Industrial research and development, 2020 (actual), 2021 (preliminary) and 2022 (intentions)

Released: 2022-06-24

Behind every great product or service that consumers enjoy lies an idea that was developed, tested and produced through research and development (R&D). Committing finances and resources to R&D provides companies with opportunities to create new goods and services or adapt existing products to remain competitive and profitable in the long term.

Despite the challenges posed by COVID-19 pandemic lockdowns, which impacted some businesses, Canadian businesses largely continued to perform R&D in 2020, increasing total R&D spending by 3.3% from 2019. This growth is partly attributable to increases in fields such as software engineering, where work can be done remotely. In addition, businesses expect to continue reporting increases in R&D spending in 2021 and 2022. Even with these challenges, some businesses (2.9% of those surveyed) found new opportunities, resulting in investments worth $121 million in COVID-19-related R&D projects.

Research and development projected to continue to grow in 2021 and 2022

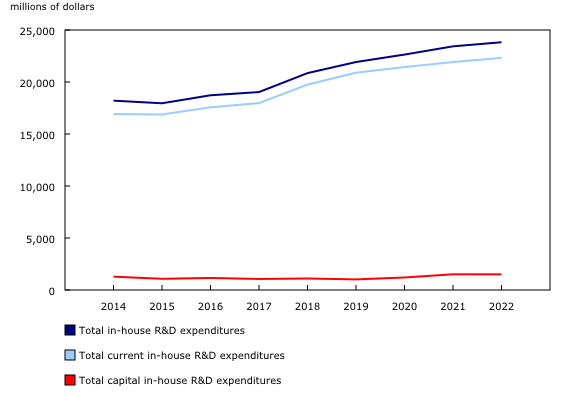

Early indications provided by businesses for 2021 and 2022 suggest that Canadian industrial in-house R&D has emerged comparatively unscathed from the upheaval in the Canadian economy brought on by the COVID-19 pandemic and lockdowns, and it will continue its upward trajectory. In-house spending on R&D in 2021 is expected to grow 3.5%, reaching $23.4 billion. Companies expect more modest growth in their in-house R&D spending in 2022, with total R&D spending anticipated to increase by 1.7% to $23.8 billion.

While growth is expected to rise overall, it will be uneven across different sectors. Data on intentions show that growth will mainly be centred on service-producing industries, such as companies that provide computer system design and related services and those that provide scientific R&D services. Despite an overall decline expected in the manufacturing sector, some industries, such as pharmaceutical and medicine manufacturing, are anticipated to see growth in 2021 and 2022.

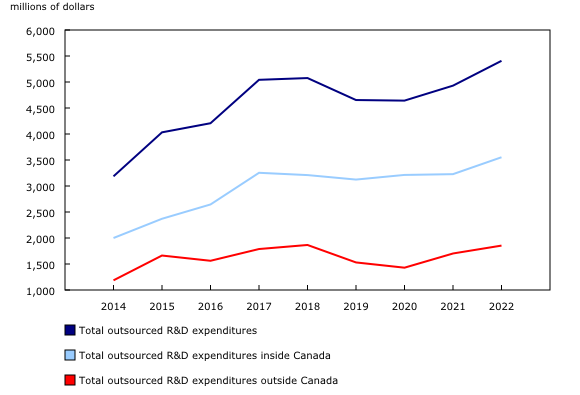

Companies also outsource R&D work to third parties (other businesses, hospitals, universities, etc.), in addition to the R&D they perform in-house. Outsourcing enables companies to save on the costs of performing R&D themselves (e.g., hiring and training specialized personnel, purchasing equipment and facilities) and to realize efficiencies by leveraging external resources and expertise.

In contrast to the consistently increasing spending on in-house R&D, outsourced R&D spending was already declining before the economic uncertainty related to the pandemic that began in 2020. Despite two years of decreases, total outsourced R&D spending is expected to grow in both 2021 (+$288 million, or +6.2%) and 2022 (+$477 million, or +9.7%). If these intentions are realized, outsourced R&D spending will surpass its previous peak, set in 2018. The growth will mainly be driven by software publishers, who expect to be outsourcing an additional $170 million of R&D by 2022, nearly double the amount outsourced in 2020 ($186 million).

The impact of COVID-19 on in-house research and development

Most businesses that were surveyed (87.3%) reported that their in-house R&D spending for 2020 did not change despite the pandemic. Consequently, R&D expenditures continued to grow in 2020, albeit at a slower rate—the 3.3% increase was the smallest since 2017, when a 1.7% gain was reported. The persistent growth in R&D spending throughout the economic and public health crisis that began in 2020 is a positive sign as the Canadian economy looks to rebuild going forward.

The increase in R&D spending in 2020 was seen across most types of expenditures. Wages and salaries, which make up about two-thirds of all spending, increased by $730 million (+5.0%). Capital expenditures rose by $178 million (+17.4%), while spending on materials was up $80 million (+4.2%) and spending on services to support R&D increased by $72 million (+5.8%). In contrast, spending on all other current R&D costs (e.g., administrative and overhead costs) declined by $324 million (-11.2%).

Oil and gas extraction sector hit hard, others see small growth

The increase in in-house R&D spending was largely attributable to higher spending by companies in the service-producing sector, which rose by $1.0 billion (+7.4%) in 2020 compared with 2019. This was led by growth in the two largest subsectors—professional, scientific and technical services, where spending increased by $519 million (+7.2%), and information and cultural industries, where spending grew by $405 million (+11.8%).

After two years of strong spending ($887 million in 2018 and $791 million in 2019) by the oil and gas extraction, contract drilling and related services sector, in-house R&D spending in the sector dropped to its lowest level since 2005 in 2020 ($530 million). This decline was accompanied by a large reduction in R&D personnel of 1,030 full-time equivalents (FTEs) compared with 2019, causing the sector's overall employment levels to drop to 907 FTEs. The decline in oil and gas extraction in-house R&D spending hit the Prairie provinces particularly hard, with R&D expenditures in the sector across the region declining $172 million.

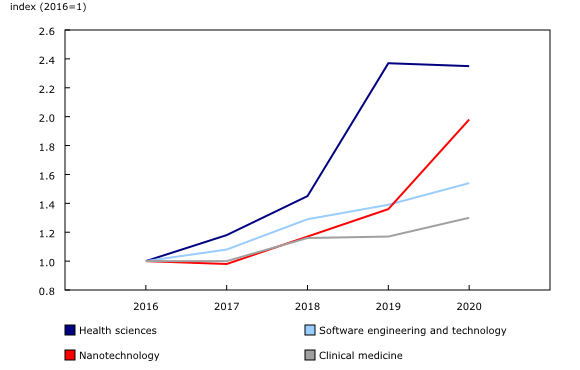

Software engineering continues to dominate in-house research and development

In addition to looking at R&D by industry, it is also possible to break down R&D spending by field of R&D. Across all industries, more than one-third ($8.2 billion) of total 2020 in-house R&D spending was focused on software engineering and technology, for which spending increased $784 million in 2020 from 2019. The software engineering field has grown every year from 2016 to 2020. From 2016 to 2017, the field saw an increase of 8.2% in R&D spending. In 2018, the field saw its most dramatic growth in spending, of 20.9 percentage points (a 29.1% increase compared with 2016). In 2019, the field saw an additional 9.8 percentage points of growth (a 38.9% increase from 2016). In 2020, the growth rose by 14.7 percentage points (a 53.6% increase from 2016).

From 2016 to 2020, spending in the clinical medicine and health sciences fields has also grown. Although clinical medicine expenditures were the larger of the two ($539 million in 2020), they increased at a slower rate (+29.9% compared with 2016 spending levels). In contrast, health sciences spending more than doubled by 2019 (+137.4% compared with 2016) before holding steady into 2020 ($428 million).

In Canada, nanotechnology is still a relatively small field of R&D, with spending in this field making up about 0.4% of all in-house R&D spending by businesses. Nevertheless, nanotechnology is considered a key emerging field of R&D technology. While spending is still small, the field has seen growth from 2016 to 2020, with spending increasing by 97.9% in 2020 compared with 2016.

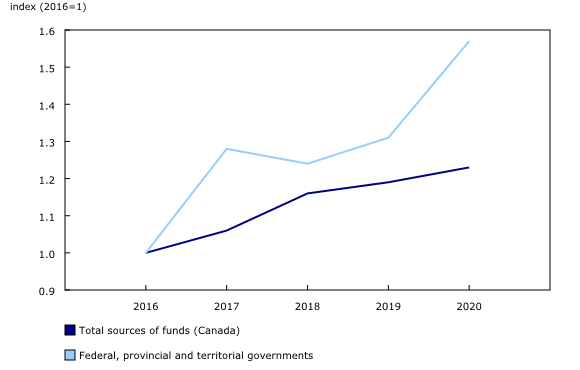

Governments play a key role in funding COVID-19-related projects

The majority of funding for industrial in-house R&D originates from within the business sector ($17.0 billion from Canadian businesses and $4.0 billion from foreign businesses). Canadian governments (through contracts and grants) also play an important role in funding R&D, providing 7.0% of all funding in 2020.

Of the $1.6 billion contributed by governments, the federal government provided the majority ($1.3 billion), while provincial and territorial governments contributed a combined total of $307 million. Government funding of industrial R&D has grown at a higher rate than Canadian funding overall and by 2020 had increased by 57.4% compared with its 2016 level.

Among surveyed companies, $35 million of funding for COVID-19-related in-house R&D projects was provided by Canadian governments, accounting for 28.8% of all funding for COVID-19-related projects in 2020.

Outsourced research and development spending holds steady despite COVID-19 pandemic

In 2020, spending on outsourced R&D from Canadian businesses held steady at $4.6 billion, declining $11 million from 2019. The vast majority (94.4%) of businesses surveyed reported that COVID-19 did not impact spending on outsourced R&D.

In 2020, outsourcing to Canadian organizations increased slightly (+$89 million, or +2.8%), while outsourcing outside Canada declined by a similar amount (-$101 million, or -6.6%). Outsourcing within the business enterprise sector increased (+$200 million, or +5.4%), while outsourcing to higher education institutions (-$90 million, or -15.8%), governments (-$20 million, or -21.5%), and other organizations and institutions (-$99 million, or -31.8%) declined.

Companies in the manufacturing sector spent a lot less on outsourced R&D in 2020 (-$231 million); most other sectors, except agriculture, forestry, fishing and hunting (-$11 million), experienced modest growth. While most industries in the manufacturing sector experienced declines, the majority of the decrease is the result of a large reduction in spending by aerospace product and parts manufacturing companies (-$157 million).

Canada's business research and development ranking among the Group of Seven unchanged

Canada's overall business enterprise expenditure on R&D (BERD) remained steady in 2020 compared with the previous year. As a percentage of the business enterprise sector's overall contribution to gross domestic product, Canada's BERD remained the lowest among countries of the Group of Seven (G7).

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Data on the characteristics of research and development in Canadian industry are an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

The data in this release are subject to revision.

Research and experimental development comprises creative and systematic work carried out to increase the stock of knowledge—including knowledge of humankind, culture and society—and to devise new applications from the available knowledge.

In-house research and development (R&D) expenditures refer to expenditures within Canada for R&D performed within the company by employees (permanent, temporary or casual) and self-employed individuals working on site on the company's R&D projects.

Onsite R&D contractors are onsite personnel hired to perform specialized project-based R&D work under the supervision and direction of the contracting organizations. They are considered separate from industrial R&D employees.

Random tabular adjustment

The random tabular adjustment (RTA) technique, which aims to increase the amount of data made available to users, while protecting the confidentiality of respondents, was applied to the estimates from the Annual Survey of Research and Development in Canadian Industry.

Statistics Canada typically uses suppression techniques to protect sensitive statistical information. These techniques involve suppressing data points that can directly or indirectly reveal information about a respondent. This can often lead to the suppression of a large number of data points and significantly reduce the amount of available data.

Using RTA, Statistics Canada can identify sensitive estimates and randomly adjust their value rather than suppress them. The size of the adjustment is calculated to protect respondent confidentiality. After adjusting the value, the agency assigns a quality measure (A, B, C, D or E) to the estimate to indicate the degree of confidence that users can have in its accuracy. Quality measures account for uncertainty related to sampling, non-response and RTA, when applied.

For more information on RTA, please refer to the blog article "Random Tabular Adjustment is here!," now available as part of the StatCan Blog.

Products

The interactive dashboard "Characteristics of research and development in Canadian industry" (71-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: