Common menu bar links

Seniors

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Canada’s population aged 65 and older has more than doubled in the past 35 years to 4.3 million—or 13% of the population—in 2006. Medium-growth scenarios suggest the senior population will grow to 23% in 2031.

The very elderly group (80 and older) is also growing quickly. From 1996 to 2006, their numbers swelled by 46% to reach 1.2 million. By 2031, this figure could rise by another 110% to reach 2.5 million.

Although Canada is one of the youngest of the G8 countries, the size of the baby boom following the Second World War should contribute to more rapid aging of the population than in other industrialized countries.

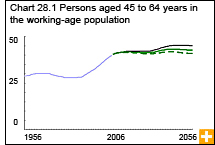

From workforce adjustments to retirement plans, the growing ranks of seniors will affect Canadian society. In 2006, there were just over 5 people aged 15 to 64 years for each person aged 65 years and older. This ratio gives an approximation of how many elderly people there are in relation to the pool of potential workers.

By comparison, the ratio in 1956 was almost 8 working-age adults for each person aged 65 years and older. By 2056, medium-growth scenarios indicate a further decline to 2.2 working-age persons for each elderly person.

Still working

Many seniors are continuing to work after retirement age, particularly university educated and self-employed seniors. Women of the baby boom generation are also remaining longer in the workforce after retirement age. In 2007, women made up 35% of senior workers, a proportion expected to increase in future years.

While most near-retirees get financial advice about retirement planning and programs, almost 3 in 10 do not. Those not receiving financial advice are less likely to expect their retirement income to be adequate than those who do. This relationship remains even when other characteristics such as income, pension coverage and registered retirement savings plan assets are taken into account.

Most Canadians (65%) approaching retirement anticipate that their retirement income will be adequate or more than adequate to maintain their standard of living. However, 19% of Canadians expect it to be barely adequate and 9% less than adequate.

On average, Canadian workers had family disposable incomes at age 75 (when most are retired) that were 80% of their incomes at age 55 (when they were working).

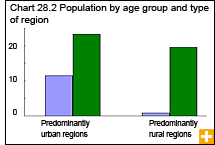

The proportion of seniors has grown more quickly in rural areas in recent years than it has in urban areas. From 1996 to 2006, seniors’ share of the rural population rose 2.1 percentage points; their share of the urban population rose 1.1 percentage points. This shift may be the result of much higher immigration levels in urban areas as well as younger people migrating out of the rural areas to urban areas.