Canada's international transactions in securities, January 2023

Released: 2023-03-17

Canadian investors reduced their holdings of foreign securities by $16.2 billion in January, the largest divestment since March 2022. Meanwhile, non-residents acquired $4.2 billion of Canadian securities in January 2023, down considerably from a $21.2 billion investment in December 2022.

As a result, international transactions in securities generated a net inflow of funds of $20.4 billion in the Canadian economy in January 2023, following a net inflow of funds of $151.0 billion in 2022.

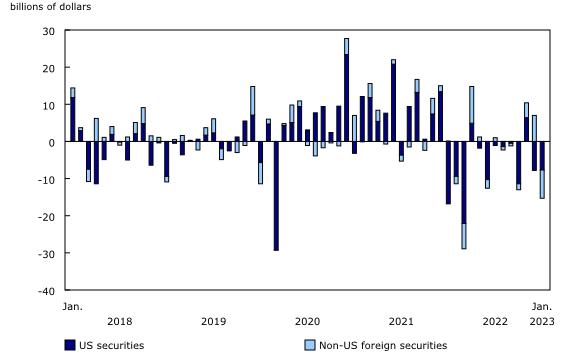

Canadian investors sell foreign shares

Canadian investors reduced their exposure to foreign securities by $16.2 billion in January. More precisely, investors sold $15.4 billion of foreign shares over the month, almost equally split between US shares ($7.7 billion) and non-US foreign shares ($7.6 billion). The latter was the largest divestment in seven years. In January, US share prices, as measured by the Standard and Poor's 500 composite index, increased 6.2% following a 19.4% decline in 2022.

In addition, Canadian investors reduced their holdings of foreign bonds by $1.5 billion, a second consecutive monthly divestment. The divestment largely targeted US bonds in both December 2022 and January 2023. In January, US long-term interest rates exceeded Canadian rates for a fifth consecutive month. Meanwhile, the Canadian dollar depreciated against the US dollar.

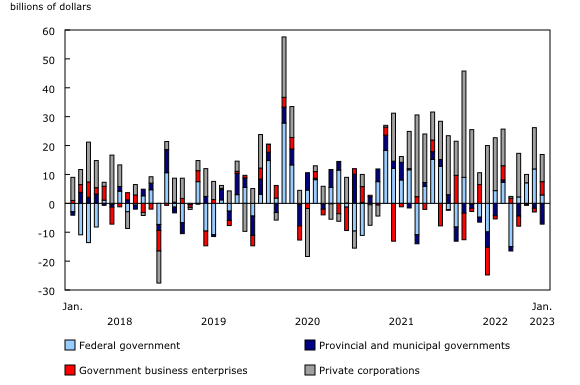

Non-resident investors target Canadian corporate bonds

Foreign investment in Canadian securities was $4.2 billion in January, led by acquisitions of corporate bonds. The overall foreign investment was down considerably in January compared with December 2022, largely due to lower investments in money market instruments.

Foreign investors acquired $11.7 billion of Canadian corporate bonds in January 2023, the largest investment in five months. The investment targeted new bonds denominated in non-US foreign currency.

At the same time, foreign investment in money market instruments slowed to $709 million in January, down from $13.6 billion in the previous month. The slowdown was observed in both the government sector and the corporate sector. In January 2023, Canadian short-term interest rates rose to their highest levels since July 2007, while long-term interest rates fell to the lowest levels in six months.

Non-resident investors reduced their exposure to Canadian equity securities by $5.5 billion in January 2023. The divestment activity focused on shares of the trade and transportation industry and, to a lesser extent, of the energy and mining industry. In January, Canadian share prices, as measured by the Standard and Poor's/Toronto Stock Exchange composite index, rose 7.1%, more than offsetting the decline recorded in December 2022.

Note to readers

The data series on international transactions in securities covers portfolio transactions in equity and investment fund shares, bonds, and money market instruments for both Canadian and foreign issues. This activity excludes transactions in equity and debt instruments between affiliated enterprises. These are classified as foreign direct investment in international accounts.

Equity and investment fund shares include common and preferred equities, as well as units or shares of investment funds. For the sake of brevity, the terms "shares" and "equity and investment fund shares" have the same meaning.

Debt securities include bonds and money market instruments.

Bonds have an original term to maturity of more than one year.

Money market instruments have an original term to maturity of one year or less.

Government of Canada paper includes Treasury bills and US-dollar Canada bills.

All values in this release are net transactions unless otherwise stated.

Next release

Data on Canada's international transactions in securities for February will be released on April 17.

Products

The Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, and Japan.

As a complement to this release, the data visualization product "Securities statistics," part of the series Statistics Canada – Data Visualization Products (71-607-X), is available online.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: