Household income in Canada: Key results from the 2016 Census

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-09-13

The median total income of Canadian households rose from $63,457 in 2005 to $70,336 in 2015, a 10.8% increase.

Today, Statistics Canada is releasing data from the 2016 Census on the incomes of Canadians. This release presents incomes of Canadians as measured in 2015, and looks at trends over the 2005-to-2015 period, a decade of significant income growth and economic change.

An important factor in the economic story of Canada over the decade was high resource prices that drew investment and people to Alberta, Saskatchewan and Newfoundland and Labrador, boosted the construction sector, and more generally filtered through the economy as a whole.

This boom in the resource sector coincided with a decline in the manufacturing sector, with fewer jobs in this sector in 2015 than 2005. The bulk of these manufacturing job losses were in Ontario and Quebec.

This census release paints a picture of the income of Canadians in 2015 before the effects of the oil price slowdown in 2015 and 2016 were fully felt.

Led by growth in resource-rich provinces, median income rose 10.8% in Canada from 2005 to 2015, compared with 9.2% growth in the previous decade and a decline of 1.8% the decade before that.

This growth was not distributed evenly across Canada. Resource-based provinces and regions had the highest income growth, led by Nunavut, and Saskatchewan. Median income growth was slowest in Ontario and Quebec, the two provinces with the largest populations and significant manufacturing activity.

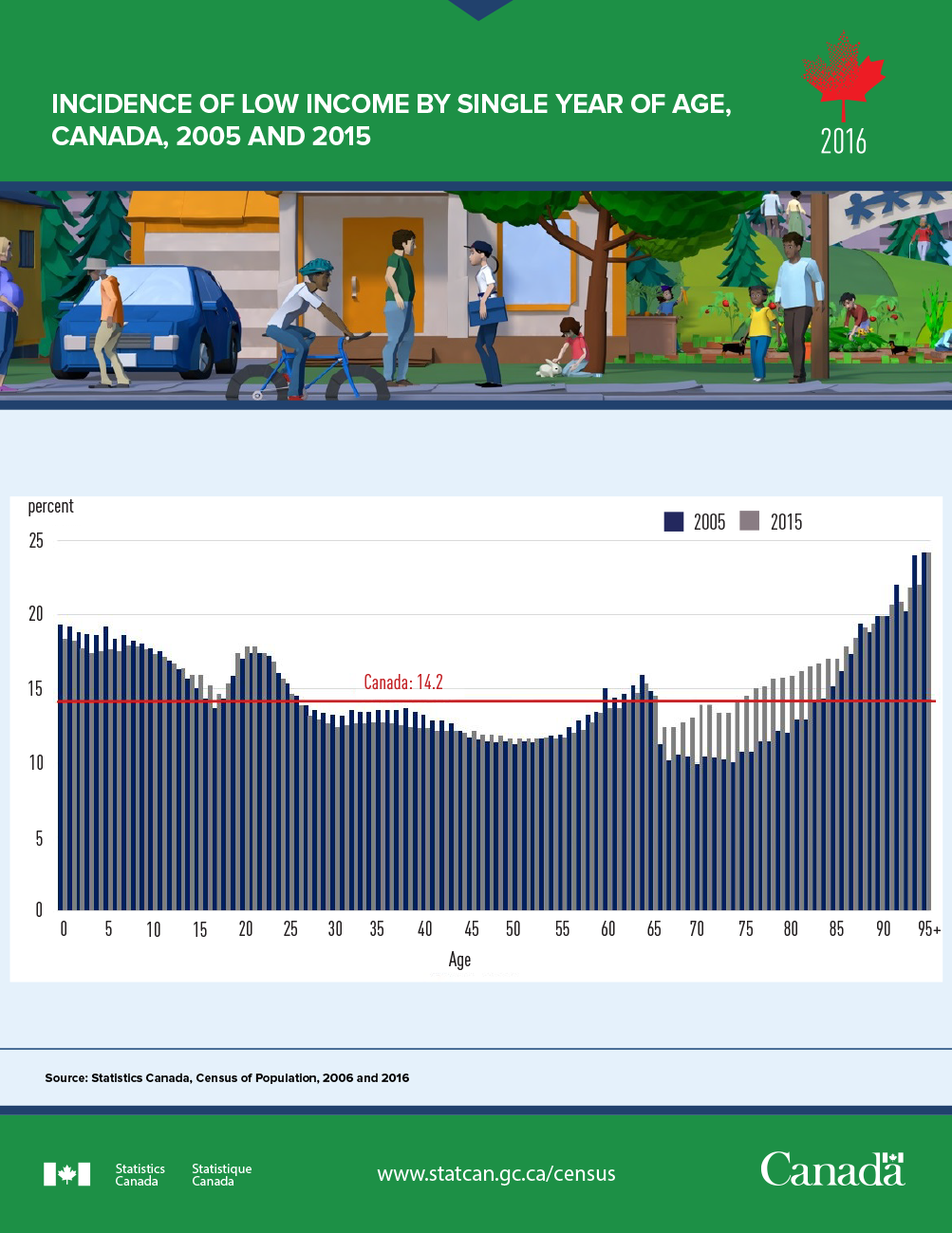

The low-income rate was relatively stable over the last decade, rising marginally from 14.0% in 2005 to 14.2% in 2015. There were regional variations over the decade. The number of persons in low income declined in Saskatchewan and Newfoundland and Labrador, while the number increased in Ontario. There were also variations across age groups with a smaller proportion of young children living in households with low income and a larger proportion of seniors.

Almost two-thirds of Canadian households contributed to an RRSP, RPP or TFSA in 2015. Of these households, more than half contributed to only one plan, while one-third contributed to two plans and 14% contributed to all three.

In 2015, 96% of Canadian couples had both spouses reporting income, up significantly from about two-thirds in the mid-1970s.

One-third of couples had fairly equal incomes in 2015 compared with about one-fifth of couples 30 years earlier.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

The economy of Canada at the time of Confederation and the incomes of Canadians bear little resemblance to today's modern global economy. Formal income statistics were not collected in 1867 and the vast majority of income was derived from farming, fishing, trapping, logging and, to a lesser degree, mining.

There were no income taxes at the time of Confederation and most Canadians in 1867 did not "retire." Rather, most people lived and worked until they were physically unable to continue, whereupon they were supported by their family.

The incomes of Canadians have evolved over the last 150 years. Today, most Canadians have paid jobs, pay taxes, receive transfers and, as shown in the earlier Census release, live mainly in urban areas.

Provincial median income growth reflects employment trends in resources and manufacturing

According to the Labour Force Survey, two industrial sectors experienced declines in employment from 2005 to 2015: manufacturing (-22%) and agriculture (-14%). Over the same period, employment in the health care sector rose over 30% as did employment in construction and the professional, scientific and technical services sector, sectors associated with economic expansion. These changes in the economy are reflected in changes to median household income.

Nunavut (+36.7%) and Saskatchewan (+36.5%) had the highest growth in median incomes over the past decade. Newfoundland and Labrador, the Northwest Territories, Alberta, and Manitoba also saw median incomes grow by more than 20% over the decade.

The decline in manufacturing jobs in Quebec and Ontario was reflected in the lower growth of median incomes in those two provinces. Quebec (+8.9%) and Ontario (+3.8%) were the provinces with the lowest growth rates.

The metropolitan areas within these regions also tended to follow these provincial/territorial patterns. For example, almost every metropolitan area in Ontario saw income growth below the national average, while almost every metropolitan area on the Prairies had income growth above the national average.

The following sections look at regions across the country and provide further detail on the growth in median household income for provinces and metropolitan areas.

Atlantic provinces and Quebec had the lowest median incomes

The Atlantic provinces and Quebec had the lowest median incomes in Canada in both 2005 and 2015. However, investments in the resource sector during this time led to higher incomes in Newfoundland and Labrador (+28.9%), resulting in the third-fastest income growth among the provinces and territories. This increase lifted Newfoundland and Labrador from the lowest median income in the Atlantic/Quebec region to the highest over the course of 10 years.

Every metropolitan area in Newfoundland and Labrador posted income growth above 12% over the decade. The growth was highest in Bay Roberts (+33.1%) and St. John's (+27.5%), followed by Corner Brook (+15.7%), Grand Falls-Windsor (+14.5%), and Gander (+12.4%). Among metropolitan areas in the rest of Atlantic Canada, only the median income in Miramichi, New Brunswick (+14.3%), grew at a faster pace than the slowest-growing Newfoundland and Labrador metropolitan area.

New Brunswick ($59,347) had the lowest median income in Canada in 2015, followed by Quebec ($59,822). Median household income grew by 8.9% in Quebec from 2005, the second-slowest provincial/territorial growth rate in Canada over the decade. Montréal, the largest city in the province, had a median total income of $61,790 in 2015, up 8.8% from 2005.

Despite a low median income growth rate in Quebec, several metropolitan areas in resource rich areas had relatively high income growth. Median incomes in Rouyn-Noranda (+20.4%), Val D'or (+18.0%) and Sept-Îles (+13.4%) all grew faster than 10%, as did those in Québec (+11.1%). Conversely, median incomes were 4.1% lower in Baie-Comeau.

In the Eastern Townships, Granby (+19.1%) and Cowansville (+16.0%) had among the highest growth in the number of households within the province. However, median income growth in Granby (+3.8%) and Cowansville (+1.8%) were well below the Quebec average of 8.9%. Both Granby and Cowansville had higher-than-average growth in the number of people over the age of 65 and they also had relatively high levels of manufacturing.

Ontario had the slowest growth in median income since 2005

The median household income in Ontario was $74,287 in 2015, ranking sixth among the provinces and territories, and $3,951 above the Canadian median. Ontario had the slowest growth in median income (+3.8%) of any province or territory over the decade, and as a result, its rank fell three places from third highest in 2005, when it was $8,077 above the Canadian median.

The decline in the manufacturing sector in Ontario over the decade partly underlies these trends. According to the Labour Force Survey, employment in all industries grew by about 8.5% in Ontario from 2005 to 2015, while the manufacturing sector lost 318,000 jobs, down 30.0% from 2005. A combination of factors, including technological change, globalization, lower exchange rates and low productivity, help explain why manufacturing employment has declined.

The Ontario portion of Ottawa–Gatineau ($86,451), Petawawa ($86,048) and manufacturing-based Oshawa ($85,697) had the highest median income among metropolitan areas in Ontario in 2015. Ottawa, with 4.4% growth in median income, rose from second place a decade earlier to first among metropolitan areas in the province. Meanwhile, Oshawa fell from first to third place, with median income edging up 0.1%.

While Petawawa ranked seventh in median income in 2005, its rank rose to second place a decade later, with median income growth of 11.8%. Petawawa and Timmins (+11.7%) shared the highest median income growth rates among metropolitan areas in Ontario.

Toronto had a median income of $78,373 in 2015, up 3.3% from 2005, and its ranking improved from the ninth-highest median income in Ontario to the eighth.

Among the 152 Canadian metropolitan areas, 9 saw median incomes fall, 8 of which were in Ontario and 1 in Quebec. The decline in manufacturing in Ontario affected certain manufacturing towns more than others. Windsor (-6.4%) and Tillsonburg (-5.7%) had the largest declines in median incomes in Ontario metropolitan areas and both had about one-quarter of their workforce in manufacturing in 2005.

Prairie provinces boom

Earlier results from the 2016 Census show that the population is moving west. While economic opportunities in the West underlie this trend, median income growth does not necessarily follow the growth in the number of households and in the West was more related to developments in the resource (oil) and construction sectors.

Over the decade, the Prairie provinces had the highest growth in both the number of households and household median income in Canada. Even within the Prairie provinces, however, there were differences. For example, the growth in the number of households was faster in Alberta (+21.6%) than Saskatchewan (+11.7%), yet the median income growth in Saskatchewan outpaced that of Alberta.

The median household income in Manitoba was $68,147 in 2015, ranking eighth among the provinces and territories. Despite a 20.3% increase in median income since 2005, roughly twice the national growth rate, Manitoba slipped one rank from seventh in 2005 because other regions had even stronger growth.

Winkler (+24.2%) and Brandon (+23.3%) had the highest median income growth among the metropolitan areas in Manitoba. The income growth was slower in Steinbach (+16.6%), despite having the fastest growth in the number of households at 41.8%. In Winnipeg, the largest city in Manitoba, median incomes grew 16.6%, somewhat below the provincial growth rate.

Saskatchewan (+36.5%) had the highest median income growth among the provinces, and was second highest nationally following Nunavut (+36.7%). On the strength of this income growth, Saskatchewan improved its provincial/territorial ranking from eighth to fifth over the decade.

Although Moose Jaw (+26.4%) had the slowest income growth among Saskatchewan metropolitan areas, it was faster than all but 17 of the 152 metropolitan areas in Canada. Saskatchewan was also home to the metropolitan area with the highest growth in median income in Canada (Yorkton), up 40.5% from 2005. The number of households in Moose Jaw and Yorkton grew by about 6.5% over this period—among the slowest growing metropolitan areas in Saskatchewan.

Alberta ($93,835) had the third-highest median income among the provinces and territories in 2015, down from second place in 2005. Alberta was the fifth-fastest growing province/territory in Canada at 24.0%.

Within Alberta, median total income rose the fastest in Wood Buffalo (35.2%), followed by Camrose (+29.9%), Wetaskiwin (+27.3%), Okotoks (+27.0%), Edmonton (+26.6%), Cold Lake (+23.0%) and Calgary (+22.7%). While Sylvan Lake had the slowest growth in median incomes of any Alberta metropolitan area (+7.8%), it had the second-largest increase in the number of households (+50.5%).

British Columbia just above the national growth rate

The median household income in British Columbia was $69,995 in 2015, seventh among the provinces and territories, down from sixth in 2005. Median incomes increased 12.2% from 2005, 1.4 percentage points above the Canadian average, making British Columbia the eighth-fastest growing region over the decade. Fewer manufacturing and agricultural jobs coincided with employment increases in utilities, health care and social assistance, and forestry and construction sectors.

Every metropolitan area in British Columbia experienced some growth in their median income. Median income growth ranged from 2% or less in Powell River, Port Alberni and Quesnel to over 20% in Cranbrook (+21.8%), Prince Rupert (+23.2%), Terrace (+24.6%), Fort St. John (+27.5%) and Dawson Creek (+31.6%). Vancouver, with a median income of $72,662 in 2015, experienced an income growth rate of 11.2% since 2005, somewhat below the provincial rate.

The territories: Strong income growth

Median household income rose significantly in all three territories. The overall median income growth rate of the territories was 22.4%, second only to the growth seen on the Prairies (+25.7%).

Nunavut led the country with a median income growth of 36.7%. The growth in Nunavut reflected more workers in the resource sector and government sector over the decade.

The Northwest Territories had the second-highest median income growth in the North at 24.5%, followed by Yukon (+18.9%).

People living in low-income households

Low income relatively stable from 2005 to 2015

This census release uses the After Tax Low Income Measure (LIM-AT). The concept underlying the LIM-AT is that a household has low income if its income is less than half of the median income of all households.

The low-income rate was relatively stable over the decade, edging up from 14.0% in 2005 to 14.2% in 2015. While the rate was relatively stable, some groups and regions saw an increase in low income, while others had fewer low-income households.

Fewer children living in low income, more low income seniors

Younger Canadians were more likely to live in low income than adults in 2015. Among children 17 years of age and younger, the low-income rate was 17.0% compared with 13.4% for Canadian adults.

A smaller proportion of children aged 5 or younger were living in low income households in 2015, as the rate decreased from 18.8% to 17.8% over the decade, while it was unchanged for children 6 to 15 years of age at 17.0%. However, a larger proportion of Canadians 65 years of age or older were in low income in 2015 compared with 2005. The rate of senior Canadians in low income rose from 12.0% in 2005 to 14.5% by 2015. While the increase was particularly strong for senior men, overall, senior women were still more likely to be in low income in 2015.

Low income down sharply in Newfoundland and Labrador and Saskatchewan

From 2005 to 2015, low income fell sharply in Newfoundland and Labrador (from 20.0% to 15.4%) and Saskatchewan (from 16.8% to 12.8%). In addition, a smaller share of the population was living in low income in Alberta and Quebec. In Ontario however, the low-income rate rose from 12.9% to 14.4%.

With its decline in low income, Saskatchewan moved from having the fourth-highest low-income rate among provinces in 2005 to having the second-lowest rate in 2015, just behind Alberta (9.3%). Newfoundland and Labrador moved from the highest rate in 2005 to fifth highest in 2015, leaving Nova Scotia, New Brunswick and Prince Edward Island with the highest incidences of low income in Canada.

Low-income rates fell fastest in metropolitan areas related to the resource boom and rose fastest in manufacturing intensive Ontario metropolitan areas

Changes in low income for metropolitan areas also reflected sectoral boom and bust. The largest declines in low income occurred in metropolitan areas in resource-rich areas of the country. The low-income rate in St. John's fell from 16.0% in 2005 to 12.0% in 2015, while in Saskatoon it fell from 15.3% to 11.7%. The metropolitan areas with the largest increases in low income were in Ontario, where every large metropolitan area saw an increase in their low-income rate, led by London (from 13.3% to 17.0%) and Windsor (from 14.0% to 17.5%).

For additional information on the incidence of low income for children, see the Census in Brief article "Children Living in Low Income Households."

Incomes of couples: Nearly one-third of all couples had fairly equal incomes

There were 8.2 million married or common-law couples in Canada in 2016. Among the vast majority of these couples (95.9%), each partner received some form of income in 2015, up significantly from about two-thirds of couples in the mid-1970s. Although one partner often received substantially more than the other, the incomes of nearly one-third (32.0%) of couples were fairly equal (both earning from 40% to 60% of the couple's total income). This was up from 30 years ago, when 20.6% of couples had fairly equal incomes.

Many factors have contributed to this advance, led by the increased labour force participation of women. Combined with a narrowing of the gender wage gap, women now contribute a larger portion of the couple's combined income.

Partners also receive income from sources such as government transfers, which can account for an important portion of a couple's income, particularly for seniors and couples with children. Changes to transfer programs, as well as demographic shifts such as population aging, have also contributed to a change in the relative split in income between partners.

Men are more likely to be the higher income recipient

While partner's incomes were fairly equal in one-third of couples, in 50.7% of couples a male had relatively higher income while in 17.3% a female had relatively higher income.

This too, has changed over time. In 1985, a man had relatively higher income in 71.3% of couples compared with 8.0% for women.

The combined median total income of couples was $87,688 in 2015. The higher income partner had a median income of $59,121, more than double that of the lower income partner ($25,015).

Same-sex couples have higher incomes

Median incomes were higher in same-sex couples than in opposite-sex couples, in part because a greater proportion of same-sex couples are in their prime working years. Female same-sex couples had a median total income of $92,857 in 2015, while male same-sex couples had a median income of $100,707—the highest among all couple types. In fact, over 12% of male same-sex couples had incomes over $200,000, compared with 7.5% of female same-sex couples and 8.4% of opposite-sex couples.

Lower income partners in same-sex couples also had higher median incomes than their opposite sex counterparts. The median income of lower income partners was $31,192 in male same-sex couples and $30,942 in female same-sex couples compared with $24,969 in opposite-sex couples.

In 2015, a greater proportion of female same-sex couples (38.4%) had fairly equal incomes compared with opposite-sex (32.0%) or male same-sex couples (33.2%).

Almost two-thirds of households used a tax-assisted savings option

With an aging population and longer life expectancies, the need to save for retirement is high on many people's minds. Canadians use a variety of methods to save for their retirement, including employer sponsored Registered Pension Plans (RPPs), or tax-sheltered savings in either Registered Retirement Savings Plans (RRSPs), or Tax-Free Savings Accounts (TFSAs). In 2015, almost two-thirds (65.2%) of Canada's 14 million households contributed to one of the three major types of registered savings accounts. Just over 30% of households contributed to more than one account, and 9.3% contributed to all three.

Households with lower income were more likely to contribute to TFSAs than to RRSPs or RPPs, and contribution rates generally increased with income. Among households with after-tax income below $80,000, a larger proportion contributed to TFSAs (33.8%) than to RRSPs (20.1%) or RPPs (17.6%). However, households with higher income were generally more likely to contribute regardless of the type of account.

For more information on this topic see the Census in Brief article "Household contribution rates for selected registered savings accounts."

Number of households, median income and median income rank, Canada, provinces and territories

Note to readers

This is the first release of income data from the 2016 Census. It is based on annual income information for the 2015 reference year for the entire population. This is the first time Statistics Canada has linked income data from the Canada Revenue Agency to all census respondents to allow for a very comprehensive estimate of income and low income. This new approach reduces respondent burden, increases use of administrative data, and allows for a much larger sample size and therefore more accurate estimates for low levels of geography or small populations.

With the availability of additional administrative data sources, this will also be the first time information for Tax-Free Savings Accounts (TFSAs) will be included with the census. Variables on the characteristics of Canadians, such as education, occupation and ethnicity, will be available, along with income, on the long-form census in subsequent Census releases.

This release largely analyzes income on the basis of medians. The median is the level of income at which half the population had higher income and half had lower.

The After Tax Low Income Measure (LIM-AT) is an internationally used measure of low income. The concept underlying the LIM-AT is that a household has low income if its income is less than half of the median income of all households.

The term metropolitan areas in this report includes census metropolitan areas (CMAs) and census agglomerations (CAs). Large metropolitan areas refers to CMAs.

Partners are considered to have fairly equal incomes when both partners received more than 40% of the couple's combined total income.

2016 Census of Population products and releases

Today, Statistics Canada is releasing the fourth set of results from the 2016 Census of Population. These results focus on the income distribution of the Canadian population in 2015 at the national, provincial, territorial and sub-provincial levels.

Census results show the levels and distribution of income and low income in Canada in 2015 and to what extent it has changed since 2005. Income levels and income growth vary greatly from one region to the next across the country.

Several 2016 Census products are also available today on the Census Program web module. This module provides easy access to census data, free of charge. Information is organized into broad categories, including analytical products, data products, reference materials, geography and a video centre.

Analytical products include two articles from the Census in Brief series.

One article provides analysis focusing on children living in low income in 2015. The second focuses on household contributions to three major types of registered savings accounts in 2015: registered pension plans (RPPs), registered retirement savings plans (RRSPs), and tax-free savings accounts (TFSAs).

Data products include the income results for a wide range of standard geographic areas, available through the Census Profile, Data tables and Highlight tables.

An interactive graph showing the distribution of total personal income by age and sex for various regions by decade is also available on the Census web module.

In addition, the Focus on Geography Series provides data and highlights on key topics found in this Daily release and in the Census in Brief articles at various levels of geography.

Reference materials contain information to help understand census data. They include the Guide to the Census of Population, 2016, which summarizes key aspects of the census, as well as response rates and other data quality information. They also include the Dictionary, Census of Population, 2016, which defines census concepts and variables, and the Income Reference Guide, which explains census concepts and changes made to the 2016 Census. This reference guide also includes information about data quality and historical comparability, and comparisons with other data sources. Both the Dictionary and the Guide to the Census of Population are updated with additional information throughout the release cycle.

Geography-related 2016 Census Program products and services can be found under Geography. This includes GeoSearch, an interactive mapping tool, and thematic maps, which show income data for various standard geographic areas.

An infographic, Income in Canada, 2016 Census of Population, that illustrates some key findings, including the median household income and the proportion of the population with low income, is also available.

The public is also invited to chat with an expert about this release, on Friday, September 15, 2017, from 12:30 to 1:30 p.m., Eastern Time.

Over the coming months, Statistics Canada will continue to release results from the 2016 Census of Population, and provide an even more comprehensive picture of the Canadian population. Please see the 2016 Census Program release schedule to find out when data and analysis on the different topics will be released throughout 2017.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: