Competing Priorities – Education and Retirement Saving Behaviours of Canadian Families

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Sylvie Guilmette

Special Surveys Division

Statistics Canada

A profile of savers for postsecondary education

RESPs as a savings mechanism

Competing saving priorities: retirement versus education

Conclusion

For many Canadian families, the value of education and the benefits of it are numerous. Previous research has found that Canadian parents are strongly committed to their children's postsecondary education.1 Almost all (95%) of the 7 million children covered by the 2002 Survey of Approaches to Educational Planning, for example, had parents who believed that an education after high school was important or very important.

Most parents and their children use a variety of means to pay for the cost of postsecondary education, including personal savings, use of government student loans, loans from banks and family and, for some, income from scholarships. However, parental expectations regarding the financing of their children's postsecondary education do not always match their actual experiences. Shipley (2003) found, for example, that the percentage of children receiving scholarships was far less than the share of parents who expected income from this source. Instead, the percentage of students taking out private loans from financial institutions or from family, friends or a spouse was much higher than parents had expected before their child went on to postsecondary studies.

Similarly, Ouelette (2006)2 found that, generally, no single source of funding was sufficient to cover the basic costs of postsecondary programs for a majority of students. Even personal savings did not cover the tuition fees, books and supplies for a majority of students during the 2001/2002 academic year.

One of the goals of Human Resources and Skills Development Canada (HRSDC) is to facilitate financial access to postsecondary education. This is done through programs such as the Canada Education Savings Program (CESP), Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). These programs are designed to ease and increase savings, thereby alleviating some of the financial burden on students during and after graduation.

Based on data from the 2009 Canadian Financial Capability Survey (CFCS), this article examines who saves for postsecondary education and how they do so. The information from this survey was collected between February and May of 2009 in all 10 provinces; residents of the territories, Indian reserves and institutions were excluded. Respondents to the survey must have been a minimum age of 18.

In 2009, 32% of respondents to the CFCS were financially responsible for children under the age of 18. Throughout this article, they are referred to as parents (see Box 1). Seven out of ten (70%) parents indicated that they were currently saving or had already saved for their children's postsecondary education at the time of the survey.

A profile of savers for postsecondary education

Regional differencesSince education falls under provincial jurisdiction, the costs of postsecondary education and funding programs can vary by province. Therefore, it is useful to first look at provincial variations in saving behaviours. Chart 1 shows the proportion of savers and the average undergraduate tuition fees for Canadian full-time students in each province in 2009/2010. With the exceptions of Newfoundland and Labrador and Quebec, the proportion of savers generally follows the same trend as average tuition fees for Canadian full-time students, suggesting that a strong relationship exists between the cost of postsecondary education and postsecondary education savings patterns across the country.

Box 1:

About the parents in this article

A parent is defined as a person financially responsible for a child under the age of 18. For the most part, this child is the biological child of the respondent, but he or she may also be a step-child, grandchild or another unrelated child for whom the respondent is financially responsible. In most cases, the child lives in the same household as the respondent. However, the child may also live elsewhere as is the case with separated or divorced parents or if the child is away at school. Based on this definition, the data represent approximately 8,342,000 parents across Canada who were financially responsible for a child under the age of 18 in 2009.

End of box

Though the overall spread in tuition cost is greater than the spread in savings behaviours, a relationship between the two is clear. Alberta, Ontario and Nova Scotia had the highest proportions of parent savers (at 78%, 74% and 73%, respectively) as well as the highest average undergraduate tuition costs in 2009/2010. In contrast, the provinces with the lowest proportions of parent savers—Manitoba and Quebec, at 60% and 61%, respectively—also had the lowest average undergraduate tuition costs. The exception was Newfoundland and Labrador where tuition costs were, in fact, lower than those in Manitoba, but where the proportion of parent savers was relatively high, at 72% in 2009.

Chart 1

Proportion of savers and average undergraduate tuition fees for Canadian full-time students in 2009/2010, by province

Source: Statistics Canada. 2009 Canadian Financial Capability Survey and 2009 Survey of Tuition and Living Accommodation Costs.

Socio-economic differencesA discussion of savings for children's postsecondary education would be incomplete without examining the relationship with income. To better understand the relationship between savings and income, the entire survey population, including parents, was divided into quintiles based on household income.

As shown in Chart 2, the proportion of parents who had saved for their children's postsecondary education increased with income. Not surprisingly, the proportion of savers was highest among the highest income quintile group. According to the CFCS, over 8 in 10 (83%) of the 2.1 million parents with a yearly household income greater than $120,000 were savers. This proportion fell steadily by 7 to 11 percentage points for each lower quintile. Nevertheless, 48% of the 1 million parents falling into the lowest income quintile, earning less than $32,000 a year in 2008, had saved for their children's postsecondary education.

Chart 2

Proportion of savers and non savers, by household income quintile and highest level of schooling of parents with children under the age of 18, 2009

Source: Statistics Canada. 2009. Canadian Financial Capability Survey.

Previous research has established that a close relationship exists between income and educational attainment. That relationship is reflected in patterns of saving for children's postsecondary education. As shown in Chart 2, parents with less than a high school diploma saved in about the same proportion as those from the lowest income quintile (at 45% and 48%, respectively). At the opposite end, parents with university undergraduate and graduate degrees, at 78% and 80%, respectively, had about the same proportion of savers as those in the highest income quintile (83%).

The largest increase in the proportion of savers occurred when parents whose highest level of education was a high school diploma were compared to parents with less than high school. As Chart 2 shows, 45% of parents without a high school diploma had savings for their children's postsecondary education compared to 63% of parents whose highest level of education was high school completion. Again, the relationship between parental education and household income plays an important intermediary role.

RESPs as a savings mechanism

Canada's Registered Education Savings Plan (RESP) is a federal savings program which includes both government contributions through the Canadian Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Such contributions are not available through other plans such as dedicated saving accounts or Guaranteed Investment Certificates (GICs).

Data from the CFCS confirm that the RESP was the favoured method of saving for children's postsecondary education. As shown in Table 1, nearly 4 million of the 5.7 million parents who had saved for their child's postsecondary education (66%) had contributed to an RESP. The second most-common approach was to contribute to a dedicated savings plan or account (28%).

| percent | |

|---|---|

| Contribute to an RESP account | 66 |

| Purchase GICs, government savings bonds or corporate bonds | 5 |

| Contribute to a dedicated savings plan or account | 28 |

| Purchase mutual funds, stocks, etc. | 4 |

| Other | 8 |

|

1 Multiple responses are allowed. Source: Statistics Canada. 2009 Canadian Financial Capability Survey. |

|

The percentage of parents with children under the age of 18 who were saving for postsecondary education and who were using RESPs as a savings vehicle was close to the national average in most provinces. However, there were some differences. The use of an RESP was most common in Ontario, at 70%. Conversely, the proportion of RESP contributors among parent savers was lowest in New Brunswick, Manitoba and Quebec, at 51%, 58% and 60%, respectively. Similar patterns were observed for education savings held outside RESPs.

Competing saving priorities: retirement versus education

The balance between saving for retirement and saving for children's postsecondary education can create a juggling act for many parents, with the necessity to ensure their own financial security in retirement, on the one hand, and the desire to give their children the opportunity to pursue a postsecondary education, on the other.

As can be seen in Table 2, nearly 6 out of 10 (59%) parents were preparing financially for retirement and saving for postsecondary education, while just over 1 out of 10 (12%) were doing neither.

| Financially preparing for retirement | Saving for postsecondary education | ||

|---|---|---|---|

| Yes | No | Total | |

| percent | |||

| Yes | 59 | 18 | 77 |

| No | 11 | 12 | 23 |

| Total | 70 | 30 | 100 |

| Source: Statistics Canada. 2009 Canadian Financial Capability Survey. | |||

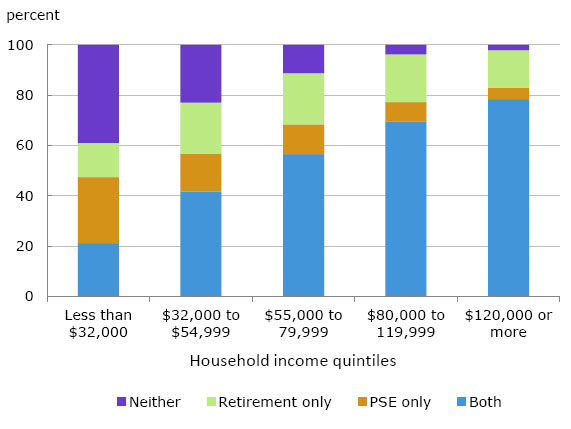

Chart 3 illustrates how saving patterns are influenced by income levels. Parents in the first income quintile, with annual earnings of less than $32,000 in 2008, were most likely to not prepare financially for their retirement nor save for their children's postsecondary education (39%). This proportion decreased as income increased. For parents with a household income over $120,000, this proportion fell to 2%.

In fact, as income increased, parents who were not financially preparing for their retirement nor saving for their children's postsecondary education, as well as parents who were saving solely for postsecondary education, saw their proportion decrease, shifting instead to preparing financially for retirement and saving for postsecondary education. Only the proportion of parents who were preparing financially for retirement only remained relatively stable across income quintiles.

Chart 3

Retirement and education savings behaviours within household income quintiles, 2009

Source: Statistics Canada. 2009 Canadian Financial Capability Survey.

Conclusion

The value of education and the benefits that flow from it are substantial for many Canadian families. And results from the CFCS show that many parents of children under the age of 18 are planning ahead for their children's postsecondary education. In 2009, 70% of parents indicated that they were currently saving or had already saved to support their children's postsecondary education.

The proportion of savers by province was strongly related to the average undergraduate tuition fees for Canadian full-time students. The three provinces with the highest proportion of savers (Alberta, at 78%, Ontario, at 74% and Nova Scotia, at 73%) also had the highest average cost for an undergraduate degree in 2009/2010. Although tuition cost is closely related to parental savings behaviours for postsecondary education, there were other important factors that also influenced savings behaviours such as highest level of parental education and household income.

The analysis finds that 83% of parents in the highest income quintile who had children under the age of 18 had set aside savings for their children's postsecondary education. This proportion fell gradually by 7 to 11 percentage points for each lower income quintile. About half (48%) of the parents among the lowest income quintile group reported having saved for their children's postsecondary education at the time of the survey.

Registered Education Savings Plans were the favoured approach for saving for children's postsecondary education, with approximately two thirds of parent savers contributing to an RESP account.

Finally, many parents of children under the age of 18 are confronted with a number of competing savings priorities. The analysis finds that nearly 6 out of 10 of these parents (59%) were preparing for both retirement and postsecondary education in 2009. However, parents at the bottom of the income distribution were most likely not to be preparing for either retirement or for their children's postsecondary education. In contrast, this proportion fell to 2% for parents at the top of the income distribution. As income increased, parents who were not preparing financially for their retirement nor saving for their children's postsecondary education, as well as parents who were saving solely for postsecondary education saw their proportion decrease, shifting instead to preparing for both retirement and postsecondary education.

Despite these challenges, it is clear that Canadian parents place a high value on savings for postsecondary education. Even among the lowest household income group, the percentage saving for their children's postsecondary education only was greater than the share preparing financially for retirement only.

Notes

-

Shipley, Lisa, Sylvie Ouellette and Fernando Cartwright. 2003. Planning and preparation: First results from the Survey of Approaches to Educational Planning (SAEP) 2002. Statistics Canada Catalogue no. 81-595-MIE – No. 010.

-

Ouellette, Sylvie. 2006. How Students Fund Their Postsecondary Education: Findings from the Postsecondary Education Participation Survey. Statistics Canada Catalogue no. 81-595-MIE – No. 042.

- Date modified: