Common menu bar links

Economic accounts

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Until 2008, Canada had gone a record 16 years since its last economic downturn and had been riding a seven-year boom in commodity prices. But the economy in 2008 was unlike any in recent memory. For many younger workers and investors, 2008 was their first experience with a recession.

In the first seven months of 2008, commodity prices rose to record levels amid slow growth in North America and steady gains in Asia. Inflation dominated the headlines, while Canada’s trade surplus set records. However, late in the summer, global demand and commodity prices faltered, and then fell precipitously after credit markets seized up in mid-September. These events quickly spilled over into the real economy of output and employment.

Slowing growth

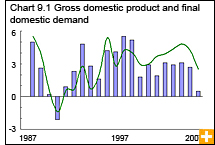

By year-end, the global economy—and Canada’s—was changing rapidly in response to the tumult in the global financial markets. In real terms (adjusted for inflation), Canada’s gross domestic product (GDP) grew 0.5% in 2008, its slowest growth since 1991.

Despite all the turmoil, Canada’s financial institutions held up well. Governments and businesses had been running large financial surpluses for the past decade, while Canadian households were less burdened with debt than those in the United States.

Canada’s GDP grew in five provinces; Saskatchewan led the way with growth of 4.4%. The GDP also advanced in Yukon and Nunavut, while declining export demand contributed to lower GDP in Ontario, Alberta, British Columbia, Newfoundland and Labrador, and the Northwest Territories.

Domestic demand, the engine of economic growth since 2001, slowed from a 4.2% pace in 2007 to 2.5% in 2008, as spending on consumer goods and services weakened and the housing market softened. Declining merchandise trade and a deterioration in Canada’s terms of trade—exports shrank a record 25% after October—contributed to the overall weakness in GDP.

Employment turned down decisively in November and December, falling 0.5% and 0.6%, respectively, from the same months of the previous year.

Goods production declines

Goods production declined 2.8% in 2008, the first decrease since 2001, the year of the high-technology meltdown. All goods producing industries declined.

Building permits declined 5.3%. Permits for residential construction declined 10.2% while permits for non-residential construction increased 2.5%. Sales of existing homes posted their largest decline since 1990, falling 17.1% across the country from 2007.

Meanwhile, the services-producing industries grew 2.1%, with all sectors advancing.