Canada's international transactions in securities, January 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-03-17

Foreign investors acquired $17.0 billion of Canadian securities in January, adding debt securities but reducing their exposure to equities. Meanwhile, Canadian investors reduced their holdings of foreign securities by $9.1 billion, following acquisitions of $13.8 billion in December 2019.

As a result, international transactions in securities generated a net inflow of funds of $26.1 billion in the Canadian economy in January, more than offsetting the $24.0 billion net outflow of funds recorded in December 2019.

Foreign investors resume their purchases of debt securities

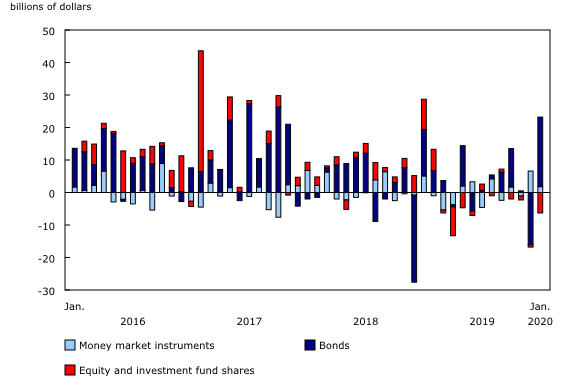

Foreign investors acquired $17.0 billion of Canadian securities in January. They added debt securities, but reduced their exposure to equities over the month.

Foreign acquisitions of Canadian bonds were $21.4 billion in January, following a divestment of $16.1 billion in December 2019. Net issuances of Canadian bonds on foreign markets accounted for over half of the investment activity, led by private corporations. Foreign purchases of new bonds issued by Canadian private corporations totalled $23.0 billion in January, the highest level since March 2015. Retirements for this sector amounted to $15.9 billion, mostly bonds retired prior to their original maturity date.

The Government of Canada issued a US$3.0 billion global bond in January, with proceeds used to strengthen Canada's international foreign reserves. The last issuance of a $US global bond by the federal government was in January 2019.

Transactions in the Canadian money market resulted in foreign acquisitions of $1.8 billion. Most of the investment in January was in Canadian private corporate paper. Borrowing conditions continued to improve in January as long-term interest rates were down by a significant 30 basis points, following a decline of 37 basis points in 2019.

In the Canadian stock market, non-resident investors reduced their exposure to Canadian equities by $6.3 billion in January. This activity followed a divestment of $2.1 billion in 2019. The reduction in January was widespread across all industries, with the banking sector accounting for the largest share (-$2.5 billion). In January, Canadian stock prices, as measured by the Standard and Poor's / Toronto Stock Exchange composite index, were up by 1.5%.

Canadian investors reduce their exposure to foreign equities

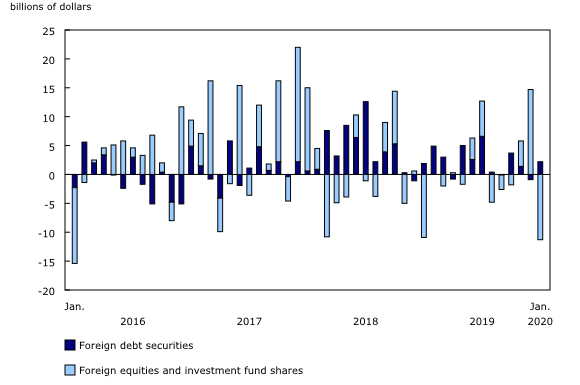

Canadian investors reduced their holdings of foreign securities by $9.1 billion in January, following strong acquisitions totalling $13.8 billion in December 2019.

Investors reduced their exposure to foreign equities by $11.3 billion in January. They sold both US and non-US stocks from their portfolios. US stock prices were down 0.2% in January, a first monthly decline since August 2019.

Canadian investment in foreign debt securities moderated the overall divestment in foreign securities in January. Purchases of foreign bonds reached $1.3 billion in the month and reflected increased holdings of non-US instruments (+$4.3 billion), which were partially offset by a reduction in holdings of US instruments (-$3.0 billion). In the foreign money market, Canadian investors added $1.0 billion to their portfolios in January.

Note to readers

The data series on international transactions in securities covers portfolio transactions in equity and investment fund shares, bonds and money market instruments for both Canadian and foreign issues. This activity excludes transactions in equity and debt instruments between affiliated enterprises, which are classified as foreign direct investment in the international accounts.

Equity and investment fund shares include common and preferred equities, as well as units/shares of investment funds.

Debt securities include bonds and money market instruments.

Bonds have an original term to maturity of more than one year.

Money market instruments have an original term to maturity of one year or less.

Government of Canada paper includes Treasury bills and US-dollar Canada bills.

All values in this release are net transactions unless otherwise stated.

Next release

Data on Canada's international transactions in securities for February will be released on April 17.

Products

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The data visualization product "Securities statistics," part of the series Statistics Canada – Data Visualization Products (71-607-X), is available online.

The Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: