Foreign direct investment, 2021

Released: 2022-04-29

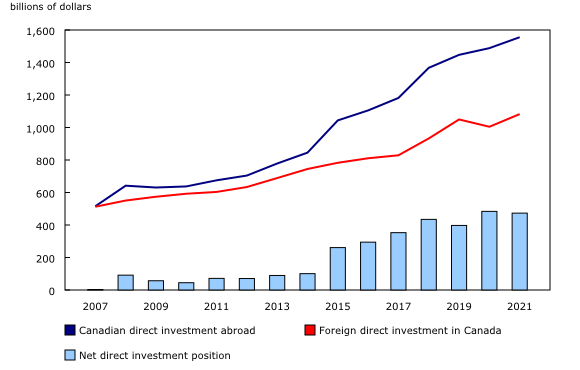

The stock of Canadian direct investment abroad rose by 4.5% to reach $1,555.6 billion at the end of 2021, on the strength of cross-border mergers and acquisitions activity. Meanwhile, the stock of foreign direct investment in Canada increased by 7.8% to reach $1,082.5 billion, more than offsetting the 4.3% decline observed in 2020. As a result, Canada's net direct investment position with the rest of the world narrowed by $10.7 billion to $473.1 billion in 2021.

The increase in Canadian direct investment abroad concentrated in the United States

The stock of Canadian direct investment abroad grew by $67.2 billion in 2021, following a $41.5 billion increase in 2020. Despite an overall rebound, some industries saw slower growth rates, or declines, when compared with the previous year.

On an industry basis, the growth in Canadian direct investment abroad was largely concentrated in the transportation and warehousing sector, increasing by $33.5 billion in 2021. The finance and insurance sector grew by 3.6% in 2021 following an increase of 4.8% in 2020. The real estate, rental and leasing sector declined by 2.0% in 2021 following an increase of 17.5% the previous year. Meanwhile, the mining and oil and gas extraction industry edged up by 0.4% in 2021 after a growth of 7.0% in 2020.

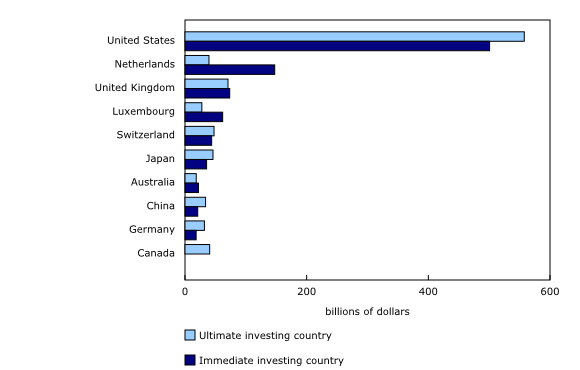

On a geographical basis, most of the increase in 2021 was driven by investments in the United States. This growth was slightly moderated by the downward revaluation effect of an appreciating Canadian dollar against the US dollar. The stock of Canadian direct investment in the United States reached $744.9 billion, up by $60.6 billion compared with 2020. The United States remains the main destination for Canadian direct investment abroad, accounting for 47.9% of all holdings.

Meanwhile, Canadian direct investment in Europe represented 25.2% at the end of 2021, led by the United Kingdom ($127.7 billion) and Luxembourg ($98.6 billion). While being relatively modest when compared with the United States and Europe, the value of Canadian direct investments in Asia/Oceania grew the most in 2021, reaching $125.6 billion, representing 8.0% of all holdings at year end.

Foreign direct investment in Canada rebounds

In 2021, the stock of foreign direct investment in Canada climbed $77.9 billion to $1,082.5 billion, rebounding strongly after a $45.0 billion decline in 2020. Most of the growth originated from a few countries, with the United States accounting for the largest increase.

Foreign direct investment from the United States rose by $40.8 billion ni 2021 to reach $500.7 billion, compared with a decline of $14.2 billion in 2020. Investors from the United States (46.3%) continued to be the primary holders of foreign direct investment in Canada, followed by European investors (35.9%). On a country basis, the Netherlands ($147.5 billion), the United Kingdom ($73.6 billion) and Luxembourg ($61.9 billion) had the largest Canadian holdings after the United States.

On an industry basis, the stock of foreign direct investment in the manufacturing sector was up by $22.6 billion, more than offsetting the $10.6 billion decline in 2020. The primary sub-industries that contributed to this growth were food manufacturing (+$5.0 billion), transportation equipment manufacturing (+$5.0 billion), and petroleum and coal product manufacturing (+$3.8 billion). The mining and oil and gas extraction sector rose by $11.6 billion, partially offsetting the large $43.2 billion decline observed in 2020 in the context of disruptions caused by the COVID-19 pandemic.

In services-producing industries, the finance and insurance sector grew by $9.0 billion in 2021, following an increase of $14.5 billion in the previous year. The professional, scientific and technical services industry was up $8.0 billion in 2021 after a $2.9 billion increase the year before. The management of companies and enterprises industry rebounded with a $6.4 billion increase by the end of 2021 after posting a $26.7 billion decline in 2020.

More than 85% of direct investment abroad is controlled from Canada

Foreign direct investment in Canada can also be measured on an ultimate investor country basis by looking through the immediate investing country to show the country that ultimately controls the investment in Canada. This measure gives a different distribution of the country allocation of the inward investment. The United States, which is already the dominant direct investor in Canada on an immediate investor basis, further increases its share of overall investment when the data are presented on an ultimate investor basis. On the other hand, Europe's share of foreign direct investment in Canada declines from 35.9% on an immediate investor basis to 26.8% on an ultimate investor basis.

Measuring Canadian direct investment abroad on an ultimate investor basis identifies the country that ultimately controls Canadian investments abroad. In 2021, 85.3% of Canada's direct investment abroad was ultimately controlled by Canadian investors. Investors from over 30 countries ultimately controlled the remaining 14.7%. The top countries included the United States (6.5%), United Kingdom (2.1%) and Switzerland (2.1%).

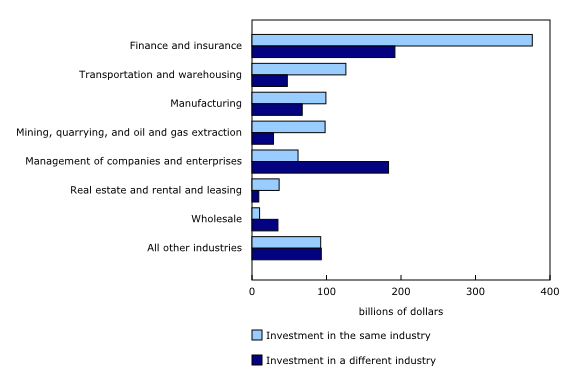

Canadian direct investors mainly invest in their own industry when investing abroad

Canadian direct investors mainly target the same industry as the one in which they operate domestically when they invest abroad. The stock of Canadian direct investment abroad for which the industry of the direct investor is the same as the industry of their foreign affiliates amounted to $899.9 billion at the end of 2021, accounting for 57.9% of all investment abroad. In comparison, Canadian direct investment in foreign affiliates of a different industry reached $655.7 billion.

Canadian investors from the finance and insurance sector, transportation and warehousing sector, and real estate and rental and leasing sector, held the vast majority of their investments abroad in their own industry. In comparison, investors from the management of companies and enterprises as well as the wholesale trade sectors held foreign assets predominantly in a different industry.

Note to readers

This is the annual release of detailed foreign direct investment position data at book value. This release contains country and industry details that are drawn from annual surveys. This detailed information is not available at the time of quarterly international investment position releases. However, aggregates of direct investment positions, both at book and market values, are available as part of the quarterly international investment position release.

Year-end position data for 2021 are projected using the latest benchmark survey data of 2020 and flows collected from the 2021 quarterly surveys. In addition, outstanding positions denominated in foreign currencies are re-evaluated to account for changes in exchange rates. These estimates will be revised next year with the integration of benchmark survey data for the reference year 2021 and will fully reflect the change in the stock of foreign direct investment from one year to the next, including volume changes such as debt or equity write-offs.

The current aggregates will be integrated into the international investment position at the time of the third-quarter 2022 release in December, in line with the Canadian System of Macroeconomic Accounts revision policy.

Direct investment is a component of the international investment position that refers to the investment of an entity in one country (the direct investor) obtaining a lasting interest in an entity in another country (the direct investment enterprise). The lasting interest implies the existence of a long-term relationship between the direct investor and the direct investment enterprise and a significant degree of influence by the direct investor on the management of the direct investment enterprise.

In practice, direct investment is deemed to occur when a direct investor owns at least 10% of the voting equity in a direct investment enterprise. This report presents the cumulative year-end positions for direct investment, measured as the total value of equity and the net value of debt instruments between direct investors and their direct investment enterprises.

Foreign direct investment by country and by industry

Following international standards, the main measure of direct investment is based on the country of residence of the direct investor (immediate parent company) for foreign direct investment in Canada and on the country of residence of the direct investment enterprise (the immediate subsidiary) for Canadian direct investment abroad. This implies that direct investment is largely attributed to the first investor or investee country, rather than the ultimate investor or investee country. Direct investment data on an immediate investor basis are available in tables 36-10-0008-01, 36-10-0009-01, 36-10-0657-01 and 36-10-0659-01.

Foreign direct investment by ultimate investor

A supplementary series on foreign direct investment by ultimate investor is now available in table 36-10-0433-01. This series differs from the standard presentation of foreign direct investment, which is based on the country of residence of the immediate direct investor, by showing the country of the investor that ultimately controls the investment. Because foreign direct investment may be channelled through holding companies or other legal entities in intermediate countries, the measurement of foreign direct investment on an ultimate investor basis can result in substantial changes in the distribution of inward and outward positions by country when compared with foreign direct investment measured on an immediate investor basis.

Data quality

In general, data for smaller countries and industries (defined as countries with foreign direct investment below $500 million or industries at the three-digit level of the North American Industry Classification System) are subject to higher sampling variability.

Products

The product Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, and Japan.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: