text on the infographic, as well as pie and bar chart and map data, are as follows:

Figure 1: Month-to-month change in residential construction investment (seasonally adjusted).

This is a map of Canada by province and territory showing the month-to-month percentage changes for investment in new housing construction. Green arrows represent an increase, while red arrows represent a decrease.

Investment in residential construction for Canada increased 57.0% compared to April 2020. Newfoundland and Labrador was up 2.4%, Prince Edward Island was up 40.3%, Nova Scotia was up 75.1%, New Brunswick was up 115.0%, Quebec was up 235.1%, Ontario was up 46.3%, Manitoba was up 61.4%, Saskatchewan was up 61.7%, Alberta was up 34.4%, British Columbia was up 23.6%, Yukon was up 61.9%, Northwest Territories was down 18.1%, Nunavut was down 9.4%.

Table 1: Total investment in millions of dollars (seasonally adjusted).

Total investment for Canada was $8,417.0 million, total investment for Newfoundland and Labrador was $28.6 million, total investment for Prince Edward Island was $42.2 million, total investment for Nova Scotia was $208.8 million, total investment for New Brunswick was $104.7 million, total investment for Quebec was $1,509.3 million, total investment for Ontario was $3,592.3 million, total investment for Manitoba was $281.3 million, total investment for Saskatchewan was $165.0 million, total investment for Alberta was $918.7 million, total investment for British Columbia was $1,541.4 million, total investment for Yukon was $12.4 million, total investment for Northwest Territories was $5.9 million, total investment for Nunavut was $6.5 million.

Figure 2: Investment in new residential construction, market share and year-over-year change (not seasonally adjusted).

Single homes: Market share was 34.8%, total investment totalled $1,442.9 million, representing a year-over-year decrease of 7.1% or $111.0 million.

Semi-detached homes: Market share was 3.7%, total investment totalled $153.6 million, representing a year-over-year decrease of 1.4% or $2.1 million.

Row homes: Market share was 10.3%, total investment totalled $426.4 million, representing a year-over-year decrease of 19.5% or $103.1 million.

Condo and rental apartments: Market share was 51.2%, total investment totalled $2,124.2 million, representing a year-over-year increase of 5.6% or $111.9 million.

Source: Table 34-10-0175-01.

- Date modified: