Infographic 1

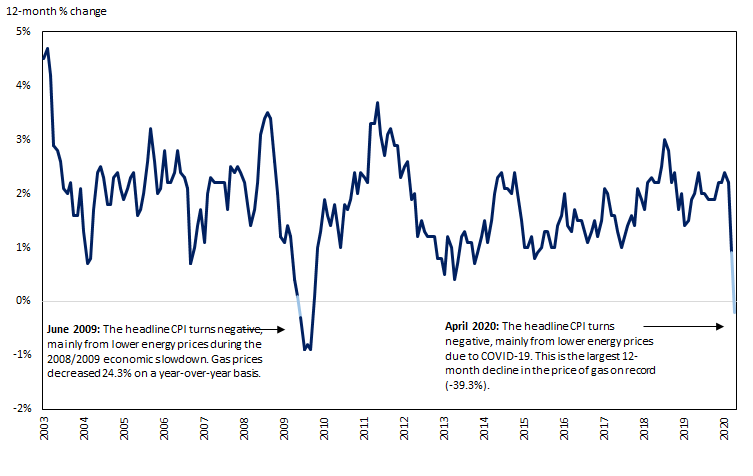

The 12-month change in the Consumer Price Index, January 2003 to April 2020

Infographic description

The title of the infographic is "The 12-month change in the Consumer Price Index, January 2003 to April 2020"

This is a line chart.

The y axis represents the 12-month percentage change in the Consumer Price Index in Canada. The y axis starts at -2% and goes to 5%, with increments of 1%.

The x axis represents monthly periods, and goes from January 2003 to April 2020, with increments of 1. However, the x axis is labelled only at the annual level.

There is one series. This series represents the 12-month percentage change in the Consumer Price Index in Canada and spans the period from January 2003 to April 2020.

At period January 2003, the series is at 4.5%.

At period February 2003, the series is at 4.7%.

At period March 2003, the series is at 4.2%.

At period April 2003, the series is at 2.9%.

At period May 2003, the series is at 2.8%.

At period June 2003, the series is at 2.6%.

At period July 2003, the series is at 2.1%.

At period August 2003, the series is at 2.0%.

At period September 2003, the series is at 2.2%.

At period October 2003, the series is at 1.6%.

At period November 2003, the series is at 1.6%.

At period December 2003, the series is at 2.1%.

At period January 2004, the series is at 1.3%.

At period February 2004, the series is at 0.7%.

At period March 2004, the series is at 0.8%.

At period April 2004, the series is at 1.7%.

At period May 2004, the series is at 2.4%.

At period June 2004, the series is at 2.5%.

At period July 2004, the series is at 2.3%.

At period August 2004, the series is at 1.8%.

At period September 2004, the series is at 1.8%.

At period October 2004, the series is at 2.3%.

At period November 2004, the series is at 2.4%.

At period December 2004, the series is at 2.1%.

At period January 2005, the series is at 1.9%.

At period February 2005, the series is at 2.1%.

At period March 2005, the series is at 2.3%.

At period April 2005, the series is at 2.4%.

At period May 2005, the series is at 1.6%.

At period June 2005, the series is at 1.7%.

At period July 2005, the series is at 2.0%.

At period August 2005, the series is at 2.6%.

At period September 2005, the series is at 3.2%.

At period October 2005, the series is at 2.6%.

At period November 2005, the series is at 2.0%.

At period December 2005, the series is at 2.1%.

At period January 2006, the series is at 2.8%.

At period February 2006, the series is at 2.2%.

At period March 2006, the series is at 2.2%.

At period April 2006, the series is at 2.4%.

At period May 2006, the series is at 2.8%.

At period June 2006, the series is at 2.4%.

At period July 2006, the series is at 2.3%.

At period August 2006, the series is at 2.1%.

At period September 2006, the series is at 0.7%.

At period October 2006, the series is at 1.0%.

At period November 2006, the series is at 1.4%.

At period December 2006, the series is at 1.7%.

At period January 2007, the series is at 1.1%.

At period February 2007, the series is at 2.0%.

At period March 2007, the series is at 2.3%.

At period April 2007, the series is at 2.2%.

At period May 2007, the series is at 2.2%.

At period June 2007, the series is at 2.2%.

At period July 2007, the series is at 2.2%.

At period August 2007, the series is at 1.7%.

At period September 2007, the series is at 2.5%.

At period October 2007, the series is at 2.4%.

At period November 2007, the series is at 2.5%.

At period December 2007, the series is at 2.4%.

At period January 2008, the series is at 2.2%.

At period February 2008, the series is at 1.8%.

At period March 2008, the series is at 1.4%.

At period April 2008, the series is at 1.7%.

At period May 2008, the series is at 2.2%.

At period June 2008, the series is at 3.1%.

At period July 2008, the series is at 3.4%.

At period August 2008, the series is at 3.5%.

At period September 2008, the series is at 3.4%.

At period October 2008, the series is at 2.6%.

At period November 2008, the series is at 2.0%.

At period December 2008, the series is at 1.2%.

At period January 2009, the series is at 1.1%.

At period February 2009, the series is at 1.4%.

At period March 2009, the series is at 1.2%.

At period April 2009, the series is at 0.4%.

At period May 2009, the series is at 0.1%.

At period June 2009, the series is at -0.3%.

At period July 2009, the series is at -0.9%.

At period August 2009, the series is at -0.8%.

At period September 2009, the series is at -0.9%.

At period October 2009, the series is at 0.1%.

At period November 2009, the series is at 1.0%.

At period December 2009, the series is at 1.3%.

At period January 2010, the series is at 1.9%.

At period February 2010, the series is at 1.6%.

At period March 2010, the series is at 1.4%.

At period April 2010, the series is at 1.8%.

At period May 2010, the series is at 1.4%.

At period June 2010, the series is at 1.0%.

At period July 2010, the series is at 1.8%.

At period August 2010, the series is at 1.7%.

At period September 2010, the series is at 1.9%.

At period October 2010, the series is at 2.4%.

At period November 2010, the series is at 2.0%.

At period December 2010, the series is at 2.4%.

At period January 2011, the series is at 2.3%.

At period February 2011, the series is at 2.2%.

At period March 2011, the series is at 3.3%.

At period April 2011, the series is at 3.3%.

At period May 2011, the series is at 3.7%.

At period June 2011, the series is at 3.1%.

At period July 2011, the series is at 2.7%.

At period August 2011, the series is at 3.1%.

At period September 2011, the series is at 3.2%.

At period October 2011, the series is at 2.9%.

At period November 2011, the series is at 2.9%.

At period December 2011, the series is at 2.3%.

At period January 2012, the series is at 2.5%.

At period February 2012, the series is at 2.6%.

At period March 2012, the series is at 1.9%.

At period April 2012, the series is at 2.0%.

At period May 2012, the series is at 1.2%.

At period June 2012, the series is at 1.5%.

At period July 2012, the series is at 1.3%.

At period August 2012, the series is at 1.2%.

At period September 2012, the series is at 1.2%.

At period October 2012, the series is at 1.2%.

At period November 2012, the series is at 0.8%.

At period December 2012, the series is at 0.8%.

At period January 2013, the series is at 0.5%.

At period February 2013, the series is at 1.2%.

At period March 2013, the series is at 1.0%.

At period April 2013, the series is at 0.4%.

At period May 2013, the series is at 0.7%.

At period June 2013, the series is at 1.2%.

At period July 2013, the series is at 1.3%.

At period August 2013, the series is at 1.1%.

At period September 2013, the series is at 1.1%.

At period October 2013, the series is at 0.7%.

At period November 2013, the series is at 0.9%.

At period December 2013, the series is at 1.2%.

At period January 2014, the series is at 1.5%.

At period February 2014, the series is at 1.1%.

At period March 2014, the series is at 1.5%.

At period April 2014, the series is at 2.0%.

At period May 2014, the series is at 2.3%.

At period June 2014, the series is at 2.4%.

At period July 2014, the series is at 2.1%.

At period August 2014, the series is at 2.1%.

At period September 2014, the series is at 2.0%.

At period October 2014, the series is at 2.4%.

At period November 2014, the series is at 2.0%.

At period December 2014, the series is at 1.5%.

At period January 2015, the series is at 1.0%.

At period February 2015, the series is at 1.0%.

At period March 2015, the series is at 1.2%.

At period April 2015, the series is at 0.8%.

At period May 2015, the series is at 0.9%.

At period June 2015, the series is at 1.0%.

At period July 2015, the series is at 1.3%.

At period August 2015, the series is at 1.3%.

At period September 2015, the series is at 1.0%.

At period October 2015, the series is at 1.0%.

At period November 2015, the series is at 1.4%.

At period December 2015, the series is at 1.6%.

At period January 2016, the series is at 2.0%.

At period February 2016, the series is at 1.4%.

At period March 2016, the series is at 1.3%.

At period April 2016, the series is at 1.7%.

At period May 2016, the series is at 1.5%.

At period June 2016, the series is at 1.5%.

At period July 2016, the series is at 1.3%.

At period August 2016, the series is at 1.1%.

At period September 2016, the series is at 1.3%.

At period October 2016, the series is at 1.5%.

At period November 2016, the series is at 1.2%.

At period December 2016, the series is at 1.5%.

At period January 2017, the series is at 2.1%.

At period February 2017, the series is at 2.0%.

At period March 2017, the series is at 1.6%.

At period April 2017, the series is at 1.6%.

At period May 2017, the series is at 1.3%.

At period June 2017, the series is at 1.0%.

At period July 2017, the series is at 1.2%.

At period August 2017, the series is at 1.4%.

At period September 2017, the series is at 1.6%.

At period October 2017, the series is at 1.4%.

At period November 2017, the series is at 2.1%.

At period December 2017, the series is at 1.9%.

At period January 2018, the series is at 1.7%.

At period February 2018, the series is at 2.2%.

At period March 2018, the series is at 2.3%.

At period April 2018, the series is at 2.2%.

At period May 2018, the series is at 2.2%.

At period June 2018, the series is at 2.5%.

At period July 2018, the series is at 3.0%.

At period August 2018, the series is at 2.8%.

At period September 2018, the series is at 2.2%.

At period October 2018, the series is at 2.4%.

At period November 2018, the series is at 1.7%.

At period December 2018, the series is at 2.0%.

At period January 2019, the series is at 1.4%.

At period February 2019, the series is at 1.5%.

At period March 2019, the series is at 1.9%.

At period April 2019, the series is at 2.0%.

At period May 2019, the series is at 2.4%.

At period June 2019, the series is at 2.0%.

At period July 2019, the series is at 2.0%.

At period August 2019, the series is at 1.9%.

At period September 2019, the series is at 1.9%.

At period October 2019, the series is at 1.9%.

At period November 2019, the series is at 2.2%.

At period December 2019, the series is at 2.2%.

At period January 2020, the series is at 2.4%.

At period February 2020, the series is at 2.2%.

At period March 2020, the series is at 0.9%.

At period April 2020, the series is at -0.2%.

The series is highlighted and labeled in two sections.

The first highlighted section is for June 2009 with the label "The headline CPI turns negative, mainly from lower energy prices during the 2008/09 economic slowdown. Gas prices decreased 24.3% on a year-over-year basis."

The second highlighted section is for April 2020 with the label "The headline CPI turns negative, mainly from lower energy prices due to COVID-19. Lowest 12-month gas movement on record at -39.3%."

Source: Table 18-10-0004-01.

- Date modified: