Activities of multinational enterprises in Canada and abroad, 2020

Released: 2023-02-08

Activities of multinational enterprises (MNEs) in Canada were significantly affected by the COVID-19 pandemic in 2020. Many of their activities declined, notably sales (-9.2%), employment (-6.6%), and their contribution to gross domestic product (GDP) (-9.8%). On the other hand, MNEs accumulated more assets (+8.7%) and performed more research and development (R&D).

Outside of Canada, affiliates of Canadian MNEs continued to grow their assets and sales, although their employment decreased.

More detailed information on operating revenues, assets, and employment, by country, can be found in the product "Activities of Multinational Enterprises: Interactive Tool." It also includes provincial data on number of jobs, GDP and international merchandise trade, by type of multinational enterprise.

Sales and assets of Canadian multinationals show different movements

In 2020, sales by Canadian MNEs from their domestic operations declined by $104.2 billion, while sales by their affiliates abroad increased by $23.7 billion. Sales increases abroad primarily came from affiliates operating in the United States. Although sales in many countries increased, the growth was generally smaller than in previous years. In 2020, the Canadian dollar depreciated against most major foreign currencies.

Worldwide assets of Canadian MNEs increased by approximately 10%, led by the finance and insurance sector (+$1.2 trillion), which includes banks. The growth in assets held by foreign affiliates of Canadian MNEs was concentrated in the United States (+$351.1 billion), followed by the United Kingdom (+$42.3 billion).

Decline in employment by multinationals more pronounced in Canada than abroad

The pandemic had significant impacts on jobs in Canada and abroad, including MNEs. Employment by MNEs in Canada declined by over 300,000 (-6.6%) in 2020, almost equally split between Canadian and foreign MNEs. In comparison, employment by non-MNEs fell by over one million (-12.4%) jobs from 2019 to 2020.

Job losses at MNEs were more pronounced in the manufacturing sector, due to factors such as supply chain issues and shutdowns. On the other hand, the professional, scientific and technical services sector was one of the few sectors that had an increase in MNE employment from 2019 to 2020. This was driven mainly by foreign MNEs (+7.4%), as the nature of many jobs in this sector enabled employees to work from home.

Meanwhile, the decline in employment by Canadian MNEs abroad was smaller (-2.1%). There were notably reductions in employment at their foreign affiliates operating in Latin America, including Honduras, Peru, Brazil and Mexico. The overall decline was moderated by an increase in employment by their affiliates operating in the United States.

Multinationals continue to increase their research and development activity

Businesses in Canada expanded their R&D activities in 2020. In-house R&D expenditure was up 3.3%, reaching $22.6 billion, while R&D personnel increased by 6.1% to just under 180,000. Combined, foreign and Canadian MNEs accounted for over 70% of total R&D spending and three-fifths of R&D personnel.

Although MNEs accounted for most R&D activity in terms of spending and personnel, non-MNEs increased their in-house R&D expenditure by 6.1% from 2019 to 2020. During this period, R&D personnel at non-MNEs increased by 10.4%, compared with a 3.8% increase at MNEs.

Among Canadian MNEs, the increase in R&D spending and R&D personnel was most visible in the information and cultural industries sector. Foreign MNEs and non-MNEs in the professional, scientific and technical services sector had the highest increase in R&D spending.

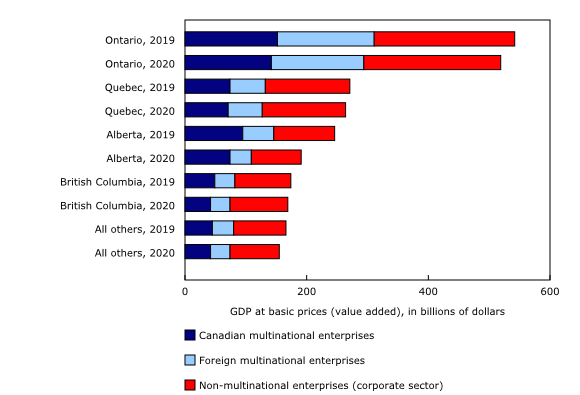

Decline in gross domestic product generated by multinationals is larger than non-multinationals

Corporate GDP decreased by 7.2% in 2020, falling to just under $1.3 trillion. This was on account of a greater decline from MNEs (-9.8%) compared with non-MNEs (-4.1%).

On a regional basis, Ontario's GDP generated by MNEs contracted by 5.6% in 2020, with a steeper decline from Canadian MNEs than foreign MNEs. The MNEs in the manufacturing sector accounted for over one-third of the decline.

In Alberta, MNEs in the mining, quarrying, and oil and gas extraction sector were the main contributor to the overall decline of the corporate GDP. This reflected the weak demand for oil in the world markets; a decline in prices; and disruptions to oil and gas extraction operations due to the pandemic.

Note to readers

This release integrates analysis from both the Activities of Multinational Enterprises in Canada and Activities of Canadian Multinational Enterprises Abroadprograms under the broad framework of multinational enterprises.

Activities of multinational enterprises in Canada cover foreign multinationals (firms in Canada controlled by a foreign parent) and Canadian multinationals (Canadian-controlled firms with a foreign affiliate).

Activities of Canadian multinational enterprises abroad cover affiliates abroad that are Canadian majority-owned. The figures represent the total sales, employment and assets of those affiliates. These affiliates also include those who are ultimately controlled by foreign enterprises. As such, a slight share of worldwide activities of Canadian multinationals can be ultimately controlled from abroad, a common practice at the international level.

"Activities of Multinational Enterprises: Interactive Tool" has been developed to allow users to quickly, easily and efficiently browse these data.

''Canadian majority-owned affiliates abroad'', ''affiliates abroad'' and ''affiliates of Canadian multinationals abroad'' are used interchangeably.

The primary statistical unit used in the provincial-level analysis is the establishment level. All other variables are presented at the enterprise level.

Products

The updated Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication will be updated to maintain its relevance.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: