Wholesale trade, November 2022

Released: 2023-01-19

$83.8 billion

November 2022

0.5%

(monthly change)

$418.0 million

November 2022

1.9%

(monthly change)

$123.5 million

November 2022

-5.3%

(monthly change)

$1,166.9 million

November 2022

-1.7%

(monthly change)

$764.0 million

November 2022

-4.0%

(monthly change)

$15,683.5 million

November 2022

1.5%

(monthly change)

$42,302.2 million

November 2022

2.2%

(monthly change)

$2,043.1 million

November 2022

1.2%

(monthly change)

$4,030.1 million

November 2022

-11.3%

(monthly change)

$9,261.2 million

November 2022

1.0%

(monthly change)

$7,970.5 million

November 2022

-2.9%

(monthly change)

x

November 2022

x

(monthly change)

$33.6 million

November 2022

-5.6%

(monthly change)

x

November 2022

x

(monthly change)

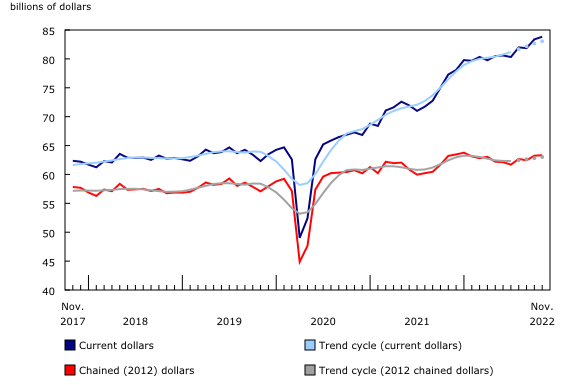

Higher wholesale sales in November

Wholesale sales rose 0.5% to $83.8 billion in November. Higher sales were posted in the motor vehicle and motor vehicle parts and accessories subsector and the machinery, equipment and supplies subsector, while sales in remaining subsectors decreased.

Constant dollar sales rose 0.1% in November.

Motor vehicle and motor vehicle parts and accessories subsector drives the increase in November

Sales of motor vehicle and motor vehicle parts and accessories rose 10.1% to $13.8 billion in November, a new record high for this subsector. This increase was the largest monthly increase since July 2020. There was widespread growth in all industry groups, but the bulk of the increase and driver of the movement was the motor vehicle industry (+12.0% to $11.1 billion), based on an increase of electric vehicles sales.

The machinery, equipment and supplies subsector increased 2.0% to $17.9 million in November, on higher sales in the construction, forestry, mining, and industrial machinery, equipment and supplies industry (+7.6% to $6.4 billion), reporting its second consecutive increase. Sales in this industry were mainly completions of orders for year end, and the increase of November sales is attributable to a lack of transportation options.

Partially offsetting the strong increases in November was a decline of sales in the miscellaneous subsector (-5.1% to $12.2 billion). Four out of the five industry groups fell month over month, but the decrease was mainly led by agricultural supplies industry (-9.7% to $4.7 billion). This month's decline follows a strong October delivering orders.

Sales up in five provinces, led by Ontario and Quebec

Sales increased in five provinces in November, representing 83.2% of national sales. The increase was predominantly seen in Ontario and Quebec, while declines in Saskatchewan partially offset these gains.

In Ontario, sales rose 2.2% to $42.3 billion in November, with increased sales in two of the seven subsectors. The driving factor for sales in this province was a 13.8% (+$1.2 billion) increase in the motor vehicle and motor vehicle parts and accessories subsector. In addition, sales were up 2.5% to $8.8 billion in the machinery, equipment and supplies subsector. Excluding the motor vehicle and motor vehicle parts and accessories subsector, sales in Ontario would have decreased 0.7% in November.

Sales in Quebec continued to grow in November for a fourth consecutive month. Sales increased 1.5% to $15.7 billion and surpassed October's record high. Sales increased in six of the seven subsectors. The miscellaneous goods subsector led the provincial gain, with an increase of 7.9% to $1.9 billion, followed by the machinery, equipment and supplies subsector, up 4.6% to $2.6 billion.

In Saskatchewan sales fell 11.3% to $4.0 billion in November. While sales dropped in five of the seven subsectors, the miscellaneous goods subsector was down 17.1% to $2.3 billion and produced almost all (94%) of the provincial decline due to an 18.3% drop in the agricultural supplies component industry.

Inventory levels drop in November

Inventories fell 0.5% to $126.0 billion in November, the first drop since January 2022. Lower inventories were reported in four of the seven subsectors, led by the building material and supplies subsector and the personal and household goods subsector. Meanwhile, the remaining three subsectors saw growth in inventories, led by the machinery, equipment, and supplies subsector.

Inventories in the building material and supplies subsector fell 3.3% to $23.8 billion in November. This decrease was driven by all three industries: electrical, plumbing, heating and air-conditioning equipment and supplies (-4.2% to $6.9 billion), metal service centres (-3.5% to $6.6 billion), and lumber, millwork, hardware and other (-2.7% to $10.3 billion).

In the personal and household goods subsector, inventory levels fell 2.6% to $20.2 billion. Inventories of pharmaceuticals and pharmacy supplies decreased (-3.9% to $8.0 billion). Additionally, there was a drop in the textile, clothing, and footwear industry, down by 4.4% to $4.5 billion. Inventories in the home entertainment equipment and household appliance; personal goods; and toiletries, cosmetics and sundries industries also contributed to the decline in inventories for November.

Although there was an overall decrease in inventories in November, there was strong growth in the machinery, equipment, and supplies subsector, up 2.4% to $35.0 billion. Three of the four industries had an increase in inventories: farm, lawn, and garden (+5.9% to $6.9 billion), construction, forestry, mining, and industrial machinery, equipment and supplies (+1.7% to $16.1 billion), and other machinery (+2.7% to $7.5 billion).

The inventory-to-sales ratio decreased from 1.51 in October to 1.50 in November. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars unless otherwise noted.

Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Section 2: Issues related to analysis and interpretation.

Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the Seasonally adjusted time series (see Section 1: Concepts and definitions) and provide information on longer-term movements, including underlying changes in direction in the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruptions.

Total wholesale sales expressed in volume are calculated by deflating current dollar values using relevant price indexes. The wholesale sales series in chained (2012) dollars is a chained Fisher volume index, with 2012 as the reference year. For more information, see "Deflation of wholesale sales."

The Monthly Wholesale Trade Survey covers all industries within the wholesale trade sector, as defined by the North American Industry Classification System (NAICS), with the exception of oilseed and grain merchant wholesalers (NAICS 41112), petroleum and petroleum products merchant wholesalers (NAICS 412) and business-to-business electronic markets, and agents and brokers (NAICS 419).

Real-time data tables

Real-time data tables 20-10-0019-01, 20-10-0020-01 and 20-10-0005-01 will be updated soon.

Next release

Wholesale trade data for December 2022 will be released on February 15, 2023.

Products

The product "Monthly Wholesale Trade Survey: Interactive Tool" (71-607-X) is available online. This product is based on the data published in the tables of the Monthly Wholesale Trade Survey: 20-10-0074-01, 20-10-0076-01 and 20-10-0003-01.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: