Natural resource indicators, third quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-01-14

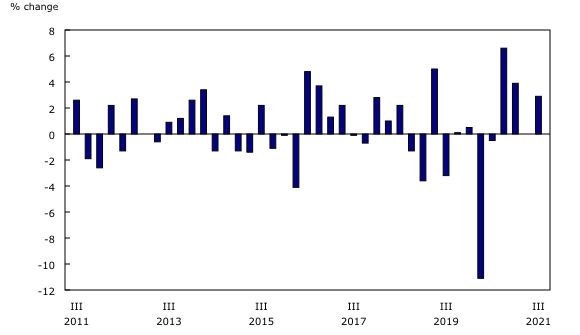

Natural resources real gross domestic product on the rise

Real gross domestic product (GDP) of the natural resources sector rose 2.9% in the third quarter. Real GDP of the natural resources sector has surpassed pre-pandemic levels, recovering from the 11.1% drop in the second quarter of 2020.

The rise in the natural resources sector was stronger than the increase in economy-wide real GDP (+1.3%), reflecting growing demand for natural resource products as many sectors are recovering from the pandemic.

The third quarter increase in real natural resource GDP was broad-based.

Real GDP of the energy subsector increased 3.4% due to increased extraction of crude oil and oil sands, as well as increased demand from trading partners.

Real GDP of the mineral and mining subsector (+3.0%) rose in the third quarter due to increased demand for copper, nickel, lead, zinc and iron ore.

Real GDP of the non-metallic minerals subsector rose 3.5%, following a 2.0% increase in the previous quarter led by increased potash demand as coal and natural gas prices increased input costs for alternate fertilizer production. Metallic minerals real GDP increased 6.5% in the third quarter, driven by copper, iron ore, aluminium, aluminium alloys and steel exports.

Real GDP of the forestry subsector fell 1.5% in the third quarter. This was largely due to record-setting heat, drought and forest fires in British Columbia and northwestern Ontario causing forestry and logging to decline significantly (-8.5%). Sawmill activity (-2.6%) also decreased after demand for products started declining from pandemic highs, as well as facing increased burdens from market tariffs.

Hunting, fishing and water GDP increased 1.6%.

Export volumes rise and import volumes fall

Natural resources export volumes rose 7.0% in the third quarter, following a 3.6% decline in the second quarter. Exports of energy (+10.2%) were being fuelled by crude oil exports (+12.8%) due to increased international energy demand.

Minerals and mining (+5.8%) rose mainly due to metallic minerals (+32.0%) exports increasing. Copper, aluminium, iron and steel exports all increased, fuelled by a rise in global demand. Forestry exports fell 5.7% due to reduced production brought on by adverse conditions in British Columbia and northwestern Ontario.

Hunting, fishing and water exports fell (-21.4%) in the third quarter of 2021 after rising 52.3% in the previous quarter. In the second quarter, restrictions faced by dine-in restaurants led to strong increases in exports as supply was redirected to international markets. This reflects a return to normal export trends.

The decrease in import volumes (-2.1%) was led by minerals and mining (-5.0%). Imports of unwrought gold from the United Kingdom declined. Forestry (-1.0%) and energy (-0.2%) imports both fell. Hunting, fishing and water imports rose 6.4%.

Natural resource prices and nominal GDP increase

Overall, natural resources prices rose 3.4% in the third quarter, led by a 9.8% increase in minerals and mining prices due to a strong increase in coal prices.

A 58.5% increase in coal prices contributed to the rise in overall natural resources nominal GDP (+6.4%). This was reflected in the nominal GDP of the minerals and mining subsector, which saw an increase of 13.1%. Nominal GDP of the energy subsector increased 9.1%, while forestry decreased 18.5%, returning to historical norms after strong increases in the past four quarters. Expressed at an annual rate, nominal natural resources GDP was $296 billion in the third quarter, representing 12.6% of the Canadian economy.

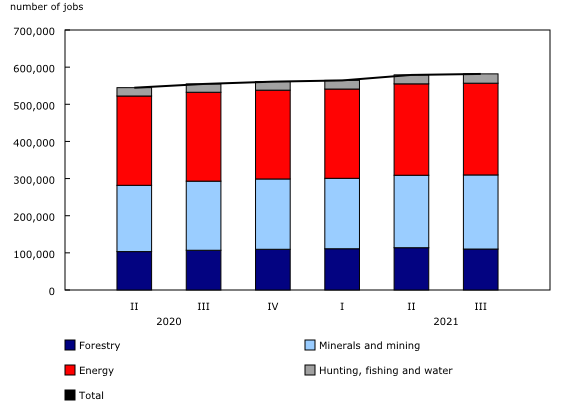

Employment continues to rise

Employment in the natural resources sector rose 0.5%, the fifth consecutive quarterly increase. Job recovery was strongest in the minerals and mining subsector (+4,400 jobs), followed by energy (+1,000 jobs). Employment in the forestry subsector fell for the first time since the start of the pandemic (-3,600 jobs) as logging activities were restricted by intense climate activity. Hunting, fishing and water created 850 jobs in the third quarter.

Downstream activities increase

For analytical purposes, secondary and tertiary processing for the forestry and minerals and mining subsectors are identified separately. The nominal GDP of these downstream activities reached $8.9 billion in the third quarter, a 3.5% increase. Prices increased 4.4% in the third quarter following a 5.9% increase in the second quarter.

2020 Annual Review

This release also includes detailed annual tables for the 2020 reference year. Annual real GDP in the natural resources sector fell by 6.9% from 2019 to 2020, with widespread declines in all sectors related to pandemic restrictions on activity. The sector lost over 63,000 jobs, led by energy (-36,000) and forestry (-15,000) in 2020. Despite this, overall compensation to employees fell 3.3% over the same period.

Note to readers

Data on natural resources for the third quarter of 2021 have been released along with revised data from the first quarter of 2017. Annual data tables have been released for 2020 along with revised data back to 2017.

The natural resource indicators (NRI) provide quarterly indicators for the main aggregates in the Natural Resource Satellite Account (NRSA), namely, gross domestic product, output, exports, imports, and employment. The estimates from this account are directly comparable to the estimates in the Canadian System of Macroeconomic Accounts (CSMA).

Core natural resources: The NRSA defines natural resource activities as those that result in goods and services originating from naturally-occurring assets used in economic activity, as well as their initial processing (primary manufacturing).

Downstream activities: Although not part of the core account, natural resources have important downstream effects on other sectors. In general, this production uses a large portion of primary manufactured products as inputs.

Employment estimates reported in this release align with the noted definitions of natural resource subsectors. Consequently, these estimates may differ from those released by the labour productivity program.

Next release

Data on natural resource indicators for the fourth quarter of 2021 will be released on March 24, 2022.

Products

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structures.

Additional information can be found in the articles "The Natural Resources Satellite Account: Feasibility study" and "The Natural Resources Satellite Account – Sources and methods," which are part of the Income and Expenditure Accounts Technical Series (13-604-M).

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: