Non-residential capital and repair expenditures, 2021 (intentions)

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-02-26

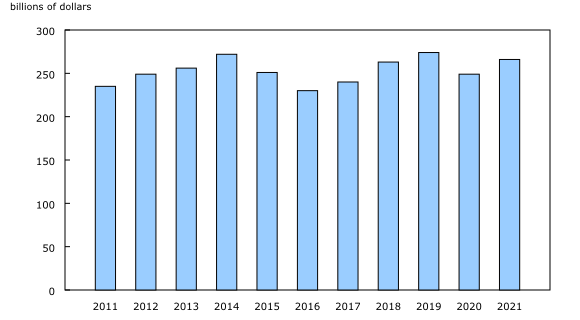

Capital spending expected to partially recover in 2021

Capital expenditures on non-residential construction and machinery and equipment are expected to increase 7.0% to $266.2 billion in 2021, following a 9.2% decline in 2020 largely attributable to the economic shock from the COVID-19 pandemic. While capital spending on non-residential structures is expected to reach $175.2 billion, up 7.5% from 2020 and surpassing the level achieved in 2019, the $91 billion anticipated for machinery and equipment (+6.2%) falls short of fully offsetting the 13.4% decline reported in 2020.

Highlights

Capital spending by public sector organizations is anticipated to increase by 9.3%, advancing on the 5.7% growth in 2020. Investments in privately held non-residential tangible assets are expected to increase by 5.6% in 2021, well short of compensating for the sizable 16.7% decline in 2020.

Of the 20 industrial sectors, 14 have indicated plans to increase their capital expenditures in 2021, compared with 5 in 2020 and 15 in 2019.

The transportation and warehousing sector is expected to lead the way for investment in Canada in 2020 and 2021, reinforcing its critical logistical role in the economy. Its capital spending is set to reach a record of $47.9 billion in 2021 (+7.2%), following a similar gain in 2020 (+4.9%) and a significant increase in 2019 (+19.5%).

Capital spending in the mining, quarrying, and oil and gas extraction sector is set to increase to $32.9 billion (+5.2%) in 2021, following a substantial decrease of $14.7 billion (-31.9%) in 2020.

Significant reductions in capital spending occurred in 2020 (-29.9%) and are expected to continue in 2021 (-26.6%) in the accommodation and food services sector, as it was directly affected by government public health restrictions related to the COVID-19 pandemic.

All but three provinces and territories should see their spending intentions increase in 2021, with the largest gains taking place in Ontario (+$7.0 billion), Quebec (+$4.7 billion) and Alberta (+$2.5 billion). This is the reverse of what took place in 2020, when preliminary estimates showed decreased investment levels for nine provinces and territories, with notable changes taking place in Alberta (-$9.7 billion), Ontario ($-6.9 billion) and Saskatchewan (-$2.4 billion).

The transportation and warehousing sector, which has not been slowed down by COVID-19, is leading investment

Record capital spending is anticipated in the transportation and warehousing sector in 2021 ($47.9 billion), driven by increased investment in non-residential construction. In fact, expenditures are expected to grow for a fifth consecutive year, with spending on structures more than doubling since 2016.

The transit and ground passenger transportation subsector should see its total investment in 2021 increase by 10.4% (+$1.2 billion to $12.3 billion) because of several large-scale public transit projects taking place in Quebec and Ontario. The governments of Canada and Quebec announced they would each invest $1.28 billion in the projected $6.3 billion cost to complete the Réseau express métropolitain in Montréal. Large investments are also expected to take place in Ontario, with the City of Ottawa having held its groundbreaking ceremony for the $4.7 billion Stage 2 of its light rail transit project in September 2020. Similar public transit projects are also ongoing in Toronto, with news of progress on the construction of the Metrolinx Eglinton Crosstown light rail transit project.

Increases are also anticipated in the pipeline transportation subsector (+$552 million to $13.0 billion) and in support activities for transportation (+$693 million to $10.7 billion). The majority of the investments for these subsectors would take place in British Columbia and Alberta.

Capital spending in the mining, quarrying, and oil and gas extraction sector is anticipated to increase to $32.9 billion (+5.2%) in 2021, following a notable decrease of $14.7 billion (-31.9%) in 2020. The oil and gas extraction subsector has been greatly affected by the COVID-19 pandemic, as noted in the energy statistics release. The global demand for crude oil was down 6.1%, and, in Canada, consumption of motor gasoline decreased 13.7% year over year, largely because many Canadians worked from home, and numerous travel restrictions and stay-at-home orders were implemented. Against this backdrop, the oil and gas extraction subsector decreased its total capital outlays by $12.2 billion in 2020, affecting both conventional oil and gas extraction (-$9.2 billion to $14.3 billion) and non-conventional oil extraction (-$3.0 billion to $7.4 billion).

The accommodation and food services sector posted the largest investment decline in 2020 (-29.9%) and anticipates a further decline in 2021 (-26.6%) as it deals with loss of revenue. Results from the Quarterly financial statistics for enterprises indicate that the arts, entertainment and recreation sector and the accommodation and food services sector both posted a net loss for 2020. However, there seems to be some optimism within the arts, entertainment and recreation sector as it anticipates an increase in capital spending of 8.6% in 2021, following a decrease of 13.3% in 2020.

Manufacturing firms reported an 11.3% increase in capital spending intentions for 2021 to $20.2 billion, mostly because of 14.5% growth in spending on capital machinery and equipment. Following a 10.6% increase in 2019, manufacturers reported a decrease of 22.5% in 2020, with chemical manufacturing in Ontario (-$903 million) and Alberta (-$767 million) being most impacted, largely because of projects reaching completion.

Leading the investment for manufacturing in 2021 is the transportation equipment manufacturing subsector, with a forecasted increase of 70.1% (+$1.4 billion to $3.5 billion). Several manufacturers have announced significant investments in electric vehicle manufacturing in Ontario. General Motors Canada announced on January 18, 2021, that it is investing $1 billion at the Ingersoll CAMI Assembly plant for electric vehicle manufacturing. Also, on October 8, 2020, the governments of Canada and Ontario announced they are each investing $295 million to retool Ford of Canada's Oakville Assembly Complex into a global hub for battery electric vehicle production. Similarly, Fiat Chrysler Automobiles is investing up to $1.5 billion in a multi-energy vehicle platform at the Windsor Assembly Plant.

Public sector organizations increasing investments during the pandemic

Investment from the public sector continued amid the pandemic, with an increase of $9.1 billion (+9.3%) expected in 2021, on top of a $5.3 billion (+5.7%) increase in 2020. This contrasts with investment by private sector organizations, whose spending decreased by $30.4 billion (-16.7%) in 2020; a modest recovery is expected in 2021, up $8.4 billion (+5.6%). Spending increases for 2021 are expected in all government sectors, with notable increases in provincial and territorial public administration (+$1.4 billion); local, municipal and regional public administration (+$1.2 billion); and educational services (+$1.1 billion).

Regional summary

While increased investment in non-residential construction and machinery and equipment is expected in 10 of the 13 provinces and territories in 2021, few anticipate levels to reach those recorded in 2019 because of decreases in 2020. However, not all provinces and territories saw declines in capital spending in 2020—Prince Edward Island (+9.4%), the Northwest Territories (+9.1%), British Columbia (+2.4%) and Nova Scotia (+2.0%) all recorded growth in 2020.

In 2021, investment spending is expected to increase in Ontario (+9.1% to $83.9 billion) and Quebec (+10.9% to $48.3 billion), following decreases of 8.2% and 4.9%, respectively, in 2020. Both provinces were greatly affected by much higher COVID-19 case counts in 2020 than other jurisdictions, and public health measures were more severe and shutdowns were in place for longer. The expectation is that the economy will recover quickly enough once vaccines are rolled out in sufficient quantities, positively impacting investment.

All the Atlantic provinces except New Brunswick anticipate a reduction in capital investment for 2021. However, for Prince Edward Island and Nova Scotia, expenditures increased in 2020 compared with 2019. Strong population growth in Prince Edward Island prior to the pandemic helped maintain investment activity levels in 2020. Monthly investment in non-residential buildings was up 20.0% for 2020 compared with 2019 in this province.

Capital expenditures on Canadian infrastructure increase by 7.2% in 2019

Capital investment in infrastructure assets increased by $6.8 billion to $100.1 billion in 2019, with growth observed in 9 of 16 infrastructure functions. Outlays on transport other than roads and public transit recorded the largest growth (+$4.2 billion, or +33.4%) largely because of major projects in pipelines, rail and seaports.

Spending on transport, including road transport and public transit, increased to $42.7 billion (+12.4%) and continues to lead investment in most provinces and territories. Investment in electricity infrastructure increased to $19.4 billion (+15.3%) and was the largest contributor to infrastructure spending in Manitoba ($1.6 billion) and Newfoundland and Labrador ($1.2 billion). Investment in the housing function (social and affordable rental homes) occupied the top spot in Nunavut ($72.4 million). In an interesting reversal, investment in health and social protection infrastructure, except housing, increased by 25.6% in 2019, while spending on education infrastructure decreased by 20.3%.

Spending increased on both publicly owned (+2.5%) and privately owned (+23.2%) infrastructure assets in 2019. Capital expenditures to support transport (air, rail, marine and pipeline) and electricity accounted for the majority of investments in infrastructure by private sector organizations (70.2%).

Note to readers

The Capital and Repair Expenditures Survey is based on a sample survey of 25,000 private and public organizations. The survey on intentions for 2021 was conducted from September 2020 to January 2021.

The survey includes intentions for 2021, preliminary estimates for 2020 and revised estimates for 2019.

Data in this release are expressed in current dollars.

Infrastructure is the physical structures and systems that support the production of goods and services and their delivery to and consumption by governments, businesses and citizens. The product Sources and Methods: Capital Investment in Infrastructure provides a summary of concepts and comparability with alternative data sources.

Visit the Construction Statistics portal to find data, publications and interactive tools related to construction statistics in one convenient location.

Real time data tables

Real time data tables 34-10-0278-01 and 34-10-0279-01 will be updated March 2.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

For analytical information, or to enquire about the concepts, methods or data quality of this release, contact Pierre-Louis Venne (613-853-2107; pierre-louis.venne@canada.ca), Investment, Science and Technology Division.

- Date modified: