Retail trade, June 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-08-21

$53.0 billion

June 2020

23.7%

(monthly change)

$0.8 billion

June 2020

15.9%

(monthly change)

$0.2 billion

June 2020

16.0%

(monthly change)

$1.4 billion

June 2020

23.4%

(monthly change)

$1.2 billion

June 2020

14.5%

(monthly change)

$11.5 billion

June 2020

23.5%

(monthly change)

$19.6 billion

June 2020

33.8%

(monthly change)

$1.9 billion

June 2020

16.0%

(monthly change)

$1.7 billion

June 2020

15.6%

(monthly change)

$7.0 billion

June 2020

19.2%

(monthly change)

$7.4 billion

June 2020

12.7%

(monthly change)

Retail sales were up 23.7% in June to $53.0 billion. After three months of sales below pre-pandemic levels, retail sales in June were 1.3% higher than February levels as more regions moved ahead with plans to reopen their economies. Sales were up in all subsectors, with growth primarily led by motor vehicle and parts dealers, as well as clothing and clothing accessories stores. Rounding out the second quarter, retail sales were down 13.3% compared with the first quarter. In volume terms, quarterly retail sales were down 12.4%.

In comparison, retail sales in the United States increased 8.9% in June. Similar to Canada, sales were driven by increases at motor vehicle and parts dealers and clothing and clothing accessories stores.

Retail sales in volume terms were up 22.9% in June.

Based on respondent feedback, approximately 9% of retailers were closed during June. The average length of shutdown was one business day. Despite these challenging times, most respondents reported their sales figures and Statistics Canada thanks them for their continued collaboration.

Given the rapidly-evolving economic situation, Statistics Canada is providing an advance estimate of July sales. Early estimates suggest that retail sales increased by 0.7% in July. Owing to its preliminary nature, this figure should be expected to be revised.

Widespread growth as more regions reopen

Retail sales were up across all subsectors in June. The motor vehicle and parts dealers subsector (+53.4%) contributed the most to the sales increase, largely the result of pent-up demand following dealership closures during the spring months.

Supporting growth in this subsector were new car dealers. According to the New Motor Vehicle Sales Survey, the value of new motor vehicle sales in June was down 19.1% year over year. However, in unadjusted terms, the value of new motor vehicle sales increased 17.8% compared with their pre-pandemic levels in February 2020. Within this segment, sales of passenger cars (+32.4%) increased more than trucks (+15.1%).

Sales at gasoline stations were up 26.3%, while sales in volume terms at gasoline stations rose 19.9%. Higher gasoline prices contributed to the gain in June, reflecting growing demand due to the gradual reopening of businesses and increased local travel. Crude oil prices were also up in June, as more economies around the world began or continued to reopen.

In other subsectors, sales were up at health and personal care stores (+11.7%), general merchandise stores (+8.6%), electronics and appliance stores (+4.4%), as well as food and beverage stores (+1.5%).

Sales surge at non-essential retailers

On the heels of double-digit growth in May, clothing and clothing accessories stores posted a 142.3% gain in June, as many regional economies implemented the later stages of their reopening plans, allowing more brick-and-mortar stores to open, including those in malls. While sales in this subsector increased in June, they remained below their February levels.

Sales rebounded at several other retailers that had been deemed non-essential at the start of the pandemic. Furniture and home furnishing stores (+70.9%), building material and garden equipment and supplies dealers (+13.0%), as well as sporting goods, hobby, book and music stores (+64.9%) all posted sales that exceeded their February levels.

Sales up in every province

Sales were up in every province in June, largely as a result of gains in the motor vehicle and parts dealers and general merchandise stores subsectors. Eight provinces rebounded to their pre-pandemic February levels.

In Ontario, sales increased 33.8%—the province's largest gain on record. In the census metropolitan area (CMA) of Toronto, sales rose 34.8%.

Sales were up 23.5% in Quebec, with the CMA of Montréal (+35.8%) posting the largest increase.

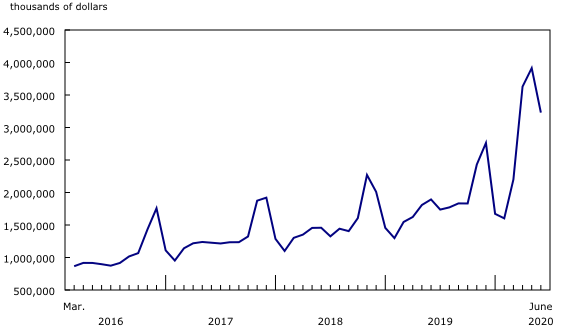

E-commerce sales in Canada

On an unadjusted basis, retail e-commerce sales were $3.2 billion in June, accounting for 5.5% of total retail trade. E-commerce sales in June made up a smaller share of retail sales than in April and May, as more non-essential retailers opened their brick-and-mortar stores.

However, the proportion of e-commerce out of total retail sales still remained above the pre-pandemic share observed in February. On a year-over-year basis, retail e-commerce increased 70.6%, while total unadjusted retail sales increased 3.0%.

Detailed information about the impact of COVID-19 on retail ecommerce is available in the article Retail e-commerce and COVID-19: How online shopping opened doors while many were closing.

When adjusted for basic seasonal effects, retail e-commerce decreased 13.0% in June.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted.

Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruptions.

For information regarding cannabis statistics, consult the Cannabis Stats Hub.

Seasonally adjusted estimates for cannabis store retailers are presented in unadjusted form as there is no seasonal pattern established by official statistics yet. Establishing such a pattern requires several months of observed data. In the interim, the seasonally adjusted estimates for cannabis store retailers will be identical to the unadjusted figures.

Statistics Canada's retail e-commerce figures include the electronic sales of two distinct types of retailers. The first type do not have a storefront. These businesses are commonly referred to as pure-play Internet retailers and are classified to North American Industry Classification System (NAICS) 45411—Electronic Shopping and Mail Order Houses. The second type have a storefront and are commonly referred to as brick-and-mortar retailers. If the online operations of a brick-and-mortar retailer are separately managed, they too are classified to NAICS 45411.

Some common electronic commerce transactions, such as travel and accommodation bookings, ticket purchases, and financial transactions, are not included in Canadian retail sales figures.

For more information on retail e-commerce in Canada, see "Retail E-Commerce in Canada."

Total retail sales expressed in volume terms are calculated by deflating current dollar values using consumer price indexes. The retail sales series in chained (2012) dollars is a chained Fisher volume index with 2012 as the reference year.

Canadian seasonally adjusted retail trade statistics measure monthly sales in industries 441 through 453 of NAICS. US total retail sales have been adjusted to match this industrial composition.

Real-time tables

Real-time tables 20-10-0054-01 and 20-10-0079-01 will be updated soon.

Next release

Data on retail trade for July will be released on September 18.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: