Farm income, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-05-26

Realized net farm income rises as increases in receipts exceed gains in expenses

The realized net income of Canadian agricultural producers rose for the first time in three years, up 10.4% to $4.9 billion in 2019. Higher cannabis and livestock receipts, combined with increased program payments, just offset rising operating expenses. This follows a 37.4% decline in 2018 when sharply higher input costs and lower canola receipts pushed net farm income lower.

Increases in realized net income were recorded in Alberta (+$425 million), Quebec (+$373 million), British Columbia (+$102 million), New Brunswick (+$41 million) and Prince Edward Island (+$20 million). With smaller increases in cannabis receipts and reduced oilseed receipts, Saskatchewan (-$311 million) and Manitoba (-$179 million) recorded the largest declines in realized net farm income.

Realized net income is the difference between a farmer's cash receipts and operating expenses, minus depreciation, plus income in kind.

Farm cash receipts trend higher

Farm cash receipts, which include market receipts from crop and livestock sales as well as program payments, rose 5.7% in 2019 to $66.1 billion. This was the ninth consecutive increase in farm cash receipts and the largest since 2012. Excluding cannabis, however, the increase becomes 2.9%, similar to the average annual gain over the previous five years (+2.4%).

Farm cash receipts rose in every province with Alberta posting the largest gain (+$1.3 billion).

Market receipts increased 4.4% to $62.9 billion in 2019, led by higher cannabis and livestock receipts.

Market receipts are the product of price and marketings. Marketings are quantities sold, using various units of measure such as tonnes for field crops and hundredweight for some livestock.

A strong increase in cannabis contributes to growth in crop receipts

Crop receipts totalled $36.6 billion in 2019, up 3.9% from the previous year. The gain was attributable to a $1.7 billion increase in licensed cannabis producer receipts during the first full year of legalized recreational use.

These receipts cover cannabis revenue for medical and recreational use as well as sales to processors of cannabis products. Growth in cannabis receipts in Ontario and Alberta accounted for 56.5% of the national increase. Excluding cannabis, crop revenues at the national level would have declined 1.1%.

Durum wheat sales rose 22.5% from 2018. Marketings increased 26.8%, due largely to higher exports. Production shortfalls elsewhere in the world led to increased export demand for high quality Canadian durum.

Lower oilseed receipts moderated the rise in crop receipts. Revenue of canola producers decreased for the second consecutive year, down 7.4% following a 6.5% decline in 2018. Prices fell 9.8% in 2019 in the wake of Chinese import restrictions on Canadian canola seed that began in March 2019. Nevertheless, marketings were up 2.7% as domestic crush reached record highs and lower prices boosted exports to other countries.

Soybean receipts decreased 17.7% year over year on lower marketings (-13.8%) and prices (-4.5%). Ample global supplies throughout 2019, along with the US-China trade dispute, lowered prices. Exports to China—Canada's largest soybean export market—fell sharply after a record year in 2018.

Chinese importers displayed a clear preference for soybeans from other nations in 2019 as reports circulated of delays at Chinese ports targeting Canadian shipments. The negative effect of African swine fever on hog numbers in China and other Asian nations also contributed to lower exports by reducing demand for soymeal.

Rising hog and dairy prices and increased cattle marketings push livestock receipts higher

Livestock receipts rose 5.1% to $26.3 billion in 2019 following a 0.1% decline in 2018.

The revenue of hog producers grew 11.6% on higher prices (+9.2%) as the impact of the African swine fever reduced herd sizes in China and elsewhere in the Far East. Marketings increased 2.2% as pork exports were stable—despite China suspending Canadian imports from June to early November.

Dairy receipts rose 5.1% as higher production costs pushed prices up 5.2%. Prices and quantities sold rose for two other supply-managed commodities (chickens and eggs), resulting in higher receipts for chicken (+4.7%) and eggs (+6.0%).

Revenues from cattle and calf production rose 3.3% on the strength of a 3.7% increase in marketings. Marketings of cattle and calf exports were up 20.5% as strong global demand for beef and lower end-of-year cattle inventories in the United States provided favourable conditions for export growth.

Program payments totalled $3.1 billion in 2019, up 40.6% from the previous year. Adverse growing conditions in 2019 and wet harvests in both 2018 and 2019 contributed to a 57.7% increase in crop insurance payments.

Almost one-third of the growth in program payments was attributable to the first instalment of the Dairy Direct Payment Program ($293 million in 2019). This $1.75 billion program provides support over an eight-year period to dairy producers as a result of market access commitments made under recent trade agreements.

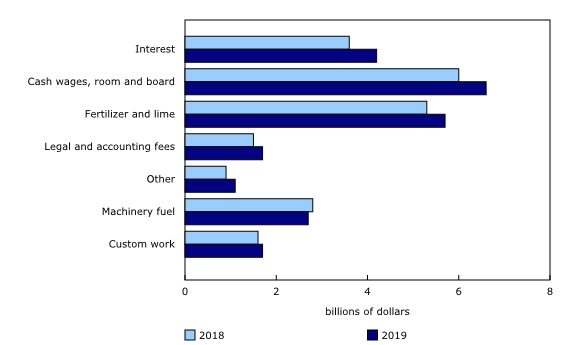

Expenses rise in the wake of increased cannabis production

Farm operating expenses (after rebates) increased 5.7% in 2019 to $53.1 billion.

Just under one-half of the increase in operating expenses can be traced to increased cannabis production. Indoor growing area of licensed producers almost tripled in the year following the legalization of recreational cannabis use in October 2018. Licensed outdoor production also began in 2019.

Interest expenses rose 16.0% following a 19.6% gain in 2018. Average interest rates for 2019 were up 6.7% compared with 2018, while debt levels rose 8.7%.

Cash wages increased 9.2%, with cannabis-related labour costs estimated to account for more than two-thirds of the increase.

Fertilizer expenses were up 7.1%, largely as a result of higher prices. Cannabis-related expenses accounted for almost one-fifth of the growth in fertilizer expenses.

Total farm expenses, which include operating expenses and depreciation, increased 5.3% to $61.2 billion in 2019 as depreciation charges grew 3.2%. Total farm expenses were up in every province.

Little change in total net income

Total net income totalled $3.9 billion in 2019, up $82 million from the previous year. This follows a $4.5 billion drop in 2018 when decreased realized net income and lower on-farm inventories of feed grains and cattle and calves reduced total net income. Total net income rose in six provinces. Increases in Alberta and Quebec partially offset declines in Saskatchewan and Manitoba.

Total net income is realized net income adjusted for changes in farmer-owned inventories of crops and livestock. It represents the return to owner's equity, unpaid farm labour, management and risk.

The value of inventory change had a negative impact on net farm income. Reduced cattle inventories combined with lower on-farm stocks of canola, durum wheat and soybeans, contributed to the negative change.

Note to readers

Realized net income can vary widely from farm to farm because of several factors, including the farm's type of commodities, prices, weather and economies of scale. This and other aggregate measures of farm income are calculated on a provincial basis employing the same concepts used in measuring the performance of the overall Canadian economy. They are a measure of farm business income, not farm household income.

Additional financial data for 2019, collected at the individual farm business level using surveys and other administrative sources, will be made available later this year. These data will help explain differences in the performance of various types and sizes of farms.

Preliminary farm income data for the previous calendar year are first released in May of each year, five months after the reference period. Revised data are then released in November of each year, incorporating data received too late to be included in the first release. Data for two years prior to the reference period are also subject to this revision.

For details on farm cash receipts for the first quarter of 2020, see the "Farm cash receipts" release in today's Daily.

Products

The interactive data visualization tool, "Net farm income, by province," is available on the Statistics Canada website.

The Agriculture and food statistics portal, accessible from the Subjects module of our website, provides users a single point of access to a wide variety of information related to agriculture and food.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: