Wholesale trade, June 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-08-22

$64.1 billion

June 2019

0.6%

(monthly change)

$389.6 million

June 2019

4.8%

(monthly change)

$93.7 million

June 2019

1.4%

(monthly change)

$920.2 million

June 2019

4.0%

(monthly change)

$585.5 million

June 2019

8.6%

(monthly change)

$12,102.5 million

June 2019

0.1%

(monthly change)

$32,755.3 million

June 2019

0.1%

(monthly change)

$1,566.7 million

June 2019

4.8%

(monthly change)

$2,337.1 million

June 2019

2.2%

(monthly change)

$6,944.0 million

June 2019

1.3%

(monthly change)

$6,382.1 million

June 2019

0.2%

(monthly change)

$15.2 million

June 2019

2.2%

(monthly change)

$44.6 million

June 2019

-16.9%

(monthly change)

$9.3 million

June 2019

-39.5%

(monthly change)

Wholesale sales rose 0.6% to $64.1 billion in June, partly offsetting the 1.9% decline in May. Sales were up in four of seven subsectors, representing 54% of total wholesale sales.

In dollar terms, the miscellaneous, and the machinery, equipment and supplies subsectors contributed the most to the increase in June, while the motor vehicle and motor vehicle parts and accessories subsector posted the largest decline.

In volume terms, wholesale sales increased 0.6%.

During the second quarter, current dollar sales rose 1.3%, the 13th consecutive quarterly gain. Quarterly sales increased in five of seven subsectors, led by the machinery, equipment and supplies subsector, and the personal and household goods subsector. Constant dollar sales were up 1.2% in the quarter.

Increase in June attributable to higher sales in four of seven subsectors

In dollar terms, the miscellaneous subsector reported the largest increase in June, as sales rose 3.5% to $8.2 billion. Sales were up in three of five of its component industries, led by the other miscellaneous (+7.2%) and the agricultural supplies (+6.7%) industries. The other miscellaneous industry comprises establishments primarily engaged in wholesaling logs, wood chips, minerals, ores and concentrates, precious metals, second-hand goods and other products.

Sales in the machinery, equipment and supplies subsector rose 1.5% to $13.9 billion in June.

In the food, beverage and tobacco subsector, sales increased for the third time in four months, up 1.3% to $12.1 billion, almost entirely offsetting the 1.4% decline reported in May. While gains were recorded in all three industries, the food industry contributed the most to the rise. On a quarterly basis, this subsector was up 0.9%, the fourth consecutive increase.

Sales in the motor vehicle and motor vehicle parts and accessories subsector decreased 1.9% to $10.9 billion. Lower sales in the motor vehicle and parts industry (-2.4%) contributed the most to the decline. In the second quarter, sales in this subsector increased 0.5%, the second consecutive gain.

Sales rise in every province in June

In June, higher sales were recorded in each province, led by increases in Alberta, Manitoba and Saskatchewan. The last time every province recorded higher month-over-month sales was in October 2017.

Sales in Alberta increased 1.3% in June to $6.9 billion, following an 8.3% decline in May. Higher sales were recorded in four of seven subsectors, led by the machinery, equipment and supplies subsector, and the motor vehicle and motor vehicle parts and accessories subsector.

Sales in Manitoba rose 4.8% to $1.6 billion, with increases in six of seven subsectors. The machinery, equipment and supplies subsector (+7.7%) led the gains, followed by the food, beverage and tobacco subsector (+5.0%). The miscellaneous subsector (-1.8%) recorded the sole decline in June, with sales reaching their lowest value since January 2015.

In Saskatchewan, sales increased for the first time in four months, up 2.2% to $2.3 billion, on higher sales in three subsectors. The advance was largely due to higher sales in the miscellaneous subsector (+5.2%), mainly in the agricultural supplies industry.

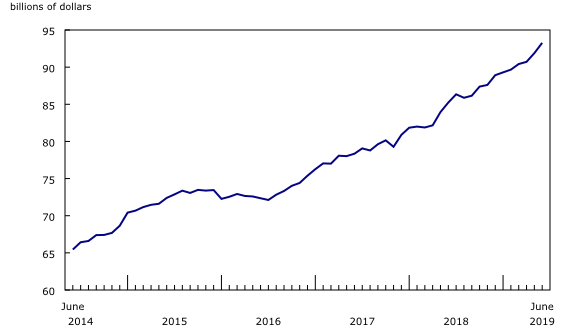

Inventories increase for a 10th consecutive month

Wholesale inventories rose 1.5% to $93.3 billion in June, the 10th consecutive monthly gain. Increases were recorded in six of seven subsectors, representing 83% of total wholesale inventories. Inventories rose 3.2% in the second quarter of 2019, the 12th consecutive quarterly increase.

Inventories in the motor vehicle and motor vehicle parts and accessories subsector increased for the second consecutive month, up 3.6% to $13.4 billion, the highest level on record. Almost 90% of the rise in the subsector was attributable to higher inventory levels in the motor vehicle industry.

In the miscellaneous subsector, inventories rose 3.3% to $11.7 billion. Increases were recorded in four of five industries, led by the other miscellaneous and the agricultural supplies industries.

Following three consecutive monthly increases, inventories in the building material and supplies subsector declined 0.9% to $15.4 billion in June. In dollar terms, the metal service centres industry contributed the most to the decline in inventory.

The inventory-to-sales ratio increased from 1.44 in May to 1.45 in June. For more than a year, this ratio has generally been on the rise, having increased from 1.36 in June 2018 to 1.45 in June 2019. Prior to 2019, the last time this ratio was 1.40 or at a higher level for more than two consecutive months was in the beginning of 2009. An increase was also observed in the manufacturing sector, where the ratio rose from 1.41 to 1.51 during the same period. A similar gain was also recorded in the United States wholesale sector, according to the United States Census Bureau.

The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Total wholesale sales expressed in volume are calculated by deflating current dollar values using relevant price indexes. The wholesale sales series in chained (2012) dollars is a chained Fisher volume index with 2012 as the reference year. For more information, see Sales in volume for Wholesale Trade.

The Monthly Wholesale Trade Survey covers all industries within the wholesale trade sector as defined by the North American Industry Classification System (NAICS), with the exception of oilseed and grain merchant wholesalers (NAICS 41112), petroleum and petroleum products merchant wholesalers (NAICS 412), and business-to-business electronic markets, and agents and brokers (NAICS 419).

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Real-time data tables

Real-time data tables 20-10-0019-01, 20-10-0020-01 and 20-10-0005-01 will be updated on September 9.

Next release

Wholesale trade data for July will be released on September 23.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca). For analytical information, or to enquire about the concepts, methods or data quality of this release, contact John Burton (613-862-4878; john.burton@canada.ca), Mining, Manufacturing and Wholesale Trade Division.

- Date modified: