Common menu bar links

Manufacturing

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

The health of Canada’s manufacturing sector declined by nearly every measure in 2008—from output and employment to the volume of sales and labour productivity. It was a year of contrast, featuring uneven growth over the course of the year and across industries.

Manufacturing’s real gross domestic product fell for a third consecutive year, dropping 5.2% from 2007 to 2008. The motor vehicle and parts industries accounted for nearly half of the decline in output.

The value of manufacturing sales remained relatively stable in 2008, slipping 0.4% from 2007 to reach $604.7 billion. However, the volume of goods sold fell 6.8% to $546.0 billion—the third successive annual decline. Sharply reduced foreign and domestic demand during the second half of the year slowed activity in Canadian factories even further.

Industries driven by discretionary consumer spending, such as motor vehicles and wood products, saw declining sales throughout much of 2008. These were offset by exceptional price increases and strong demand for commodities during the first half of the year.

However, by the third quarter, that strong demand quickly disappeared as the global downturn spread. It continued into the early months of 2009.

Manufacturing sales drop

In 2008, 13 of 21 manufacturing industries posted sales decreases. Motor vehicle manufacturers’ sales dropped 22.0% to a 14-year low. The wood products industry fared poorly for a fourth year in a row, as sales fell 13.1%.

Higher prices pushed manufacturers’ sales of petroleum and coal products up 22.2% to a record high. The value of petroleum product sales surpassed that of food and motor vehicles, Canada’s previous biggest players.

The primary metals and chemical products industries also benefited from robust demand for most of the year, as both industries posted sales growth of just over 4.0%.

Newfoundland and Labrador, New Brunswick, Nova Scotia, Saskatchewan and Alberta all reported sharply higher manufacturing sales. This was partly the result of high prices, as well as busy refineries and strong demand, for most of the year, for chemical and primary metal products.

In Ontario, steep declines in sales of motor vehicles and auto parts contributed to a 4.6% drop in manufacturing sales to their lowest level since 1998. In Quebec, robust growth in the aerospace and petroleum products industries contributed to a 1.8% rise in total sales.

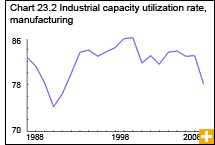

Labour productivity was down 1.9% in 2008, the first decrease since 2001. Manufacturing’s industrial capacity utilization rate fell from 82% in 2007 to 78% in 2008, a level not seen since the 1990 recession.

Operating profits remained almost unchanged in 2008 at $46.3 billion. Motor vehicle and parts producers lost $3.3 billion in operating profits. Excluding motor vehicles and parts, manufacturers’ operating profits increased 10.7% in 2008, compared with 5.4% for the economy as a whole.