Employment Insurance, March 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-05-24

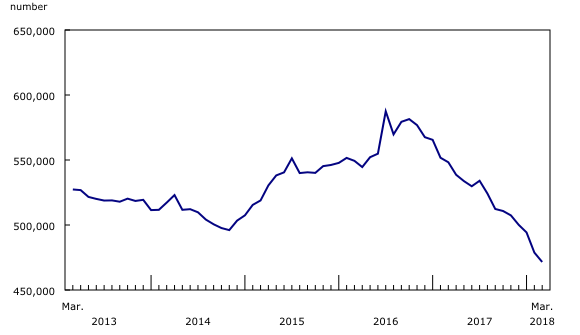

In March, 471,500 people received regular Employment Insurance (EI) benefits, down 7,300 (-1.5%) from February. The decline continues a downward trend in the number of beneficiaries that began in the autumn of 2016.

There were fewer beneficiaries in six provinces, led by British Columbia (-3.2%), Quebec (-2.6%) and Alberta (-2.4%). Smaller declines occurred in Manitoba (-1.6%), New Brunswick (-1.2%) and Ontario (-1.2%). The number of recipients rose slightly in Nova Scotia (+1.4%) and Prince Edward Island (+1.0%), while there was little change in the other provinces.

In the 12 months to March, the number of EI recipients in Canada fell by 76,700 (-14.0%). Over the same period, the Labour Force Survey (LFS) showed the unemployment rate declining by 0.8 percentage points to 5.8%, matching a record low since comparable data became available in 1976.

In general, variations in the number of beneficiaries can reflect changes in the circumstances in a number of different groups, including those becoming beneficiaries, those going back to work, those exhausting their regular benefits, and those no longer receiving benefits for other reasons.

Provincial and sub-provincial overview

In British Columbia, 43,600 people received regular benefits in March, down 3.2% from February. This continues a downward trend that began in the autumn of 2016. Declines were observed across the province in March, with notable decreases in the census metropolitan areas (CMAs) of Abbotsford–Mission (-9.7%) and Kelowna (-4.5%). In the 12 months to March, the number of EI recipients declined by 17.6% in the province. Over the same period, the LFS unemployment rate in British Columbia fell by 0.6 percentage points to 4.7%, the lowest among all provinces.

In March, EI recipients in Quebec totalled 108,500, down 2.6% from the previous month. The number of beneficiaries has trended down sharply, especially since the summer of 2017. The unemployment rate has also been on a constant downward trend and reached 5.6% in March, approaching the record low of 5.0% in December 2017. Declines in March were observed in the CMAs of Montréal (-3.3%) and Québec (-1.5%). There were also fewer beneficiaries (-2.6%) in areas outside of the CMAs and census agglomerations (CAs). Compared with March 2017, the number of beneficiaries fell by 19.6%. According to quarterly data from the Job Vacancy and Wage Survey (JVWS), Quebec has posted continuous year-over-year increases in job vacancies since the second half of 2016.

In Alberta, 60,100 people received benefits in March, down 1,500 (-2.4%) from February. Decreases were observed throughout the province, led by the CAs (-4.8%). Compared with March 2017, Alberta recorded the fastest year-over-year decline in the number of beneficiaries among the provinces, down 26.4%. Data from the JVWS showed that job vacancies in Alberta have increased on a year-over-year basis since the first quarter of 2017. Coinciding with the declining trend in the number of beneficiaries and an increase in job vacancies, the province recorded real gross domestic product growth of 4.9% in 2017, following declines of 3.9% in 2015 and 3.6% in 2016.

In Manitoba, 15,500 people received benefits in March, down 1.6% from the previous month. The CMA of Winnipeg led the decline (-3.6%). Compared with March 2017, the number of beneficiaries in Manitoba was little changed as a decrease in the Winnipeg CMA (-5.4%) was offset by more beneficiaries in regions outside of the CMAs and CAs (+6.9%).

The number of beneficiaries in New Brunswick fell for the fourth consecutive month in March, albeit slightly (-1.2%). Decreases were observed in the province's CAs (-4.1%). In the 12 months to March, the number of beneficiaries in New Brunswick declined by 10.4%.

EI beneficiaries in Ontario totalled 120,100 in March, down slightly (-1.2%) from the previous month. There were notable declines, however, in the CMAs of Oshawa (-4.7%) and Greater Sudbury (-4.4%). Compared with 12 months earlier, the number of beneficiaries in the province fell by 11.8%, and coincided with a 0.8 percentage point decline in the unemployment rate, reaching 5.5% in March, as reported in the LFS.

Following a decrease in February, the number of EI recipients in Nova Scotia rose slightly (+1.4%) in March to 27,400, the result of more recipients in areas outside of the CMA and CAs (+3.4%). Compared with March 2017, the number of beneficiaries in Nova Scotia was down by 3.6%.

The number of people receiving EI benefits in Prince Edward Island also rose slightly (+1.0%) in March to 8,100. On a year-over-year basis, the number of recipients rose by 2.0%.

In Newfoundland and Labrador, 37,900 people received EI benefits in March, little changed from February. However, increases were observed in the CMA of St. John's (+3.4%). Compared with March 2017, the number of beneficiaries in the province rose by 1.9%.

There were 17,900 EI beneficiaries in Saskatchewan in March, little changed from February. In the 12 months to March, the number of beneficiaries in Saskatchewan was down 3.8%.

Employment Insurance beneficiaries by occupation

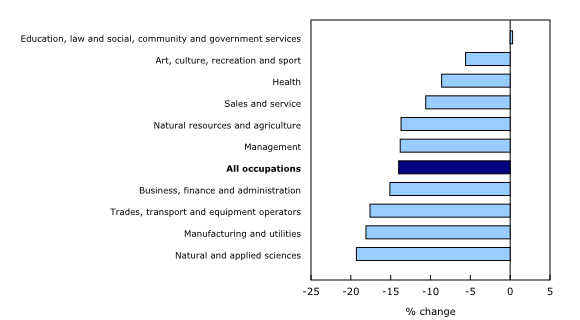

For a seventh consecutive month, the number of beneficiaries fell on a year-over-year basis in 9 of the 10 broad occupation groups. The largest declines in March were among those whose last job was in natural and applied sciences (-19.3%); manufacturing and utilities (-18.1%); trades, transport and equipment operators (-17.6%); as well as business, finance and administration (-15.1%). In the 12 months to March, New Brunswick, Quebec, Ontario, Alberta, and British Columbia posted year-over-year declines in all or virtually all broad occupation groups.

The lone exception was those whose last job was in education, law and social, community and government services, as the number of beneficiaries was virtually unchanged in March compared with 12 months earlier.

Employment Insurance beneficiaries in major demographic groups

Compared with February, there were fewer EI recipients among men (-2.3%) in March, affecting all major age groups. While the overall number of women receiving benefits was little changed, there was a 4.0% decline among young women aged 15 to 24.

In the 12 months to March, the number of beneficiaries declined in all major demographic groups, led by young men (-22.3%) and men aged 25 to 54 (-18.2%). Declines were sharper for men than for women across all age groups and coincided with declining unemployment rates for all demographic groups over the same period, as observed in the LFS.

Employment Insurance claims

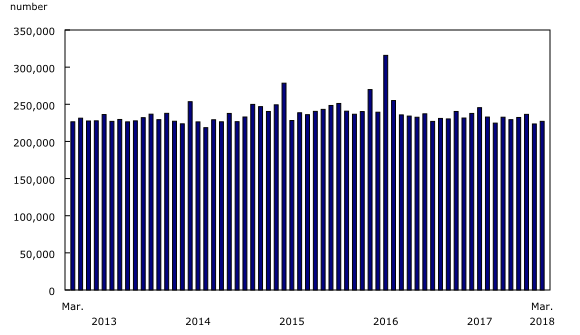

The number of claims totalled 227,000 in March, up 1.6% from February. The number of claims provides an indication of the number of people who could become beneficiaries.

Claims rose notably in Quebec (+7.2%), following a decline of similar magnitude in February. There were also more claims in Ontario (+3.4%) and New Brunswick (+3.2%), as well as in Newfoundland and Labrador (+2.2%). These increases were moderated by declines in Saskatchewan (-11.9%), Alberta (-8.9%) and British Columbia (-2.6%). At the same time, the number of claims fell slightly in Nova Scotia (-1.0%) and Manitoba (-1.0%), while there was little change in Prince Edward Island.

In the 12 months to March, claims decreased 1.4% nationally.

Note to readers

Concepts and methodology

The analysis presented here focuses on people who received regular Employment Insurance (EI) benefits related to job loss. Claims data pertain to initial and renewal claims received for any type of EI benefits, including special benefits.

EI statistics are produced from administrative data sources provided by Service Canada and Employment and Social Development Canada. These statistics may, from time to time, be affected by changes to the Employment Insurance Act or administrative procedures.

Regular EI benefits are available to eligible individuals who lose their jobs and who are available for and able to work, but cannot find a job. To receive EI benefits, individuals must first submit a claim.

EI statistics indicate the number of people who received EI benefits, and should not be confused with Labour Force Survey (LFS) data, which provide estimates of the total number of unemployed people. There is always a certain proportion of unemployed people who do not qualify for benefits. Some unemployed people have not contributed to the program because they have not worked in the past 12 months or their employment is not insured. Other unemployed people have contributed to the program but do not meet the eligibility criteria, such as workers who left their job voluntarily or those who did not accumulate enough hours of work to receive benefits.

All data in this release are seasonally adjusted. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Numbers in the Daily text are rounded to the nearest hundred.

The number of regular EI beneficiaries and the number of claims received for the current and previous month are subject to revision.

The number of beneficiaries is a measure of all people who received EI benefits from March 11 to 17. This period coincides with the reference week of the LFS. However, claims data are for the entire month.

Geographical definitions

A census metropolitan area (CMA) or a census agglomeration (CA) is formed by one or more adjacent municipalities centred on a population centre. A CMA must have a total population of at least 100,000. A CA must have a population of at least 10,000. See Standard Geographical Classification 2011 – definitions for more information.

Next release

Data on Employment Insurance for April will be released on June 21.

Products

More information about the concepts and use of Employment Insurance statistics is available online in the Guide to Employment Insurance Statistics (73-506-G).

Contact information

For more information, contact us (toll-free: 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Vincent Ferrao (613-951-4750; vincent.ferrao@canada.ca) or Client Services (toll free: 1-866-873-8788; statcan.labour-travail.statcan@canada.ca), Labour Statistics Division.

- Date modified: