Railway carloadings, July 2022

Released: 2022-09-27

30.2 million metric tonnes

July 2022

5.6%

(12-month change)

Highlights

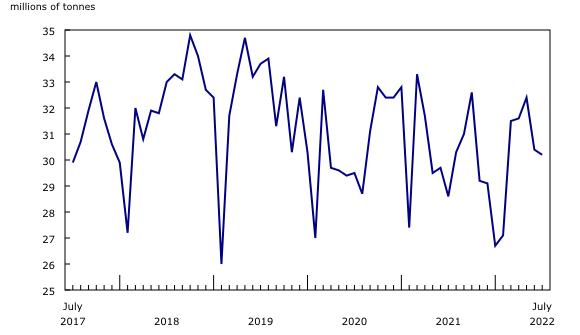

In July, the volume of cargo carried by Canadian railways reached 30.2 million tonnes, up 5.6% from July 2021 levels. Higher carloadings of energy products and potash helped contribute to this third consecutive month of year-over-year growth.

For July 2022, the overall freight volume was also the highest level since July 2019, before the pandemic, just under the five-year monthly average of 30.9 million tonnes.

To further explore current and historical data in an interactive format, please visit the Monthly Railway Carloadings: Interactive Dashboard.

The July increase in total freight carried was due to higher volume of domestic loadings, both non-intermodal (commodities) and intermodal (mainly containers).

Coal carloadings leads increase

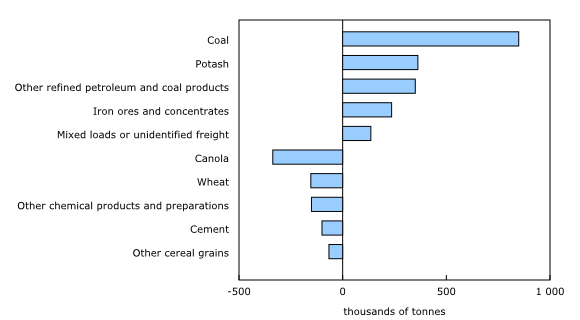

The tonnage of non-intermodal freight loadings was up for the third consecutive monthly year-over-year period, rising 7.1% year over year to 23.3 million tonnes in July, driven largely by increases in carloadings of some energy commodities.

Rising global fuel consumption and industrial production has increased the demand for energy products worldwide. Loadings of coal, on an upward trend for five months, grew sharply by 39.2% (+849 000 tonnes) from July 2021. It appears that with higher gas prices and constraints on energy supplies affecting Europe because of the war in Ukraine, demand for coal is on the rise.

Likewise, loadings of other refined petroleum and coal products (e.g., propane, butane) posted a year-over-year increase for a 16th consecutive month, up 88.2% (+350 000 tonnes) in July, following substantial increases in June (+71.5%) and May (+77.9%).

These movements in railway carloadings of energy commodities during July were in line with data on Canadian international merchandise trade, with exports (+77.8%) and imports (+71.2%) of energy products growing year over year.

In July, loadings of potash were up for the fourth month in a row, rising by 21.3% (+363 000 tonnes) from the same month in 2021. This monthly year-over-year increase in tonnage reflects strong global demand for Canadian fertilizers.

In addition, loadings of iron ores and concentrates continued on a five-month growth trend, up 4.9% (+236 000 tonnes) year over year in July, while loadings of mixed loads or unidentified freight were up by 136 000 tonnes―more than 12 times the volume recorded in July 2021.

Grains continue to dampen volumes

Growth in freight traffic in July was moderated by declines in loadings of several commodities, in particular grain. Loadings of canola have fallen year over year for 17 straight months, dropping by 67.1% (-337 000 tonnes) in July, following large declines in June (-59.4%) and May (-57.8%).

Similarly, wheat loadings, which have been on a downward trend since May 2021, dipped 8.8% (-154 000 tonnes) in July compared with the same month in 2021. However, this is a marked improvement from both June (-49.1%) and May (-48.0%).

Loadings of other cereal grains also declined year over year for the 10th consecutive month in July, down 23.0% (-66 000 tonnes) from the same month a year ago.

Grain shipments by rail, which have been declining since the beginning of 2021, are starting to show signs of improvement. Indeed, the year-over-year changes in July 2022, while still negative, were less than those recorded in previous months. With a bumper crop expected across Canada this year, grain shipments by rail in the coming months could start to recover.

Year over year, loadings of other chemical products and preparations dropped 70.1% (-151 000 tonnes) in July―marking the 10th consecutive month of a year-over-year decline―while loadings of cement were down 24.7% (-100 000 tonnes).

Intermodal traffic up

Domestic intermodal shipments—mainly containers—also contributed to the overall growth in freight traffic in July, rising 4.6% year over year to 3.0 million tonnes. This was the highest volume recorded for the month of July in three years.

This growth appears to reflect strong consumer demand in both Canadian and international markets, with businesses restocking inventories as supply chains recover. Indeed, Canada's imports (+16.2%) and exports (+7.0%) of consumer goods were up year over year in July, according to July data on Canadian international merchandise trade.

American freight down

Freight traffic coming from the United States remained high in July despite a 1.6% dip from July 2021, after 15 consecutive monthly year-over-year gains. Tonnage edged down by about 61 000 tonnes to reach 3.8 million tonnes in July 2022—the third highest level on record for the month of July.

Note to readers

The Monthly Railway Carloadings Survey collects data on the number of rail cars, tonnage, units and 20-feet equivalent units from railway transporters operating in Canada that provide for-hire freight services.

Cargo loadings from Armstrong, Ontario to the Atlantic coast are classified to the eastern division (eastern Canada), while loadings from Thunder Bay, Ontario to the Pacific coast are classified to the western division (western Canada).

Survey data are revised on a monthly basis to reflect new information.

The data in this release are not seasonally adjusted.

The Transportation Data and Information Hub provides Canadians with online access to comprehensive statistics and measures on the country's transportation sector.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: