Securities statistics, first quarter 2022

Released: 2022-06-09

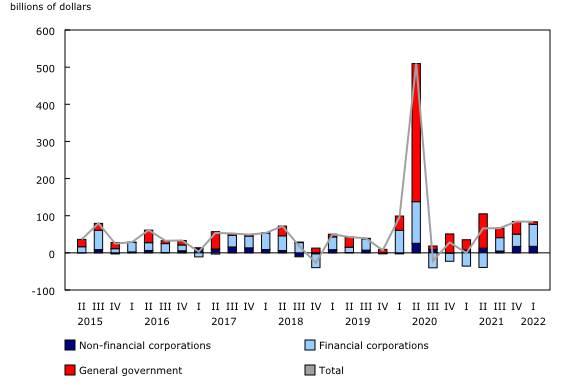

Canadian governments and corporations borrowed a net $83.6 billion in the form of debt securities in the first quarter of 2022. This marked the fourth consecutive quarter for which new issues exceeded retirements. The borrowing activity in the quarter was led by Canadian chartered banks and, to a lesser extent, by non-financial corporations.

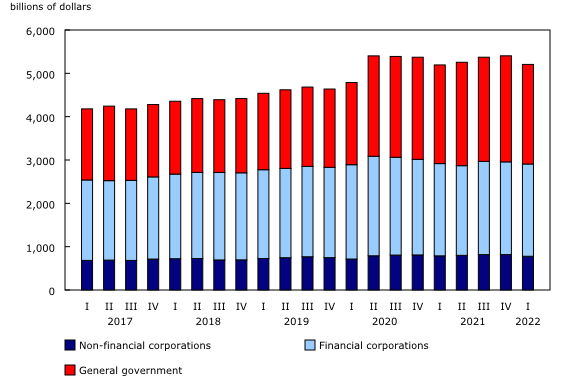

The outstanding value of Canadian debt securities reached a record $5,242.9 billion at the end of the first quarter, up $65.6 billion from the previous quarter. This increase was moderated by the downward revaluation resulting from the appreciation of the Canadian dollar against major foreign currencies. Nearly one-quarter (23.4%) of the total stock of debt securities was denominated in foreign currencies at the end of March. The Canadian dollar was up by 1.5 US cents against the US dollar and 3.9 euro cents against the euro in the first quarter.

New issues of debt securities led by chartered banks

Canadian chartered banks issued a net $59.3 billion of debt securities in the first quarter of 2022, led by a record $28.8 billion of instruments denominated in euros and targeting international markets. As a result, the outstanding amount of debt securities owed by Canadian chartered banks rose $48.9 billion in the first quarter to $1,374.9 billion, the largest increase since the second quarter of 2020, which was marked by record issuances of Canadian dollar-denominated instruments at the onset of the pandemic.

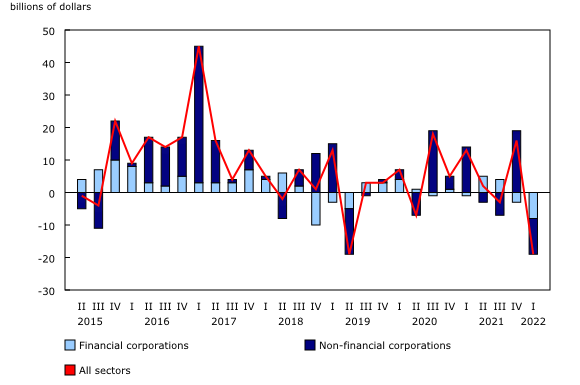

Non-financial corporations were also net borrowers of funds in the first quarter, raising $17.6 billion of funds in the credit markets. Of this amount, issuances of foreign currency-denominated instruments totalled $14.4 billion, the largest amount since the first quarter of 2015. The borrowing activity in the first quarter of 2022 was mainly from firms operating in the information and cultural industry to fund merger and acquisition deals. The total outstanding value of non-financial corporations' debt securities was $757.4 billion at the end of the first quarter.

Government borrowing activity slows

In the first quarter, the overall government borrowing activity in debt securities slowed to its lowest level since the second quarter of 2019. The federal government raised a net $16.6 billion of funds in the form of debt securities, the lowest amount in one year. Overall, borrowings in the form of bonds (+$22.7 billion) were moderated by retirements in money market instruments (-$6.1 billion). Meanwhile, provincial and territorial governments repaid more debt securities, as retirements exceeded new issuances by $9.7 billion.

The market value of Canadian debt securities decreases

The value of debt securities can also be expressed at market value, in addition to book value. The market value reflects revaluations arising from market price changes.

The market value of debt securities issued by Canadian entities was $5,206.1 billion at the end of the first quarter, down $198.4 billion from the previous quarter. More specifically, the market value of long-term debt securities declined by $170.6 billion to $ 4,739.2 billion. In comparison, the book value of these instruments rose by $93.2 billion during the same period. The difference was mainly attributable to changes in interest rates, which affected the price of these debt securities. Canadian long-term interest rates increased by 96 basis points in the first quarter, reflecting a surge in the cost to borrow funds. In March, the Bank of Canada raised the policy interest rate for the first time since March 2020.

Net retirements of equity securities in the quarter

Net retirements of Canadian equity securities totalled $18.6 billion in the first quarter, following issuances of a similar value in the previous quarter. Retirements were driven by Canadian companies buying back their shares, as well as merger and acquisition activities. On an industry basis, the mining, quarrying and oil and gas extraction industry and, to a lesser extent, the transportation and warehousing industry, posted the largest retirements. Nevertheless, the market value of outstanding Canadian equity securities reached $4,210.6 billion at the end of the first quarter, up $72.0 billion from the previous quarter. Canadian equity prices, as measured by the Standard and Poor's / Toronto Stock Exchange composite index, were up by 3.1% in the first quarter.

Note to readers

This quarterly release, available about 70 days after the reference period, includes information on debt securities issues by sector, currency, maturity, type of interest rate and market of issuance, as well as by the economic sectors issuing debt securities in relation with the sectors investing in these instruments. It also includes information on Canadian equity securities by sector and industry. Statistics on Canadian portfolio investment abroad, previously released with Canada's international investment position, are now available with this release. Canadian holdings of foreign securities by type of securities, by currency of denomination, by country of issuer of these securities, and by sector of non-resident issuer are available.

Definitions and concepts used are consistent with the recommendations of the Handbook on Securities Statistics, an internationally agreed framework for classifying securities instruments. Data are accessible through an easy-to-use and flexible visualization tool. The tool includes dynamic cross-tables that allow users to look at the dataset from a variety of dimensions, as well as other visualization layers that illustrate different characteristics of the data in the form of interactive tables and charts.

Definitions

Securities statistics cover issuances and holdings of negotiable financial instruments. Securities include debt instruments designed to be traded in financial markets, such as treasury bills, commercial paper and bonds, as well as equity instruments such as listed shares.

The book value of a debt instrument reflects the value of the debt at creation, and any subsequent economic flows, such as transactions (e.g., repayment of principal), valuation changes (independent of changes in its market price) and other changes. The book value is composed of the outstanding principal amount plus any accrued interest. The market value reflects the value at which securities are acquired or disposed of in transactions between willing parties, excluding commissions, fees and taxes.

Currency valuation

The value of securities denominated in foreign currency is converted to Canadian dollars at the end of each period. When the Canadian dollar appreciates in value, the restatement of the value of these instruments in Canadian dollars lowers the recorded value. The opposite is true when the Canadian dollar depreciates.

Products

The data visualization product "Securities statistics," part of the series Statistics Canada – Data Visualization Products (71-607-X), is available online.

The document "Enhancing Canada's statistics on securities," part of Latest Developments in the Canadian Economic Accounts (13-605-X), is also available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: