Retail trade, December 2016

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-02-22

$44.9 billion

December 2016

-0.5%

(monthly change)

$0.7 billion

December 2016

-0.2%

(monthly change)

$0.2 billion

December 2016

-1.1%

(monthly change)

$1.2 billion

December 2016

-1.4%

(monthly change)

$1.0 billion

December 2016

-0.5%

(monthly change)

$9.5 billion

December 2016

-1.1%

(monthly change)

$16.3 billion

December 2016

-0.9%

(monthly change)

$1.6 billion

December 2016

-0.1%

(monthly change)

$1.6 billion

December 2016

1.2%

(monthly change)

$6.3 billion

December 2016

1.1%

(monthly change)

$6.3 billion

December 2016

-0.3%

(monthly change)

Following four consecutive monthly increases, retail sales decreased 0.5% in December. Declines were widespread as lower sales were reported in 9 of 11 subsectors, representing 82% of retail trade.

After removing the effects of price changes, retail sales in volume terms decreased 1.0%.

Retail sales decrease in December

After three consecutive monthly gains, sales at motor vehicle and parts dealers were down 0.9%. Lower sales at new car dealers accounted for the decline at the subsector level, more than offsetting gains at all other store types. Following an 11.4% decline in November, sales at automotive parts, accessories and tire stores bounced back in December, rising 18.2%. Sales at other motor vehicles dealers (+5.0%), which include snowmobile dealers, were up for the fifth consecutive month. Used car dealers (+1.6%) also reported higher sales in December.

Food and beverage stores registered a 0.4% decrease in December. Lower sales at beer, wine and liquor stores (-3.6%) more than offset gains in October and November. Higher receipts at supermarkets and other grocery stores (+0.4%) and specialty food stores (+0.8%) were mainly due to higher volumes, as food prices were down in December.

Sales at gasoline stations rose 6.6% in December, largely reflecting higher prices at the pump. According to the Consumer Price Index, on an unadjusted basis, the price of gasoline rose 3.1% in December.

Building material and garden equipment and supplies dealers (+0.7%) reported higher sales for the fourth consecutive month.

Weaker holiday sales

Store types typically associated with holiday shopping registered weaker sales in December.

Sales at clothing and clothing accessories stores (-3.7%) decreased for the second time in three months. Within this subsector, lower receipts at clothing stores (-3.2%) accounted for most of the decline. Jewellery, luggage and leather goods stores (-12.4%) also posted lower sales in December. The sole increase in the subsector was reported at shoe stores (+0.8%).

Receipts at general merchandise stores (-1.3%) declined for the second month in a row.

Electronics and appliance stores (-2.3%) sales were down for the second time in eight months.

Sales at sporting goods, hobby, book and music stores declined 0.5%. Lower sales at hobby, toy and games stores, and book stores and news dealers more than offset higher sales at sporting goods stores.

Sales down in eight provinces

Retail sales were down in eight provinces in December.

Ontario (-0.9%) reported the largest decrease in dollar terms. December's decrease was largely due to lower sales at new car dealers.

Sales in Quebec were down 1.1%, with declines in 9 of 11 subsectors.

Retail sales in British Columbia declined 0.3% in December, due in part to lower sales at new car dealers.

In Nova Scotia (-1.4%), retail sales were down for the first time in six months.

Alberta (+1.1%) retail sales advanced for the fifth consecutive month, largely due to higher sales at gasoline stations and, to a lesser extent, automotive, parts accessories and tire stores.

In Saskatchewan (+1.2%), retail sales rose primarily on the strength of higher sales at gasoline stations.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales reached $1.7 billion in December, accounting for 3.4% of total retail sales in Canada, their highest proportion in 2016.

This unadjusted movement in Internet-based retail sales coincided with the holiday shopping period.

Retail sales in 2016

Canadian store retailers generated sales of $532 billion in 2016, up 3.7% from 2015. The increase was partially attributable to higher prices, as sales in volume terms were up 2.5%. Ontario led the way, increasing 4.7% in 2016, while sales declined in Alberta.

Job numbers affect retail sales

Sales in the retail sector were influenced by the economic downturn that affected certain regions of the country, especially during the first half of 2016 when Canada's real gross domestic product declined 0.4% from January to June.

Low global oil prices led to decreased production in Canadian oilfields and employment reductions in the largest oil producing provinces. Based on Statistics Canada's Labour Force Survey, employment in Alberta fell by 19,000 from December 2015 to December 2016 (-0.8%), while employment fell by 6,900 (-1.2%) in Saskatchewan, and by 5,700 (-2.4%) in Newfoundland and Labrador.

These employment losses played a role in weaker retail sales, especially in Alberta where sales were down 1.6% in 2016. This was the second consecutive annual decrease, and only the third decrease in 25 years for Alberta. Although retail sales in Saskatchewan (+1.1%) and Newfoundland and Labrador (+0.9%) were up for the year, the growth rates in these provinces were well below the national average

The Canadian economy strengthened in the third and fourth quarters of the year, leading to employment growth and stronger retail sales in some provinces. Canadian year-over-year employment gains of 214,000 in 2016 were concentrated in Quebec (up 90,000), Ontario (up 81,000) and British Columbia (up 72,000). These provinces also contributed the most to increased retail sales. In total, retail sales rose $18.9 billion in 2016, with Ontario (up $8.7 billion), Quebec (up $4.7 billion) and British Columbia (up $4.5 billion) leading the way.

Changes in tax rate leads to shift in consumer behaviour

In 2016, the Harmonised Sales Tax (HST) rate increased in three of the Atlantic provinces. New Brunswick and Newfoundland and Labrador saw their HST rise from 13% to 15% on July 1, while it increased from 14% to 15% on October 1 in Prince Edward Island.

In New Brunswick and Newfoundland and Labrador, purchases of big ticket items such as automobiles ramped up in the period just before the increase took effect, and then dropped sharply the month of the increase. As a result, seasonally adjusted retail sales were up in June for both New Brunswick and Newfoundland and Labrador. By contrast, these two provinces saw sales dip in July when the HST took effect with New Brunswick down 7.1%, and Newfoundland and Labrador down 4.5%.

In Prince Edward Island, where the HST increased by 1%, the effect was less pronounced. Seasonally adjusted sales did reach a year-to-date high in September ($186 million), but that level was surpassed in both November and December.

Sales by auto and food retailers lead the way

Almost half of Canadian retail sales are accounted for by two industry subsectors. Businesses classified to the motor vehicle and parts subsector (25.2%) and the food and beverage stores subsector (21.6%) together generated 46.8% of reported retail sales in 2016. These proportions were relatively unchanged from 2015.

One notable difference in retail spending was that year-over-year gasoline station sales declined by $1.7 billion in 2016, mainly due to lower prices at the pump. According to the annual average Consumer Price Index, gasoline prices were 6.0% lower in 2016 than in 2015. Of every retail dollar spent, 10.1 cents took place at gasoline stations in 2016, compared with 10.8 cents in 2015.

New car dealers generated $6.6 billion more in sales than in 2015, and accounted for 21% of all Canadian retail purchases. Canadian sales of light trucks (including minivans, sport-utility vehicles, pick-up trucks, and vans) remained strong with 1,286,640 units sold, up 8.7% over 2015.

On-line purchases peak in the holiday season

On-line sales, including those by businesses classified to the North American Industrial Classification System 45411 — Electronic Shopping and Mail Order Houses, hit $12.5 billion in 2016, and accounted for 2.3% of total retail sales.

Leading up to the holiday shopping season, on-line sales surged in November ($1.5 billion), which includes Black Friday and Cyber Monday, and in December ($1.7 billion). December's on-line share of retail sales hit 3.4%, a high for the year.

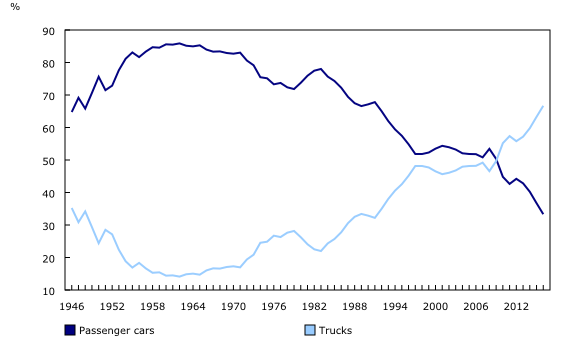

The evolution of retail trade in Canada

As 2017 marks the 150th anniversary of Confederation, we take a look at an aspect of the history of retail trade in Canada.

In 1962, passenger cars represented approximately 85% of all motor vehicle units sold in Canada. In 2016, 54 years later, sales of trucks which includes minivans, sport-utility vehicles, vans and buses represented approximately 67% of all motor vehicle units sold in Canada.

Summary tables of unadjusted data by industry and by province and territory are now available.

For information on related indicators, refer to Latest statistics.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Statistics Canada's retail e-commerce figures are disseminated in unadjusted form. As a result, one must use caution when comparing retail sales that are seasonally adjusted (CANSIM 080-0020) in the Daily with retail e-commerce figures (CANSIM 080-0033).

Statistics Canada's retail e-commerce figures include the electronic sales of two distinct types of retailers. The first is retailers that do not have a storefront. These businesses are commonly referred to as 'pure-play' Internet retailers and are classified to North American Industry Classification System (NAICS) 45411—Electronic Shopping and Mail Order Houses. The second type of retailer is those that have a storefront and are commonly referred to as 'brick and mortar' retailers. If the online operations of a brick and mortar retailer are separately managed, they too are classified to NAICS 45411.

CANSIM 080-0033 represents the Internet sales of Canadian-based retailers. The foreign e-commerce purchases from Canadian-based retailers are included in the Internet sales totals. Conversely, Internet purchases by Canadians from foreign-based retailers are not included in Statistics Canada's retail trade figures.

Common electronic commerce transactions, such as travel and accommodation bookings, ticket purchases and financial transactions are not included in Canadian retail sales figures. For more information on individual Internet use and e-commerce, consult the most recent release of the Canadian Internet Use Survey and/or the Survey of Digital Technology and Internet Use.

For more information on retail e-commerce in Canada, see Retail E-Commerce in Canada.

Total retail sales expressed in volume are calculated by deflating current dollar values using consumer price indexes. The retail sales series in chained (2007) dollars is a chained Fisher volume index with 2007 as the reference year. For more information, see Calculation of Volume of Retail Trade Sales.

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Real-time CANSIM tables

Real-time CANSIM tables 080-8020 and 080-8024 will be updated on March 1. For more information, consult the document Real-time CANSIM tables.

Next release

Data on retail trade for January will be released on March 21.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

For analytical information, or to enquire about the concepts, methods or data quality of this release, contact Jason Aston (613-951-0746; jason.aston@canada.ca), Retail and Service Industries Division.

- Date modified: