Common menu bar links

Business performance and ownership

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

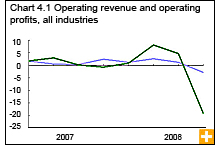

The sharp downturn seen in the last quarter of 2008, and the years of solid results that preceded it, are reflected in the data on the performance of companies operating in Canada.

In the fourth quarter of 2008, corporations earned $62.4 billion in seasonally adjusted operating profits, down 19.2% from the third quarter—the largest quarterly decline in 16 years. About two-thirds of the major industry groups reported lower profits. Nonfinancial industries’ profits fell 17.6% to $46.9 billion; those of the financial industries declined 23.8% to $15.5 billion.

Profits decline

Lower profits in the fourth quarter were attributable to lower revenues: oil and gas extractors, banks and other depository credit intermediaries, and manufacturers led the decline.

Manufacturers’ earnings fell 20.9% to $9.5 billion in the fourth quarter of 2008; much of the decrease came from the petroleum and coal industry. Chemicals, plastics and rubber products manufacturers helped offset declines; their profits rose 5.2% to $1.9 billion despite temporary plant shutdowns in the quarter. Retailers earned $4.1 billion in the final quarter of 2008, down 2.0% from the third quarter.

Losses from trading in financial instruments caused banks to lead declines in the financial industries. Banking and other depository credit intermediaries earned $4.8 billion, down 26.4% from the third quarter.

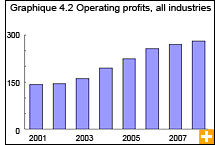

Despite those fourth-quarter declines, corporations earned $281.7 billion in 2008, 4.3% more than in 2007. Much of the growth came from oil and gas extraction (up 54.0% to $38.0 billion) and petroleum and coal manufacturers (up 17.9% to $13.7 billion), because of high oil and gas prices during the first half of 2008.

Banking and depository credit intermediaries dragged down financials, as amounts set aside for future losses on investments, loans and other assets more than doubled in 2008. Banks posted profits of $22.4 billion, down 20.2% from 2007.

Corporate income taxes were higher in 2007

Corporations paid $55.7 billion in taxes in 2007; $37.9 billion to the federal government, and $17.8 billion to provincial governments.

The finance and insurance industries paid $13.8 billion in income taxes, up 11.5% from 2006. The banking and other depository credit intermediation industries accounted for $5.5 billion of that total.

Non-financial industries paid $41.9 billion in income tax in 2007, down 2.4% from the previous year.