Food services and drinking places, May 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-07-22

$3.1 billion

May 2020

35.3%

(monthly change)

$41.1 million

May 2020

35.3%

(monthly change)

$15.3 million

May 2020

24.9%

(monthly change)

$76.3 million

May 2020

34.6%

(monthly change)

$70.7 million

May 2020

40.4%

(monthly change)

$512.9 million

May 2020

45.4%

(monthly change)

$1,168.7 million

May 2020

29.2%

(monthly change)

$113.6 million

May 2020

25.3%

(monthly change)

$102.1 million

May 2020

28.6%

(monthly change)

$454.8 million

May 2020

37.4%

(monthly change)

$534.0 million

May 2020

42.4%

(monthly change)

$4.9 million

May 2020

23.4%

(monthly change)

$3.5 million

May 2020

20.6%

(monthly change)

$1.5 million

May 2020

12.1%

(monthly change)

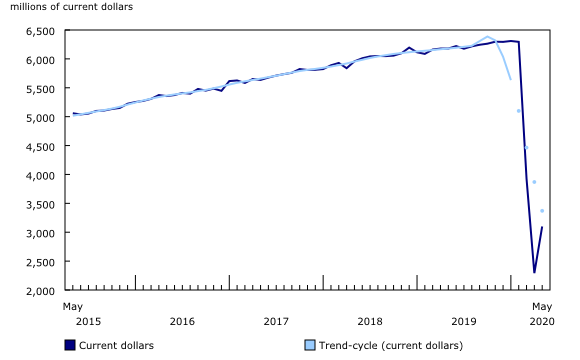

Following two consecutive months of decreased sales due to COVID-19 regulations, sales in the food services and drinking places subsector increased 35.3% (seasonally adjusted) to $3.1 billion in May compared with April. With businesses across the country gradually reopening, higher sales were reported across all industry groups and each of the provinces and territories. Nevertheless, when comparing May 2020 to May 2019, unadjusted sales are still down by half (-49.9%).

Further information can be found in the "Food Services and Drinking Places Sales" dashboard. This web application provides access to data on sales in food services and drinking places for Canada, and by province and territory. This dynamic application allows users to compare provincial and territorial data through interactive maps and charts.

COVID-19

In March, a sequence of unprecedented government interventions was put in place related to COVID-19, including the closure of non-essential businesses, travel restrictions, and public health measures directing Canadians to limit public interactions. During this time, all provinces restricted access and implemented closures to businesses in the restaurant industry, which continued for the entire month of April. In May, businesses continued to reopen offering take-out options, while some provinces—including Manitoba, New Brunswick, Alberta and British Columbia—allowed dine-in and patio services under strict guidelines. Based on respondent feedback, 42% of food service and drinking place operators reported being closed at some point in May, compared with 56% in April. Also, 22% reported being closed for the entire month of May, compared with 41% being closed for the entire month of April.

Sales in the food services and drinking places subsector increase as COVID-19 restrictions ease

The largest increases in dollar terms were reported at limited-service restaurants (+30.8%) followed by full-service restaurants (+51.4%), special food services (+8.3%) and drinking places (+155.6%).

Sales at limited-service restaurants increased by almost one-third (+30.8%). One-quarter (25%) of limited-service restaurants were closed at some point in May falling from 31% in April. Just over one-tenth (11%) were closed for the entire month of May, compared with 18% who were close for the entire month of April. Since March, limited-service restaurants saw the least-pronounced drop in sales in percentage terms, with sales buoyed by take-out and delivery.

Full-service restaurant sales increased by more than half in May 2020 (+51.4%) compared with April, although sales are still less than half the size (40%) of limited-service sales where they are usually similar in normal times. As dining rooms and patios began to open in parts of the country and other restaurants relied on take-out and delivery, sales began to recover. Less than half (44%) of full-service restaurants were closed for part of May compared with 65% in April. One-fifth (21%) were closed for the entire month of May compared with 47% closed for the whole month of April.

Sales of special food services saw a small increase (+8.3%) as schools and businesses continued to be closed and flights, sporting events, concerts, and events such as conferences and weddings were cancelled or postponed. Almost half (49%) of special food services reported being closed for part of May compared with 60% in April. One-third (34%) reported being closed for the entire month of May, compared with 49% being closed for the entire month of April.

Sales at drinking places saw the largest rebound in percentage terms (+155.6%), even though many nightclubs and bars continued to be closed throughout the month. Most (85%) drinking places were closed at some point in May compared with 89% in April. Some reopened throughout the month so that 59% were closed for the entire month of May compared with 79% in April. Sales at drinking places fell by the highest proportion, as nightclubs and bars were closed and many do not have take-away food options.

Sales in the food services and drinking places subsector increase in every province and territory

Every province and territory reported an increase in sales in May 2020. Ontario (+29.2%), Quebec (+45.4%), British Columbia (+42.4%) and Alberta (+37.4%) reported the largest increases in dollar terms.

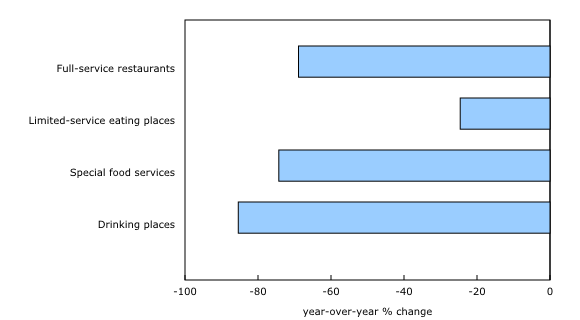

Year-over-year sales in the food services and drinking places subsector decrease

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

Due to the effects of COVID-19 on the food services and drinking places subsector, unadjusted sales for May 2020 were down by half (-49.9%) compared with May 2019. Sales fell in each of the following industry groups: full-service restaurants (-68.9%); limited-service restaurants (-24.6%); special food services (-74.3%); and drinking places (-85.4%).

Year-over-year sales decreased in every province, with Ontario (-52.8%), Quebec (-56.5%), British Columbia (-48.4%) and Alberta (-42.4%) reporting the largest dollar declines. Nova Scotia (-48.0%) and Newfoundland and Labrador (-43.4%) also showed large declines.

Prices for food purchased from restaurants were up 2.2% in May 2020 compared with May 2019, and prices for alcoholic beverages served in licensed establishments increased 2.1% in the same period.

Note to readers

All data in this release are seasonally adjusted and are expressed in current dollars, unless otherwise noted. Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Trend-cycle data are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Data for the current reference month are preliminary. Usually, unadjusted data are revised for the previous two months, and seasonally adjusted data are revised for the previous three months. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruption.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: