Payroll employment, earnings and hours, June 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-08-27

$1,118.50

June 2020

9.4%

(12-month change)

$1,110.47

June 2020

4.3%

(12-month change)

$984.30

June 2020

13.8%

(12-month change)

$984.58

June 2020

9.5%

(12-month change)

$1,011.44

June 2020

8.0%

(12-month change)

$1,061.03

June 2020

9.9%

(12-month change)

$1,150.42

June 2020

10.8%

(12-month change)

$1,004.70

June 2020

6.0%

(12-month change)

$1,107.04

June 2020

7.1%

(12-month change)

$1,205.07

June 2020

3.5%

(12-month change)

$1,104.23

June 2020

11.2%

(12-month change)

$1,262.45

June 2020

8.2%

(12-month change)

$1,536.09

June 2020

6.6%

(12-month change)

$1,503.85

June 2020

5.2%

(12-month change)

June data are now available from the Survey of Employment, Payrolls and Hours (SEPH), which provides monthly information on payroll employment, earnings and hours worked for Canada and the provinces and territories.

By the end of June, COVID-19 public health restrictions had been substantially eased in most parts of the country. Tighter restrictions remained in place in much of southwestern Ontario, including Toronto. As businesses and workplaces continued to reopen across Canada, physical distancing and other public health requirements remained in place. Likewise, large gatherings continued to be limited.

Since the beginning of the COVID-19 economic shutdown, Statistics Canada has been committed to capturing the impact of COVID-19 on the labour force. In conjunction with Labour Force Survey (LFS) data, SEPH data shed light on this impact, in large part by providing detailed subsector and industry statistics.

The SEPH provides an account of payroll employment—that is, the number of employees receiving pay or benefits (employment income) during a given month. The survey excludes the self-employed, owners and partners of unincorporated businesses and professional practices, and employees in the agricultural sector.

LFS employment data capture the number of people who were working or absent from work (including unpaid) during a given month.

When used together to track trends in the labour market, the SEPH and LFS provide valuable insights into the impact of COVID-19 on the labour market.

The easing of COVID-19 restrictions is reflected in June payroll employment

The number of employees receiving pay or benefits from their employer, measured in the SEPH as payroll employment, rose by 666,500 (+4.9%) in June. This followed three consecutive months of declines—March (-0.9 million), April (-1.9 million) and May (-0.5 million)—and brought the total payroll employment change since February to a decrease of 2.7 million (-15.7%).

Employment increases in all provinces

SEPH payroll employment rose in every province in June, with the largest increases in Ontario (+231,500, or +4.4%), Quebec (+189,000, or +6.1%) and British Columbia (+97,200, or +5.1%). These figures are consistent with the June LFS results. New Brunswick, the first province to begin easing COVID-19 restrictions, recorded the fastest payroll employment growth, up 6.7% (+18,500).

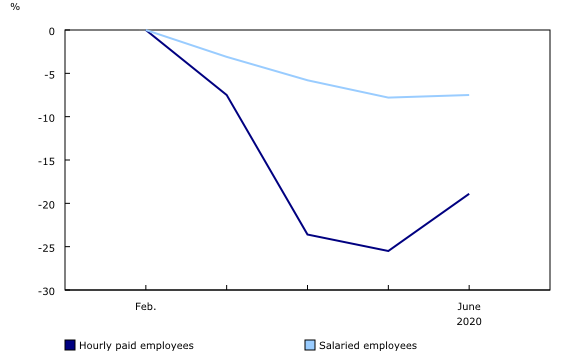

All of the June employment increase is accounted for by hourly paid employees

From February to May, payroll employment declined by about 3.3 million. Three-quarters (76.4%) of this decline was among hourly paid employees, who represented less than 60% of all payroll employees in 2019, and who tend to earn significantly less than salaried employees. In February 2020, for example, salaried employees earned an average of $1,410 per week, while hourly paid employees earned an average of $800 per week.

In June, all of the payroll employment increase was among hourly paid employees, whose employment rose by 646,800 (+8.9%). Despite these gains, the number of hourly paid employees was 18.9% below its pre-COVID-19 level. In comparison, the number of salaried employees was little changed from May and was 7.5% below its pre-COVID-19 level.

Average weekly earnings decline as payroll employment increases for lower-paid workers

In June, total weekly payroll (including overtime) for all employees rose for the first time since February, up 3.4% compared with May. This brought the total weekly payroll to 9.3% below its pre-COVID-19 level.

Average weekly earnings declined 1.8% to $1,119 in June, as employment increased significantly in sectors with relatively low average weekly earnings. Despite the monthly decline, earnings were up 9.4% compared with June 2019, as lower-paid workers were harder hit by employment declines during the COVID-19 economic shutdown.

Total hours worked rise while average hours worked per week decline

Month over month, total hours worked increased 3.8% in June, but remained 13.5% lower than in February. The accommodation and food services sector and the arts, entertainment and recreation sector recorded the largest losses in total hours worked from February to June, down 48.9% and 41.8%, respectively.

In June, average weekly hours worked decreased 0.9% (-0.3 hours), bringing the average to 33.8 hours per week, compared with 34.1 hours in May. However, this was still higher than in February, when payroll employees worked an average of 33.0 hours per week.

Employment levels rise most in retail trade and in accommodation and food services

In June, with the easing of public health restrictions, payroll employment rose the most in retail trade (+151,700, or +9.7%) and accommodation and food services (+133,600, or +23.2%), the two sectors hardest hit by job losses during the COVID-19 economic shutdown. According to a new experimental series on monthly business openings and closures released on August 5, the number of business closures in these sectors in April 2020 was more than double what it was in April 2019.

In June, payroll employment gains in retail trade were largest among clothing and clothing accessories stores (+41,900, or +41.4%) and motor vehicle and parts dealers (+28,200, or +18.3%). Despite recording the largest increase in June, the number of payroll jobs in clothing and clothing accessories stores was down 36.6% compared with February. Some retail trade subsectors were closer to their pre-COVID-19 level, including general merchandise stores, where payroll employment in June was down 1.9% from its February level. Overall, as reported in the retail trade release, retail sales rose by 23.7% in June and surpassed the February level by 1.3%. Meanwhile, average weekly earnings in retail trade increased by 8.0% year over year to $664 in June.

In accommodation and food services, the number of jobs rose the most among full-service restaurants and limited-service eating places (+113,600, or +24.5%), as a result of the easing of public health restrictions. Payroll employees in accommodation and food services earned an average of $440 per week in June, up 6.4% compared with 12 months earlier.

Payroll employment up significantly in offices of dentists and other health practitioners

Employment rose by 90,200 (+5.0%) in health care and social assistance in June, largely the result of an increase in ambulatory health care services. Within the ambulatory health care services subsector, payroll employment increased significantly in offices of dentists (+38,700, or +89.7%) and offices of other health practitioners (including, for example, chiropractors and optometrists) (+13,300, or +22.9%), as many businesses were able to at least partially reopen and return to providing routine services. Average weekly earnings in health care and social assistance were $1,017 in June, up 8.4% year over year.

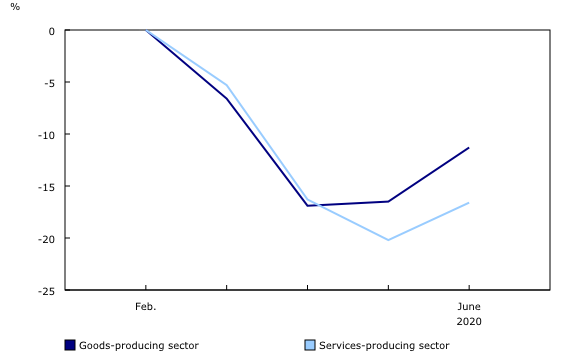

Faster payroll employment recovery in the goods-producing sector

While payroll employment levels increased the most in services-producing sectors month over month, they rose at a faster pace in relative terms in the goods-producing sector. Following a small increase of 0.5% in May, payroll employment in the goods-producing sector rose 6.2% (+153,900) in June, bringing employment to 11.3% below the February level. In the services-producing sector, the number of jobs grew by 4.5% (+489,800) in June, bringing employment to 16.6% below its pre-COVID-19 level.

Notable employment increase in transportation equipment manufacturing

In manufacturing, payroll employment increased by 81,100 (+6.2%) in June, led by gains in transportation equipment manufacturing (+19,200, or +12.2%). Based on recent results from the Monthly Survey of Manufacturing, motor vehicles and motor vehicle parts accounted for more than half of the sales gain in manufacturing in June. Average weekly earnings in the manufacturing sector were $1,139 in June, up 1.6% compared with June 2019.

Second month of employment gains in construction

In June, payroll employment in construction rose for a second consecutive month, up 71,900 (+8.5%) to 13.3% below its February level. Month-over-month gains were widespread across all provinces and, at the national level, were mostly among specialty trade contractors, although increases were also observed in the other two subsectors (construction of buildings, and heavy and civil engineering construction). Average weekly earnings in construction were $1,315 in June, up 3.2% compared with 12 months earlier.

Looking ahead

According to Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada, nearly two-thirds of businesses surveyed through the month of June expected their number of employees to remain the same over the next three months. A little less than one in six expected their number of employees to increase over the same period.

July LFS results, which reflect labour market conditions for the week of July 12 to 18, showed that employment continued to recover through the beginning of the summer.

SEPH results for July will be released on September 24.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Survey of Employment, Payrolls and Hours is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to measure the following goals:

Note to readers

The key objective of the Survey of Employment, Payrolls and Hours (SEPH) is to provide a monthly portrait of the level of earnings, employment and hours worked, by detailed industry, at the national, provincial and territorial levels.

SEPH estimates are produced by integrating information from three sources: a census of approximately 1 million payroll deduction records provided by the Canada Revenue Agency; the Business Payrolls Survey, which collects data from a sample of 15,000 establishments; and administrative records of federal, provincial and territorial public administration employment, provided by these levels of government.

Estimates of average weekly earnings and hours worked are based on a sample and are therefore subject to sampling variability. This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level. Payroll employment estimates are based on a census of administrative records and are not subject to sampling variability.

With each release of SEPH data, data for the preceding month are revised. Users are encouraged to use the most up-to-date data available for each month.

Statistics Canada also produces employment estimates from its Labour Force Survey (LFS). The LFS is a monthly household survey, the main objective of which is to divide the working-age population into three mutually exclusive groups: the employed (including the self-employed), the unemployed and those not in the labour force. This survey is the official source for the unemployment rate, and it collects data on the sociodemographic characteristics of all those in the labour market.

As a result of conceptual and methodological differences, estimates of changes from the SEPH and LFS differ occasionally. However, the trends in the data are similar. For a more in-depth discussion of the conceptual differences between employment measures from the LFS and SEPH, refer to Section 8 of the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

Unless otherwise stated, this release presents seasonally adjusted data, which facilitate comparisons because the effects of seasonal variations are removed. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Non-farm payroll employment data are for all hourly and salaried employees, and for the "other employees" category, which includes piece-rate and commission-only employees.

Unless otherwise specified, average weekly hours data are for hourly and salaried employees only, and exclude businesses that could not be classified to a North American Industry Classification System (NAICS) code.

All earnings data include overtime and exclude businesses that could not be classified to a NAICS code. Earnings data are based on gross taxable payroll before source deductions. Average weekly earnings are derived by dividing total weekly earnings by the number of employees.

Real-time data tables

Real-time tables 14-10-0357-01, 14-10-0358-01, 14-10-0331-01 and 14-10-0332-01 will be updated on September 14.

Next release

Data on payroll employment, earnings and hours for July will be released on September 24.

Products

More information about the concepts and use of the Survey of Employment, Payrolls and Hours is available in the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

The product "Earnings and payroll employment in brief: Interactive app" (14200001) is now available. This interactive data visualization application provides a comprehensive picture of the Canadian labour market using the most recent data from the Survey of Employment, Payrolls and Hours. The estimates are seasonally adjusted and available by province and largest industrial sector. Historical estimates going back 10 years are also included. The interactive application allows users to quickly and easily explore and personalize the information presented. Combine multiple provinces and industrial sectors to create your own labour market domains of interest.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: