Annual Survey of Manufacturing Industries, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-22

$703 billion

2019

1.4%

(annual change)

$7.1 billion

2019

-2.4%

(annual change)

$2.2 billion

2019

7.3%

(annual change)

$9.7 billion

2019

6.6%

(annual change)

$19.3 billion

2019

1.4%

(annual change)

$177.8 billion

2019

3.6%

(annual change)

$317.1 billion

2019

1.0%

(annual change)

$19.1 billion

2019

1.7%

(annual change)

$16.8 billion

2019

-1.4%

(annual change)

$78.8 billion

2019

-0.3%

(annual change)

$54.4 billion

2019

-0.8%

(annual change)

x

2019

x

(annual change)

$0.1 billion

2019

1.4%

(annual change)

x

2019

x

(annual change)

Total revenue of Canadian manufacturers increased by 1.5% or $11.0 billion to $749.6 billion in 2019. This is the fourth consecutive annual increase, up 13.9% since 2015.

Revenue from goods manufactured (see note to readers), which accounted for 94% of total revenue, recorded an annual increase of 1.4% or $9.7 billion to reach $702.5 billion in 2019.

Transportation equipment, food and fabricated metal product manufacturing lead the increase

Growth in revenue from goods manufactured was driven mostly by transportation equipment manufacturing (+$7.6 billion to $138.7 billion), food manufacturing (+$5.2 billion to $109.6 billion) and fabricated metal product manufacturing (+$3.2 billion to $42.4 billion).

Aerospace product and parts manufacturing grew 15.2% or $3.4 billion from 2018 to $25.6 billion in 2019, helped in part by increased international demand. According to the Canadian International Merchandise Trade Database, total exports for this industry were up 5.7% to $17.4 billion in 2019.

In 2019, motor vehicle manufacturing recouped a portion of the losses recorded in the previous two years, growing 4.1% or $2.5 billion from 2018, to $62.5 billion. Increased demand for Canadian-made motor vehicles was partly caused by a small recovery in exports to the United States (+3.5%). In 2019, manufacturing revenues were still 8.9% lower than their most recent peak of $68.6 billion in 2016.

While all food manufacturing industry groups were up in 2019, the largest gain was seen in meat product manufacturing (+$2.0 billion to $30.9 billion). The prices received as the goods left the plant increased by 4.4% for this industry. Canada exported just over a quarter of the meat it produced in 2019. Meat products made up 28% of all food manufacturing in 2019, followed by dairy at 14%.

In 2019, architectural and structural metals manufacturing contributed $2.0 billion or 61% to the annual increase seen in fabricated metal product manufacturing. All industry groups except forging and stamping grew.

Wood product and primary metal manufacturing in decline

The gains in revenue from goods manufactured were curbed mostly by decreases seen in wood product manufacturing (-$4.3 billion to $31.6 billion) and primary metal manufacturing (-$3.6 billion to $49.3 billion).

Revenue from wood product manufacturing fell 11.9% in 2019, following seven consecutive increases which had resulted in a growth of 80.5%. Domestic and United States demand for Canadian wood products declined in 2019. Housing starts in Canada were down 2.0% to 208,685 units in 2019, while exports of wood products to the United States fell 14.8% or $2.2 billion to $12.3 billion.

Revenue from primary metal manufacturing fell 6.9% or $3.6 billion in 2019, more than offsetting the increase of 4.4% seen in 2018. The alumina and aluminum production and processing industry and the iron and steel mills and ferro-alloy industry contributed a combined $3.1 billion to the decline, mostly on the heels of a decline in exports to the United States of $2.0 billion. From June 1, 2018, to May 20, 2019, the United States imposed a 25% import tariff on Canadian steel and a 10% tariff on Canadian aluminum products. The impact of these tariffs on Canada's exports was noteworthy and varied by product group. Prices also declined by 1.7% in the primary metal industry.

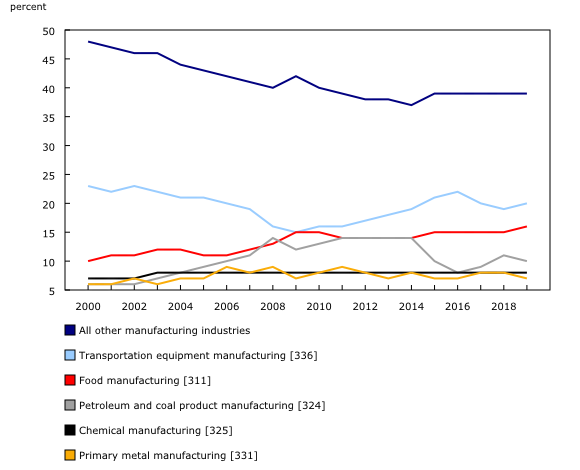

The share of petroleum and coal product manufacturing is shrinking

In 2019, transportation equipment retained the largest share of revenue from goods manufactured at 20%, followed by food at 16%. Petroleum and coal product manufacturing was in third position with a share of 10%. This share represents a decrease from the 13% share of 10 years earlier, the three percentage points having been lost to transportation equipment manufacturing.

In 2019, revenues from goods manufactured in transportation equipment grew 5.8%, caused in part by a 2.0% increase in prices. Ontario and Quebec made up 93% of the industry. The motor vehicle market share of transportation equipment revenue fell from 52% in 2010 to 45% in 2019, while the share of aerospace product manufacturing grew from 16% to 18% over the same period.

Industrial food prices rose 2.1%, contributing to the 5.0% increase in revenue from goods manufactured in the food industry. Ontario (38%), Quebec (23%) and Alberta (13%) make up most of the food industry, but this industry is the largest manufacturing activity in Prince Edward Island, Saskatchewan, Nova Scotia and Manitoba.

After two years of consecutive growth, revenue from goods manufactured for petroleum and coal product manufacturing decreased by 0.8% in 2019, to $72.6 billion, mostly due to the decline recorded in Ontario (-$2.8 billion or -14.6%). The Industrial Product Price Index fell 5.1% in this industry in 2019.

Expenses grow faster than revenue for a third year

Total expenses grew faster than total revenue for a third consecutive year. In 2019, total expenses were up 2.2% or $15.1 billion to reach $686.2 billion, while total revenues increased by 1.5% or $11.0 billion to $749.6 billion.

For every dollar earned in total revenue in 2019, manufacturing companies spent an average of 92 cents in total expenses. The beverage and tobacco product industry spent the least (78 cents), while the wood product industry spent the most (97 cents).

The wood product manufacturing industry was particularly hard-hit with an 8-cent increase per dollar spent from 2018. Canadian mills were impacted by lower lumber and other sawmill product prices, ongoing duties imposed by the United States on exports of Canadian softwood lumber to their country, as well as production curtailments.

Cost of materials and supplies are stable

Total cost of materials and supplies, which include expenses such as raw materials and components, repairs and maintenance, and payments to manufacturing subcontractors, were relatively stable in 2019, increasing by 0.7% or $2.8 billion to $432.2 billion.

In 2019, for every dollar earned in total revenue, manufacturing companies spent 58 cents in total cost of materials and supplies. The three most material-intensive industries were petroleum and coal product (76 cents), transportation equipment (70 cents) and primary metal (66 cents). Beverage and tobacco products was the least material-intensive industry (35 cents).

Total salaries and wages on the rise

Total salaries and wages reached $97.8 billion, an increase of 3.4% or $3.2 billion from 2018.

Petroleum and coal product was the least labour-intensive industry in 2019, spending 2 cents of every dollar earned on total salaries and wages. The printing and related support activities industry spent the most at 27 cents.

In 2019, total salaries and wages were up for a second year in 15 of 21 industries. Beverage and tobacco product manufacturing recorded the largest annual growth rate (+13.3%) and clothing manufacturing the smallest (+1.0%). The largest decline came from wood product manufacturing (-2.4%).

Note to readers

Data on cannabis manufacturing were collected for the first time as part of the Annual Survey of Manufacturing and Logging Industries for reference year 2019. They were added as a third sub-industry under the beverages and tobacco product manufacturing industry.

In addition to revenue from the sale of physical goods manufactured, revenue from goods manufactured also includes revenue from manufacturing service fees and custom work, as well as from repair work. In these cases, clients are only charged for labour, as they own the materials and products.

The difference between total revenue and revenue from goods manufactured is made up of revenue from financial investments, sales of goods purchased for resale (as is), and business activities other than manufacturing, such as wholesaling.

Data for 2018 have been revised.

This survey collects data from businesses based on their fiscal year. For the year 2019, this can include data for the period ending as late as March 31, 2020. As such, these results do not fully reflect the impact of COVID-19 on businesses. Future releases from this survey will provide more comprehensive information on the impact of COVID-19 on businesses. In the meantime, users can obtain information from the Monthly Survey of Manufacturing or from other Statistics Canada programs.

The data for reference year 2019 were collected during the spring and summer of 2020. This collection period includes the events and business disruptions related to COVID-19 and, in some industries, response rates have been lower. As a result, there may be larger-than-normal revisions to the data in future releases. For more information on data quality and revisions please refer to 2103- Annual Survey of Manufacturing and Logging Industries.

Changes in methodology were made to the Annual Survey of Manufacturing and Logging Industries beginning with reference year 2013. Users should therefore use caution when comparing current data with historical data prior to 2013. For more information on the methodology changes, consult the Integrated Business Statistics Program document in the Behind the data feature of our website.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: