Stock and consumption of fixed capital, 2021

Released: 2022-11-17

Strong residential construction was the main source of the growth for the total capital stock in 2021. Continued lower investment weakened non-residential stock, mainly in the mining, quarrying, and oil and gas extraction sector.

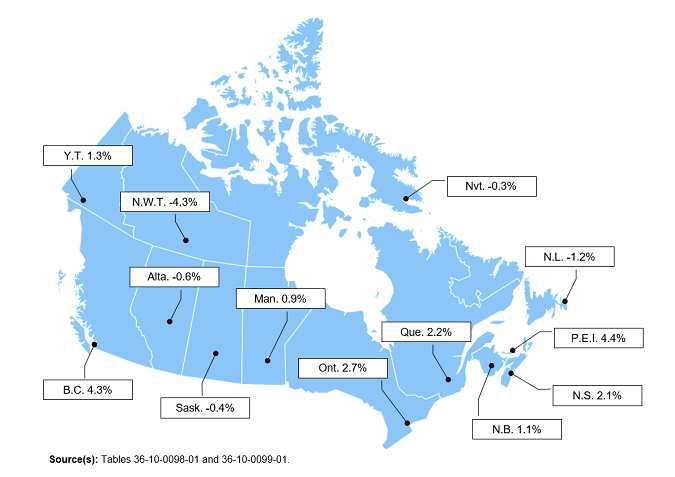

In 2021, the total capital stock continued to fall in volume terms in the natural resources' rich provinces and territories: Newfoundland and Labrador (-1.2%), in Saskatchewan (-0.4%), in Alberta (-0.6%), in the Northwest Territories (-4.3%), and in Nunavut (-0.3%).

In volume terms, Canada's total capital stock increased 1.8% in 2021 compared with 1.4% a year earlier. In 2021, the gap between residential and non-residential capital stock increased. Canadian net capital stock totalled $6.3 trillion, with $2.9 trillion in non-residential capital stock, such as machinery and engineering, whereas the residential capital stock stood at $3.4 trillion.

Strength in residential construction

The capital stock associated with residential renovations (+3.6%) and new residential construction (+2.8%) increased notably in 2021, as a strong labour market and favourable credit conditions aided these activities.

Residential capital stock increased in all provinces and territories in 2021. Growth in residential capital stock was particularly strong in Prince Edward Island (+6.5%) and in British Columbia (+4.2%). Prince Edward Island's growth was its highest since 1978 and was dominated by new housing, which coincided with an influx of new immigrants in recent years. Newfoundland and Labrador (+0.6%) had the lowest growth in its residential capital stock.

Note to readers

This release reflects revised estimates of investment flows and prices in accordance with the latest revision of the Canadian System of Macroeconomic Accounts.

The classification of non-residential capital stock is based on the final demand classification used in the supply and use tables.

Estimates of non-residential and residential investment, depreciation and the associated net stocks are available by geographical breakdown on a current price basis, 2012 constant price basis (2012 asset price = 100) and chained (2012) dollar basis. Non-residential estimates of depreciation and stock are available by industry and by asset, using linear, geometric and hyperbolic methods. Residential estimates are available by type of investment using geometric methods.

Products

The data visualization product "Infrastructure Statistics Hub," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: