Livestock estimates, January 1, 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-02-28

The Canadian livestock sector continued to navigate challenges in the latter half of 2021. In Western Canada, extreme weather events—ranging from record heat and drought conditions to severe flooding events—limited forage, increased feed costs and disrupted transportation routes. Throughout the country, ongoing labour issues, as well as enhanced public health measures caused by the COVID-19 pandemic, slowed supply chains and the processing sector.

On January 1, 2022, Canadian hog and sheep inventories were up, while cattle inventories were down, compared with the same date a year earlier.

The Canadian cattle herd fell to the lowest level recorded since January 1, 1989, as high feed costs and export demand for beef supported an increase in slaughter. Canadian cattle inventories have generally declined year over year since 2005.

Meanwhile, despite strong increases in international hog exports, slowdowns in the domestic processing sector contributed to higher on-farm hog inventories.

Sheep inventories were up year over year for the first time since January 1, 2017, attributable to more births, as higher prices for lambs and favourable market conditions throughout 2021 supported flock increases in several provinces.

Cattle and calf slaughter reaches highest level in over a decade

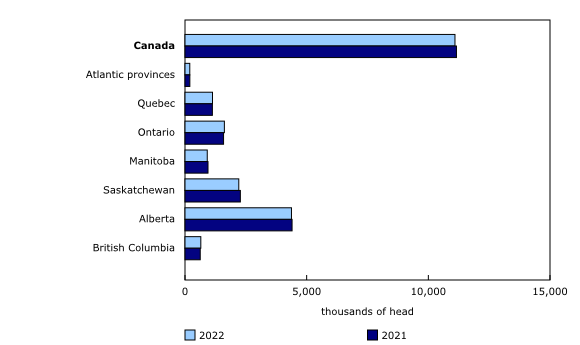

Canadian farmers held 11.1 million cattle and calves on their farms on January 1, 2022, down 0.5% from the previous year, as the Canadian cattle herd continued to contract. Inventories were one-quarter (-25.7%) below the January 1 peak reached in 2005.

Cattle and calf slaughter for the period from July to December 2021 was up 0.7% from the same period in 2020, and reached the highest level recorded since the second half of 2009. Strong export demand for Canadian beef—particularly from the United States—helped support domestic slaughter, as total exports of beef and veal rose 19.6% in 2021, compared with 2020.

Inventories were up 1.2% to 2.9 million head in Eastern Canada, but declined by 1.2% to 8.2 million head in Western Canada, as drought conditions maintained pressure on the livestock sector. Alberta held the largest cattle inventories among the provinces on January 1, contributing 39.4% to the national total, followed by Saskatchewan (19.9%) and Ontario (14.6%).

Canadian cattle producers retained less breeding stock on January 1, 2022, as year-over-year decreases in the number of beef cows (-0.9% to 3.5 million head), dairy cows (-0.2% to 979,200 head) and beef heifers for breeding (-4.0% to 517,300 head) more than offset increases in the number of dairy heifers for breeding (+0.8% to 429,700 head) and bulls (+1.7% to 213,600 head).

Producers also held fewer feeder heifers (-2.3%) and steers (-3.9%) than on January 1, 2021. Compared with 2020, slaughter of feeder heifers and slaughter of steers were both up at the national level over the course of 2021, contributing to this decline.

Canadian farmers held 1.4 million dairy cows and heifers on their farms on January 1, 2022, up 0.1% from the same date a year earlier. The inventory of calves grew 1.2% to 3.8 million head, as international imports of live calves increased by 36.3% over the second half of 2021, compared with the same period in 2020, to meet demand from feedlots in Western Canada.

International exports of cattle and calves for the latter half of 2021 were up 22.8% year over year to 331,100 head, particularly in Western Canada, where drought conditions and high feed costs spurred sales of both feeder and slaughter animals to the United States.

Average prices for Canadian feeder and slaughter cattle generally remained higher in the second half of 2021, compared with the same period in 2020, even as prices were pressured by herd reductions in the Prairie provinces.

As of January 1, 2022, inventories of cattle and calves were reported by 72,275 farms, down 0.9% from January 1, 2021. The number of cattle farms in Canada has generally decreased since 2004, largely because of business consolidations.

US demand for Canadian hogs remains strong

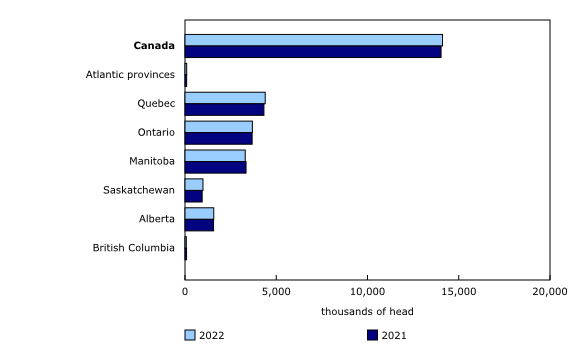

Hog producers reported 14.1 million hogs on their farms on January 1, 2022, up 0.6% from the same date in 2021. Quebec, Ontario and Manitoba continued to hold the largest inventories among the provinces. These three provinces are home to over 80% of Canada's hogs, with Quebec accounting for nearly one-third of Canadian hog inventories, at 4.4 million head. Meanwhile, in British Columbia, hog inventories fell to 72,000 head, a 16.3% year-over-year decrease, as several thousand hogs died during the major flooding events of late 2021.

As of January 1, 2022, hog inventories were reported by 7,575 farms, down 0.3% from the same date a year earlier. These farms reported 1.2 million sows and gilts (+0.3%), while the number of boars increased by 1.2% year over year to 17,100 head.

The pig crop, which represents the number of live piglets after weaning, reached 14.9 million (-0.1%) from July to December 2021, a slight decrease from the same period a year earlier.

Labour issues and lower export demand for pork were the primary drivers behind the year-over-year decrease in total slaughter from July to December 2021, to 10.9 million head (-5.4%). This decrease was particularly strong in Ontario, where slaughter fell 10.1% to 2.7 million head.

Canada exported 3.4 million live hogs in the second half of 2021, up 23.2% from the same period in 2020, as processing disruptions in Eastern Canada continued to encourage exports of live hogs to the United States. Ontario posted the most significant year-over-year increase in exports (+75.9% to 987,600 head), as producers sought to offset decreases in domestic slaughter.

While producer prices trended lower towards the end of 2021, as export demand for live hogs from the United States began to weaken, average Canadian producer prices generally remained well above those received in the latter half of 2020.

Lamb prices tumble after record highs

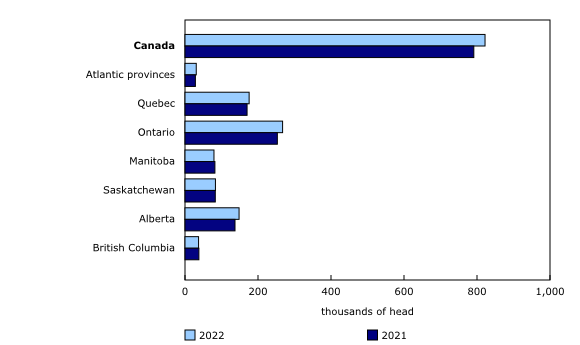

Canadian inventories of sheep and lambs were up 3.9% year over year to 822,000 head on January 1, 2022, the first annual increase since 2018.

Ontario and Quebec together were home to over half of Canada's sheep and lambs on January 1.

The sheep breeding herd rose 2.4% year over year to 599,900 head, with increases observed in the number of ewes (+2.4%) and replacement lambs (+3.0%), while rams remained stable. Inventories of market lambs rose 8.0% year over year to 222,100 head on January 1, 2022, on account of higher births (+6.1%). During the latter half of 2021, lamb slaughter fell 4.2% year over year to 326,300 head.

Average producer prices for Canadian slaughter lambs weakened during the second half of 2021, falling below prices received for the same period in 2020. This contrasted with the at-times record prices received earlier in the year, when supplies were tighter relative to demand.

International exports of live sheep and lambs increased almost six-and-a-half times year over year for the period from July to December 2021, reaching 22,200 head, as US prices strengthened relative to domestic markets. Meanwhile, international imports of live animals fell to 4,100 head, as demand from Western Canada declined to more historical levels.

Note to readers

Livestock estimates are available for Canada and the provinces, as well as for the United States.

For the latest information on the Census of Agriculture, visit the Census of Agriculture portal.

For more information on agriculture and food, visit the Agriculture and food statistics portal.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: