Labour productivity, hourly compensation and unit labour cost, first quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-04

First quarter 2021

-1.7%

(quarterly change)

Labour productivity falls for a third straight quarter

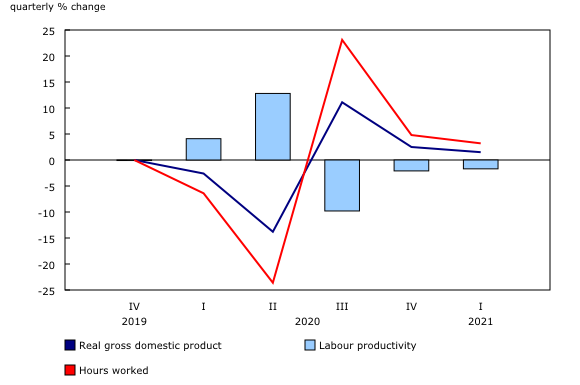

Labour productivity of Canadian businesses fell 1.7% in the first quarter, after posting a decline of 2.1% in the previous quarter and a record decrease of 9.8% in the third quarter of 2020. This third consecutive quarterly drop continued to offset the strong gains in productivity observed in the first two quarters of 2020.

The adjustment in productivity therefore continued in the first quarter, following historic increases and subsequent large declines throughout 2020. Compared with the fourth quarter of 2019—the last quarter before the COVID-19 pandemic began—productivity was up 1.9%.

After public health measures related to the pandemic were tightened in some regions of the country at the beginning of the year, the pace of economic and labour market recovery slowed in the first quarter, but businesses continued to increase their output and hours worked, though at a slower rate than in the previous two quarters. This was the third consecutive quarter in which business output and hours worked were up, after record declines in the second quarter of 2020. In the first quarter, the gain in hours worked outpaced again the increase in output, resulting in the decrease in labour productivity.

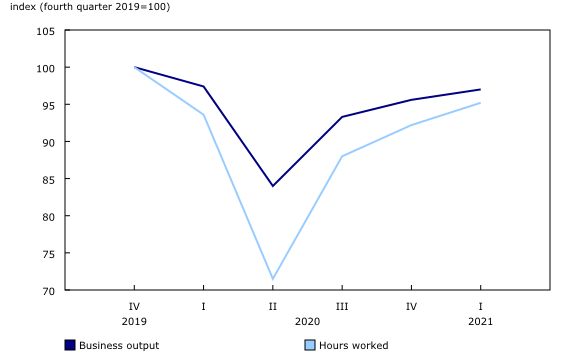

Business output almost back to its pre-pandemic level

Growth in businesses' real gross domestic product (GDP) slowed to 1.5% in the first quarter, down from the increase of 2.5% in the previous quarter and the 11.1% rebound in the third quarter of 2020.

In the first quarter, the GDP of businesses was closer to its pre-pandemic level (-3.0% from the fourth quarter of 2019), but differences between industry sectors remained. The output of goods-producing businesses was relatively closer to its pre-COVID-19 level (-1.3%), while the output of service-producing businesses was 4.1% below its level in the fourth quarter of 2019.

Hours worked also continue the slowdown that began in the previous quarter

Meanwhile, hours worked in the business sector rose 3.2% in the first quarter, the third-largest consecutive gain ever seen. It follows a strong 4.8% advance in the previous quarter and a net rebound of 23.1% in the third quarter of 2020.

Despite the record increase of these three quarters combined, hours worked have still not returned to their pre-pandemic level. They were 4.8% below that level, therefore showing slower recovery than business output.

In the first quarter, hours worked in service-producing businesses (+2.8%) rose more slowly than in the previous quarter (+5.0%), while the gain in goods-producing businesses (+4.3%) was similar in both quarters. Hours worked rose in 14 of the 16 main industrial sectors, but only information and cultural industries (+12.6% from the fourth quarter of 2019), professional services (+4.4%), and finance and insurance (+1.3%) exceeded pre-COVID-19 levels.

In the business sector, employment (+1.6%) and hours worked per job (+1.7%) rose at a similar pace. The number of people who had more than one job increased 8.7%, a similar gain as in the previous quarter (+8.6%). At the same time, the number of people who were absent without pay fell 11.3%, after edging up 0.6% in the fourth quarter of 2020.

Impacts of the COVID-19 pandemic on hours worked in the business sector, first quarter of 2021

Estimates of hours worked in the business sector are essentially based on data from the Labour Force Survey (LFS). It should be noted that for hours worked (used to measure productivity), both main and secondary jobs are considered—not only the main job as in the LFS. The main survey for the LFS for the reference period that includes the months of January, February and March does not capture the job losses outside the reference weeks. To account for those, as for the previous four quarters, the estimates of hours lost as a result of the pandemic were adjusted using a compilation of supplementary questions added to the LFS questionnaire in February, March and April 2021 for the respective reference months of January, February and March 2021. These adjustments are reflected in the data on hours worked and related measures (including labour productivity) for the first quarter of 2021.

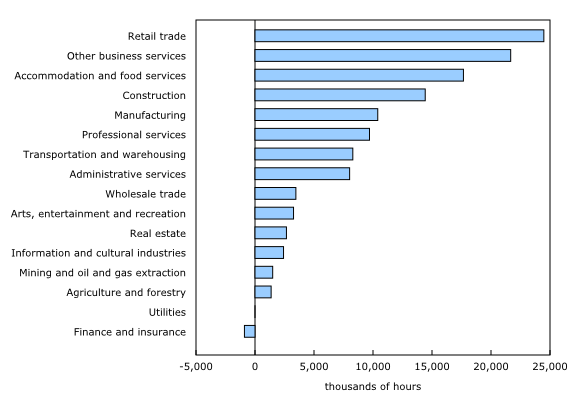

Hours of work lost in the business sector are quite similar to those recorded in the previous quarter

In the business sector, when only workers who were active or on paid leave are taken into account, roughly 133.6 million hours of work were lost in the first quarter, while 5.2 million hours of overtime were worked. The result is a net loss of 128.4 million hours. This loss was comparable to the one recorded in the previous quarter (-130.5 million hours).

At the industry level, all sectors continued to see hours lost in the first quarter, except finance and insurance. However, the magnitude of these losses was tied to the capacity of sectors to adapt to public health measures. As in the previous two quarters, the sectors most affected by hours lost were retail trade, other business services, and accommodation and food services. Close to half of the total hours lost in the first quarter were in these three sectors, where remote work is uncommon.

In the first quarter, among all activity sectors, retail trade (-24.5 million hours) lost the most hours. In contrast, a net gain in hours worked (almost 1 million hours) was observed only in finance and insurance, since workers in this sector clocked much more overtime than usual and remote work is already widespread.

Most industrial sectors continue to see productivity decline

Both goods-producing and service-producing businesses contributed to the overall decrease in productivity in the first quarter. After falling 1.8% in the previous quarter, productivity in goods-producing businesses declined 2.0%. Meanwhile, service-producing businesses decreased 1.5%, after posting a 2.7% drop in the previous quarter.

In general, productivity was down in 11 of the 16 main industrial sectors. Productivity increases were posted only in accommodation and food services (+4.6%); arts, entertainment and recreation (+2.8%); and mining and oil and gas extraction (+1.0%). Productivity was unchanged in both the agriculture and forestry and the retail trade sectors.

In the United States, the labour productivity of businesses rose 1.3% in the first quarter, after falling 1.1% in the fourth quarter of 2020.

Unit labour costs are virtually unchanged for a second consecutive quarter

In Canadian businesses, both productivity (-1.7%) and hourly compensation (-1.6%) continued to decline at a similar pace in the first quarter. As a result, labour costs per unit of output (+0.1%) of Canadian businesses were virtually unchanged for a second straight quarter.

Expressed in US dollars, unit labour costs of Canadian businesses were up 3.0%, the largest increase since the third quarter of 2017 (+9.4%). This increase in the first quarter largely reflects the appreciation of the Canadian dollar relative to the US dollar (+3.0%).

By comparison, unit labour costs of American businesses were essentially unchanged (-0.1%), with both productivity (+1.3%) and hourly compensation (+1.3%) posting similar gains.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release "Labour productivity, hourly compensation and unit labour cost" is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Volatile data starting in the first quarter of 2020

Data have been quite volatile from one quarter to the next, reflecting the impacts of the pandemic on economic activity and the labour market. Given the sharp changes in the last five quarters, the percentage changes from the pre-pandemic level—i.e., from the fourth quarter of 2019—can better reflect the changes in productivity and related measures than percentage changes from quarter to quarter. However, the quarterly data in Table 1 of this release are presented only in the usual format: the percentage change from the same quarter in the previous year (q/q-4) and the change from the previous quarter (q/q-1).

Revisions

With this release on labour productivity and related measures, data were revised back to the first quarter of 2020 at the aggregate and industry levels. These revisions are consistent with those incorporated in the release on quarterly gross domestic product (GDP) by income and expenditure and the release on monthly GDP by industry, released on June 1, 2021.

This release also incorporates the new 2020 benchmark data on provincial and territorial labour productivity and related measures, published on May 20, 2021.

Productivity measures

The term productivity in this release refers to labour productivity. For the purposes of this analysis, labour productivity and related variables cover the business sector only.

Labour productivity is a measure of real GDP per hour worked.

Unit labour cost is defined as the cost of workers' wages and benefits per unit of real GDP.

The approach to measuring real output in the business sector differs from the one that is used in the estimates by industry. For the business sector, output is measured using the expenditure-based GDP approach at market prices. This approach is similar to that used for the quarterly measures of productivity in the United States. However, output by industry is based on the value added at basic prices.

All the growth rates reported in this release are rounded to one decimal place. They are calculated with index numbers rounded to three decimal places, which are now available in data tables.

All necessary basic variables for productivity analyses (such as hours worked, employment, output and compensation) are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Next release

Labour productivity, hourly compensation and unit labour cost data for the second quarter of 2021 will be released on September 3.

Products

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structures.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: