Balance sheet of the agricultural sector, December 31, 2019 (revised data)

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-02-18

$540.5 billion

2019

3.4%

(annual change)

$0.3 billion

2019

-0.0%

(annual change)

$2.6 billion

2019

16.4%

(annual change)

$2.4 billion

2019

1.0%

(annual change)

$2.6 billion

2019

13.3%

(annual change)

$55.6 billion

2019

3.9%

(annual change)

$140.9 billion

2019

4.9%

(annual change)

$40.7 billion

2019

1.1%

(annual change)

$106.9 billion

2019

3.8%

(annual change)

$151.3 billion

2019

1.7%

(annual change)

$37.4 billion

2019

4.1%

(annual change)

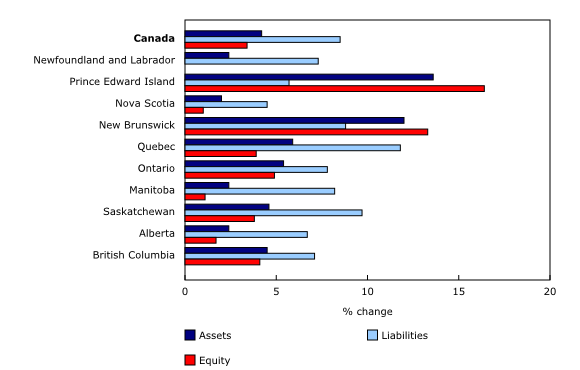

Farm equity in Canada rose 3.4% to $540.5 billion as of December 31, 2019. This was the smallest annual percentage increase in farm equity since 2009 as growth in land values slowed and farm debt continued to rise.

Farm equity rose in every province except Newfoundland and Labrador, where it was essentially unchanged. Just under 60% of the increase was attributable to the gains in Ontario and Saskatchewan.

Asset values increase on the continued appreciation of farmland

The value of total farm assets rose 4.2% to $649.7 billion in 2019—the smallest percentage increase since 2009. Contributing to this growth in asset values was a 5.0% rise in land values. According to the Farm Credit Canada Farmland Values Report, the 2019 increase in land values was the lowest rate of growth since 2010. Even so, rising land values accounted for 80.6% of the increase in total asset values. The value of land was up in every province except Newfoundland and Labrador, which posted a small decline (-0.5%). Ontario (+6.0%) accounted for almost one-third of the national increase.

Higher quota values and continued investment in machinery also contributed to the rise in farm asset values. Moderating this increase was a 6.3% decline in the value of breeding livestock inventories as a result of lower prices and lower inventories.

Total liabilities increase in all provinces

Total liabilities rose at a faster pace than farm assets, up 8.5% to $109.2 billion at the end of 2019, above the previous five-year average increase of 6.6%. Almost 90% of the gain was attributable to a 9.3% rise in long-term liabilities. Total liabilities grew in every province, with Quebec (+11.8%) and Ontario (+7.8%) accounting for almost half of the national increase.

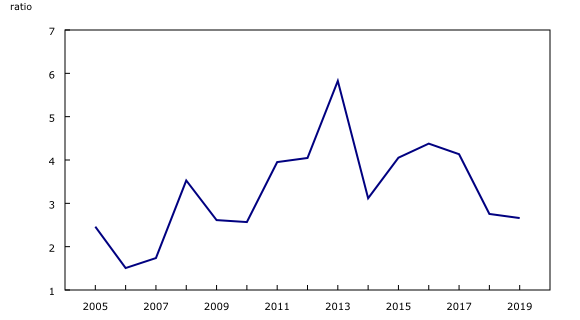

Interest coverage ratio falls to its lowest value since 2010

The interest coverage ratio, which measures the ability of the farm business to meet its interest payments (net income before interest and taxes divided by interest expenses), fell from 2.8 in 2018 to 2.7 in 2019. This was its lowest value since 2010 (2.6) and the third consecutive decline.

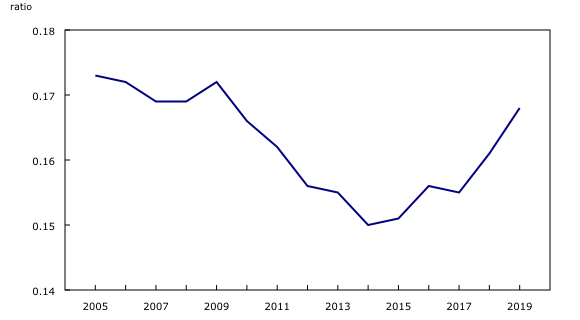

Debt-to-asset ratio rises again

The debt-to-asset ratio rose for the fourth time in five years, up 4.3% to its highest level since 2009. This indicates that a higher proportion of assets were financed through debt. It is also a measure of solvency—the ability of a farm to repay debt obligations when due. Two profitability measures—the rate of return on farm assets as well as farm equity—were both essentially unchanged in 2019 from the recent lows recorded a year earlier.

Note to readers

The balance sheet of the agricultural sector provides the value of farm assets used in agricultural production, the liabilities associated with these assets and the farm sector equity as of December 31 for Canada and the provinces.

Assets and liabilities in the agriculture sector's balance sheet include those of farm businesses and non-operator landlords (for farm real estate assets leased to farm operators and the corresponding liabilities) and exclude the personal portion of farm households. This most closely reflects the assets and liabilities used in agricultural production.

The balance sheet of the agricultural sector integrates data already produced by Statistics Canada, such as farm debt, value of farm capital, livestock and crop estimates, farm product prices, and selected data from the Farm Financial Survey. These data are subject to revision.

Products

Find more agriculture and food statistics.

Support the 2021 Census of Agriculture.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: