Natural resource indicators, fourth quarter 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-03-26

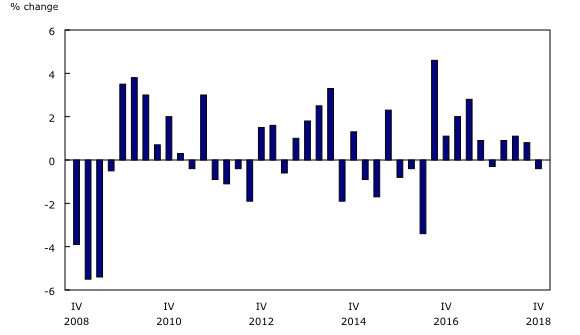

Natural resources gross domestic product declines

Real gross domestic product (GDP) of the natural resources sector decreased by 0.4% in the fourth quarter, following a 0.8% increase in the third quarter. By comparison, real GDP growth for the total economy slowed (+0.1%).

The forestry subsector (-4.9%) posted the largest decline in real GDP. Primary manufacturing (-5.6%) accounted for most of the decrease, with the primary sawmill and wood commodity grouping declining 6.7%. This coincided with fewer housing starts, a shortage of rail cars causing transportation constraints and shutdowns at a number of sawmills.

Real GDP in the energy subsector declined 0.3% in the fourth quarter, following three consecutive quarterly increases. Energy services fell 5.3%, coinciding with the announcement of temporary oil production cuts in Alberta, which took effect on January 1.

The mineral and mining subsector increased 1.4% following a 3.2% expansion in the third quarter. Services incidental to minerals and mining (+12.3%) led the increase, followed by metallic mineral extraction (+1.8%).

The value of natural resource activity, as measured by nominal GDP, fell 7.3% to $232.4 billion (nominal terms, at annual rates) in the fourth quarter. The energy subsector (-9.7%) accounted for most of the decline, due to sharply lower prices. Natural resources represented 11.2% of the total economy in the fourth quarter, down from 12.0% in the third quarter.

Energy drives the decline in natural resource prices

Natural resource prices were down 7.0% in the fourth quarter, largely attributable to lower energy prices (-9.4%). Overall, energy prices recorded their largest decline since the first quarter of 2016, following four consecutive quarterly increases. Crude oil prices fell 22.8% in the fourth quarter, while the total refined petroleum product price decreased 6.4%. According to estimates from the Raw Materials Price Index, crude oil prices have begun to show signs of recovery in the first months of 2019.

Prices in the forestry subsector declined 4.6%, led by primary sawmill and wood products (-9.2%). This coincided with a fourth quarter decline in Canadian and United States housing starts. Mineral and mining prices decreased 0.6% in the quarter.

Lower exports and imports of natural resources are attributable to energy

Real natural resource exports declined 1.5% in the fourth quarter, following a 4.0% increase in the third quarter. Lower exports were the result of less trade in the energy (-2.0%) and forestry (-6.8%) subsectors. Energy exports were down on lower shipments from Alberta, while forestry declined due to log supply constraints and sawmill closures.

Mineral and mining exports (+1.6%) rose for the fourth consecutive quarter, led by coal (+23.7%) and non-metal minerals (+9.4%).

Real imports of natural resources were down 1.4%, following an 8.6% decrease in the third quarter. Energy imports declined 2.5% in the fourth quarter, the second consecutive quarterly contraction, with total refined petroleum products down 3.1%.

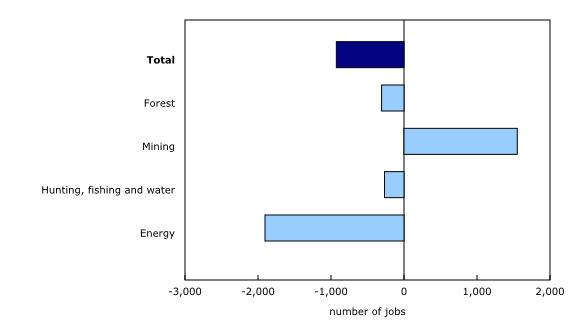

Employment down

Employment in the natural resources sector declined by 900 jobs (-0.2%) in the fourth quarter, following seven consecutive quarterly increases. A loss of 1,900 jobs (-0.7%) in the energy subsector offset a 1,600 job (+0.8%) increase in the mining subsector.

Downstream activities decrease

Secondary and tertiary processing for the forestry and minerals and mining subsectors are identified separately in the natural resource indicators for analytical purposes. An additional 1.7% of Canadian GDP is attributable to these downstream activities.

Real GDP of these downstream activities decreased 0.3% in the fourth quarter, following eight consecutive quarterly increases. Downstream activities in forestry declined 3.6%, while downstream mining activities increased 0.9%.

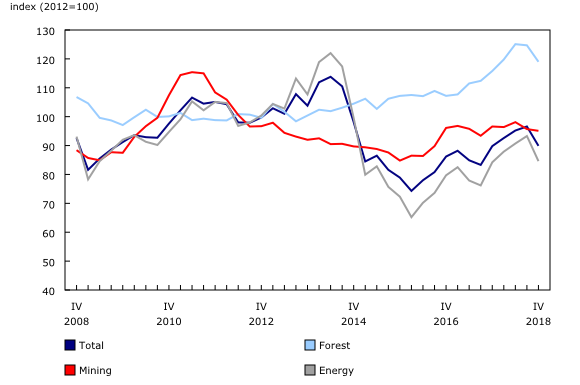

Natural resources sector expands in 2018

The natural resources sector expanded by 3.0% for the year 2018, outpacing growth in the total economy (+1.8%). The energy subsector was responsible for most of this growth, increasing 4.3% in 2018 with the majority of gains in the first half of the year. The share of the natural resources sector to total GDP grew from 10.9% in 2017 to 11.7% in 2018.

Prices rose in each natural resources subsector in 2018, up 8.1% overall. Energy prices rose 11.2% in 2018 on increases in the first three quarters of the year, despite large declines in the fourth quarter. The forestry subsector rose 9.3%, with higher prices in the first half of the year followed by declines in the latter half.

Natural resources exports grew 5.6% in 2018, on the strength of the energy (+7.1%) and the mineral and mining (+5.8%) subsectors. Real natural resources imports (+0.7%) also rose in 2018, on higher imports of energy products (+4.8%).

Employment in the natural resources sector rose by 8,400 jobs (+1.4%) in 2018. An increase in employment in the energy subsector added 4,100 jobs (+1.6%), while the mineral and mining subsector added 3,300 jobs (+1.8%).

Note to readers

The natural resource indicators (NRI) provide quarterly indicators for the main aggregates in the Natural Resource Satellite Account (NRSA), namely, nominal and real gross domestic product as basic prices, output, real exports and imports and employment. The estimates from this account are directly comparable to the estimates found in the Canadian System of Macroeconomic Accounts.

The energy subsector accounts for approximately two-thirds of the Canadian natural resource sector, while the mining subsector accounts for just over 20%. The forest (8%) and hunting, fishing and water (4%) subsectors account for the rest.

Core natural resources: The NRSA defines natural resource activities as those which result in goods and services originating from naturally-occurring assets used in economic activity, as well as their initial processing (primary manufacturing).

Downstream activities: Although not part of the core account, natural resources have important downstream effects on other sectors. In general, this production uses a large portion of primary manufactured products as inputs.

With the third quarter of 2018 release of the NRI and the 2017 release of the NRSA, constant dollar estimates of gross domestic product and international trade have been rebased from 2007=100 to 2012=100 in line with the other macroeconomic accounts.

Note: Natural resource bioproducts have been added to the NRSA as of the release of NRI for the first quarter of 2018. For the purpose of the account, bioproducts are split into four categories:

Energy and forestry subsectors:

- Energy subsector: Bioenergy

- Energy subsector: Biofuels

- Forestry subsector: Bioenergy and biofuels from forestry biomass (a subset of 1) and 2));

- Forestry subsector: Other bioproducts from forestry biomass.

Total of natural resource bioproducts = bioenergy (1) + biofuels (2) + other bioproducts from forestry biomass (4).

Next release

Data on natural resource indicators for the first quarter will be released on June 26.

Products

Additional information can be found in the articles "The Natural Resources Satellite Account: Feasibility study" and "The Natural Resources Satellite Account – Sources and methods," which are part of the Income and Expenditure Accounts Technical Series (13-604-M).

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: