Building permits, June 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-08-04

$10.3 billion

June 2021

6.9%

(monthly change)

$23.8 million

June 2021

-74.8%

(monthly change)

$52.2 million

June 2021

0.1%

(monthly change)

$189.7 million

June 2021

6.4%

(monthly change)

$114.0 million

June 2021

6.5%

(monthly change)

$2,078.3 million

June 2021

-11.6%

(monthly change)

$4,635.8 million

June 2021

22.7%

(monthly change)

$330.1 million

June 2021

3.6%

(monthly change)

$160.3 million

June 2021

27.6%

(monthly change)

$1,344.8 million

June 2021

12.7%

(monthly change)

$1,318.6 million

June 2021

-4.7%

(monthly change)

$27.7 million

June 2021

38.2%

(monthly change)

$6.6 million

June 2021

-62.6%

(monthly change)

$6.4 million

June 2021

653.2%

(monthly change)

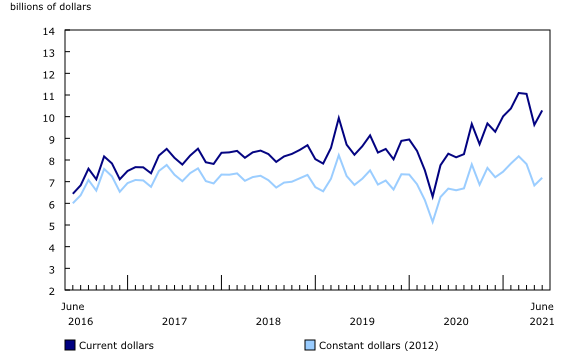

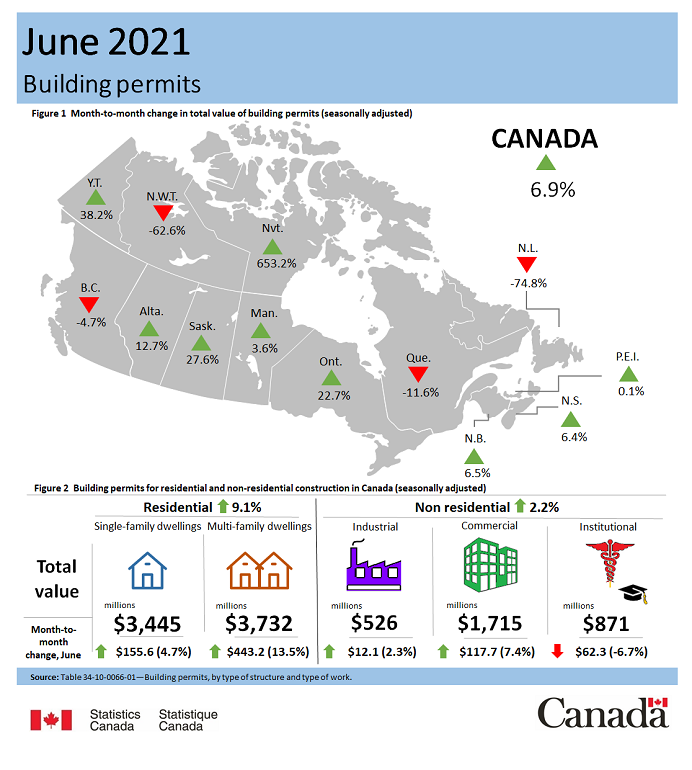

The total value of building permits rose 6.9% to $10.3 billion in June. Seven provinces contributed to the gain, led by Ontario, which jumped 22.7%. Construction intentions in the residential sector were up 9.1%, while the non-residential sector advanced 2.2%.

On a constant dollar basis (2012=100), building permits increased 5.2% to $7.2 billion.

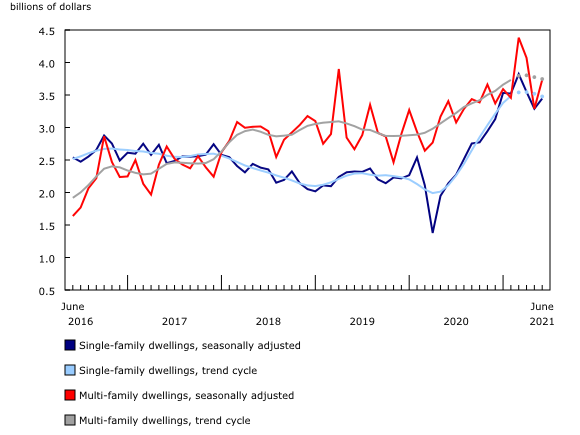

Ontario residential permits bounce back

High-value permits for new apartment buildings in the census metropolitan areas (CMA) of Toronto and Hamilton helped push multi-family permits up 13.5% to $3.7 billion nationally in June. Provincially, Ontario led the way, rebounding 67.8% to $1.8 billion. On the other hand, Quebec reported the largest decrease (-29.9%), pulling back from a record high in May.

Construction intentions for single-family dwellings increased 4.7% to $3.4 billion. Seven provinces saw gains in this component, led by Ontario and Alberta.

Overall, the value of residential building permits increased 9.1% to $7.2 billion, following two months of lower construction intentions.

Non-residential permits up slightly

Construction intentions for the non-residential sector were up 2.2% to $3.1 billion in June. Gains were reported in eight provinces, led by Alberta (+32.7%).

The value of commercial permits rose 7.4% to $1.7 billion. High-value permits, such as the Agri-food Hub and Trade Centre in the city of Lethbridge and an office building in the city of Vaughan, helped Alberta (+54.8%) and Ontario (+16.2%) to lead this component. Newfoundland and Labrador, down 92.5%, returned to more typical levels following a strong May.

Industrial permits increased 2.3% to $526 million. Six provinces showed increases, led by Ontario (+37.8%), while Quebec reported the largest decrease (-32.9%).

The institutional component was down in June, falling 6.7% to $871 million, as Ontario's notable decrease (-37.7%) drew down the national level. Meanwhile, Quebec surged 38.4% to $359 million, as several permits issued for alternative care and senior citizen residences coincided with an initiative from the government of Quebec to increase the number of beds.

Residential permits pull down second-quarter intentions

Total building permits declined 1.7% to $31.0 billion in the second quarter of 2021 compared with the previous period. Despite this, the value of building permits remained the second highest on record and was 38.5% above the same quarter in 2020, which was heavily impacted by COVID-19 restrictions in the construction industry.

The value of permits for the residential sector fell 4.2% to $21.4 billion in the second quarter. Permits for both multi-family and single-family dwellings dropped, with seven provinces reporting decreases.

Construction intentions in the non-residential sector rose 4.5% to $9.6 billion. Although second-quarter values exceeded the values in the first quarter of 2020, non-residential permits remained below the quarterly levels of 2019. Among the non-residential components, institutional permits increased for a fourth consecutive quarter, boosted by large projects in the education and health care sectors.

To explore data using an interactive user interface, visit the Building permits: Interactive Dashboard.

To explore the impact of COVID-19 on the socioeconomic landscape, please consult the Canadian Economic Dashboard and COVID-19.

For more information on housing, please visit the Housing Statistics Portal.

Statistics Canada has a Housing Market Indicators dashboard. This Web application provides access to key housing market indicators for Canada, by province and by census metropolitan area. These indicators are updated automatically with new information from monthly releases, giving users access to the latest data.

Note to readers

Unless otherwise stated, this release presents seasonally adjusted data with current dollar values, which facilitate month-to-month and quarter-to-quarter comparisons by removing the effects of seasonal variations. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Starting with the March 2021 reference period, monthly constant dollar estimates are available for the entire data series (34-10-0066-01). Constant dollars remove the effects of price changes over time and are calculated using quarterly deflators from the Building Construction Price Index (18-10-0135-01). Typically, the first two months of a quarter use the previous quarter's price level and are revised when the new quarterly price index becomes available.

Building components

- Single-family dwellings: Residential buildings containing only one dwelling unit (e.g., single-detached house, bungalow, linked home [linked at the foundation]).

- Multi-family dwellings: Residential buildings containing multiple dwelling units (e.g., apartment, apartment condominium, row house, semi-detached house).

- Industrial buildings: Buildings used in the processing or production of goods, or related to transportation and communication.

- Commercial buildings: Buildings used in the trade or distribution of goods and services.

- Institutional and government buildings: Buildings used to house public and semi-public services, such as those related to health and welfare, education, or public administration, as well as buildings used for religious services.

Revision

Unadjusted data for the current reference month are subject to revision based on late responses. Data for the previous month have been revised. Seasonally adjusted data for the previous two months have also been revised.

Trend-cycle estimates have been added to the charts as a complement to the seasonally adjusted series. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially at the end of the series. The higher variability associated with trend-cycle estimates is indicated with a dotted line on the chart.

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Next release

Data on building permits for July will be released on September 2.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: