Industrial product and raw materials price indexes, October 2014

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2014-11-28

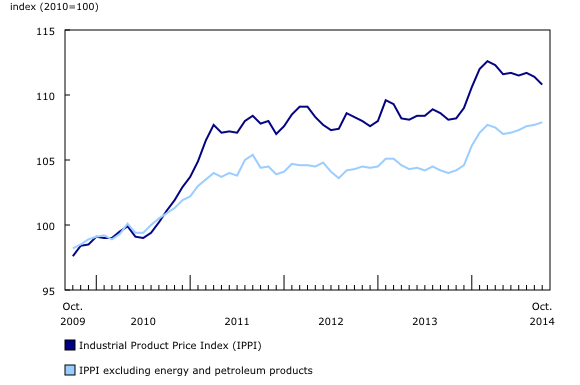

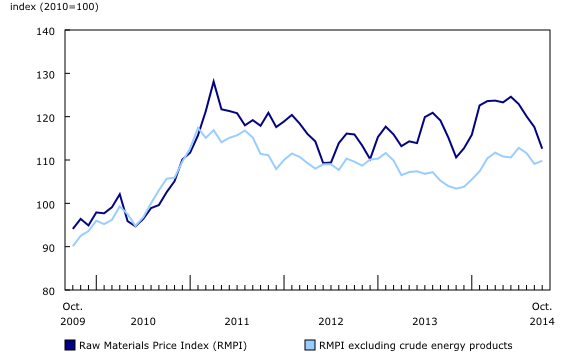

The Industrial Product Price Index (IPPI) decreased 0.5% in October, mainly because of lower prices for energy and petroleum products. The Raw Materials Price Index (RMPI) declined 4.3% in October, largely as a result of lower prices for crude energy products.

Industrial Product Price Index, monthly change

The IPPI declined 0.5% in October after decreasing 0.3% in September. Of the 21 major commodity groups, 12 were up, 4 were down and 5 were unchanged.

The decline in the IPPI was led by lower prices for energy and petroleum products (-4.6%). This was the largest decline for energy and petroleum products since June 2012. Motor gasoline (-7.2%), and, to a lesser extent, light fuel oils (-4.3%) and diesel fuel (-3.3%), were the main reasons for the decline in this commodity group. The last time motor gasoline decreased to this extent was July 2009 when prices fell 7.2%. Growing crude oil supplies and weaker global demand have put downward pressure on prices for refined petroleum products. The IPPI excluding energy and petroleum products increased 0.2% in October.

Moderating the decline in the IPPI for October was higher prices for motorized and recreational vehicles (+0.9%). The main reason for the gain was higher prices for passenger cars and light trucks (+0.9%), motor vehicle engines and motor vehicle parts (+0.9%) as well as aircraft (+1.8%). The increase in the prices of motorized and recreational vehicles was closely linked to the depreciation of the Canadian dollar relative to the US dollar.

To a lesser extent, chemicals and chemical products (-0.8%) also contributed to the decline in the IPPI. Lower prices for petrochemicals (-4.4%) was the main reason for the decline in this commodity group, as lower petrochemical feedstock prices have put downward pressure on prices.

Also contributing to the decline in the IPPI was fruit, vegetables, feed and other food products (-0.6%). The decrease in this commodity group was mainly due to grain and oilseed products, not elsewhere classified (-4.7%) as well as other animal feed (-2.4%).

Some IPPI prices are reported in US dollars and are converted to Canadian dollars using the average monthly exchange rate. Consequently, any change in the value of the Canadian dollar relative to the US dollar will affect the level of the index. From September to October, the Canadian dollar depreciated 1.8% relative to the US dollar. If the exchange rate had remained constant, the IPPI would have declined 1.0% instead of decreasing 0.5%.

Industrial Product Price Index, 12-month change

The IPPI rose 2.5% during the 12-month period ending in October, following a 2.6% gain in September.

Compared with October 2013, the advance of the IPPI was mainly attributable to motorized and recreational vehicles (+5.1%), led by higher prices for passenger cars and light trucks (+5.3%), motor vehicle engines and motor vehicle parts (+4.0%) and aircraft (+9.8%).

Moderating the year-over-year increase in the IPPI was lower prices for energy and petroleum products (-3.7%). The decline in this commodity group was mainly due to lower prices for diesel fuel (-8.7%), motor gasoline (-2.5%) and light fuel oils (-5.0%).

Meat, fish, and dairy products (+11.0%) also contributed to the year-over-year increase in the IPPI, with higher prices for fresh and frozen beef and veal (+32.4%) and fresh and frozen pork (+17.6%).

Chemicals and chemical products (+4.5%) also contributed to the year-over-year increase of the IPPI, primarily as a result of higher prices for dyes and pigments, and petrochemicals (+9.9%), plastic resins (+7.3%) as well as fertilizers, pesticides and other chemical products (+4.4%).

Raw Materials Price Index, monthly change

The RMPI fell 4.3% in October, following a 2.1% decrease in September. It was the fourth consecutive monthly decline and the largest decrease in the index since the 4.4% drop in June 2012. Of the six major commodity groups, two were down, three were up and one was unchanged.

The decrease in the RMPI was mainly attributable to lower prices for crude energy products (-8.8%), which posted the largest decline since June 2012. Lower prices for conventional crude oil (-8.9%) were largely responsible for the decline in this commodity group. The decrease in crude oil prices was partly due to higher crude oil production and a slowdown in world demand. The RMPI excluding crude energy products rose 0.6% in October.

The decline of the RMPI was moderated primarily by prices for animals and animal products, which rose 1.8% in October, after two consecutive monthly decreases. The main contributors to the increase in this commodity group were live animals (+2.8%), particularly cattle and calves (+3.7%) and hogs (+4.0%).

Raw Materials Price Index, 12-month change

The RMPI fell 2.3% in the 12-month period ending in October, after declining 1.3% in September. On a year-over-year basis, it was the largest decrease in the index since November 2013.

Compared with the same month a year earlier, the decrease in the RMPI was almost entirely attributable to a 9.2% drop in the prices of crude energy products. Conventional crude oil (-9.3%) was mainly responsible for the decline in this commodity group. The RMPI excluding crude energy products rose 5.6% in October.

The decrease in the RMPI over the 12-month period was moderated mainly by higher prices for animals and animal products (+14.3%), which have been trending upward on a year-over-year basis since April 2013. Live animals (+24.6%), particularly cattle and calves (+43.6%) and hogs (+20.2%), was primarily the source of the increase in this commodity group.

Compared with the same month a year earlier, the decline of the RMPI was also moderated by prices for metal ores, concentrates and scrap (+1.6%), which posted a sixth consecutive year-over-year increase.

Note to readers

The Industrial Product Price Index (IPPI) and Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The Industrial Product Price Index reflects the prices that producers in Canada receive as the goods leave the plant gate. It does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all the costs that occur between the time a good leaves the plant and the time the final user takes possession of it, including the transportation, wholesale and retail costs.

Canadian producers export many goods. They often indicate their prices in foreign currencies, especially in US dollars, which are then converted into Canadian dollars. In particular, this is the case for motor vehicles, pulp, paper and wood products. Therefore, a rise or fall in the value of the Canadian dollar against its US counterpart affects the IPPI. However, the conversion into Canadian dollars only reflects how respondents provide their prices. This is not a measure that takes the full effect of exchange rates into account.

The conversion of prices received in US dollars is based on the average monthly exchange rate (noon spot rate) established by the Bank of Canada, and it is available on CANSIM in table 176-0064 (series v37426). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The Raw Materials Price Index reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Table CANSIM table329-0074: Industrial Product Price Index, by major commodity aggregations.

Table CANSIM table329-0075: Industrial Product Price Index, by commodity.

Table CANSIM table329-0076: Industrial Product Price Index, for selected groups, by region.

Table CANSIM table329-0077: Industrial Product Price Index, by North American Industry Classification System.

Table CANSIM table330-0008: Raw Materials Price Index, by commodity.

Definitions, data sources and methods: survey numbers survey number2306 and survey number2318.

The industrial product and raw materials price indexes for November 2014 will be released on January 6, 2015.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (613-951-4636; statcan.mediahotline-ligneinfomedias.statcan@canada.ca).

- Date modified: