Labour Force Survey, September 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-10-09

Context: COVID-19 restrictions continue to ease

The September Labour Force Survey (LFS) results reflect labour market conditions as of the week of September 13 to 19. At the beginning of September, as Canadian families adapted to new back-to-school routines, public health restrictions had been substantially eased across the country and many businesses and workplaces had re-opened. Throughout the month, some restrictions were re-imposed in response to increases in the number of COVID-19 cases. In British Columbia, new rules and guidelines related to bars and restaurants were implemented on September 8. In Ontario, limits on social gatherings were tightened for the hot spots of Toronto, Peel and Ottawa on September 17 and for the rest of the province on September 19.

Assessing the labour market as the lifting of COVID-19 restrictions continues

This LFS release continues to integrate the international standard concepts such as employment and unemployment with supplementary indicators that help to monitor the labour market as restrictions are lifted and capture the full scope of the impacts of COVID-19.

A series of survey enhancements were continued in September, including supplementary questions on working from home, workplace adaptations, financial capacity, concerns related to returning to usual workplaces and receipt of federal COVID-19 support payments.

This release also includes, for the third consecutive month, information on the labour market conditions of population groups designated as visible minorities. Through the addition of a new survey question and the introduction of new statistical methods, the LFS is now able to more fully determine the impact of the COVID-19 economic shutdown on diverse groups of Canadians.

Data from the LFS are based on a sample of more than 50,000 households. Statistics Canada continued to protect the health and safety of Canadians in September by adjusting the processes involved in survey operations. We are deeply grateful to the many Canadians who responded to the survey. Their ongoing cooperation ensures that we continue to paint an accurate and current portrait of the Canadian labour market and Canada's economic performance.

Highlights

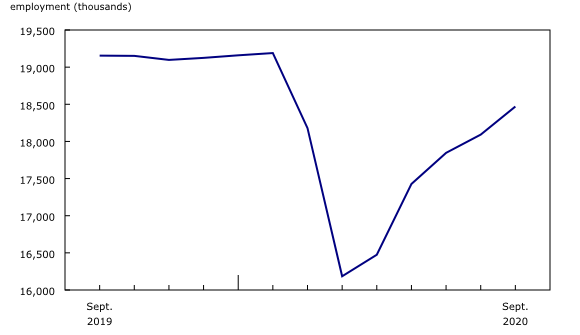

Employment rose by 378,000 (+2.1%) in September, bringing employment to within 720,000 (-3.7%) of its pre-COVID February level

Most of the employment increase in September was in full-time work, which rose by 334,000 (+2.1%), building on gains of 206,000 (+1.4%) in August.

The number of Canadians who were employed but worked less than half their usual hours for reasons likely related to COVID-19 fell by 108,000 (-7.1%) in September.

Among Canadians who worked most of their usual hours, the proportion working from home edged down from August to September, from 26.4% to 25.6%.

Employment increased in every province except New Brunswick and Prince Edward Island in September, with the largest gains in Ontario and Quebec.

Self-employment was little changed in September. Compared with February, self-employment was down 6.0%, while the number of employees was within 3.3% of its pre-pandemic level.

Employment among core-aged women (25 to 54 years old) increased for the fifth consecutive month (+134,000; +2.3%) in September, outpacing core-age men. The increase was split between full-time and part-time work. Employment for this group was within 2.1% of pre-COVID employment levels—the closest of the major demographic groups.

Employment among core-age men rose by 61,000 (+1.0%) in September, driven by full-time gains. This brought core aged men to within 2.4% of their pre-COVID employment level.

For both mothers (+0.9%) and fathers (+1.5%), September employment was on par with pre-pandemic levels (not seasonally adjusted).

Employment growth was strong for young women (+62,000 or +5.7%) and men (+66,000 or +6.0%) aged 15 to 24 in September. Despite these increases, employment for Canadian youth remained 10% below February levels, much further behind the recovery in the other major demographic groups.

Compared with September 2019, the number of low-wage employees was down by more than one-fifth (-761,000) in September 2020 (not seasonally adjusted).

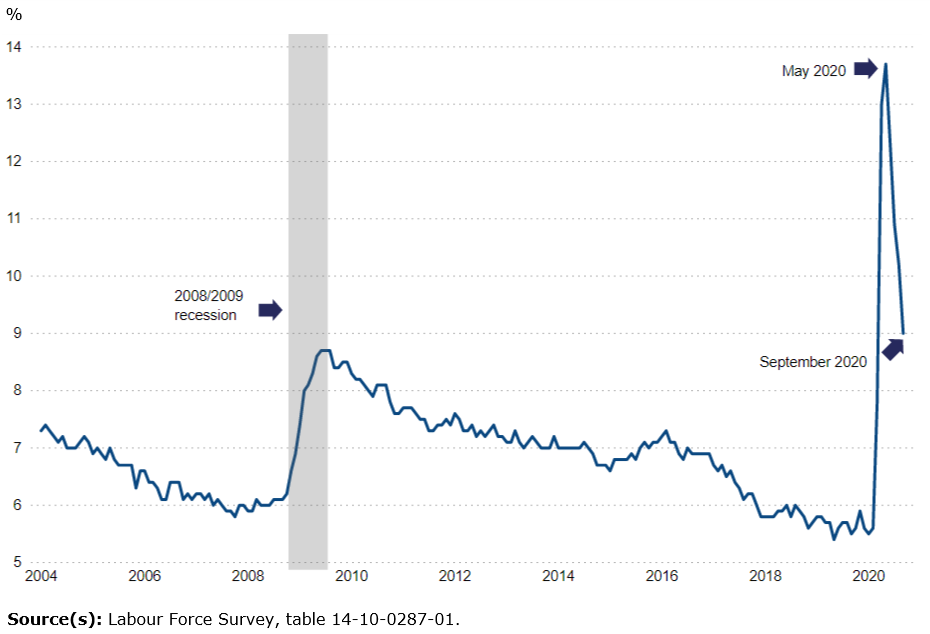

The unemployment rate declined for the fourth consecutive month in September, falling 1.2 percentage points to 9.0%

There were 1.8 million unemployed Canadians in September, down 214,000 (-10.5%) from August and continuing the four-month downward trend from the record-high 2.6 million unemployed people in May.

The majority of unemployed people (approximately 1.5 million) were looking for work.

The number of people who wanted to work but did not search for a job (580,000) has been trending downward since peaking at 1.5 million in April.

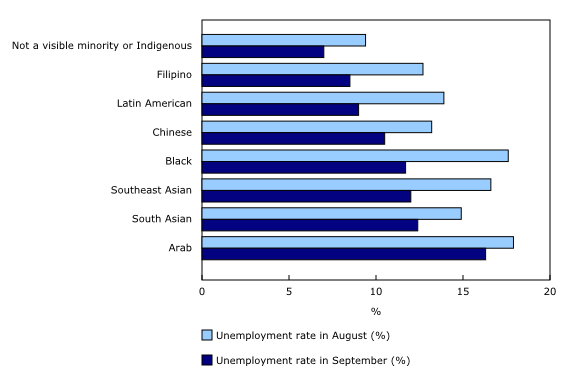

The unemployment rate of Black Canadians dropped 5.9 percentage points to 11.7% in September, while the rate for Filipino Canadians declined by 4.2 percentage points to 8.5%.

The unemployment rate for male youth aged 15 to 24 remained the highest among all major demographic groups at 20.5% in September, although it was down 5.1 percentage points from August.

Employment continued to increase in both the services-producing (+2.1%) and the goods-producing (+2.0%) sectors in September

In services, monthly gains were led by accommodation and food services (+72,000), educational services (+68,000) as well as information, culture and recreation (+56,000).

In the goods sector, employment gains were largest in manufacturing (+68,000).

Employment was 3.6% below its pre-COVID February level in the services sector, and 4.3% below in the goods-producing sector.

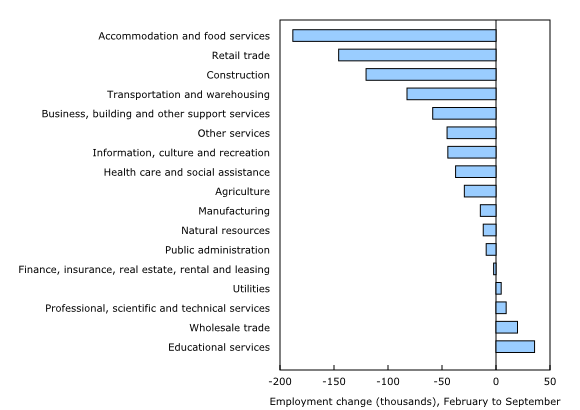

Compared with February, total employment was down 720,000 (-3.7%), with three-quarters of this decline coming from four industries: accommodation and food services, retail trade, construction, and transportation and warehousing.

While some industries face a long recovery to pre-COVID employment levels, some sectors, including manufacturing, have almost fully recovered.

Employment in September is higher than it was in February in educational services.

The proportion of Canadians receiving Canada Emergency Response Benefit (CERB), Canada Emergency Student Benefit (CESB) or regular Employment Insurance payments fell from 16.1% in August to 13.5% in September

One in five (21.8%) CERB recipients in September were either currently self-employed or had been self-employed in the last 12 months.

Employment growth accelerates in September

Following an increase of 246,000 (+1.4%) in August, employment rose by 378,000 (+2.1%) in September. The unemployment rate declined 1.2 percentage points to 9.0% in September, down from the peak of 13.7% in May.

September gains brought employment to within 720,000 (-3.7%) of its pre-COVID February level. The accommodation and food services (-188,000) and retail trade (-146,000) industries remained furthest from full recovery, while youth employment was 263,000 (-10.3%) below February levels.

The number of Canadians who were employed but worked less than half their usual hours for reasons likely related to COVID-19 fell by 108,000 (-7.1%) in September. Combined with the declines from May to August, this left COVID-related absences from work at 605,000 (+74.9%) above February levels.

During the September 13 to 19 reference week, the total number of Canadian workers affected by the COVID-19 economic shutdown stood at 1.3 million. In April, this number peaked at 5.5 million, including a 3.0 million drop in employment and a COVID-related increase of 2.5 million absences from work.

The share of Canadians working from home edges down

Among Canadians who worked most of their usual hours, the proportion working from home edged down in September, from 26.4% to 25.6%. Consistent with typical seasonal patterns, the number of Canadians working their usual hours increased notably, with increases among both those working from home (+300,000) and those working at locations other than home (+1.4 million).

A large number of Canadians continued to adapt to COVID-19 by working remotely in September, with over twice as many people working from home (4.2 million) than those who usually do so (1.9 million).

The transition to working from home has involved new challenges in terms of job demands and balancing work and family life. In September, employees who worked at least half their usual hours and who worked from home worked longer hours on average per week (37.6 hours) than their counterparts who worked outside the home (35.6 hours). Employees working from home also worked more unpaid overtime on average (1.6 hours) than employees working outside the home (0.7 hours).

Employment growth concentrated in full-time work

Most of the employment increase in September was in full-time work, which rose by 334,000 (+2.1%), building on gains of 206,000 (+1.4%) in August. The number of part-time workers grew at a slower pace in September (+44,000; +1.3%), following virtually no change in August. More than one in five part-time workers (22.7%) wanted full-time work but were unable to find it, an increase of 3.4 percentage points from 12 months earlier.

Self-employment unchanged in September

For self-employed Canadians, the labour market impacts of the COVID-19 shutdown and subsequent re-opening have been different than for employees. From February to April, employment losses were less pronounced for the self-employed (-79,000; -2.7%) than for employees (-2.9 million; -18.0%). As total employment rebounded from April to September, the number of self-employed workers initially remained flat before declining in August.

Self-employment was little changed in September. Compared with February, self-employment was down 6.0%, while the number of employees was within 3.3% of its pre-pandemic level. In addition, the self-employed continued to experience a larger drop in hours than employees. On a year-over-year basis, the total number of hours worked by self-employed workers was down 17.4%, compared with 3.9% for employees.

Unemployment rate continues to fall

The unemployment rate declined for the fourth consecutive month in September, falling 1.2 percentage points to 9.0%. As a result of the COVID-19 economic shutdown, the unemployment rate more than doubled from 5.6% in February to a record high 13.7% in May. By way of comparison, during the 2008/2009 recession, the unemployment rate rose from 6.2% in October 2008 to peak at 8.7% in June 2009. It then took approximately nine years to return to its pre-recession rate.

There were 1.8 million unemployed Canadians in September, down 214,000 (-10.5%) from August and continuing the four-month downward trend from the record-high 2.6 million unemployed people in May. The majority of unemployed people (approximately 1.5 million) were job searchers, while 363,000 Canadians were either on temporary layoff, and expected to return to a previous job within six months, or had arrangements to begin a new job within four weeks.

In any given month, the net change in unemployment is the difference between the number of people becoming unemployed and those leaving unemployment, either because they became employed or left the labour force. In September, more than half of those who left unemployment became employed (57.3%), while over half of those who became unemployed in September (59.4%) had been out of the labour force in August.

Unemployment rate falls for Black Canadians but remains higher than average

From August to September, the unemployment rate for 15- to 69-year-olds declined among six of the seven largest population groups designated as visible minorities for which reliable estimates could be produced using the current LFS sample size (not seasonally adjusted). There was little change in the unemployment rate of Arab Canadians.

The unemployment rate of Black Canadians dropped 5.9 percentage points to 11.7% in September, while the rate for Filipino Canadians declined by 4.2 percentage points to 8.5% (not seasonally adjusted). Canadians who did not identify as Indigenous and who were not a visible minority continued to have the lowest unemployment rate in September (7.0%), while Arab Canadians (16.3%) had the highest unemployment rate (not seasonally adjusted).

The decrease in the unemployment rate among Black Canadians in September was mainly attributable to employment gains and lower unemployment in sales and service occupations, as well as in occupations in education, law and social, community and government services. Ontario accounted for nearly 80% of net employment gains within the Black population.

Labour underutilization continues to fall

The number of people who wanted to work but did not search for a job was down in September (-77,000; -11.8%). If people in this group were included as unemployed, the adjusted unemployment rate would be 11.9%. The overall number of people who wanted to work but did not search for a job (580,000) has been trending downward since peaking at 1.5 million in April.

Labour underutilization occurs when people who could potentially work are not working, or when people could work more hours than they are currently. The "labour underutilization rate" combines those who were unemployed, those who were not in the labour force but who wanted a job and did not look for one, and those who were employed but worked less than half of their usual hours for reasons likely related to the pandemic.

The labour underutilization rate peaked at 36.1% in April and has trended downward ever since. In September, as the economy continued to recover, the labour underutilization rate fell from 20.3% in August to 18.3%, but still remained well above pre-pandemic levels (11.2% in February).

Employment increases in both goods-producing and services-producing sectors

Employment continued to increase in both the services-producing (+303,000; +2.1%) and the goods-producing (+75,000; +2.0%) sectors in September. In services, monthly gains were led by accommodation and food services (+72,000), educational services (+68,000) as well as information, culture and recreation (+56,000). In the goods sector, employment gains were largest in manufacturing (+68,000).

As the Canadian economy continues to recover and adapt to the impacts of COVID-19, some industries face a longer path to recovery than others. Compared with February, total employment in September was down 720,000 (-3.7%), with three-quarters of this decline coming from four industries: accommodation and food services, retail trade, construction, and transportation and warehousing.

Employment continues to recover in accommodation and food services but stalls in retail trade

Employment in accommodation and food services rose by 72,000 (+7.4%) in September. This was the fifth consecutive monthly increase and brought total gains since the initial easing of COVID-19 restrictions in May to 427,000. Nevertheless, employment in this industry was the furthest from recovery in September, down 15.3% (-188,000) from its pre-pandemic February level.

The accommodation and food services industry is likely to continue to face a number of challenges over the coming months. While outdoor dining is likely to become impractical during the winter months and as some COVID restrictions are re-introduced, a recent study indicated that Canadians plan to reduce spending at restaurants (see Expected changes in spending habits during the recovery period).

Following four months of increases, employment in retail trade held steady in September. Compared with February, employment in this industry was down by 146,000 (-6.4%). After increasing sharply in May and June, following the initial easing of COVID-19 restrictions, retail sales slowed markedly in July.

In construction, long road to recovery remains

Employment in construction remained little changed for the second consecutive month in September, and was down by 120,000 (-8.1%) compared with its pre-COVID level. Compared with February, employment in construction was down the most in Ontario (-54,000; -9.5%) and British Columbia (-39,000; -16.3%).

Construction consists of three subsectors: construction of buildings, heavy and civil engineering construction, and specialty trade contractors. According to the latest results from the Survey of Employment Payrolls and Hours, employment in construction fell from February to July in each of these subsectors, with the largest decline among specialty trade contractors. Results from the release of investment in building construction for July showed that investment in building construction was slightly lower in July than in February.

Employment in transportation and warehousing recovers modestly in September

The number of people employed in transportation and warehousing rose by 23,000 (+2.5%) in September, the first notable increase since June. Employment in this industry declined by 82,000 (-8.0%) compared with February.

The employment decline since February in the transportation and warehousing industry is consistent with a number of indicators showing that transportation has faced particular challenges in recovering from the COVID-19 economic shutdown. For example, results from the monthly civil aviation statistics program show that major Canadian airlines faced an 89.5% drop in passenger demand from July 2019 to July 2020. Similarly, data from the urban public transit statistics program show that the number of public transit passengers fell by 65.5% year over year in July.

Manufacturing employment almost fully recovered, but lagging behind in Alberta

While some industries face a long recovery to pre-COVID employment levels, some sectors—including manufacturing—have almost fully recovered.

The pace of employment growth in manufacturing picked up in September (+68,000; +4.1%), following two months of modest growth over the summer. The September gains brought the total employment change in this industry to a level similar to that of February. While employment in manufacturing remained well below pre-pandemic levels in Alberta (-17,000; -12.1%) and to a lesser extent in Quebec (-15,000; -3.1%), employment was above the pre-COVID level in Ontario (+17,000; +2.3%).

The most recent gross domestic product by industry data showed a significant expansion in the manufacturing sector for the months of June (+5.9%) and July (+15.9%), as many factories ramped up production in response to the initial re-opening of the economy. Despite the continued gains through July, manufacturing activity remained about 6% below February's pre-pandemic level. Results from the Monthly Survey of Manufacturing showed that sales increased for a third consecutive month in July, with motor vehicle and parts producers accounting for most of the increase, as many automakers shortened or skipped their summer shutdowns.

Early in the COVID-19 economic shutdown, concerns about availability of personal protective equipment (PPE) stemmed largely from concerns about access to international supplies. As of July, 7.4% of businesses in the manufacturing, wholesale, and retail trade sectors are involved with the production or distribution of PPE, according to the report titled "Gearing up to restart: Businesses' need for personal protective equipment," released today.

Employment in educational services rises in September and surpasses pre-COVID levels

Employment in educational services grew by 68,000 (+5.0%) in September, led by Ontario and Quebec. After declining by 11.5% from February to April, employment in the industry has now increased for five consecutive months and has reached a level 2.6% higher than in February.

As students returned to school in August and September, a number of jurisdictions increased staffing levels to support classroom adaptations. On a year-over-year basis, employment in educational services was up by 32,000 (+2.3%) in September, driven by an increase in elementary and secondary school teachers and educational counsellors (not seasonally adjusted).

Employment slow to recover for low-wage employees

The labour market impact of the COVID-19 economic shutdown has been particularly severe for low-wage employees (defined as those who earned less than $16.03 per hour, or two-thirds of the 2019 annual median wage of $24.04/hour). From February to April, employment among low-wage employees fell by 38.1%, compared with a decline of 12.7% for all other paid employees (not seasonally adjusted).

In September, there were one-fifth fewer (-22.1%; -761,000) low-wage employees than 12 months previously. In comparison, there was a small year-over-year increase (+295,000; +2.3%) in all other employees, reflecting the uneven labour market impact of COVID-19 on different groups of workers.

Almost half (48.8%) of the year-over-year decline in low-wage employees in September was accounted for by three industries: retail trade; accommodation and food services; and business, building and other support services industries. The ability of former employees to return to employment—either in their previous industry or in new activities—will be critical to both the economic well-being of workers and the performance and productivity of the economy.

Strong employment growth among core-age women, while youth employment continues to lag behind in recovery

Employment among core-aged women (25 to 54 years old) increased for the fifth consecutive month in September (+134,000; +2.3%), with gains split between full-time and part-time work. Employment for this group was within 2.1% of its pre-COVID February level—the closest of the major demographic groups.

On a year-over-year basis, employment among core-aged women declined most in the accommodation and food services; and the business, building and other support services industries. These declines were partially offset by gains in the insurance, real estate, rental and leasing industry; as well as in educational services.

Following a drop of 0.5 percentage points, the unemployment rate for core aged women was 7.0% in September, the lowest rate among the major demographic groups. The unemployment decline coincided with more women in the labour market, driven by five consecutive months of strong job growth. The participation rate for women in the core working age of 25 to 54 fully returned to its pre-COVID rate of 83.5% (compared with a record-low of 77.8% in April).

Employment returns to pre-COVID levels for both mothers and fathers

From August to September, employment increased at a much faster pace for core-aged mothers with children aged 18 years and younger (+6.4%; +171,000) than for fathers with children of the same age (+1.7%; +47,000). The monthly increase was driven by a typical seasonal increase in women working in the educational services industry as the new school year began (not seasonally adjusted). Total employment in September was on par with pre-pandemic levels for both mothers (+0.9%) and fathers (+1.5%), regardless of whether the youngest child was pre-school or school-aged (not seasonally adjusted).

Despite this employment recovery, it is taking longer for work absences to return to pre-COVID levels among mothers. In September, the number of mothers who worked less than half of their usual hours for reasons most likely related to COVID-19 was 70.0% higher than in February, compared with 23.7% among fathers (not seasonally adjusted). This includes lost hours due to personal circumstances, such as caring for children, as well as those related to job situation, such as reduced shifts.

Among parents who were at work in the September reference week, mothers (33.3%) were more likely than fathers (26.8%) to have worked most of their hours from home. This may indicate that more mothers than fathers were trying to balance work and childcare responsibilities.

Core-aged men disproportionately affected by slow growth in construction as well as transportation and warehousing

Employment among core-age men rose by 61,000 (+1.0%) in September, driven by full-time gains. This brought core-aged men to within 2.4% of their pre-COVID employment level.

On a year-over-year basis, two industries—construction, and transportation and warehousing—accounted for the majority of all employment declines among core-aged men.

The unemployment rate for men aged 25 to 54 dropped 0.5 percentage points to 7.6% in September but remained well above the near-record-low of 4.3% observed 12 months earlier. Like their female counterparts, labour force participation among men in the core working-age group fully returned to its pre-COVID rate in September (up 0.3 percentage points to 91.2%). This was up markedly from the record-low participation rate of 85.3% in April.

Youth employment remains furthest from pre-COVID levels

Employment increased among youth aged 15 to 24 in September, including gains for young women (+62,000; +5.7%) and young men (+66,000; +6.0%). Despite these monthly increases, employment remained further from full recovery for youth than for other major age groups, with female youth employment being 10.4% below February levels and male youth being 10.2% below.

On a year-over-year basis, youth employment in accommodation and food services was down 99,000 (-20.0%, not seasonally adjusted) in September. This industry typically accounts for one-fifth of youth employment (19.6% in 2019).

Youth unemployment rate declines as students return to school

The unemployment rate for male youth aged 15 to 24 fell to 20.5% in September. This was a drop of 5.1 percentage points from August to September. Similarly, the unemployment rate for female youth declined 3.0 percentage points to 17.2% in September. Youth unemployment rates were considerably higher than a year earlier—up 6.6 percentage points for young men, and 7.5 percentage points for young women.

Schools reopened for most students by mid-September, albeit with many changes involving online and in-person classes. Almost two-thirds (62.8%) of young Canadians aged 15 to 24 were enrolled in school in September, a level similar to September 2019 (62.0%) (not seasonally adjusted).

The unemployment rate of youth who belong to a population group designated as a visible minority fell by 7.6 percentage points in September (not seasonally adjusted), a larger decline than among youth who were not a visible minority or Indigenous (down 2.6 percentage points). Nonetheless, the unemployment rate remained higher among visible minority youth (24.7%) than among youth who were not a visible minority or Indigenous (15.4%) (not seasonally adjusted).

More people aged 55 and older working in September

Employment among workers aged 55 and older rose by 57,000 (+1.4%) in September. Following five consecutive monthly employment gains, employment for this group was within 4.1% of its pre-pandemic February level. Employment among older men (3.2% below pre-pandemic levels) has recovered at a faster pace than for older women (5.4% below pre-pandemic levels).

By industry, year-over-year employment declines for people in this age group were largest in the construction and the health care and social assistance industries.

Compared with 12 months earlier, the participation rate for people aged 55 and older had virtually recovered for men (43.5%) in September, while it remained 1.7 percentage points below for women (31.1%).

Employment rate among very recent immigrants remains closest to February level, as restrictions placed on international borders continue to impact international migration

The employment rate of immigrants who landed in Canada more than five years ago increased by 1.7 percentage points to 57.8% in September. By comparison, the employment rate for people born in Canada increased by 0.5 percentage points to 60.0%. Immigrants who landed in Canada more than five years ago are more likely than very recent immigrants to be employed in industries where employment has been relatively less affected by COVID-19, including health care and social assistance; public administration; and finance, insurance, real estate, rental and leasing. For more information on the impact of the COVID-19 pandemic on immigrant employment, see Transitions into and out of employment by immigrants during the COVID-19 lockdown and recovery.

The employment rate among very recent immigrants (five years or less) was little changed in September, at 63.6%. Trends in labour market indicators for this group should be understood in the context of a declining population resulting from restrictions placed on international migration. For more information on recent changes in international migration, see Canada's population estimates: Age and sex, July 1, 2020.

Employment increases for Indigenous people

Employment among Indigenous people living off-reserve increased by 2.7% (+15,000) from August to September, while employment among non-Indigenous Canadians rose by 1.5% (+264,000) (not seasonally adjusted). In September, employment for Indigenous people was at 93.9% of its February level, compared with 98.1% for non-Indigenous Canadians.

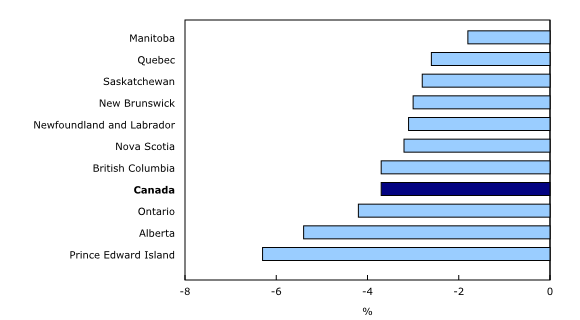

Recovery to pre-COVID employment levels continues to be uneven across regions

Employment increased in every province except New Brunswick and Prince Edward Island in September, with the largest gains in Ontario and Quebec. For further information on key province-level and industry-level labour market indicators, see Labour Force Survey in brief: Interactive app.

As of September, employment was relatively close to pre-COVID February levels in a number of provinces, including Manitoba (-1.8%) and New Brunswick (-3.0%). Among the four provinces with the largest populations, employment was closest to February levels in Quebec (-2.6%) and farthest in Alberta (-5.4%). In British Columbia, there were 3.7% fewer people working in September than in February, while in Ontario there were 4.2% fewer people working.

Employment in Ontario increased by 168,000 in September (+2.4%), largely in full-time work, and building on gains of 670,000 over the previous three months. The largest employment gains in September were in accommodation and food services, manufacturing, and educational services. The unemployment rate fell 1.1 percentage points to 9.5%, the fourth consecutive monthly decline.

During the LFS reference week of September 13 to September 19, all regions of Ontario were in Stage 3 reopening. However, public health measures such as physical distancing requirements and limits on gatherings remained in place and were tightened for the hot spots of Toronto, Peel and Ottawa on September 17 and for the rest of the province on September 19.

In the census metropolitan area (CMA) of Toronto, employment increased by 114,000 (+3.4%), a faster pace of growth than the province overall. Employment in Toronto grew to within 3.5% of its pre-pandemic level.

In Quebec, employment rose by 77,000 (+1.8%), adding to gains of 630,000 over the previous four months. Educational services and accommodation and food services contributed the most to the gains in September. The unemployment rate fell 1.3 percentage points to 7.4%, the fifth consecutive monthly decline, but still well above the low attained just prior to the start of the pandemic. Prior to the downturn, the unemployment rate in Quebec had trended downward for four years in a row, reaching a record-low of 5.1% on average in 2019.

In the Montréal CMA, employment grew by 57,000 (+2.7%) in September, a faster growth rate than the province. Employment in Montréal was 1.4% below its pre-pandemic level.

All provinces in Western Canada had more people working in September, led by British Columbia and Alberta.

In British Columbia, employment grew by 55,000 (+2.3%) in September, the fifth consecutive monthly increase. The unemployment rate fell 2.3 percentage points to 8.4%. In the Vancouver CMA, employment increased by 35,000 (+2.7%) in the month and was 7.9% below its February level, a degree of recovery lower than the province as a whole.

In Alberta, employment rose by 38,000 (+1.8%) in September, nearly all in full-time work. Educational services, information, culture and recreation, and public administration contributed the most to the increase. The unemployment rate was little changed at 11.7% as more people participated in the labour market. Alberta had the slowest employment growth rate of all provinces in 2019 at 0.5%, compared with the national growth rate of 2.1%.

In Manitoba, employment increased for the fifth consecutive month, up 15,000 in September, while the unemployment rate fell 1.1 percentage points to 7.0%.

In Atlantic Canada, Nova Scotia reported the largest employment gain in September, up 12,000 (+2.7%), continuing the upward trend that began five months earlier. Employment in Nova Scotia was within 3.2% of its February level and the unemployment rate fell 2.4 percentage points to 7.9%.

After notable increases in May and June, employment in New Brunswick has changed little in recent months and held steady in September. The unemployment rate rose 1.0 percentage points in September to 10.4% as more people searched for work.

In Prince Edward Island, employment fell slightly (-800) following four successive monthly gains. The unemployment rate in September was 10.1%.

Quarterly update for the territories

The Labour Force Survey collects labour market data in the territories, produced in the form of three-month moving averages.

In the third quarter ending in September, employment in Yukon held steady, following a decline of 1,200 in the second quarter. The unemployment rate remained at 6.2%. Over the same period, employment as a percentage of the population aged 15 and older was little changed at 65.0%.

Following a decline of 1,300 in the second quarter, employment in the Northwest Territories was little changed in the third quarter. The unemployment rate was 9.4%.

Employment in Nunavut increased by an estimated 1,100 people in the third quarter, partly offsetting the decline in the previous quarter. Employment as a percentage of the population rose from 44.8% in the second quarter to 48.7% in the third quarter. The unemployment rate was little changed at 16.0%.

September unemployment rates similar in Canada and the United States

The COVID-19 global pandemic has profoundly impacted the economies and labour markets of countries around the world. While comparisons of these impacts are challenging due to differences in concepts, survey design and reference periods, comparisons between the labour market situations of Canada and the United States can be made by carefully adjusting Canadian data to US concepts. For more information on Canada-US comparisons, see "Measuring Employment and Unemployment in Canada and the United States – A comparison."

Adjusted to US concepts, the unemployment rate in Canada was 7.9% in September, the same as the rate reported in the United States. The Canadian rate was 3.3 percentage points higher than in February, while the American rate was 4.4 percentage points higher.

At the same time, the employment rate (the number of employed as a percentage of the working age population) was 59.7% in Canada and 56.6% in the United States in September. The Canadian employment rate was 2.7 percentage points lower in September than in February, compared with 4.5 percentage points lower in the United States.

The labour force participation rate in Canada was 64.8% in September, 0.6 percentage points lower than it was in February. In the United States, the participation rate was 61.4%, 2.0 percentage points lower than in February.

Looking ahead: Upcoming changes to economic support benefits

CERB recipients more likely to be in households with financial difficulties

In March and April, the federal government introduced a number of programs, including the Canada Emergency Response Benefit (CERB) and Canada Emergency Student Benefit (CESB) to help Canadians adjust to the impact of the COVID-19 economic shutdown. From August to September, the proportion of Canadians receiving CERB, CESB, or regular Employment Insurance (EI) payments fell from 16.1% to 13.5%.

The relatively slow recovery of self-employment—and the number of hours worked by self-employed Canadians—is reflected in the profile of those receiving COVID-19 support payments. In September, one in five (21.8%) CERB recipients were either currently self-employed or had been self-employed in the last 12 months.

The proportion of CERB recipients living in a household experiencing difficulty meeting its necessary expenses increased to 42.0%, up 4.3 percentage points from August.

On September 27, some CERB recipients transitioned to the EI program. The federal government has announced that it intends to introduce new support programs for CERB recipients who are not eligible for EI, including the Canada Recovery Benefit for self-employed workers. As part of Statistics Canada's commitment to understanding the ongoing impact of COVID-19 on the labour market, the LFS will continue to monitor the extent to which Canadians take advantage of these COVID-19 economic support programs.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Labour Force Survey is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goals:

Note to readers

The Labour Force Survey (LFS) estimates for September are for the week of September 13 to 19.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey".

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

LFS estimates at the Canada level do not include the territories.

Since March 2020, LFS collection operations have been adapted to ensure that high quality information is collected in a way which protects the health and safety of both Statistics Canada interviewers and respondents. All face-to-face interviews have been replaced by telephone or online interviews. In addition, all telephone interviews have been conducted by interviewers working from their home rather than Statistics Canada's call centres. As was the case in June, July and August, approximately 40,000 interviews were completed in September.

To provide advice and guidance on future adaptations to LFS collection strategies, and the quality of LFS information, Statistics Canada has created a Labour Force Survey Expert Panel. Membership of this panel will be announced in the coming weeks.

The distribution of LFS interviews in September 2020 compared with August 2020, was as follows:

Personal face-to-face interviews

• August 2020 0.0%

• September 2020 0.0%

Telephone interviews – from call centres

• August 2020 0.0%

• September 2020 0.0%

Telephone interviews – from interviewer homes

• August 2020 69.2%

• September 2020 67.4%

Online interviews

• August 2020 30.8%

• September 2020 32.6%

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population aged 15 and older.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime).

In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods.

Supplementary indicators used in September 2020 analysis

To continue capturing the effect of the COVID-19 pandemic on the labour market, the supplementary indicators used in March and April have been slightly adapted. Therefore, the May to September supplementary indicators are not directly comparable to the supplementary indicators published in April and March 2020.

Employed, worked zero hours includes employees and self-employed who were absent from work all week, but excludes people who have been away for reasons such as 'vacation,' 'maternity,' 'seasonal business' and 'labour dispute.'

Employed, worked less than half of their usual hours includes both employees and self-employed, where only employees were asked to provide a reason for the absence. This excludes reasons for absence such as 'vacation,' 'labour dispute,' 'maternity,' 'holiday,' and 'weather.' Also excludes those who were away all week.

Not in labour force but wanted work includes persons who were neither employed, nor unemployed during the reference period and wanted work, but did not search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.'

Unemployed, job searchers were without work, but had looked for work in the past four weeks ending with the reference period and were available for work.

Unemployed, temporary layoff or future starts were on temporary layoff due to business conditions, with an expectation of recall, and were available for work; or were without work, but had a job to start within four weeks from the reference period and were available for work (don't need to have looked for work during the four weeks ending with the reference week).

Labour underutilization rate (specific definition to measure the COVID-19 impact) combines all those who were unemployed with those who were not in the labour force but wanted a job and did not look for one; as well as those who remained employed but lost all or the majority of their usual work hours for reasons likely related to COVID-19 as a proportion of the potential labour force.

Potential labour force (specific definition to measure the COVID-19 impact) includes people in the labour force (all employed and unemployed people), and people not in the labour force who wanted a job but didn't search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.'

Time-related underemployment rate combines people who remained employed but lost all or the majority of their usual work hours as a proportion of all employed people.

New information on population groups

Beginning in July, the LFS includes a question asking respondents to report the population groups to which they belong. Possible responses, which are the same as in the 2016 Census, include:

• White

• South Asian e.g., East Indian, Pakistani, Sri Lankan

• Chinese

• Black

• Filipino

• Arab

• Latin American

• Southeast Asian e.g., Vietnamese, Cambodian, Laotian, Thai

• West Asian e.g., Iranian, Afghan

• Korean

• Other

For LFS records interviewed before July, population group characteristics were assigned using an experimental sample matching data integration method. This involved directly integrating LFS and census information for approximately 20% of LFS records. For the remaining 80%, population group characteristics were assigned using information available at the population level from both LFS and census. Further development of this method will continue in the coming months.

According to the Employment Equity Act, visible minorities are "persons, other than Aboriginal peoples, who are non-Caucasian in race or non-white in colour." In the text, data for the population who identify as Aboriginals are analyzed separately. The remaining category is described as "people not designated as visible minorities" or "people who are not a visible minority."

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The seasonally adjusted data for retail trade and wholesale trade industries presented here are not published in other public LFS tables. A seasonally adjusted series is published for the combined industry classification (wholesale and retail trade).

Next release

The next release of the LFS will be on November 6.

Products

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The product "Labour Force Survey in brief: Interactive app" (14200001) is also available. This interactive visualization application provides seasonally adjusted estimates available by province, sex, age group and industry. Historical estimates going back five years are also included for monthly employment changes and unemployment rates. The interactive application allows users to quickly and easily explore and personalize the information presented. Combine multiple provinces, sexes and age groups to create your own labour market domains of interest.

The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (71-607-X) is also available. This interactive dashboard provides easy, customizable access to key labour market indicators. Users can now configure an interactive map and chart showing labour force characteristics at the national, provincial or census metropolitan area level.

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: