Energy statistics, March 2023

Released: 2023-06-06

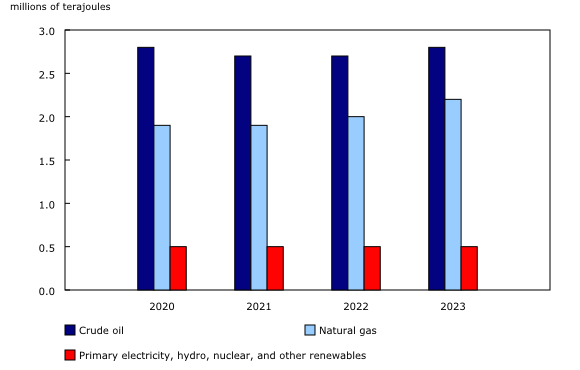

March 2023 saw year-over-year increases in both primary (+4.6%) and secondary (+3.8%) energy production.

During the first quarter of 2023, both primary (+5.0%) and secondary (+2.2%) energy production were up compared with the first quarter of 2022. The quarterly increase in the primary energy sector was led by natural gas (+6.9%), while that in the secondary energy sector was due to refined petroleum products (+2.6%).

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information portal and follow #energynews on social media.

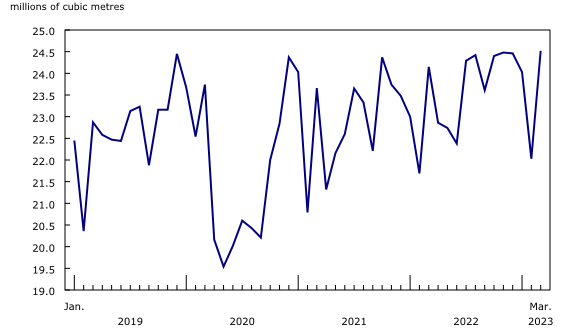

Record production for crude oil and equivalent products

Production of crude oil and equivalent products grew 1.6% to 24.5 million cubic metres in March, as oil sands producers were operating near full capacity prior to the start of annual maintenance at various energy-producing facilities in April. This was the highest level observed since the series started in January 2016.

Oil sands extraction drove the overall gain in production, up 2.6% year over year to 16.1 million cubic metres in March. Production of synthetic crude was the primary contributor, increasing 5.9% to 6.4 million cubic metres, while production of crude bitumen edged up 0.6% to 9.7 million cubic metres.

Following a month-over-month increase in February, the Raw Materials Price Index for crude oil and bitumen in March was down 3.3% from the previous month, while prices were 28.1% lower than in March one year earlier.

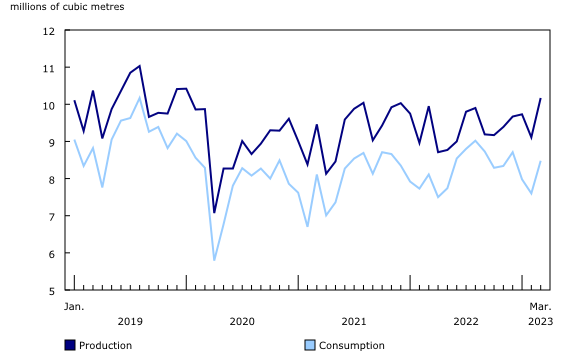

Production and domestic consumption of finished petroleum products up in March

Production of finished petroleum products in Canada rose 2.2% year over year to 10.2 million cubic metres in March, the highest level since January 2020 (10.4 million cubic metres), just before the COVID-19 pandemic. The higher production in March was partially fuelled by Canadian demand (+4.6%) for some refined petroleum products, including kerosene-type jet fuel (+30.4%) and finished motor gasoline (+3.8%).

Meanwhile, exports of finished petroleum products edged up 1.0% to 1.6 million cubic metres in March, while imports rose 7.0% to 0.8 million cubic metres.

According to the Industrial Product Price Index, prices of refined petroleum products were down 15.9% in March, compared with the previous year. In March 2022, market instability due to the invasion of Ukraine by Russia contributed to a significant spike in energy prices.

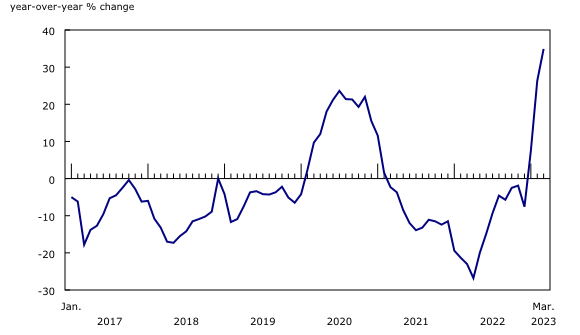

Natural gas production reaches new series high, inventory levels rise sharply

Production of marketable natural gas rose 6.5% year over year to 680.4 million gigajoules in March, the highest monthly production level recorded since this series began in January 2016. Production has been increasing since bottoming out in February 2021 (526.3 million cubic metres).

Deliveries of natural gas to Canadian consumers rose 4.6% to 493.9 million gigajoules in March, largely due to increased demand in Alberta's industrial sector (+6.5%), which is heavily influenced by oil sands production.

Demand for Canadian natural gas in the United States (-2.3%) declined for a third consecutive month, due in part to reduced natural gas usage for residential heating in the northeast US and in Europe.

Closing inventories of natural gas held in Canadian facilities were up 34.9% to 581.1 million gigajoules in March, compared with March 2022. This large year-over-year increase was influenced by lower demand for winter heating and reduced exports in March 2023. In addition, inventories were lower in March 2022 due to stronger domestic demand and higher exports.

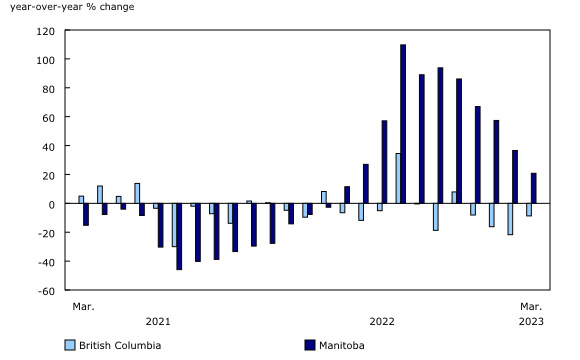

Drought in British Columbia drives electricity imports

Total electricity generation in Canada rose 0.8% to 57.1 million megawatt-hours (MWh) year over year in March, while consumption increased 0.5% to 54.0 million MWh.

Total exports of electricity to the United States rose 7.8% in March. Exports from Manitoba (+24.1%) continued to recover from drought conditions experienced in this province from late 2020 to early 2022. Meanwhile, exports to the United States from British Columbia fell 24.7%, as this province has faced below normal precipitation levels since September 2022, as noted by Agriculture and Agri-Food Canada. Generally, drought conditions result in lower reservoir levels, reducing hydroelectric generation.

Note to readers

The consolidated energy statistics table (25-10-0079-01) presents monthly data on primary and secondary energy by fuel type (crude oil, natural gas, electricity, coal, etc.) in terajoules and supply and demand characteristics (production, exports, imports, etc.) for Canada. The table uses data from a variety of survey and administrative sources. Estimates are available starting with the January 2020 reference month. For more information, please consult the Consolidated Energy Statistics Table: User Guide.

The survey programs which support the "Energy statistics" release include:

- Crude oil and natural gas (survey number 2198; tables 25-10-0036-01, 25-10-0055-01 and 25-10-0063-01). Data for January and February 2023 have been revised.

- Energy transportation and storage (survey number 5300, tables 25-10-0075-01 and 25-10-0077-01).

- Natural gas transmission, storage and distribution (survey numbers 2149, 5210 and 5215; tables 25-10-0057-01, 25-10-0058-01 and 25-10-0059-01). Data for January and February 2023 have been revised.

- Refined petroleum products (survey number 2150, table 25-10-0081-01).

- Renewable fuel plant statistics (survey number 5294, table 25-10-0082-01). National estimates of renewable fuel plant statistics are presented by supply and disposition characteristics (production, shipments, inventories, etc.).

- Electric power statistics (survey number 2151, tables 25-10-0015-01 and 25-10-0016-01). Data for February 2022 have been revised.

- Coal and coke statistics (survey numbers 2147 and 2003, tables 25-10-0045-01 and 25-10-0046-01). Data for March 2022, January and February 2023 have been revised.

Data are subject to revisions. Energy data and other supporting data used in the text are revised on an ongoing basis for each month of the current year to reflect new information provided by respondents and updates to administrative data. Historical revisions are also performed periodically.

Definitions, data sources and methods for each survey program are available under the respective survey number.

The Energy Statistics Program uses respondent and administrative data.

Data in this release are not seasonally adjusted.

Occasionally, data from Environment and Climate Change Canada is referenced by the Energy Statistics Program using Heating Degree Days (HDDs) as a measure of temperature. HDDs reflect the relationship between outdoor temperatures and the need to heat indoors to maintain room temperature. As temperatures outside fall, the number of HDDs increases.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: